| Funding Amount | Total Exposure | Quantity |

|---|---|---|

Don't have an account yet? Register now

How does MTF works?

Cash balance

MTF leverage

Buy stocks in delivery for up to

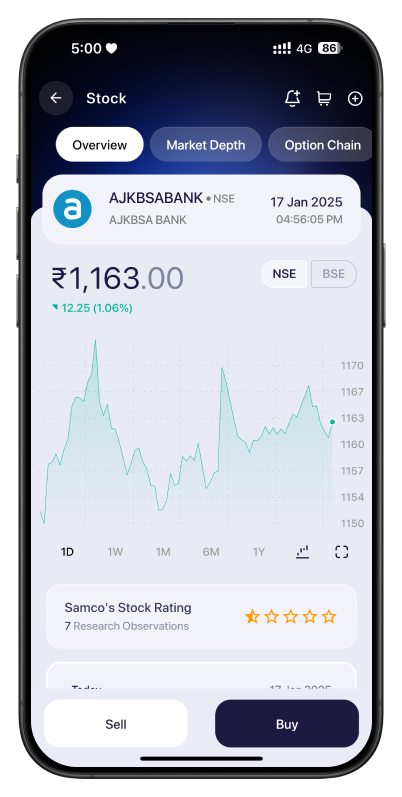

Click on buy button of your preferred equity stock

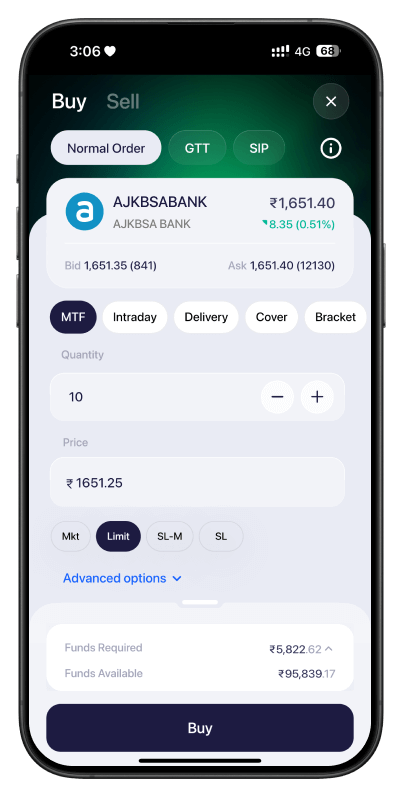

Enter quantity and select “MTF” under the product type

Click on ‘Quick Trade’ to place your MTF orders

| S/no | Stock | CMP | Leverage | Margin% | Action |

|---|---|---|---|---|---|

| 1 | 360ONE | 943.75 | 2x | 50 | |

| 2 | 3IINFOLTD | 22.23 | 1.11x | 90 | |

| 3 | 3MINDIA | 30715 | 2x | 50 | |

| 4 | 5PAISA | 385.75 | 1.25x | 80 | |

| 5 | AARTIDRUGS | 358.25 | 2x | 50 | |

| 6 | AARTIIND | 404.2 | 2x | 50 | |

| 7 | AARTIPHARM | 717.25 | 1.43x | 70 | |

| 8 | AARTISURF | 453.2 | 1.18x | 85 | |

| 9 | AAVAS | 2030.9 | 1.67x | 60 | |

| 10 | ABB | 5379.5 | 2x | 50 | |

| 11 | ABBOTINDIA | 30710 | 2x | 50 | |

| 12 | ABCAPITAL | 195.82 | 1.67x | 60 | |

| 13 | ABFRL | 264.3 | 2x | 50 | |

| 14 | ABREL | 1894.8 | 1.54x | 65 | |

| 15 | ABSLAMC | 633.9 | 1.25x | 80 | |

| 16 | ABSLLIQUID | 1000 | 2x | 50 | |

| 17 | ACC | 2059.3 | 2.86x | 35 | |

| 18 | ACCELYA | 1326.9 | 3.33x | 30 | |

| 19 | ACE | 1246.4 | 1.25x | 80 | |

| 20 | ACI | 633.2 | 1.25x | 80 | |

| 21 | ACLGATI | 58.1 | 1.18x | 85 | |

| 22 | ADANIENSOL | 895.15 | 1.18x | 85 | |

| 23 | ADANIENT | 2415.6 | N/A | 100 | |

| 24 | ADANIGREEN | 945.6 | 1.11x | 90 | |

| 25 | ADANIPORTS | 1232.9 | 1.67x | 60 | |

| 26 | ADANIPOWER | 545.55 | 1.11x | 90 | |

| 27 | ADFFOODS | 244.73 | 2x | 50 | |

| 28 | AEGISLOG | 806.3 | 2.5x | 40 | |

| 29 | AEROFLEX | 175.76 | 1.18x | 85 | |

| 30 | AETHER | 836.75 | 1.43x | 70 | |

| 31 | AFFLE | 1538.7 | 1.54x | 65 | |

| 32 | AGROPHOS | 34.04 | 1.18x | 85 | |

| 33 | AHL | 182.83 | 1.18x | 85 | |

| 34 | AIAENG | 3185.6 | 2x | 50 | |

| 35 | AJANTPHARM | 2635 | 1.67x | 60 | |

| 36 | AKZOINDIA | 3515.3 | 2x | 50 | |

| 37 | ALEMBICLTD | 104.05 | 2x | 50 | |

| 38 | ALIVUS | 1000.5 | 1.18x | 85 | |

| 39 | ALKEM | 4957.6 | 2x | 50 | |

| 40 | ALKYLAMINE | 1831.3 | 2x | 50 | |

| 41 | ALLCARGO | 29.01 | 1.67x | 60 | |

| 42 | AMBER | 6744.5 | 1.43x | 70 | |

| 43 | AMBUJACEM | 565.75 | 2.86x | 35 | |

| 44 | AMIORG | 2323.2 | 1.25x | 80 | |

| 45 | AMRUTANJAN | 685.4 | 1.67x | 60 | |

| 46 | ANANDRATHI | 1732.7 | 1.25x | 80 | |

| 47 | ANANTRAJ | 470 | 1.54x | 65 | |

| 48 | ANDHRAPAP | 74.54 | 1.25x | 80 | |

| 49 | ANDHRSUGAR | 71.59 | 1.25x | 80 | |

| 50 | ANGELONE | 2352.6 | 3.33x | 30 | |

| 51 | ANUP | 3153 | 1.43x | 70 | |

| 52 | ANURAS | 796 | 1.25x | 80 | |

| 53 | APARINDS | 4995.5 | 1.25x | 80 | |

| 54 | APCOTEXIND | 329.4 | 1.18x | 85 | |

| 55 | APEX | 216.81 | 2x | 50 | |

| 56 | APLLTD | 851.95 | 2x | 50 | |

| 57 | APOLLOHOSP | 7005.5 | 2.22x | 45 | |

| 58 | APOLLOPIPE | 389.1 | 1.67x | 60 | |

| 59 | APOLLOTYRE | 448.2 | 2x | 50 | |

| 60 | APTECHT | 124.49 | 1.25x | 80 | |

| 61 | APTUS | 319.95 | 1.25x | 80 | |

| 62 | ARE&M | 995.8 | 2.5x | 40 | |

| 63 | ARIHANTCAP | 73.74 | 1.18x | 85 | |

| 64 | ARVIND | 362.95 | 1.67x | 60 | |

| 65 | ARVINDFASN | 407.6 | 2x | 50 | |

| 66 | ASAHIINDIA | 667.45 | 1.25x | 80 | |

| 67 | ASHIANA | 270.7 | 1.18x | 85 | |

| 68 | ASHOKA | 194.27 | 2.5x | 40 | |

| 69 | ASHOKLEY | 214.4 | 1.67x | 60 | |

| 70 | ASIANPAINT | 2459.9 | 2.5x | 40 | |

| 71 | ASIANTILES | 44.29 | 1.43x | 70 | |

| 72 | ASKAUTOLTD | 434.15 | 1.18x | 85 | |

| 73 | ASTEC | 747.9 | 2x | 50 | |

| 74 | ASTERDM | 500.3 | 2.5x | 40 | |

| 75 | ASTRAL | 1313.8 | 2x | 50 | |

| 76 | ASTRAMICRO | 746.95 | 1.25x | 80 | |

| 77 | ASTRAZEN | 8514.5 | 1.67x | 60 | |

| 78 | ATUL | 5715.5 | 2x | 50 | |

| 79 | AUBANK | 582.35 | 2.5x | 40 | |

| 80 | AUROPHARMA | 1133.4 | 1.54x | 65 | |

| 81 | AUTOAXLES | 1645.2 | 1.67x | 60 | |

| 82 | AUTOBEES | 216.21 | 2x | 50 | |

| 83 | AVADHSUGAR | 489.7 | 1.25x | 80 | |

| 84 | AVALON | 827.35 | 1.25x | 80 | |

| 85 | AVANTIFEED | 866.95 | 2.5x | 40 | |

| 86 | AWHCL | 514.2 | 1.43x | 70 | |

| 87 | AWL | 283.05 | 2x | 50 | |

| 88 | AWL | 283.05 | 2x | 50 | |

| 89 | AXISBANK | 1161.3 | 1.82x | 55 | |

| 90 | AXISBNKETF | 542.6 | 2x | 50 | |

| 91 | AXISBPSETF | 12.47 | 2x | 50 | |

| 92 | AXISGOLD | 79.94 | 1.11x | 90 | |

| 93 | BAJAJ-AUTO | 7961.5 | 2.86x | 35 | |

| 94 | BAJAJCON | 171.67 | 2x | 50 | |

| 95 | BAJAJELEC | 551.85 | 1.43x | 70 | |

| 96 | BAJAJFINSV | 1969.2 | 2x | 50 | |

| 97 | BAJAJHCARE | 621.9 | 1.11x | 90 | |

| 98 | BAJAJHIND | 19.34 | 1.25x | 80 | |

| 99 | BAJAJHLDNG | 11585 | 2.5x | 40 | |

| 100 | BAJFINANCE | 9056.5 | 2x | 50 | |

| 101 | BALAMINES | 1312.2 | 2x | 50 | |

| 102 | BALKRISIND | 2490.2 | 2.22x | 45 | |

| 103 | BALMLAWRIE | 192.52 | 2.5x | 40 | |

| 104 | BALRAMCHIN | 564.8 | 2x | 50 | |

| 105 | BANDHANBNK | 158.41 | 1.67x | 60 | |

| 106 | BANKBARODA | 240.79 | 1.54x | 65 | |

| 107 | BANKBEES | 543.8 | 2.5x | 40 | |

| 108 | BANKINDIA | 115.48 | 2x | 50 | |

| 109 | BANKNIFTY1 | 545.91 | 2.5x | 40 | |

| 110 | BARBEQUE | 273.65 | 1.11x | 90 | |

| 111 | BASF | 4526.2 | 1.11x | 90 | |

| 112 | BATAINDIA | 1234.3 | 1.54x | 65 | |

| 113 | BAYERCROP | 4860 | 2x | 50 | |

| 114 | BBL | 2965.2 | 1.18x | 85 | |

| 115 | BBTC | 1909.7 | 2x | 50 | |

| 116 | BCLIND | 39.12 | 1.18x | 85 | |

| 117 | BDL | 1399.3 | 2.5x | 40 | |

| 118 | BECTORFOOD | 1558.4 | 1.43x | 70 | |

| 119 | BEL | 293.6 | 2.22x | 45 | |

| 120 | BEML | 3116.5 | 1.67x | 60 | |

| 121 | BERGEPAINT | 542.05 | 2.5x | 40 | |

| 122 | BFUTILITIE | 777.2 | 1.82x | 55 | |

| 123 | BHARATFORG | 1055.1 | 2.22x | 45 | |

| 124 | BHARATGEAR | 71.25 | 1.18x | 85 | |

| 125 | BHARATRAS | 9717 | 1.43x | 70 | |

| 126 | BHARATWIRE | 180.41 | 1.11x | 90 | |

| 127 | BHARTIARTL | 1822.6 | 2.22x | 45 | |

| 128 | BHEL | 226 | 1.43x | 70 | |

| 129 | BIKAJI | 712.15 | 1.43x | 70 | |

| 130 | BIOCON | 329.15 | 2x | 50 | |

| 131 | BIRLACABLE | 155.91 | 1.18x | 85 | |

| 132 | BIRLACORPN | 1112.2 | 1.67x | 60 | |

| 133 | BIRLANU | 1893 | 2x | 50 | |

| 134 | BLISSGVS | 123.21 | 1.43x | 70 | |

| 135 | BLKASHYAP | 60.08 | 1.18x | 85 | |

| 136 | BLS | 383.5 | 1.18x | 85 | |

| 137 | BLUESTARCO | 2053.3 | 1.43x | 70 | |

| 138 | BODALCHEM | 67.58 | 1.67x | 60 | |

| 139 | BOMDYEING | 134.61 | 1.82x | 55 | |

| 140 | BOROLTD | 339.75 | 1.18x | 85 | |

| 141 | BORORENEW | 499.7 | 1.25x | 80 | |

| 142 | BOSCHLTD | 27370 | 2.5x | 40 | |

| 143 | BPCL | 298.75 | 1.67x | 60 | |

| 144 | BRIGADE | 983.15 | 2.5x | 40 | |

| 145 | BRITANNIA | 5416.2 | 2.5x | 40 | |

| 146 | BSE | 5930.5 | 2x | 50 | |

| 147 | BSOFT | 372.1 | 1.67x | 60 | |

| 148 | CAMLINFINE | 167.75 | 1.25x | 80 | |

| 149 | CAMPUS | 236.93 | 1.43x | 70 | |

| 150 | CAMS | 3894.4 | 1.82x | 55 | |

| 151 | CANBK | 94.7 | 1.43x | 70 | |

| 152 | CANFINHOME | 697.4 | 1.33x | 75 | |

| 153 | CAPACITE | 375.6 | 1.54x | 65 | |

| 154 | CAPLIPOINT | 1971.8 | 2x | 50 | |

| 155 | CARBORUNIV | 1007.7 | 2x | 50 | |

| 156 | CARERATING | 1173.5 | 1.67x | 60 | |

| 157 | CARTRADE | 1532.2 | 1.18x | 85 | |

| 158 | CARYSIL | 622 | 1.18x | 85 | |

| 159 | CASTROLIND | 206.03 | 2x | 50 | |

| 160 | CCL | 624.45 | 2.5x | 40 | |

| 161 | CDSL | 1232.2 | 1.25x | 80 | |

| 162 | CEATLTD | 3023.8 | 1.67x | 60 | |

| 163 | CELLO | 562.05 | 1.18x | 85 | |

| 164 | CENTENKA | 520.65 | 1.11x | 90 | |

| 165 | CENTRALBK | 36.11 | 2x | 50 | |

| 166 | CENTRUM | 24.23 | 1.18x | 85 | |

| 167 | CENTUM | 1711.1 | 1.18x | 85 | |

| 168 | CENTURYPLY | 728.65 | 2x | 50 | |

| 169 | CERA | 5681.5 | 1.67x | 60 | |

| 170 | CESC | 157.68 | 2x | 50 | |

| 171 | CGCL | 163.2 | 1.18x | 85 | |

| 172 | CGPOWER | 598.75 | 1.43x | 70 | |

| 173 | CHALET | 823.15 | 1.25x | 80 | |

| 174 | CHAMBLFERT | 654.75 | 1.43x | 70 | |

| 175 | CHEMCON | 191.92 | 2.5x | 40 | |

| 176 | CHEMPLASTS | 441.55 | 1.25x | 80 | |

| 177 | CHENNPETRO | 631 | 1.33x | 75 | |

| 178 | CHOICEIN | 538.65 | 1.18x | 85 | |

| 179 | CHOLAFIN | 1611.9 | 1.67x | 60 | |

| 180 | CHOLAHLDNG | 1804.3 | 1.11x | 90 | |

| 181 | CIEINDIA | 412.85 | 2.5x | 40 | |

| 182 | CIGNITITEC | 1196.6 | 1.18x | 85 | |

| 183 | CIPLA | 1496.4 | 2.86x | 35 | |

| 184 | CLEAN | 1184 | 1.43x | 70 | |

| 185 | CMSINFO | 464.8 | 1.25x | 80 | |

| 186 | COALINDIA | 399.25 | 2.86x | 35 | |

| 187 | COCHINSHIP | 1446.7 | 1.67x | 60 | |

| 188 | COFORGE | 6408 | 1.54x | 65 | |

| 189 | COLPAL | 2551.6 | 2.86x | 35 | |

| 190 | CONCOR | 699.3 | 2x | 50 | |

| 191 | CONCORDBIO | 1741.2 | 1.18x | 85 | |

| 192 | CONFIPET | 55.71 | 1.25x | 80 | |

| 193 | CONTROLPR | 660.6 | 1.18x | 85 | |

| 194 | COROMANDEL | 2133.6 | 2x | 50 | |

| 195 | COSMOFIRST | 578.05 | 2.5x | 40 | |

| 196 | CPSEETF | 87.85 | 3.33x | 30 | |

| 197 | CRAFTSMAN | 4588.7 | 1.18x | 85 | |

| 198 | CREDITACC | 1082.15 | 1.18x | 85 | |

| 199 | CRISIL | 4468.7 | 2x | 50 | |

| 200 | CROMPTON | 335.1 | 1.67x | 60 | |

| 201 | CSBBANK | 329.35 | 2.5x | 40 | |

| 202 | CUB | 172.83 | 2x | 50 | |

| 203 | CUMMINSIND | 2895.5 | 2x | 50 | |

| 204 | CYIENT | 1184.5 | 2x | 50 | |

| 205 | CYIENTDLM | 461.55 | 1.18x | 85 | |

| 206 | DABUR | 481.35 | 2.86x | 35 | |

| 207 | DALBHARAT | 1846.4 | 2.5x | 40 | |

| 208 | DALMIASUG | 405.45 | 1.67x | 60 | |

| 209 | DATAMATICS | 603.9 | 1.43x | 70 | |

| 210 | DATAPATTNS | 1890.7 | 1.43x | 70 | |

| 211 | DBCORP | 243.09 | 1.43x | 70 | |

| 212 | DBL | 459 | 2.5x | 40 | |

| 213 | DBOL | 68.14 | 1.25x | 80 | |

| 214 | DBREALTY | 192.3 | 1.18x | 85 | |

| 215 | DCAL | 207.47 | 1.18x | 85 | |

| 216 | DCBBANK | 123.43 | 1.82x | 55 | |

| 217 | DCMSHRIRAM | 1069 | 2.5x | 40 | |

| 218 | DCW | 85.54 | 1.25x | 80 | |

| 219 | DEEPAKFERT | 1258.7 | 1.67x | 60 | |

| 220 | DEEPAKNTR | 1970.5 | 1.82x | 55 | |

| 221 | DEEPINDS | 490.85 | 1.18x | 85 | |

| 222 | DELHIVERY | 263.05 | 1.43x | 70 | |

| 223 | DELTACORP | 82.87 | 2x | 50 | |

| 224 | DEN | 33.04 | 1.25x | 80 | |

| 225 | DEVYANI | 165.21 | 1.54x | 65 | |

| 226 | DHAMPURSUG | 128.03 | 2x | 50 | |

| 227 | DHANI | 61.64 | 1.18x | 85 | |

| 228 | DHANUKA | 1315.5 | 2.5x | 40 | |

| 229 | DISHTV | 5.74 | 1.18x | 85 | |

| 230 | DIVISLAB | 5754 | 2x | 50 | |

| 231 | DIXON | 15252 | 1.67x | 60 | |

| 232 | DLF | 656.25 | 2x | 50 | |

| 233 | DLINKINDIA | 451 | 1.25x | 80 | |

| 234 | DMART | 4221.5 | 2.5x | 40 | |

| 235 | DODLA | 1152.1 | 1.25x | 80 | |

| 236 | DOLLAR | 390.7 | 1.18x | 85 | |

| 237 | DPSCLTD | 13.03 | 1.18x | 85 | |

| 238 | DREAMFOLKS | 239.37 | 1.43x | 70 | |

| 239 | DRREDDY | 1158.4 | 2.5x | 40 | |

| 240 | DWARKESH | 40.31 | 1.11x | 90 | |

| 241 | DYNAMATECH | 6299 | 1.18x | 85 | |

| 242 | EASEMYTRIP | 12.19 | 1.54x | 65 | |

| 243 | EBBETF0430 | 1490.63 | 3.33x | 30 | |

| 244 | EBBETF0431 | 1335.51 | 3.33x | 30 | |

| 245 | ECLERX | 2517.2 | 2x | 50 | |

| 246 | EICHERMOT | 5615.5 | 2.5x | 40 | |

| 247 | EIDPARRY | 840.35 | 1.67x | 60 | |

| 248 | EIHOTEL | 370.4 | 2.5x | 40 | |

| 249 | EKC | 123.79 | 1.18x | 85 | |

| 250 | ELECTCAST | 101.79 | 1.11x | 90 | |

| 251 | ELGIEQUIP | 441.1 | 1.18x | 85 | |

| 252 | EMAMILTD | 626.75 | 2x | 50 | |

| 253 | EMBDL | 107.07 | 1.67x | 60 | |

| 254 | EMUDHRA | 875.65 | 1.25x | 80 | |

| 255 | ENDURANCE | 1939.5 | 2x | 50 | |

| 256 | ENGINERSIN | 183.72 | 2x | 50 | |

| 257 | EPIGRAL | 1876.9 | 1.18x | 85 | |

| 258 | EPL | 194.33 | 1.11x | 90 | |

| 259 | EQUITASBNK | 60.96 | 3.33x | 30 | |

| 260 | ERIS | 1400.5 | 1.67x | 60 | |

| 261 | ESABINDIA | 4641 | 1.43x | 70 | |

| 262 | ESCORTS | 3231.9 | 1.43x | 70 | |

| 263 | ETERNAL | 222.08 | 1.54x | 65 | |

| 264 | ETHOSLTD | 2667 | 1.11x | 90 | |

| 265 | EVEREADY | 302 | 1.11x | 90 | |

| 266 | EXCELINDUS | 1063.3 | 2.5x | 40 | |

| 267 | EXIDEIND | 377 | 2.5x | 40 | |

| 268 | FACT | 668.45 | 1.11x | 90 | |

| 269 | FAIRCHEMOR | 890.95 | 1.18x | 85 | |

| 270 | FCL | 239.97 | 1.11x | 90 | |

| 271 | FDC | 430.8 | 2x | 50 | |

| 272 | FEDERALBNK | 194.92 | 2x | 50 | |

| 273 | FEDFINA | 89.45 | 1.18x | 85 | |

| 274 | FIEMIND | 1418 | 1.18x | 85 | |

| 275 | FILATEX | 43.35 | 1.18x | 85 | |

| 276 | FINCABLES | 896.45 | 2x | 50 | |

| 277 | FINEORG | 4308.7 | 1.67x | 60 | |

| 278 | FINOPB | 252.27 | 1.18x | 85 | |

| 279 | FINPIPE | 175.87 | 1.67x | 60 | |

| 280 | FIVESTAR | 750.4 | 1.11x | 90 | |

| 281 | FLAIR | 252.55 | 1.18x | 85 | |

| 282 | FLUOROCHEM | 3930.5 | 1.11x | 90 | |

| 283 | FOODSIN | 86.19 | 1.18x | 85 | |

| 284 | FORCEMOT | 8622.5 | 2x | 50 | |

| 285 | FORTIS | 649.95 | 2x | 50 | |

| 286 | FUSION | 142.24 | 1.11x | 90 | |

| 287 | GABRIEL | 562.9 | 1.67x | 60 | |

| 288 | GAEL | 124.98 | 1.18x | 85 | |

| 289 | GAIL | 184.7 | 2x | 50 | |

| 290 | GALAXYSURF | 2183.6 | 2x | 50 | |

| 291 | GANDHAR | 147.7 | 1.18x | 85 | |

| 292 | GANDHITUBE | 692.2 | 1.18x | 85 | |

| 293 | GANECOS | 1607.6 | 1.18x | 85 | |

| 294 | GANESHBE | 121.64 | 1.18x | 85 | |

| 295 | GARFIBRES | 872.15 | 2x | 50 | |

| 296 | GATEWAY | 62.91 | 1.18x | 85 | |

| 297 | GENUSPOWER | 287.5 | 1.18x | 85 | |

| 298 | GEOJITFSL | 73.1 | 1.18x | 85 | |

| 299 | GESHIP | 889.45 | 1.43x | 70 | |

| 300 | GFLLIMITED | 56.89 | 1.18x | 85 | |

| 301 | GHCL | 616.7 | 2.5x | 40 | |

| 302 | GHCLTEXTIL | 78.96 | 1.18x | 85 | |

| 303 | GICHSGFIN | 174.54 | 2.5x | 40 | |

| 304 | GICRE | 417.35 | 1.82x | 55 | |

| 305 | GILLETTE | 7805.5 | 2x | 50 | |

| 306 | GILT5YBEES | 61.29 | 2x | 50 | |

| 307 | GLAND | 1442.6 | 1.43x | 70 | |

| 308 | GLAXO | 2926.9 | 2x | 50 | |

| 309 | GLENMARK | 1356.8 | 1.54x | 65 | |

| 310 | GLOBUSSPR | 1054.6 | 1.11x | 90 | |

| 311 | GMBREW | 697.65 | 2.5x | 40 | |

| 312 | GMDCLTD | 315 | 2.5x | 40 | |

| 313 | GMMPFAUDLR | 1049.1 | 1.82x | 55 | |

| 314 | GMRAIRPORT | 85.64 | 2x | 50 | |

| 315 | GNFC | 495.6 | 2.5x | 40 | |

| 316 | GOACARBON | 477.2 | 1.11x | 90 | |

| 317 | GOCLCORP | 269.4 | 1.18x | 85 | |

| 318 | GOCOLORS | 727.45 | 1.18x | 85 | |

| 319 | GODFRYPHLP | 7344.5 | 1.33x | 75 | |

| 320 | GODREJAGRO | 769.6 | 1.82x | 55 | |

| 321 | GODREJCP | 1244.6 | 2x | 50 | |

| 322 | GODREJIND | 1134.3 | 1.67x | 60 | |

| 323 | GODREJPROP | 2000.3 | 2x | 50 | |

| 324 | GOKEX | 817.55 | 1.25x | 80 | |

| 325 | GOLD1 | 79.61 | 3.33x | 30 | |

| 326 | GOLDBEES | 79.23 | 3.33x | 30 | |

| 327 | GOLDIAM | 376.45 | 1.18x | 85 | |

| 328 | GOLDIETF | 81.74 | 3.33x | 30 | |

| 329 | GOLDSHARE | 80.05 | 3.33x | 30 | |

| 330 | GOODLUCK | 774.3 | 1.18x | 85 | |

| 331 | GPIL | 193.69 | 1.18x | 85 | |

| 332 | GPPL | 143.41 | 2x | 50 | |

| 333 | GRANULES | 463.05 | 1.67x | 60 | |

| 334 | GRAPHITE | 474 | 1.43x | 70 | |

| 335 | GRASIM | 2702.8 | 2x | 50 | |

| 336 | GRAVITA | 1923.5 | 1.25x | 80 | |

| 337 | GREAVESCOT | 195.77 | 1.67x | 60 | |

| 338 | GREENPANEL | 234.98 | 1.25x | 80 | |

| 339 | GREENPLY | 295.45 | 1.43x | 70 | |

| 340 | GRINDWELL | 1677.4 | 2x | 50 | |

| 341 | GRINFRA | 1088.5 | 1.18x | 85 | |

| 342 | GRSE | 1721.5 | 2.5x | 40 | |

| 343 | GSFC | 186.69 | 1.11x | 90 | |

| 344 | GSPL | 310 | 2x | 50 | |

| 345 | GUFICBIO | 343.8 | 1.18x | 85 | |

| 346 | GUJALKALI | 642.5 | 2.5x | 40 | |

| 347 | GUJGASLTD | 429.25 | 2.5x | 40 | |

| 348 | GULFOILLUB | 1184.1 | 1.67x | 60 | |

| 349 | HAL | 4209.2 | 2.5x | 40 | |

| 350 | HAPPYFORGE | 799.15 | 1.18x | 85 | |

| 351 | HARIOMPIPE | 386.9 | 1.25x | 80 | |

| 352 | HARSHA | 395.1 | 1.11x | 90 | |

| 353 | HATSUN | 950.2 | 1.11x | 90 | |

| 354 | HAVELLS | 1613.9 | 2x | 50 | |

| 355 | HBLENGINE | 515.1 | 1.11x | 90 | |

| 356 | HCC | 26.76 | 1.25x | 80 | |

| 357 | HCLTECH | 1431.7 | 2.5x | 40 | |

| 358 | HDFCAMC | 4130 | 1.82x | 55 | |

| 359 | HDFCBANK | 1878 | 2.86x | 35 | |

| 360 | HDFCGOLD | 81.61 | 3.33x | 30 | |

| 361 | HDFCLIFE | 716.05 | 2x | 50 | |

| 362 | HDFCLIQUID | 1007.04 | 2x | 50 | |

| 363 | HDFCSILVER | 94 | 1.11x | 90 | |

| 364 | HDFCSML250 | 154.66 | 1.11x | 90 | |

| 365 | HEG | 479.75 | 1.43x | 70 | |

| 366 | HEIDELBERG | 199.75 | 2x | 50 | |

| 367 | HEMIPROP | 130.58 | 1.25x | 80 | |

| 368 | HERANBA | 248.34 | 1.25x | 80 | |

| 369 | HERCULES | 167.5 | 1.18x | 85 | |

| 370 | HERITGFOOD | 416.05 | 1.11x | 90 | |

| 371 | HEROMOTOCO | 3781.9 | 2.86x | 35 | |

| 372 | HEUBACHIND | 587.25 | 2.5x | 40 | |

| 373 | HFCL | 82.39 | 1.43x | 70 | |

| 374 | HGINFRA | 1117.8 | 1.18x | 85 | |

| 375 | HGS | 480.15 | 1.18x | 85 | |

| 376 | HIKAL | 432.9 | 1.67x | 60 | |

| 377 | HIMATSEIDE | 147.69 | 1.67x | 60 | |

| 378 | HINDALCO | 609.9 | 2x | 50 | |

| 379 | HINDCOPPER | 209.69 | 2.5x | 40 | |

| 380 | HINDOILEXP | 175.71 | 1.11x | 90 | |

| 381 | HINDPETRO | 390.05 | 2.5x | 40 | |

| 382 | HINDUNILVR | 2366.6 | 2.86x | 35 | |

| 383 | HINDWAREAP | 200.86 | 1.18x | 85 | |

| 384 | HINDZINC | 438 | 1.43x | 70 | |

| 385 | HITECH | 100.81 | 1.11x | 90 | |

| 386 | HLEGLAS | 275.9 | 1.18x | 85 | |

| 387 | HMAAGRO | 31.69 | 1.18x | 85 | |

| 388 | HNDFDS | 598.5 | 1.18x | 85 | |

| 389 | HNGSNGBEES | 380.43 | 2x | 50 | |

| 390 | HOMEFIRST | 1175.1 | 1.11x | 90 | |

| 391 | HONAUT | 34235 | 1.67x | 60 | |

| 392 | HPAL | 54.47 | 1.25x | 80 | |

| 393 | HPL | 439.8 | 1.18x | 85 | |

| 394 | HSCL | 443.85 | 1.25x | 80 | |

| 395 | HUDCO | 224.16 | 1.67x | 60 | |

| 396 | ICICIB22 | 104.73 | 3.33x | 30 | |

| 397 | ICICIBANK | 1356.4 | 2.22x | 45 | |

| 398 | ICICIGI | 1811.8 | 2x | 50 | |

| 399 | ICICIPRULI | 586.3 | 1.82x | 55 | |

| 400 | ICIL | 294.5 | 1.18x | 85 | |

| 401 | ICRA | 5645.5 | 1.43x | 70 | |

| 402 | IDBI | 81.54 | 1.82x | 55 | |

| 403 | IDEAFORGE | 365.8 | 1.25x | 80 | |

| 404 | IDFCFIRSTB | 63.32 | 1.67x | 60 | |

| 405 | IEX | 186.61 | 1.82x | 55 | |

| 406 | IFCI | 43.62 | 1.33x | 75 | |

| 407 | IGARASHI | 476.25 | 1.18x | 85 | |

| 408 | IGL | 176.53 | 2x | 50 | |

| 409 | IGPL | 440.65 | 1.18x | 85 | |

| 410 | IIFL | 333.1 | 2x | 50 | |

| 411 | IIFLCAPS | 215.41 | 1.67x | 60 | |

| 412 | IKIO | 245.97 | 1.11x | 90 | |

| 413 | IMAGICAA | 69.33 | 1.18x | 85 | |

| 414 | INDBANK | 30.16 | 1.11x | 90 | |

| 415 | INDHOTEL | 842.05 | 2x | 50 | |

| 416 | INDIACEM | 282.5 | 1.33x | 75 | |

| 417 | INDIAGLYCO | 1358.5 | 2x | 50 | |

| 418 | INDIAMART | 2148.2 | 1.67x | 60 | |

| 419 | INDIANB | 568.15 | 1.67x | 60 | |

| 420 | INDIGO | 5244.5 | 2x | 50 | |

| 421 | INDIGOPNTS | 1023.6 | 1.43x | 70 | |

| 422 | INDOCO | 239.78 | 1.18x | 85 | |

| 423 | INDUSINDBK | 788.25 | 1.18x | 85 | |

| 424 | INDUSTOWER | 386.1 | 1.67x | 60 | |

| 425 | INFY | 1413.1 | 2.5x | 40 | |

| 426 | INGERRAND | 3559.9 | 3.33x | 30 | |

| 427 | INOXGREEN | 136.96 | 1.25x | 80 | |

| 428 | INOXINDIA | 1021.1 | 1.18x | 85 | |

| 429 | INOXWIND | 164.68 | 1.54x | 65 | |

| 430 | INTLCONV | 73.21 | 1.18x | 85 | |

| 431 | IOB | 36.44 | 2x | 50 | |

| 432 | IOC | 133.83 | 2.5x | 40 | |

| 433 | IOLCP | 64.18 | 2x | 50 | |

| 434 | IONEXCHANG | 518.35 | 1.25x | 80 | |

| 435 | IPCALAB | 1409 | 2x | 50 | |

| 436 | IPL | 141.04 | 1.11x | 90 | |

| 437 | IRB | 46.69 | 1.67x | 60 | |

| 438 | IRCON | 160.61 | 2.5x | 40 | |

| 439 | IRCTC | 760.6 | 2x | 50 | |

| 440 | IREDA | 176.39 | 1.18x | 85 | |

| 441 | IRFC | 129.06 | 1.43x | 70 | |

| 442 | ISGEC | 1099.9 | 1.11x | 90 | |

| 443 | ITBEES | 35.97 | 1.11x | 90 | |

| 444 | ITC | 424.45 | 2.5x | 40 | |

| 445 | ITDCEM | 528.35 | 1.25x | 80 | |

| 446 | ITI | 268.2 | 2x | 50 | |

| 447 | J&KBANK | 98.24 | 1.67x | 60 | |

| 448 | JAICORPLTD | 91 | 2.5x | 40 | |

| 449 | JAMNAAUTO | 76.83 | 1.67x | 60 | |

| 450 | JBCHEPHARM | 1628 | 2.5x | 40 | |

| 451 | JCHAC | 1799.5 | 2.5x | 40 | |

| 452 | JINDALSAW | 257.9 | 2.5x | 40 | |

| 453 | JINDALSTEL | 854.25 | 2x | 50 | |

| 454 | JINDWORLD | 68.85 | 1.18x | 85 | |

| 455 | JIOFIN | 242.28 | 1.18x | 85 | |

| 456 | JISLJALEQS | 54.18 | 1.25x | 80 | |

| 457 | JKCEMENT | 5050.9 | 2x | 50 | |

| 458 | JKIL | 717.1 | 1.11x | 90 | |

| 459 | JKLAKSHMI | 813.6 | 2x | 50 | |

| 460 | JKPAPER | 330.4 | 2x | 50 | |

| 461 | JKTYRE | 303.45 | 2x | 50 | |

| 462 | JMFINANCIL | 99.7 | 1.67x | 60 | |

| 463 | JPPOWER | 15.41 | 1.11x | 90 | |

| 464 | JSL | 558.7 | 1.11x | 90 | |

| 465 | JSWENERGY | 509.7 | 1.43x | 70 | |

| 466 | JSWINFRA | 306.5 | 1.11x | 90 | |

| 467 | JSWSTEEL | 1009.4 | 2.5x | 40 | |

| 468 | JTEKTINDIA | 136.9 | 1.18x | 85 | |

| 469 | JTLIND | 66.98 | 1.11x | 90 | |

| 470 | JUBLFOOD | 703.05 | 2x | 50 | |

| 471 | JUBLINGREA | 668.25 | 1.18x | 85 | |

| 472 | JUBLPHARMA | 915.95 | 1.43x | 70 | |

| 473 | JUNIORBEES | 681.39 | 3.33x | 30 | |

| 474 | JUSTDIAL | 916.95 | 1.67x | 60 | |

| 475 | JYOTHYLAB | 376.9 | 2x | 50 | |

| 476 | KABRAEXTRU | 261.15 | 1.11x | 90 | |

| 477 | KAJARIACER | 791.05 | 2x | 50 | |

| 478 | KALYANKJIL | 525.35 | 1.43x | 70 | |

| 479 | KANSAINER | 259.87 | 2x | 50 | |

| 480 | KARURVYSYA | 218.46 | 2x | 50 | |

| 481 | KAYNES | 5671.2 | 1.43x | 70 | |

| 482 | KCP | 208.3 | 1.18x | 85 | |

| 483 | KEC | 723.5 | 2x | 50 | |

| 484 | KEI | 2754.9 | 2.5x | 40 | |

| 485 | KELLTONTEC | 110.6 | 1.18x | 85 | |

| 486 | KESORAMIND | 3.32 | 1.11x | 90 | |

| 487 | KFINTECH | 1052.4 | 1.43x | 70 | |

| 488 | KHADIM | 296.6 | 1.18x | 85 | |

| 489 | KHAICHEM | 50.71 | 1.18x | 85 | |

| 490 | KIMS | 645.45 | 1.43x | 70 | |

| 491 | KIRIINDUS | 643.6 | 1.25x | 80 | |

| 492 | KIRLOSBROS | 1633.2 | 1.25x | 80 | |

| 493 | KIRLOSENG | 757.75 | 2x | 50 | |

| 494 | KIRLOSIND | 3201.7 | 1.18x | 85 | |

| 495 | KIRLPNU | 1161.2 | 1.18x | 85 | |

| 496 | KITEX | 240.72 | 1.18x | 85 | |

| 497 | KKCL | 461.2 | 1.18x | 85 | |

| 498 | KNRCON | 228.15 | 2x | 50 | |

| 499 | KOKUYOCMLN | 109.84 | 1.18x | 85 | |

| 500 | KOLTEPATIL | 333.3 | 1.11x | 90 | |

| 501 | KOPRAN | 205.85 | 1.18x | 85 | |

| 502 | KOTAKBANK | 2123.4 | 2.22x | 45 | |

| 503 | KOTARISUG | 35.51 | 1.11x | 90 | |

| 504 | KPIL | 931.9 | 2x | 50 | |

| 505 | KPITTECH | 1149.2 | 1.82x | 55 | |

| 506 | KPRMILL | 1033.85 | 1.67x | 60 | |

| 507 | KRBL | 294.35 | 1.43x | 70 | |

| 508 | KRSNAA | 808.05 | 1.18x | 85 | |

| 509 | KSB | 736.45 | 1.18x | 85 | |

| 510 | KSCL | 1522.7 | 2x | 50 | |

| 511 | KSL | 762.2 | 1.18x | 85 | |

| 512 | KTKBANK | 190.48 | 1.33x | 75 | |

| 513 | LALPATHLAB | 2772.3 | 1.82x | 55 | |

| 514 | LANDMARK | 422 | 1.18x | 85 | |

| 515 | LAOPALA | 226.3 | 2x | 50 | |

| 516 | LATENTVIEW | 383.2 | 1.43x | 70 | |

| 517 | LAURUSLABS | 626.9 | 1.67x | 60 | |

| 518 | LGBBROSLTD | 1199.4 | 1.82x | 55 | |

| 519 | LICHSGFIN | 593.95 | 2.22x | 45 | |

| 520 | LICI | 797.65 | 1.43x | 70 | |

| 521 | LIKHITHA | 280.55 | 1.11x | 90 | |

| 522 | LINDEINDIA | 6236 | 1.43x | 70 | |

| 523 | LIQUID | 999.99 | 1.11x | 90 | |

| 524 | LIQUIDBEES | 1000 | 3.33x | 30 | |

| 525 | LIQUIDETF | 999.99 | 3.33x | 30 | |

| 526 | LIQUIDIETF | 999.99 | 3.33x | 30 | |

| 527 | LIQUIDSBI | 1000 | 1.11x | 90 | |

| 528 | LLOYDSME | 1284.1 | 1.18x | 85 | |

| 529 | LMW | 15587 | 2x | 50 | |

| 530 | LODHA | 1240.8 | 1.43x | 70 | |

| 531 | LT | 3227.7 | 2.5x | 40 | |

| 532 | LTF | 158.6 | 1.43x | 70 | |

| 533 | LTFOODS | 351.35 | 2x | 50 | |

| 534 | LTGILTBEES | 28.44 | 1.54x | 65 | |

| 535 | LTIm | 4276.3 | 1.11x | 90 | |

| 536 | LTTS | 4235.8 | 2x | 50 | |

| 537 | LUMAXTECH | 541.8 | 1.67x | 60 | |

| 538 | LUPIN | 1934.2 | 2.5x | 40 | |

| 539 | LUXIND | 1430.3 | 1.43x | 70 | |

| 540 | LXCHEM | 171.72 | 1.11x | 90 | |

| 541 | M&M | 2634.6 | 2.86x | 35 | |

| 542 | M&MFIN | 272.65 | 1.67x | 60 | |

| 543 | MADRASFERT | 78.79 | 1.11x | 90 | |

| 544 | MAFANG | 117 | 1.11x | 90 | |

| 545 | MAHABANK | 47.52 | 2x | 50 | |

| 546 | MAHLIFE | 314 | 1.82x | 55 | |

| 547 | MAHLOG | 290.9 | 1.67x | 60 | |

| 548 | MAHSCOOTER | 11129 | 2.5x | 40 | |

| 549 | MAHSEAMLES | 688.6 | 2.5x | 40 | |

| 550 | MAITHANALL | 904 | 1.18x | 85 | |

| 551 | MANALIPETC | 55.51 | 1.25x | 80 | |

| 552 | MANAPPURAM | 226.82 | 1.67x | 60 | |

| 553 | MANGCHEFER | 195.06 | 1.11x | 90 | |

| 554 | MANINFRA | 156.85 | 1.11x | 90 | |

| 555 | MANKIND | 2520 | 1.54x | 65 | |

| 556 | MANYAVAR | 786 | 1.43x | 70 | |

| 557 | MAPMYINDIA | 1733.9 | 1.11x | 90 | |

| 558 | MARICO | 720.45 | 2.86x | 35 | |

| 559 | MARKSANS | 213.52 | 1.43x | 70 | |

| 560 | MARUTI | 11664 | 2.5x | 40 | |

| 561 | MASFIN | 265.28 | 1.33x | 75 | |

| 562 | MASTEK | 2333.7 | 1.11x | 90 | |

| 563 | MATRIMONY | 500.9 | 1.18x | 85 | |

| 564 | MAXHEALTH | 1077.5 | 1.54x | 65 | |

| 565 | MAYURUNIQ | 494.9 | 1.54x | 65 | |

| 566 | MAZDOCK | 2731.9 | 2.5x | 40 | |

| 567 | MCX | 5628 | 2x | 50 | |

| 568 | MEDANTA | 1295.3 | 1.11x | 90 | |

| 569 | MEDPLUS | 790.4 | 1.18x | 85 | |

| 570 | METROBRAND | 1095 | 1.11x | 90 | |

| 571 | METROPOLIS | 1666.7 | 1.82x | 55 | |

| 572 | MFSL | 1209.7 | 1.43x | 70 | |

| 573 | MGL | 1252.4 | 2x | 50 | |

| 574 | MHRIL | 306.05 | 2x | 50 | |

| 575 | MID150BEES | 198.85 | 2x | 50 | |

| 576 | MIDHANI | 287.95 | 1.54x | 65 | |

| 577 | MINDACORP | 507.1 | 2x | 50 | |

| 578 | MMTC | 53.62 | 1.18x | 85 | |

| 579 | MOIL | 328.75 | 2x | 50 | |

| 580 | MOL | 75.48 | 1.18x | 85 | |

| 581 | MOLDTKPAC | 505.3 | 1.67x | 60 | |

| 582 | MON100 | 165.13 | 3.33x | 30 | |

| 583 | MONTECARLO | 583 | 1.18x | 85 | |

| 584 | MOREPENLAB | 52.27 | 1.43x | 70 | |

| 585 | MOTHERSON | 128.34 | 1.82x | 55 | |

| 586 | MOTILALOFS | 639.35 | 1.67x | 60 | |

| 587 | MPHASIS | 2267.1 | 2x | 50 | |

| 588 | MPSLTD | 2435.8 | 1.67x | 60 | |

| 589 | MRF | 124490 | 2.5x | 40 | |

| 590 | MRPL | 137.58 | 1.33x | 75 | |

| 591 | MSTCLTD | 527.1 | 1.11x | 90 | |

| 592 | MSUMI | 53.02 | 1.43x | 70 | |

| 593 | MTARTECH | 1412 | 1.43x | 70 | |

| 594 | MUKANDLTD | 95.76 | 1.18x | 85 | |

| 595 | MUNJALSHOW | 114.88 | 1.18x | 85 | |

| 596 | MUTHOOTFIN | 2080.7 | 1.54x | 65 | |

| 597 | MUTHOOTMF | 139.84 | 1.18x | 85 | |

| 598 | NAM-INDIA | 581 | 1.54x | 65 | |

| 599 | NATCOPHARM | 826.6 | 2x | 50 | |

| 600 | NATIONALUM | 151.22 | 1.43x | 70 | |

| 601 | NAUKRI | 6776 | 2x | 50 | |

| 602 | NAVA | 482.55 | 1.11x | 90 | |

| 603 | NAVINFLUOR | 4270.9 | 2.5x | 40 | |

| 604 | NAVKARCORP | 97.48 | 1.11x | 90 | |

| 605 | NAVNETEDUL | 140.86 | 1.67x | 60 | |

| 606 | NAZARA | 965.5 | 1.43x | 70 | |

| 607 | NBCC | 95.8 | 2x | 50 | |

| 608 | NCC | 220.61 | 2x | 50 | |

| 609 | NCLIND | 210.74 | 2.5x | 40 | |

| 610 | NDTV | 122.57 | 1.11x | 90 | |

| 611 | NECLIFE | 22.86 | 1.18x | 85 | |

| 612 | NELCAST | 89.98 | 1.18x | 85 | |

| 613 | NELCO | 910.5 | 1.18x | 85 | |

| 614 | NEOGEN | 1619.8 | 1.11x | 90 | |

| 615 | NESCO | 967.85 | 1.67x | 60 | |

| 616 | NESTLEIND | 2383.3 | 2.5x | 40 | |

| 617 | NETWORK18 | 45.11 | 1.11x | 90 | |

| 618 | NEULANDLAB | 12749 | 2x | 50 | |

| 619 | NFL | 81.85 | 2.5x | 40 | |

| 620 | NH | 1793.3 | 2.5x | 40 | |

| 621 | NHPC | 85.32 | 1.33x | 75 | |

| 622 | NIACL | 166.8 | 2.5x | 40 | |

| 623 | NIF100BEES | 252.01 | 2x | 50 | |

| 624 | NIFTY1 | 256.11 | 3.33x | 30 | |

| 625 | NIFTYBEES | 261.91 | 3.33x | 30 | |

| 626 | NIFTYIETF | 260.53 | 3.33x | 30 | |

| 627 | NILKAMAL | 1632.7 | 2x | 50 | |

| 628 | NLCINDIA | 242.15 | 2.5x | 40 | |

| 629 | NMDC | 65.74 | 2.22x | 45 | |

| 630 | NOCIL | 188.59 | 2x | 50 | |

| 631 | NRBBEARING | 218.62 | 1.11x | 90 | |

| 632 | NSLNISP | 35.76 | 1.18x | 85 | |

| 633 | NTPC | 359.3 | 3.33x | 30 | |

| 634 | NUVAMA | 5878.5 | 1.18x | 85 | |

| 635 | NUVOCO | 322.5 | 1.18x | 85 | |

| 636 | NYKAA | 189.84 | 1.54x | 65 | |

| 637 | OBEROIRLTY | 1641.4 | 2x | 50 | |

| 638 | OFSS | 7882.5 | 2x | 50 | |

| 639 | OIL | 378.3 | 2x | 50 | |

| 640 | OLECTRA | 1232 | 1.11x | 90 | |

| 641 | ONGC | 241.22 | 1.43x | 70 | |

| 642 | ONMOBILE | 47.99 | 1.43x | 70 | |

| 643 | ORCHPHARMA | 775.9 | 1.18x | 85 | |

| 644 | ORIENTCEM | 358.6 | 2.5x | 40 | |

| 645 | ORIENTELEC | 214.86 | 2.5x | 40 | |

| 646 | ORIENTHOT | 146.2 | 1.25x | 80 | |

| 647 | ORIENTPPR | 24.9 | 1.54x | 65 | |

| 648 | ORISSAMINE | 4971.9 | 1.18x | 85 | |

| 649 | PAGEIND | 44930 | 2.5x | 40 | |

| 650 | PARADEEP | 136.13 | 1.18x | 85 | |

| 651 | PARAGMILK | 185.88 | 2.5x | 40 | |

| 652 | PATANJALI | 2000.8 | 1.18x | 85 | |

| 653 | PATELENG | 42.54 | 1.18x | 85 | |

| 654 | PCBL | 432.95 | 2.5x | 40 | |

| 655 | PEL | 990.25 | 1.67x | 60 | |

| 656 | PENIND | 189.16 | 1.18x | 85 | |

| 657 | PERSISTENT | 4705.5 | 1.67x | 60 | |

| 658 | PETRONET | 300.45 | 2.5x | 40 | |

| 659 | PFC | 423.8 | 2.5x | 40 | |

| 660 | PFIZER | 4201.8 | 2x | 50 | |

| 661 | PGEL | 960.85 | 1.18x | 85 | |

| 662 | PGHH | 14029 | 2x | 50 | |

| 663 | PGHL | 5199.5 | 2x | 50 | |

| 664 | PHARMABEES | 21.28 | 2x | 50 | |

| 665 | PHOENIXLTD | 1598.7 | 1.67x | 60 | |

| 666 | PIDILITIND | 3026.5 | 2.5x | 40 | |

| 667 | PIIND | 3641.6 | 2x | 50 | |

| 668 | PILANIINVS | 4332.5 | 1.18x | 85 | |

| 669 | PNB | 98.83 | 1.67x | 60 | |

| 670 | PNBGILTS | 92.55 | 1.18x | 85 | |

| 671 | PNBHOUSING | 1001.7 | 2.5x | 40 | |

| 672 | PNCINFRA | 273.55 | 1.18x | 85 | |

| 673 | POKARNA | 948.2 | 1.18x | 85 | |

| 674 | POLICYBZR | 1649.6 | 1.54x | 65 | |

| 675 | POLYCAB | 5299.5 | 1.67x | 60 | |

| 676 | POLYMED | 2320.4 | 2.5x | 40 | |

| 677 | POLYPLEX | 1248.7 | 2.5x | 40 | |

| 678 | POONAWALLA | 383.8 | 1.11x | 90 | |

| 679 | POWERGRID | 305.75 | 2.5x | 40 | |

| 680 | POWERINDIA | 12695 | 2x | 50 | |

| 681 | POWERMECH | 2755.5 | 1.18x | 85 | |

| 682 | PPLPHARMA | 221.84 | 1.43x | 70 | |

| 683 | PRAJIND | 520.6 | 1.18x | 85 | |

| 684 | PRECWIRE | 137.92 | 1.18x | 85 | |

| 685 | PRESTIGE | 1207.4 | 1.33x | 75 | |

| 686 | PRICOLLTD | 444.35 | 1.11x | 90 | |

| 687 | PRINCEPIPE | 258.98 | 1.43x | 70 | |

| 688 | PROZONER | 32.41 | 1.11x | 90 | |

| 689 | PRSMJOHNSN | 134.72 | 1.67x | 60 | |

| 690 | PRUDENT | 2335.7 | 1.18x | 85 | |

| 691 | PSB | 28.15 | 1.18x | 85 | |

| 692 | PSPPROJECT | 634.85 | 1.67x | 60 | |

| 693 | PSUBNKBEES | 71.39 | 1.54x | 65 | |

| 694 | PTC | 176.48 | 1.33x | 75 | |

| 695 | PTC | 176.48 | 1.33x | 75 | |

| 696 | PVRINOX | 952.75 | 1.67x | 60 | |

| 697 | QGOLDHALF | 78.75 | 3.33x | 30 | |

| 698 | QUESS | 313.05 | 1.82x | 55 | |

| 699 | QUICKHEAL | 286.2 | 2x | 50 | |

| 700 | RADIANTCMS | 69.17 | 1.18x | 85 | |

| 701 | RADICO | 2438 | 2.5x | 40 | |

| 702 | RAILTEL | 309.4 | 1.54x | 65 | |

| 703 | RAIN | 141.41 | 2x | 50 | |

| 704 | RAINBOW | 1512.2 | 1.18x | 85 | |

| 705 | RAJESHEXPO | 192.69 | 2.5x | 40 | |

| 706 | RAJRATAN | 299.9 | 1.18x | 85 | |

| 707 | RALLIS | 225.44 | 2x | 50 | |

| 708 | RAMASTEEL | 9.76 | 1.18x | 85 | |

| 709 | RAMCOCEM | 962.2 | 2x | 50 | |

| 710 | RAMCOIND | 243.25 | 1.18x | 85 | |

| 711 | RAMCOSYS | 384.85 | 1.11x | 90 | |

| 712 | RAMKY | 479.5 | 1.18x | 85 | |

| 713 | RAMRAT | 519.15 | 1.18x | 85 | |

| 714 | RANASUG | 13.58 | 1.18x | 85 | |

| 715 | RANEHOLDIN | 1425 | 1.18x | 85 | |

| 716 | RATEGAIN | 458.15 | 1.54x | 65 | |

| 717 | RATNAMANI | 2654.2 | 1.67x | 60 | |

| 718 | RAYMOND | 1512.5 | 1.82x | 55 | |

| 719 | RBA | 72.66 | 1.11x | 90 | |

| 720 | RBLBANK | 182.76 | 1.54x | 65 | |

| 721 | RCF | 133.58 | 2.5x | 40 | |

| 722 | RECLTD | 424.8 | 2.5x | 40 | |

| 723 | REDINGTON | 226.37 | 2x | 50 | |

| 724 | RELAXO | 408.25 | 2x | 50 | |

| 725 | RELIANCE | 1239.3 | 2.5x | 40 | |

| 726 | RELINFRA | 253.2 | 1.18x | 85 | |

| 727 | RENUKA | 28.65 | 1.11x | 90 | |

| 728 | REPCOHOME | 376.15 | 1.43x | 70 | |

| 729 | RESPONIND | 195.02 | 1.18x | 85 | |

| 730 | RHIM | 486.2 | 1.43x | 70 | |

| 731 | RICOAUTO | 63.49 | 1.43x | 70 | |

| 732 | RIIL | 839.75 | 2.5x | 40 | |

| 733 | RITCO | 281.3 | 1.18x | 85 | |

| 734 | RITES | 232.72 | 1.67x | 60 | |

| 735 | RKFORGE | 767.95 | 1.43x | 70 | |

| 736 | ROHLTD | 390.7 | 1.18x | 85 | |

| 737 | ROLEXRINGS | 1343.2 | 1.25x | 80 | |

| 738 | ROSSARI | 688.8 | 3.33x | 30 | |

| 739 | ROTO | 217.48 | 1.18x | 85 | |

| 740 | ROUTE | 981.8 | 1.43x | 70 | |

| 741 | RPGLIFE | 2185 | 2x | 50 | |

| 742 | RRKABEL | 935.75 | 1.18x | 85 | |

| 743 | RSYSTEMS | 333.55 | 1.18x | 85 | |

| 744 | RUPA | 191.86 | 1.11x | 90 | |

| 745 | RUSTOMJEE | 534.1 | 1.18x | 85 | |

| 746 | RVNL | 367.05 | 2.5x | 40 | |

| 747 | SAFARI | 2129.9 | 1.11x | 90 | |

| 748 | SAIL | 115.3 | 1.43x | 70 | |

| 749 | SAKHTISUG | 22.93 | 1.18x | 85 | |

| 750 | SALZERELEC | 1081.1 | 1.18x | 85 | |

| 751 | SAMHI | 176.37 | 1.18x | 85 | |

| 752 | SAMMAANCAP | 115.58 | 1.25x | 80 | |

| 753 | SANDHAR | 392.85 | 1.67x | 60 | |

| 754 | SANGHVIMOV | 303.53 | 1.18x | 85 | |

| 755 | SANOFI | 6207 | 2x | 50 | |

| 756 | SANSERA | 1123.4 | 1.18x | 85 | |

| 757 | SAPPHIRE | 308.15 | 1.43x | 70 | |

| 758 | SARDAEN | 486.1 | 1.18x | 85 | |

| 759 | SAREGAMA | 548.05 | 1.43x | 70 | |

| 760 | SBCL | 435.45 | 1.18x | 85 | |

| 761 | SBFC | 98.33 | 1.18x | 85 | |

| 762 | SBICARD | 888.65 | 2.5x | 40 | |

| 763 | SBIETFQLTY | 205.74 | 2x | 50 | |

| 764 | SBILIFE | 1565.4 | 2x | 50 | |

| 765 | SBIN | 771.75 | 2x | 50 | |

| 766 | SCHAEFFLER | 3195.2 | 2x | 50 | |

| 767 | SCI | 175.24 | 1.67x | 60 | |

| 768 | SDL26BEES | 129.84 | 2x | 50 | |

| 769 | SETFGOLD | 81.46 | 3.33x | 30 | |

| 770 | SETFNIF50 | 247.69 | 3.33x | 30 | |

| 771 | SETFNIFBK | 540.96 | 2.5x | 40 | |

| 772 | SFL | 650.1 | 1.67x | 60 | |

| 773 | SHALBY | 194.11 | 1.18x | 85 | |

| 774 | SHALPAINTS | 112.35 | 1.18x | 85 | |

| 775 | SHANKARA | 609.25 | 1.11x | 90 | |

| 776 | SHANTIGEAR | 480.15 | 1.11x | 90 | |

| 777 | SHARDACROP | 549.65 | 2x | 50 | |

| 778 | SHILPAMED | 661.55 | 1.11x | 90 | |

| 779 | SHK | 198.83 | 2.5x | 40 | |

| 780 | SHOPERSTOP | 519.45 | 2.5x | 40 | |

| 781 | SHREDIGCEM | 73.47 | 1.11x | 90 | |

| 782 | SHREECEM | 30800 | 2.5x | 40 | |

| 783 | SHRIRAMFIN | 676.05 | 1.43x | 70 | |

| 784 | SHRIRAMPPS | 78.72 | 1.11x | 90 | |

| 785 | SHYAMMETL | 898.95 | 1.18x | 85 | |

| 786 | SIEMENS | 2811.5 | 2.5x | 40 | |

| 787 | SIGACHI | 39.45 | 1.11x | 90 | |

| 788 | SILVER | 97.8 | 1.11x | 90 | |

| 789 | SILVERBEES | 93.8 | 1.54x | 65 | |

| 790 | SIRCA | 282.71 | 1.11x | 90 | |

| 791 | SIS | 335.75 | 2.5x | 40 | |

| 792 | SIYSIL | 736.5 | 1.11x | 90 | |

| 793 | SJS | 928.6 | 1.18x | 85 | |

| 794 | SJVN | 95.03 | 2x | 50 | |

| 795 | SKFINDIA | 3898.2 | 2x | 50 | |

| 796 | SKIPPER | 440.45 | 1.18x | 85 | |

| 797 | SMCGLOBAL | 111.7 | 1.18x | 85 | |

| 798 | SMLISUZU | 1699.2 | 2x | 50 | |

| 799 | SNOWMAN | 49.56 | 1.11x | 90 | |

| 800 | SOBHA | 1202.1 | 1.82x | 55 | |

| 801 | SOLARINDS | 12128 | 2x | 50 | |

| 802 | SOMANYCERA | 438.8 | 1.11x | 90 | |

| 803 | SONACOMS | 446.8 | 1.54x | 65 | |

| 804 | SONATSOFTW | 335.05 | 2x | 50 | |

| 805 | SOTL | 382.1 | 1.18x | 85 | |

| 806 | SOUTHBANK | 24.42 | 1.33x | 75 | |

| 807 | SPAL | 727.65 | 1.18x | 85 | |

| 808 | SPARC | 150.36 | 1.43x | 70 | |

| 809 | SPCENET | 8.54 | 1.18x | 85 | |

| 810 | SPENCERS | 67.71 | 2x | 50 | |

| 811 | SPIC | 84.84 | 1.18x | 85 | |

| 812 | SPLPETRO | 631.9 | 1.18x | 85 | |

| 813 | SPORTKING | 88.21 | 1.18x | 85 | |

| 814 | SRF | 2991.6 | 2.22x | 45 | |

| 815 | SSWL | 192.26 | 1.18x | 85 | |

| 816 | STAR | 665.1 | 1.82x | 55 | |

| 817 | STARCEMENT | 221.82 | 1.11x | 90 | |

| 818 | STARHEALTH | 386.15 | 1.54x | 65 | |

| 819 | STCINDIA | 120.57 | 1.11x | 90 | |

| 820 | STEELXIND | 8.26 | 1.18x | 85 | |

| 821 | STERTOOLS | 316.75 | 1.18x | 85 | |

| 822 | STLTECH | 82.53 | 2x | 50 | |

| 823 | STOVEKRAFT | 681.95 | 1.18x | 85 | |

| 824 | SUBEXLTD | 11.84 | 1.18x | 85 | |

| 825 | SUBROS | 598.2 | 2x | 50 | |

| 826 | SUDARSCHEM | 1033.6 | 2.5x | 40 | |

| 827 | SULA | 283.25 | 1.11x | 90 | |

| 828 | SUMICHEM | 556.8 | 2.5x | 40 | |

| 829 | SUNDARMFIN | 5179.3 | 1.67x | 60 | |

| 830 | SUNDRMFAST | 924.9 | 2x | 50 | |

| 831 | SUNFLAG | 249.74 | 1.18x | 85 | |

| 832 | SUNPHARMA | 1693.1 | 2.5x | 40 | |

| 833 | SUNTECK | 396.35 | 2.5x | 40 | |

| 834 | SUNTV | 682.9 | 1.43x | 70 | |

| 835 | SUPRAJIT | 396.75 | 1.67x | 60 | |

| 836 | SUPREMEIND | 3398.2 | 2x | 50 | |

| 837 | SUPRIYA | 743.9 | 1.11x | 90 | |

| 838 | SURYAROSNI | 256.84 | 1.11x | 90 | |

| 839 | SURYODAY | 120.6 | 1.11x | 90 | |

| 840 | SUVEN | 126.14 | 2x | 50 | |

| 841 | SUVENPHAR | 1195.7 | 2.5x | 40 | |

| 842 | SWANENERGY | 432.1 | 1.43x | 70 | |

| 843 | SWARAJENG | 4184.8 | 1.67x | 60 | |

| 844 | SYMPHONY | 1142.3 | 1.67x | 60 | |

| 845 | SYNGENE | 729.15 | 2x | 50 | |

| 846 | SYRMA | 494.7 | 1.43x | 70 | |

| 847 | TAJGVK | 451.65 | 1.18x | 85 | |

| 848 | TANLA | 480.1 | 1.18x | 85 | |

| 849 | TARSONS | 399.4 | 1.18x | 85 | |

| 850 | TASTYBITE | 8281 | 2x | 50 | |

| 851 | TATACHEM | 847.5 | 1.67x | 60 | |

| 852 | TATACOMM | 1593.7 | 2.5x | 40 | |

| 853 | TATACONSUM | 1105.9 | 2.22x | 45 | |

| 854 | TATAELXSI | 4929 | 2x | 50 | |

| 855 | TATAMOTORS | 616.05 | 1.43x | 70 | |

| 856 | TATAPOWER | 381.25 | 2.5x | 40 | |

| 857 | TATASTEEL | 136.97 | 2.5x | 40 | |

| 858 | TATATECH | 653.8 | 1.18x | 85 | |

| 859 | TATVA | 721.75 | 1.18x | 85 | |

| 860 | TBZ | 202.36 | 1.18x | 85 | |

| 861 | TCI | 1097.7 | 1.67x | 60 | |

| 862 | TCIEXP | 673.45 | 1.67x | 60 | |

| 863 | TCPLPACK | 4009.9 | 1.18x | 85 | |

| 864 | TCS | 3273.8 | 2.86x | 35 | |

| 865 | TDPOWERSYS | 437.95 | 1.18x | 85 | |

| 866 | TEAMLEASE | 1832.2 | 2x | 50 | |

| 867 | TECHM | 1308.7 | 2.5x | 40 | |

| 868 | TECHNOE | 1033.3 | 1.18x | 85 | |

| 869 | TEGA | 1454.7 | 1.11x | 90 | |

| 870 | TEJASNET | 863.25 | 1.43x | 70 | |

| 871 | TEXINFRA | 103.5 | 1.18x | 85 | |

| 872 | TEXMOPIPES | 54.63 | 1.11x | 90 | |

| 873 | TEXRAIL | 140.43 | 1.11x | 90 | |

| 874 | THERMAX | 3366.4 | 1.82x | 55 | |

| 875 | THYROCARE | 706.2 | 2x | 50 | |

| 876 | TI | 245.73 | 1.18x | 85 | |

| 877 | TIIL | 2443.8 | 1.18x | 85 | |

| 878 | TIINDIA | 2503.6 | 2.5x | 40 | |

| 879 | TIMETECHNO | 358.9 | 1.11x | 90 | |

| 880 | TIMKEN | 2566 | 2.5x | 40 | |

| 881 | TIRUMALCHM | 271.9 | 1.11x | 90 | |

| 882 | TITAGARH | 789.2 | 1.43x | 70 | |

| 883 | TITAN | 3272.1 | 2.5x | 40 | |

| 884 | TMB | 422.75 | 1.18x | 85 | |

| 885 | TNPETRO | 73.4 | 1.18x | 85 | |

| 886 | TNPL | 130.67 | 2.5x | 40 | |

| 887 | TORNTPHARM | 3222.7 | 2x | 50 | |

| 888 | TORNTPOWER | 1605.2 | 2x | 50 | |

| 889 | TRACXN | 52.01 | 1.18x | 85 | |

| 890 | TRANSWORLD | 293.5 | 1.18x | 85 | |

| 891 | TREL | 36.65 | 1.18x | 85 | |

| 892 | TRENT | 5035.5 | 1.67x | 60 | |

| 893 | TRIDENT | 27.04 | 1.11x | 90 | |

| 894 | TRITURBINE | 512.95 | 1.67x | 60 | |

| 895 | TRIVENI | 402.5 | 1.11x | 90 | |

| 896 | TRU | 7.35 | 1.18x | 85 | |

| 897 | TTKPRESTIG | 658.9 | 2x | 50 | |

| 898 | TTML | 60.24 | 1.11x | 90 | |

| 899 | TVSHLTD | 8926 | 1.18x | 85 | |

| 900 | TVSMOTOR | 2614.2 | 2x | 50 | |

| 901 | TVSSCS | 115.43 | 1.18x | 85 | |

| 902 | TVSSRICHAK | 2865.9 | 2x | 50 | |

| 903 | TVTODAY | 168.71 | 1.43x | 70 | |

| 904 | UBL | 2109.4 | 2.22x | 45 | |

| 905 | UCOBANK | 30.25 | 2x | 50 | |

| 906 | UFLEX | 533.95 | 2.5x | 40 | |

| 907 | UGROCAP | 189.72 | 1.18x | 85 | |

| 908 | UJJIVANSFB | 39.3 | 2.5x | 40 | |

| 909 | ULTRACEMCO | 11728 | 2.5x | 40 | |

| 910 | UNICHEMLAB | 623.25 | 1.67x | 60 | |

| 911 | UNIONBANK | 127.26 | 2x | 50 | |

| 912 | UNIPARTS | 320.85 | 1.11x | 90 | |

| 913 | UNITDSPR | 1503.2 | 2x | 50 | |

| 914 | UNIVCABLES | 439.75 | 1.18x | 85 | |

| 915 | UNOMINDA | 852.95 | 1.43x | 70 | |

| 916 | UPL | 659.65 | 2.22x | 45 | |

| 917 | USHAMART | 320.6 | 1.43x | 70 | |

| 918 | UTIAMC | 1026.1 | 3.33x | 30 | |

| 919 | UTINEXT50 | 67.83 | 1.11x | 90 | |

| 920 | UTKARSHBNK | 24.31 | 1.11x | 90 | |

| 921 | UTTAMSUGAR | 281.1 | 1.11x | 90 | |

| 922 | VADILALIND | 6022 | 1.18x | 85 | |

| 923 | VALIANTORG | 346.35 | 1.11x | 90 | |

| 924 | VARROC | 433.5 | 1.11x | 90 | |

| 925 | VASCONEQ | 39.58 | 1.18x | 85 | |

| 926 | VBL | 549.2 | 2.5x | 40 | |

| 927 | VEDL | 398.7 | 1.54x | 65 | |

| 928 | VENKEYS | 1698.8 | 2x | 50 | |

| 929 | VENUSPIPES | 1321.5 | 1.43x | 70 | |

| 930 | VGUARD | 361.45 | 1.33x | 75 | |

| 931 | VIJAYA | 991.9 | 1.18x | 85 | |

| 932 | VINATIORGA | 1625.1 | 2x | 50 | |

| 933 | VINDHYATEL | 1305.5 | 1.18x | 85 | |

| 934 | VINYLINDIA | 287.15 | 1.11x | 90 | |

| 935 | VIPIND | 282.25 | 2x | 50 | |

| 936 | VISHNU | 436.25 | 1.18x | 85 | |

| 937 | VISHWARAJ | 9.18 | 1.11x | 90 | |

| 938 | VMART | 3242.4 | 2.5x | 40 | |

| 939 | VOLTAS | 1277.1 | 2x | 50 | |

| 940 | VPRPL | 172.28 | 1.18x | 85 | |

| 941 | VRLLOG | 480.8 | 1.67x | 60 | |

| 942 | VSTIND | 290.2 | 2x | 50 | |

| 943 | VSTTILLERS | 3633.8 | 2.5x | 40 | |

| 944 | VTL | 496.4 | 2.5x | 40 | |

| 945 | WABAG | 1444.5 | 2x | 50 | |

| 946 | WELCORP | 797.2 | 1.43x | 70 | |

| 947 | WELENT | 511.55 | 1.18x | 85 | |

| 948 | WELSPUNLIV | 132.05 | 1.43x | 70 | |

| 949 | WESTLIFE | 708.1 | 2x | 50 | |

| 950 | WHIRLPOOL | 1100.2 | 1.43x | 70 | |

| 951 | WIPRO | 247.65 | 1.82x | 55 | |

| 952 | WONDERLA | 704.05 | 1.67x | 60 | |

| 953 | WSTCSTPAPR | 453.5 | 1.18x | 85 | |

| 954 | XCHANGING | 89.64 | 1.18x | 85 | |

| 955 | YATHARTH | 505.65 | 1.18x | 85 | |

| 956 | YATRA | 84.01 | 1.18x | 85 | |

| 957 | ZEEL | 112.62 | 1.67x | 60 | |

| 958 | ZENSARTECH | 656.45 | 1.11x | 90 | |

| 959 | ZFCVINDIA | 13488 | 2x | 50 | |

| 960 | ZYDUSLIFE | 822.1 | 2.5x | 40 | |

| 961 | ZYDUSWELL | 1765.4 | 2x | 50 |

The securities are quoted as an example and not as a recommendation.

Samco Securities Limited ("Samco") offers a Margin Trading Facility (MTF) to its clients, enabling them to leverage their investments in approved securities. This policy outlines the risk management framework, compliance requirements, and operational procedures governing MTF, ensuring adherence to regulatory standards and the safeguarding of client interests.

This policy is formulated in accordance with the Securities and Exchange Board of India (SEBI) guidelines, particularly SEBI circular CIR/MRD/DP/54/2017 dated June 13, 2017, and subsequent amendments. Samco ensures compliance with all SEBI regulations and circulars pertaining to MTF.

Only securities specified by SEBI and exchanges are eligible under MTF.Samco provides a list of over 800 MTF eligible stocks, which is subject to periodic review based on market conditions and internal risk assessments.

| Category of Stock | Initial Margin Applicable | Form of Margin Acceptance |

|---|---|---|

| Group I stocks available for trading in the F&O Segment | VaR + 3 times applicable ELM* | In the form of Cash and/or Group-I Equity Securities, available in F&O, with an appropriate haircut. |

| Group I stocks other than F&O stocks and units of Equity ETFs | VaR + 5 times applicable ELM* | In the form of Cash and/or Group-I Equity Securities, available in F&O, with an appropriate haircut. |

Securities forming part of "Group I Securities" as per SEBI Master Circular No. SEBI/ HO/ MRD/ DP/ CIR/ P/ 2016/ 135 dated December 16, 2016, shall be eligible for MTF. Samco reserves the right to include or exclude securities from the "MTF Approved Category List" at its discretion without prior intimation.

The Initial Margin payable by the client shall be in the form of Cash and/or Group I Equity Securities, available in F&O, with an appropriate haircut. Samco may apply additional haircuts at its discretion.

Margin on "Funded Securities" under MTF is computed by grossing applicable margins and checking against available margins. Collateral and funded shares are marked to market daily.

Clients must maintain required margins at all times. If there is a margin shortfall, Samco will issue a margin call. If not met at the earliest, Samco may liquidate the securities and/or close the position.

Market Capitalisation: Stocks with a higher market capitalization (large-cap stocks) are generally preferred for margin trading as they tend to have more stable price movements compared to Mid cap & Small-cap stocks. Large-cap stocks are usually considered less risky and more liquid.

Stock Price Range: Scrips with a moderate price range are often preferred for margin trading. Stocks that are too low-priced (penny stocks) may have low liquidity or be more volatile, while extremely high-priced stocks may not be attractive to many traders because of the large capital required.

Historical Performance: The historical performance of a stock in terms of price stability and profitability is another important factor. Stocks with a consistent performance track record are more likely to be included in MTF lists.

Sector and Industry Performance: Stocks belonging to sectors or industries that are currently performing well are likely to be included in margin trading. For example, if the technology sector is booming, stocks within this sector may be more likely to qualify for MTF.

Company Fundamentals: A company’s financial health, including profitability, revenue growth, debt levels, and management quality, impacts its eligibility for margin trading. Stocks of companies with strong fundamentals are generally preferred.

Risk Management and Margin Requirements: The broker's risk management policies and the margin requirements set for each stock influence the classification of scrips. Brokers typically set higher margin requirements for stocks that are more volatile or have lower liquidity to manage the potential risk.

Price-to-Earnings (P/E) Ratio: Stocks with a reasonable P/E ratio (not too high or too low) may be considered more stable for margin trading. Extreme ratios may signal overvaluation or undervaluation, leading to higher risks.

Corporate Actions: Events like mergers, acquisitions, stock splits, or bonus issues can influence a stock’s eligibility for margin trading. Stocks undergoing such actions may have heightened risks, and brokers will evaluate whether to offer margin trading on such stocks.

Samco offers up to 4X leverage on eligible securities, subject to regulatory limits and internal risk assessments.

Exposure Monitoring:An interest of 0.05% per day is charged on the outstanding borrowed capital for each day the amount remains unpaid (This rate may vary based on market conditions with prior notice). Standard brokerage and statutory charges apply as per Samco's prevailing tariff structure.

Samco employs advanced RMS tools to monitor client positions and margin requirements on a real-time basis.

Corporate actions such as dividends, stock splits, bonus issues, mergers, and rights issues will impact the valuation and margin requirements of securities under MTF. In the case of corporate actions, MTF positions will be converted to CNC/Delivery, and clients must ensure sufficient margin availability to accommodate these adjustments.

In the event of a margin shortfall, clients will be notified via email to replenish the deficient margin within a stipulated period. If the margin is not restored within the given timeframe, Samco reserves the right to initiate the liquidation of client positions to cover the shortfall. The square-off process is categorized into two types: risk-based square-off and margin shortfall square-off.

Risk-based square-off is executed when market volatility, illiquidity, or adverse news increases the risk associated with a position, irrespective of margin availability.

Margin shortfall square-off occurs when a client's available margin falls below the required level and is not rectified within the prescribed time.

For example, if a client purchases shares worth ₹1,00,000 under MTF with an initial margin requirement of ₹25,000 (25%) and the stock value drops, raising the margin requirement to ₹30,000, a shortfall of ₹5,000 arises. If the client fails to provide this additional margin within the stipulated period after a margin call, Samco will liquidate a portion of the securities to cover the deficit. The key difference between the two square-off scenarios is that risk-based square-off is initiated due to external risk factors impacting a position, regardless of the margin status, while margin shortfall square-off is specifically triggered by the client’s failure to maintain the required margin.

In the event of margin shortfall or breach of exposure limits, Samco reserves the right to square off positions without prior notice to the client.

While Samco endeavors to notify clients of margin shortfalls via SMS, email, or platform notifications, it is the client's responsibility to monitor their positions and margins.

Client Responsibilities

This policy is subject to periodic review to incorporate changes due to regulatory updates, market conditions, or internal assessments. Any amendments will be updated on the website & policy