What is an ETF?

An Exchange Traded Fund (ETF) is an investment fund traded on stock exchanges, similar to individual stocks. ETFs include various assets like bonds, stocks, or commodities, allowing investors to diversify without buying each asset separately. They are easily converted to cash, can be traded during market hours at current prices, and offer flexibility for strategies like short selling or margin buying.

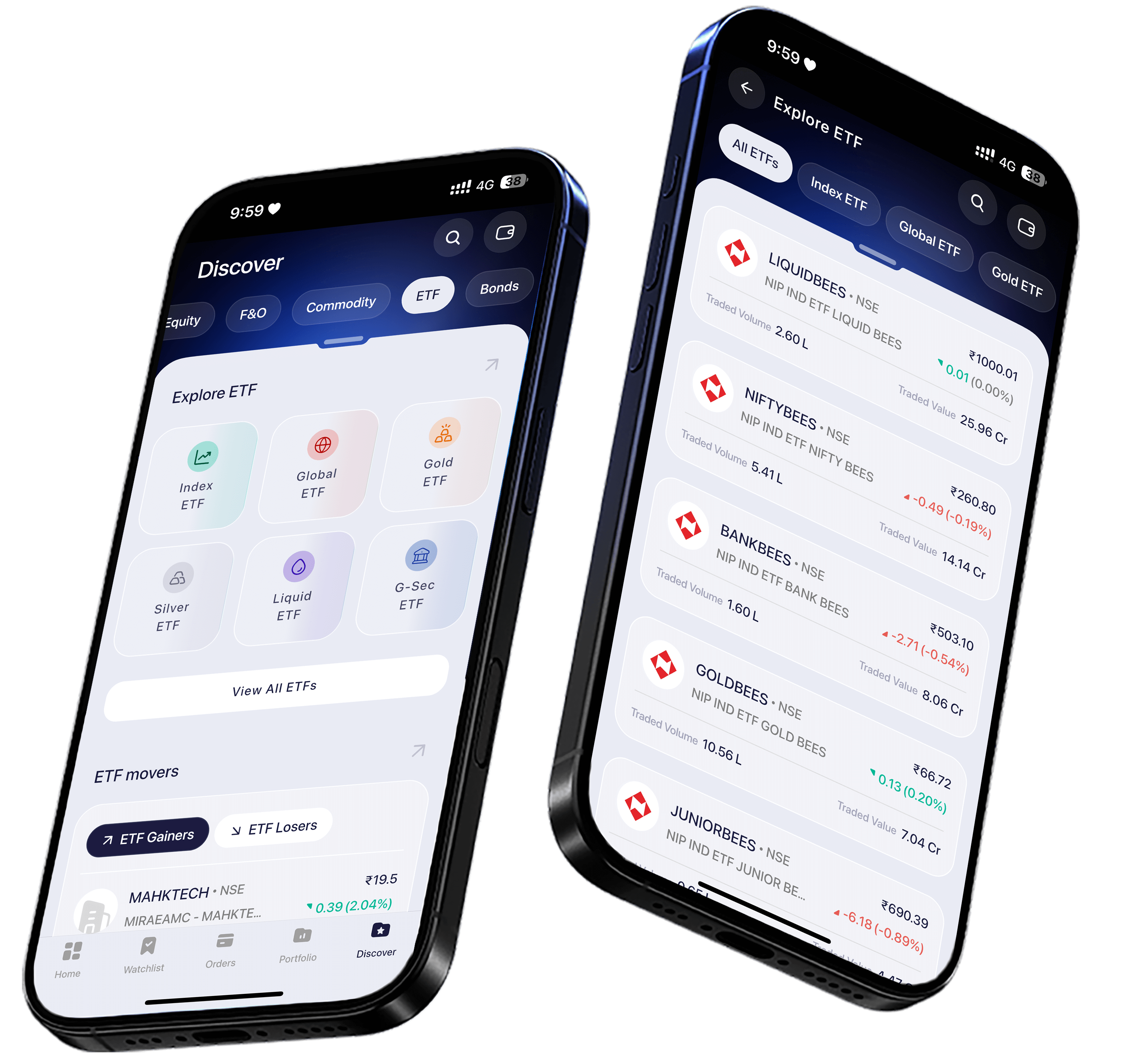

Invest in ETFs Online

The top ETFs in India include various options like the Nifty ETF and ETF Sensex. For those interested, the Nifty 50 ETF list provides detailed options along with the Nifty ETF price.

ICICIPRAMC - BHARATIWIN

105.64

+0.91

(0.87%)

NIP IND ETF BANK BEES

555.79

+11.99

(2.20%)

NIP IND ETF PSU BANK BEES

72.47

+1.08

(1.51%)

NIP IND ETF GOLD BEES

79.53

+0.30

(0.38%)

INVESCO INDIA GOLD ETF

8,310.65

-16.35

(-0.20%)

KOTAK PSU BANK

649.00

+8.99

(1.40%)

NIP IND ETF JUNIOR BEES

685.59

+4.20

(0.62%)

EDELAMC - EBBETF0430

1,493.33

+2.70

(0.18%)

EDELAMC - EBBETF0431

1,338.32

+2.81

(0.21%)

UTIAMC - UTISENSETF

856.37

+17.92

(2.14%)

ICICI PRUDENTIAL GOLD ETF

82.04

+0.30

(0.37%)

HDFC GOLD ETF

81.96

+0.35

(0.43%)

INVESCO INDIA GOLD ETF

8,310.65

-16.35

(-0.20%)

ADITYBIRLA SL GOLD ETF-GR

84.71

+0.73

(0.87%)

UTI GOLD ETF

80.35

+0.30

(0.37%)

AXIS MF - AXIS GOLD ETF

80.18

+0.24

(0.30%)

CPSE EFT

93.65 0.74 (0.80%)

ICICI Pru Nifty PSU Bank ETF

93.65 0.74 (0.80%)

ICICI Pru Nifty PSU Bank ETF

93.65 0.74 (0.80%)

How to Invest in ETF?

Investors in an ETF that tracks a stock index may get lump dividend payments or reinvestments for the index's constituent firms

Benefits of Investing in ETFs

Recent Blogs

FAQ's

Different kinds of Exchange-Traded Funds (ETFs) exist such as equity ETFs, bond ETFs, commodity ETFs, sectors and industries related to a certain area or business field (sector) or industry, and international ones. For example, gold ETFs provide exposure to gold, while Nifty ETFs track the performance of the Nifty 50 index in India. Other types include small-cap ETFs for investing in smaller companies and sector-specific ETF funds like technology or healthcare.

ETFs are listed on stock exchanges, and people can purchase or sell them like stocks during the day's trading hours. They gather money from many investors to buy various assets, creating diversification in holdings. They trade on exchanges like stocks, offering ETF share price fluctuations throughout the day.

ETFs are similar to stocks in that they can be traded on exchanges, have lower costs and provide greater adaptability. Mutual funds, on the other hand, are purchased or sold at the closing of a trading day and might carry higher charges.

For examining ETFs, observe the sectors or asset classes they focus on, their past performance, expense ratios, and the assets they hold underneath. For instance, analyzing a Nifty 50 ETF would involve looking at the top 50 companies listed on the NSE and their performance. Similarly, a gold ETF would require an understanding of gold price trends and market conditions. Tools and resources provided by platforms like Samco Securities can aid in this analysis

At the final part of every trading day, the Net Asset Value (NAV) of an ETF is calculated. The NAV represents the per-share value of the ETF's assets minus liabilities. It's an important metric for investors to understand the value of their holdings, although ETF share prices can deviate from NAV during the trading day.

Think about what you want to achieve with your investments, how much risk you can handle, expense ratios, and the history of the ETF when choosing ETFs for your collection. Consider options like the best India ETFs or top gold ETFs in India for a diversified portfolio. Platforms like Samco Securities offer tools and insights to help you make informed decisions.

ETFs can divide investment risks, provide immediate access to cash, and lower costs. ETFs also allow for flexible trading strategies. They offer a transparent and efficient way to gain exposure to various markets and asset classes, making them a versatile tool for both novice and experienced investors.

You need to first log in to Samco Securities, then go to the ETFs part and choose the specific ETF where you wish to put money. After this, set a purchase order for that chosen ETF. The platform provides an easy-to-use interface and a range of analytical tools to help you select and trade ETFs.

ETFs can be traded on stock exchanges all day long, but index funds are mutual funds that get priced at the end of each trading day. Normally, ETFs charge lower fees and allow for more flexible trading. Index funds, however, might be preferable for investors who follow a buy-and-hold strategy and want automatic reinvestment of dividends.

| ISIN | Haircut [%] | Value of Holdings | Margin Post Haircut |

|---|---|---|---|

Easy & quick

Easy & quick