What are Futures and Options?

F&O Trading : Invest in

futures and options

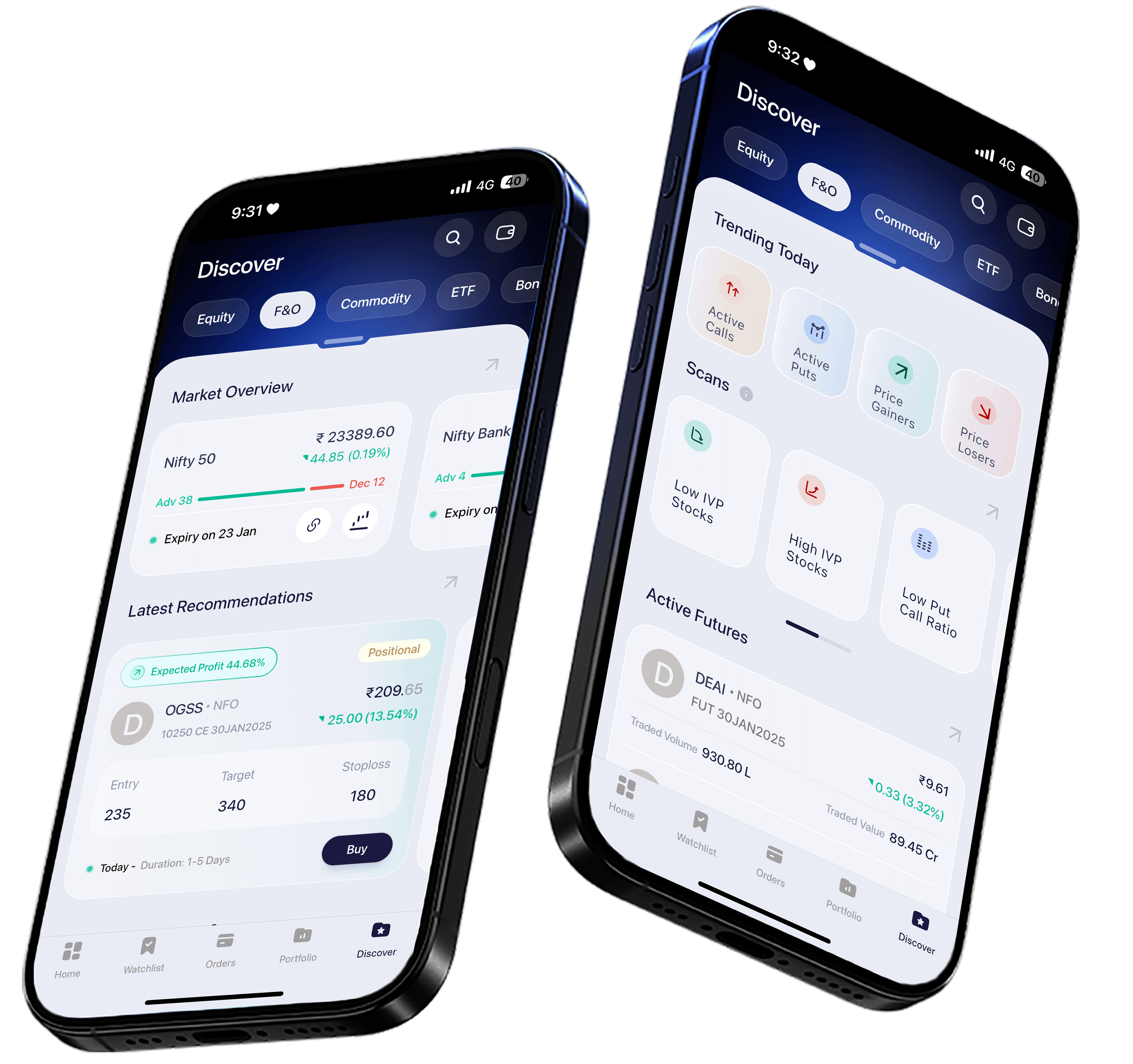

Explore the latest stats on top gainers, losers, and active positions in the futures and options market which act as the best indicator for option trading

Reasons to Choose Samco for

Future & Option Trading

Recent Blogs

FAQ's

The minimum investment in online options investment can vary based on the broker and the specific option contract. Typically, you can start trading options with a few thousand rupees, but it's essential to consider the premium costs and associated fees.

Future option trading carries risks such as market volatility, time decay, and shifts in implied volatility in the futures market. To manage these, traders should diversify by spreading investments across various options and asset classes, employ stop-loss orders to limit losses, and hedge positions using strategies like protective puts or covered calls.

To trade options in F&O trading with less money, consider focusing on lower-cost contracts, using spread strategies like debit spreads to minimise upfront costs, and leveraging margin accounts if allowed by your broker to boost buying power while managing risk.

Options trading involves several charges: the premium for buying the option, brokerage fees (varies by broker), a 0.05% STT on the selling side, exchange transaction fees, 18% GST on brokerage and transaction fees, SEBI turnover charges of Rs. 5 per Rs. 1 crore traded, and standardized state-level stamp duty.

Futures are standardised contracts obligating the buyer to purchase, or the seller to sell, a specific asset at a predetermined price on a future date. They are commonly used for commodities, indices, and currencies, and are traded on exchanges.

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price within a certain period. Options are used for hedging, speculation, and income generation.

Futures Contracts: Require the holder to buy or sell the asset at a set price on a future date, involving higher risk and potential returns.

Options Contracts: Give the holder the right, but not the obligation, to buy (call option) or sell (put option) the asset at a specified price before the expiration date, providing more flexibility and controlled risk.

Futures trading involves entering into a contract to buy or sell an asset at a future date and price. Profits and losses are realised daily through a process called marking to market. Traders can speculate on price movements or use futures for hedging purposes.

Options trading involves buying and selling call and put options based on market predictions. Traders use various strategies to profit from price movements, volatility, and time decay. Effective risk management is crucial due to the inherent risks of options trading.

| ISIN | Haircut [%] | Value of Holdings | Margin Post Haircut |

|---|---|---|---|

Easy & quick

Easy & quick