Open Interest Definition

Open Interest means the number of positions that has been created and which has not been squared off or expired in the futures and options segment. It is the total of the positions which are outstanding at a particular point of time. Suppose a person initiates a position in the security, it will amount to an increase in open interest till the time the position gets squared off. An increase in Open Interest indicates that fresh money is entering the contract and a decrease in the open interest signifies that money is moving out of the particular contract.

Open Interest is important for trading as it indicates whether money is moving in or out of a contract. An increase in price with an increase in Open Interest indicates that fresh buying is happening in a security. Conversely, a decrease in price with an increase in Open Interest indicates that fresh shorts have been created in the scrip.

An increase in price with a decrease in Open Interest indicates that the short positions are being covered while a decrease in price along with a decrease in price reflects that the long positions are being covered.

Open Interest changes are generally measured in percentages.

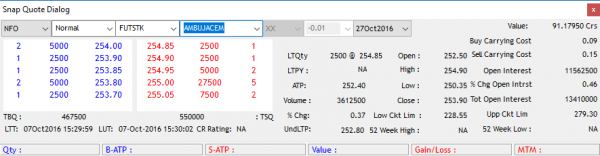

In the SAMCO NEST Trader, Open Interest can be seen in the Snap Quote Dialog box by pressing the short cut key “F6”.

On the right hand side, both Open Interest and % Change in Open Interest can be tracked.

The derivative contracts for a particular scrip is put into ban period if the total Open Interest for all the months goes above 95% of market-wide position limits. If a scrip is in ban period, no new positions can be created, while squaring off is allowed. The security is removed from the ban if the total open interest goes below 80%.

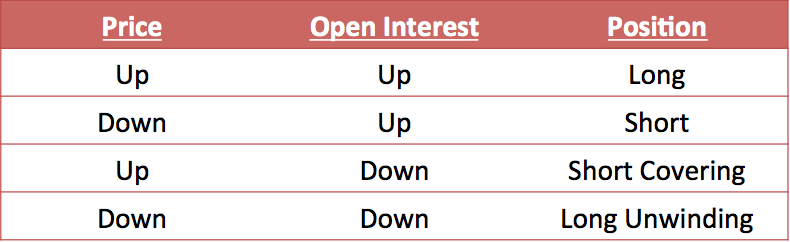

What’s the relationship between price and open interest data?

If price is in an increasing trend and OI is increasing, it’s interpreted as Fresh Longs being build and is a Bullish Signal.

If price is in an increasing trend and OI is decreasing, it’s interpreted as Short Covering being a short term correction in an otherwise downtrend.

If price is in an decreasing trend and OI is increasing, it’s interpreted as Fresh Shorts being added and is a Bearish Signal.

If price is in an decreasing trend and OI is decreasing, it’s interpreted as Long Unwinding being a short term profit booking in an otherwise uptrend.

What’s the difference between volume and Open Interest (OI)?

Volume is the total number of contracts traded in a given time period, and open interest in a security is the number of open contracts at a particular period of time.

Easy & quick

Easy & quick

Leave A Comment?