Most investors aim to diversify their investments to reduce overall risk. For this, they use multiple investment options like FDs, PPF, Insurance policies, Mutual funds etc.

Out of all these investment options, mutual funds have become quite popular among retail investors.

But mutual funds are often advertised as complex investment products. Fortunately, this is not true.

Once you learn how to analyse a mutual fund, you’ll quickly be able to select best mutual funds from duds.

8 Most Important Things to Consider While Analysing a Mutual Fund

1. Fund Performance Vs Benchmark Performance

While analysing a mutual fund, the first thing you must check is the performance of the fund against its benchmark.

Each scheme has a benchmark that it uses to track and measure its performance. A good mutual fund scheme is one which consistently beats its benchmark in the long-term.

Let us understand this with a simple example. Suppose you invested in ABC Equity Fund. The fund generated a 1-year return of 20%.

The returns might look pretty decent. However, the returns generated by the benchmark is 25%.

This means that the fund has underperformed its benchmark. If you would have simply invested in the benchmark index, then you would have made 25%. Whereas, by investing in the fund you made 5% less.

When a fund generates higher returns than the benchmark, the excess return is known as ‘alpha’ of the fund.

Since you are investing your hard-earned money, you will expect your fund to beat its benchmark and create higher Alpha.

Hence the first parameter while analysing a mutual fund is to select funds which have consistently outperformed its benchmark.

2. Expense Ratio

Expense ratio is the fees charged by the fund house to manage the portfolio. It includes fund manager fees, distribution, investor transaction and other charges.

Expense ratio is directly proportional to your fund returns. Higher expense ratio results in lower portfolio returns.

When analysing a mutual fund, you should ensure that the expense ratio of the fund is in line with its peers.

3. Risk

‘Mutual funds are subject to market risks.’ We have all heard this disclaimer. Mutual funds are inherently risky. Hence it is very important for investors to match their risk tolerance with the fund’s risk profile.

A mutual fund’s risk profile can be analysed using a riskometer. The Securities and Exchange Board of India, SEBI has mandated mutual funds to disclose the risk profile of every mutual fund to investors.

Usually, there are 5 categories in a riskometer – low, moderately low, moderate, moderately high and high.

While analysing a mutual fund, you should also analyse the risk profile of the fund.

If you are a low-risk investor, then you should avoid high-risk mutual funds like midcap and small cap funds.

4. Portfolio Turnover Ratio

Portfolio Turnover Ratio tells you how frequently your fund manager buys and sells securities. Portfolio turnover ratio is directly linked to the fund management fees.

Higher portfolio turnover ratio = higher fund management fees.

Often, fund managers indulge in excessive portfolio churning to increase their management fees.

While constant portfolio monitoring is important, you must ensure that portfolio churning results in superior returns.

So, always keep an eye on the portfolio turnover ratio while analysing a mutual fund.

5.Margin of Safety Index

MosDex is a RankMF’s proprietary Margin of Safety Index which indicates if the equity schemes are expensive or cheap.

- If the value of MosDEX is high, it means the scheme is undervalued.

- If the value of the MosDEX is low, it means that the scheme is expensive.

RankMF’s SmartSIP works smartly on MosDex indicators which can offer you more than 4% returns than a regular SIP. Hence it is not just important to know which funds are right to invest but also important to be aware when is the right time and price to invest in a mutual fund scheme.

6. Study the fund’s Alpha and Beta

The alpha ratio is valuable to an investor as it helps them determine whether an asset or fund is worth investing.

Alpha is the measure where you understand the extra returns generated by the fund against its benchmark.

Beta measures the risk involved in a fund.

- Beta > 1 = the fund gains or loses more than the benchmark.

- Beta < 1 = the fund gains or loses less than the benchmark.

Let us understand this with a simple example.

Let us consider two funds A and B. Both have a Beta of 2. Alpha of fund A is 2. Alpha of fund B is 1.75.

In the above example, both funds A and B have the same Beta. But Alpha of fund A is higher than fund B. This means that for the same level of risk, the fund manager of fund A is able to generate higher returns than fund B.

Alpha and Beta play an important role in analysing a mutual fund.

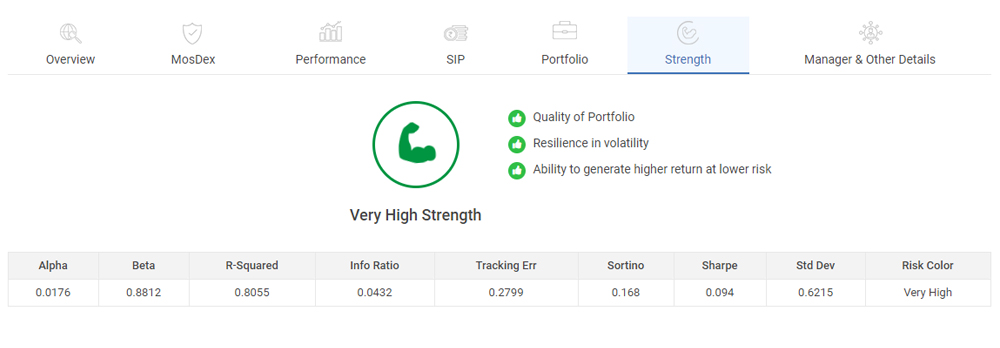

7. Strength of the fund indicator

Strength of a fund is analysed by an indicator called Strength Indicator. It is an indicator which tells that how resilient a scheme is in market volatility and its ability to generate a higher return at lower risk using ratios such as alpha, beta, standard deviation, Sharpe ratio, etc.

- Standard deviation refers to the volatility of a fund. Higher the standard deviation, the more volatile the returns will be.

- Sharpe ratio refers to the additional returns generated by the fund per unit of risk taken. A higher Sharpe ratio means better risk-adjusted returns for the investor.

RankMFs advanced mechanism evaluates a scheme on the basis of such 2 crore data points and analyses the strength of a portfolio

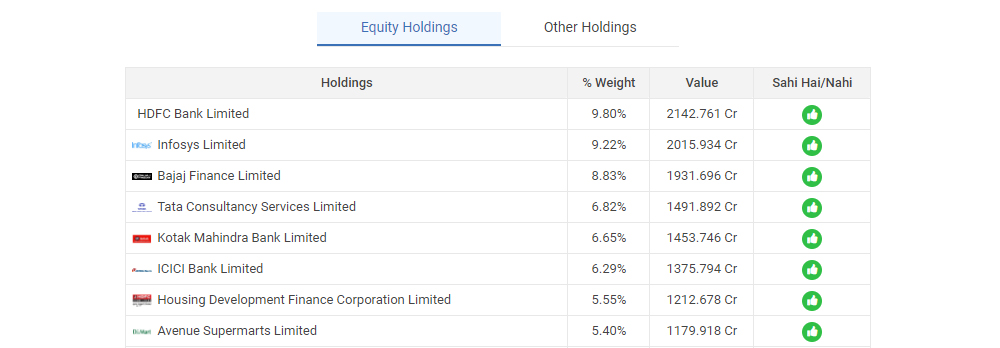

8. Quality of Mutual Fund Scheme Holdings

A mutual fund combines different securities to form a single scheme. The total number of holdings in a particular scheme depends on the type of fund.

For example, index funds are expected to have a large number of holdings, often in hundreds of stocks. You must carefully analyse the quality of holdings that the fund has.

RankMF exclusively provides you with data which would help you analyse the quality of stock it holds.

Watch this video to understand & how to analyze and proprietary of mutual fund

Final Thoughts

Once you know how to analyse a mutual fund, it will automatically help you select the best mutual fund from duds.

This knowledge can go a long way in helping you make the correct investment decisions. However, unless you are an active investor who closely follows the market trends, it is not easy for you to choose a mutual fund and calculate the ratios by yourself.

RankMF, with the help of advanced technology and research experts, has made a research engine which evaluates more than 20 crore data points daily to rate and rank all mutual fund schemes in India. Also, it gives the most honest answer to, “kaunsa mutual fund sahi hai?”

Also, RankMF helps investors choose and invest in the right mutual fund schemes to generate better returns and achieve their financial goals. It also helps investors in selecting the right funds based on their potential to grow in the future and not just past performance.

So, open a FREE RankMF account today and start investing in your future goals!

Easy & quick

Easy & quick

Leave A Comment?