Steps: How to Invest in MF (Mutual Funds)

In this tutorial, we will be guiding you as to how to invest in Mutual Fund through SIP mode using RankMF.

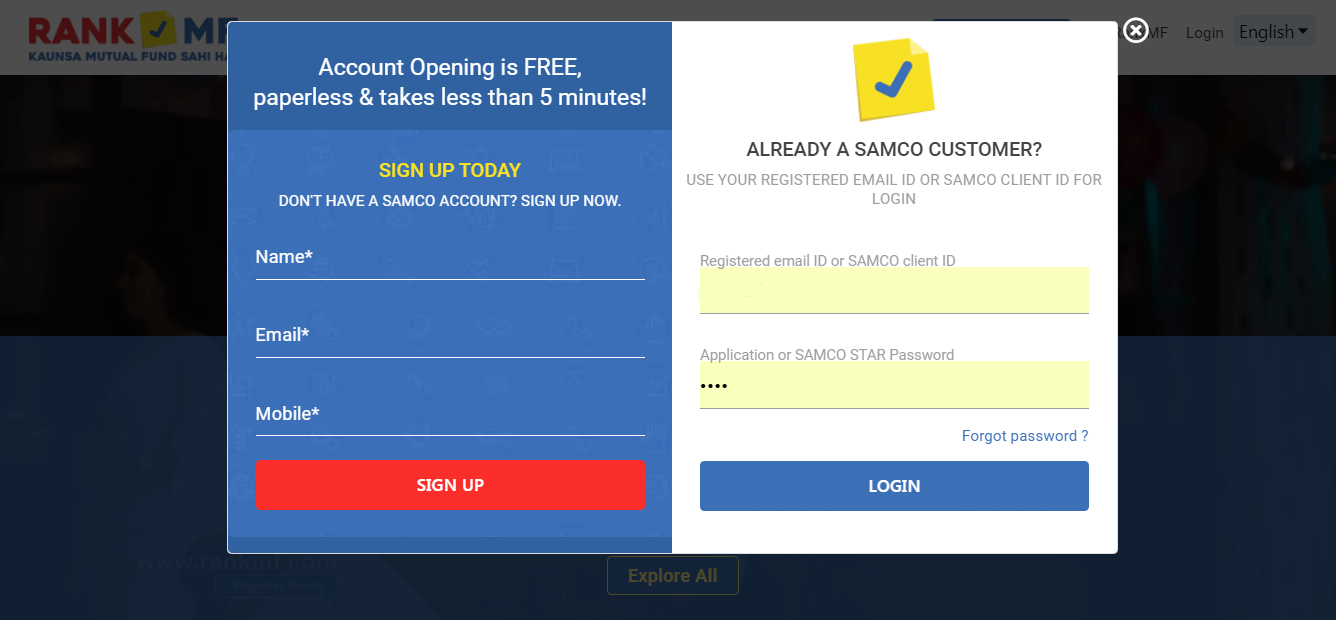

- Open an Account/Login

- Open RankMF on your browser and click on Open an Account (If you are not a Samco/RankMF Client).

- If already a client with Samco, proceed to

2. Enter your login id and password.

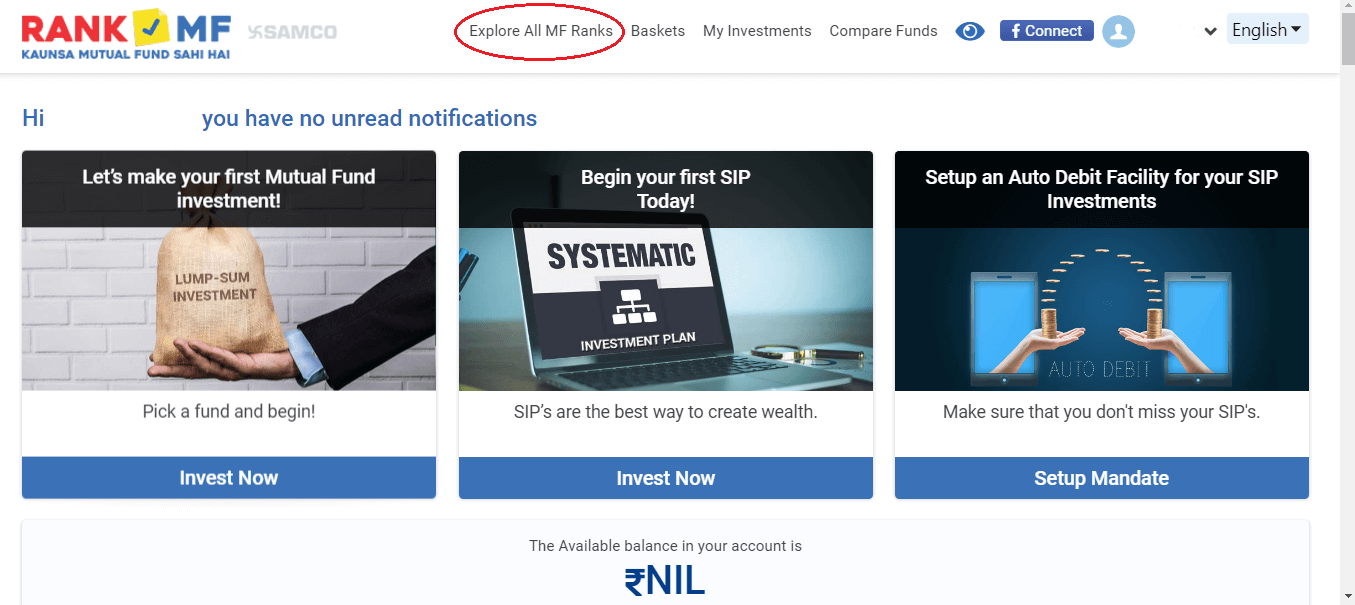

3. After logging in, click on Explore All MF Ranks.

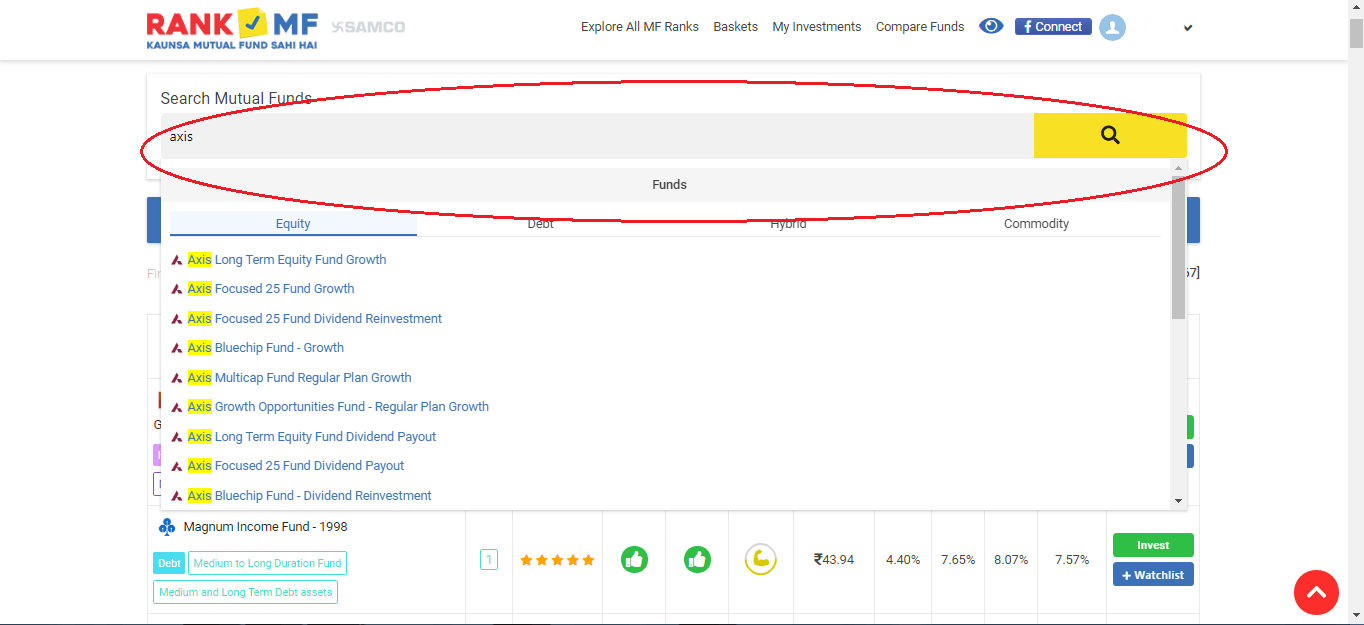

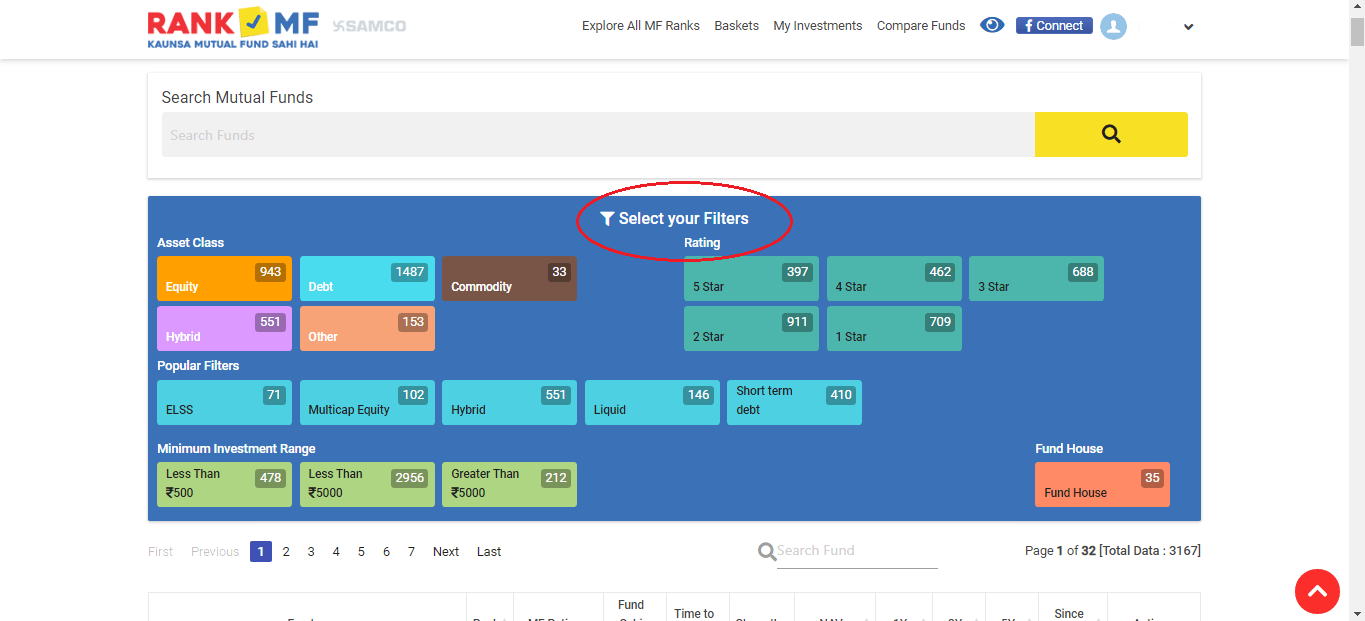

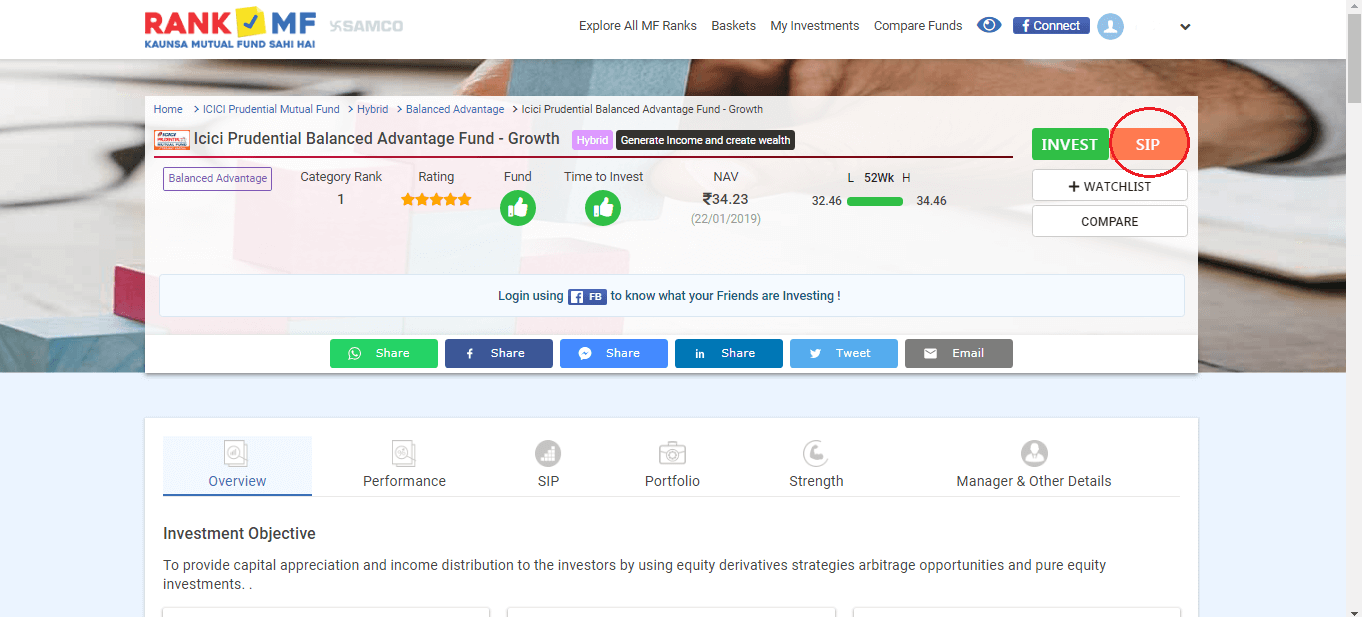

4. Here you have two options:

- Either you can type the initials of the name of the scheme in the search tab (See point 5 for explanation) or

- you can filter the scheme from various categories of mutual funds in order to select the appropriate one (See point 6 for explanation).

5. In the search tab, you can begin by typing the name of the fund house/scheme. All mutual funds schemes under that fund house will appear on the screen and you can select the fund of which you want to check details.

6. Otherwise, you can apply the filter and select a fund scheme according to various categories of the fund you want to invest in such as equity large cap, equity midcap, balanced fund, debt funds and so on.

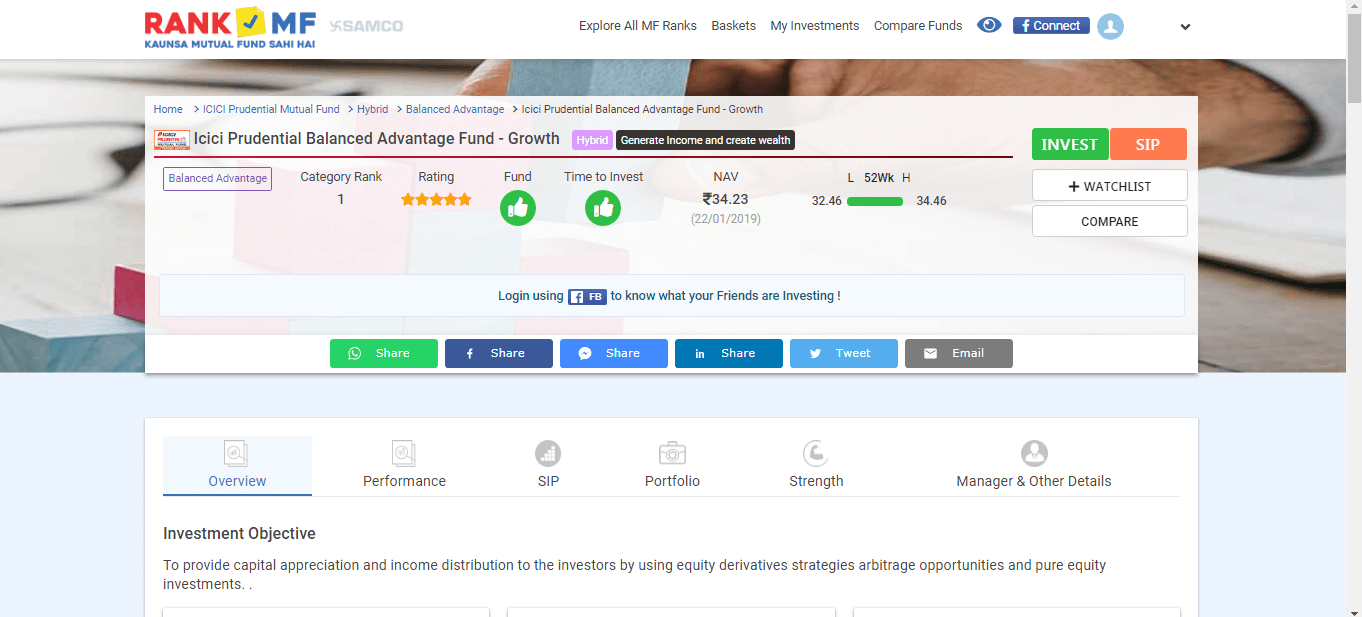

7. After selecting the fund, all the information of that fund would be displayed on the screen under the Overview tab(How to invest in Mutial Fund). This includes:

- Category rank

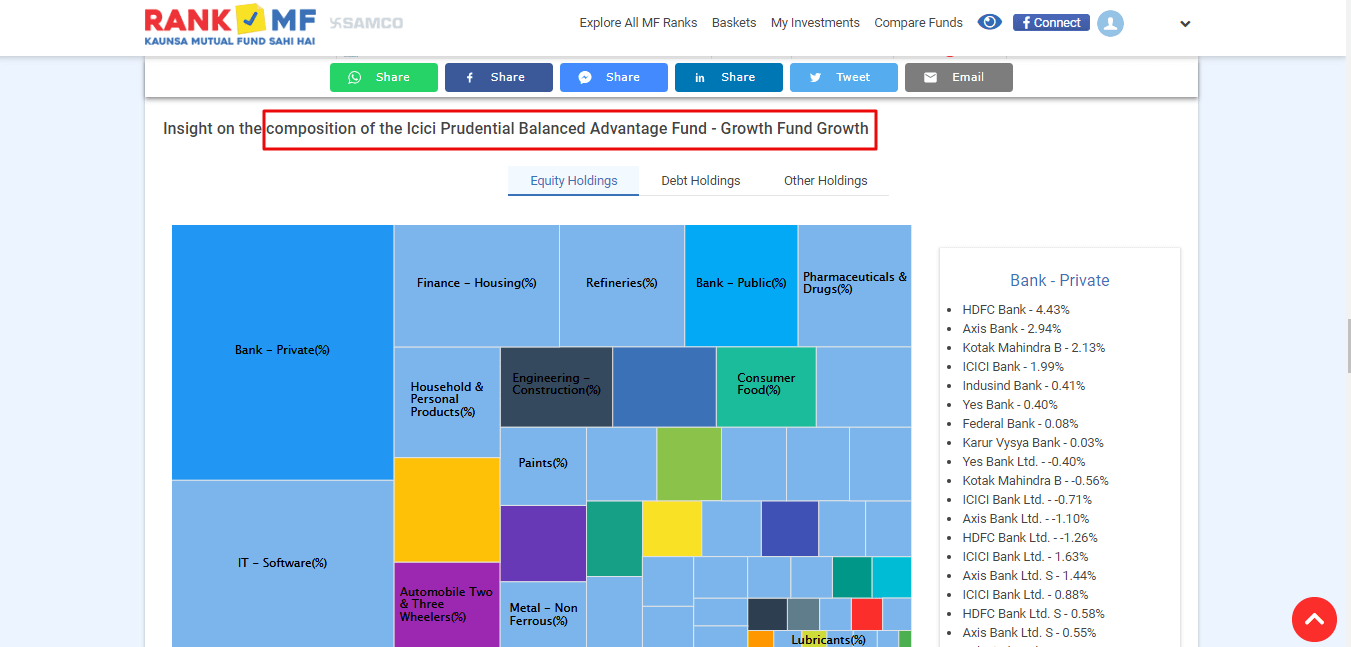

- Rating (out of 5 stars)

- Fund Sahi ya Nahi signal

- Time to invest

- Latest NAV

- 52-week high and low of the fund NAV.

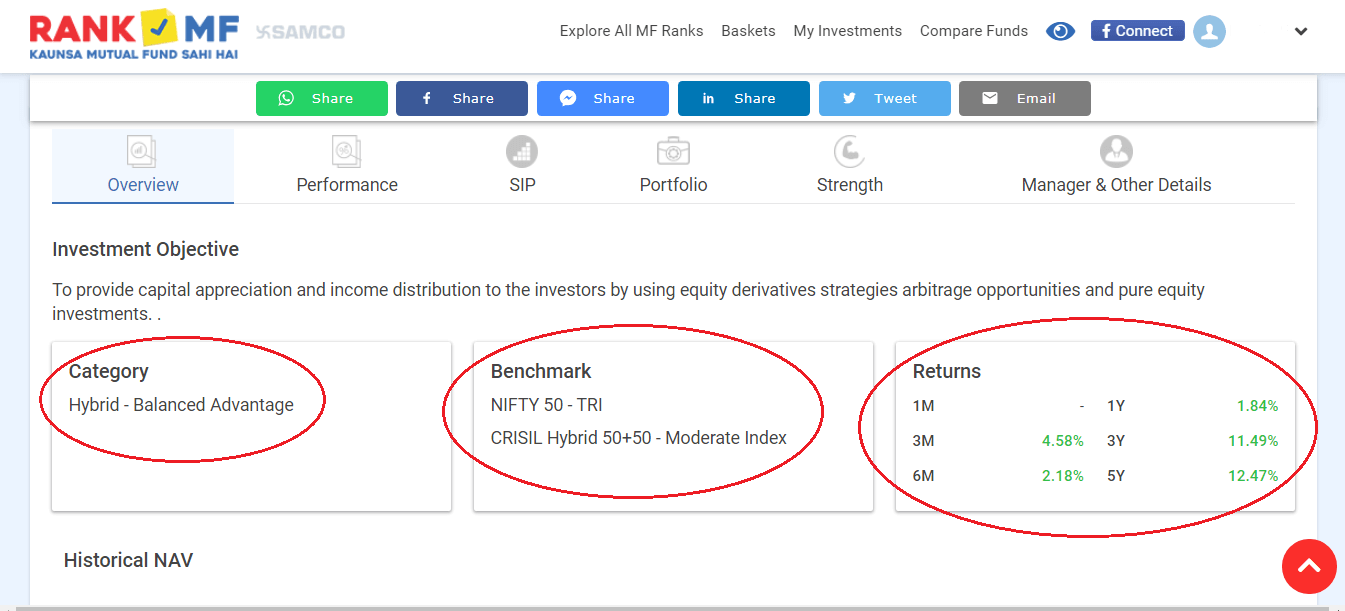

8. It will give you an overview of the fund which will contain fund category, benchmark and fund returns over a period of time.

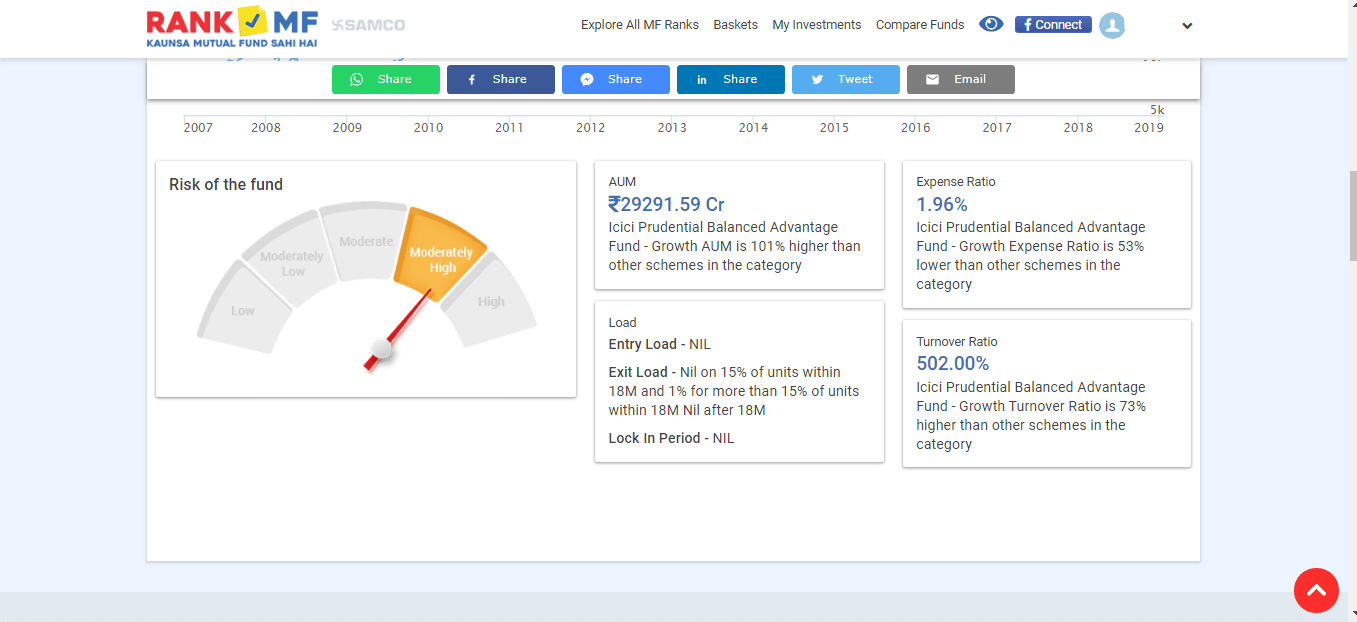

9. The overview tab further provides details with respect to the risk of the fund exhibited by the Riskometer. It also gives you a snapshot of the assets under management (AUM) of the fund scheme, the total expense ratio, exit load and the turnover ratio.

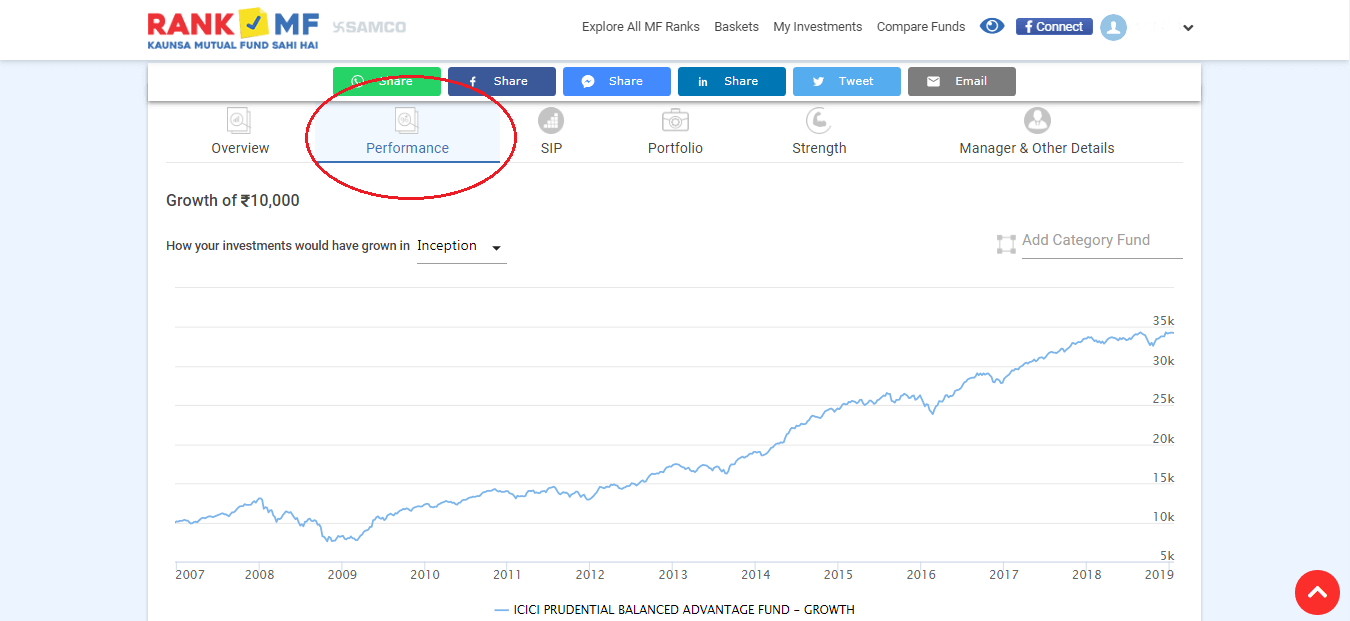

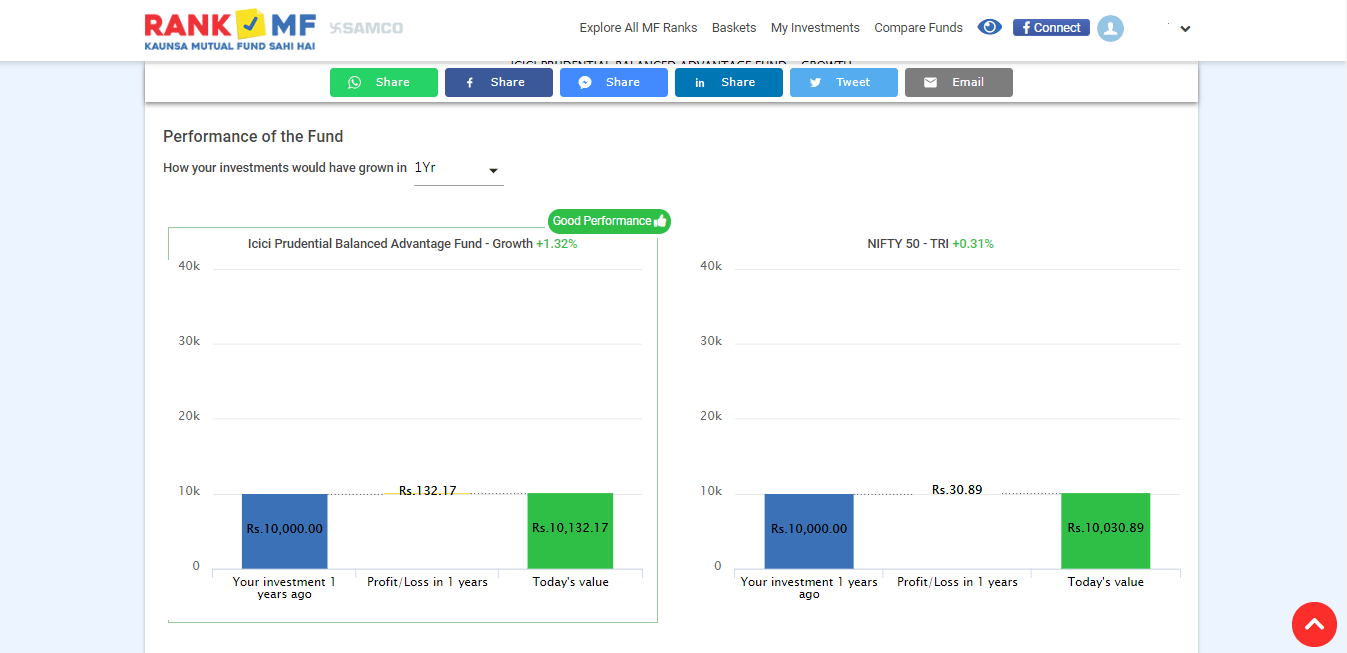

10. Under the ‘Performance’ tab, you’ll find useful information about the fund scheme performance from inception and for various other time frames.

11. The Performance tab shows a comparison of the fund performance with its relevant benchmark for different time periods which can help you in determining how many times the scheme has outperformed the market index/benchmark.

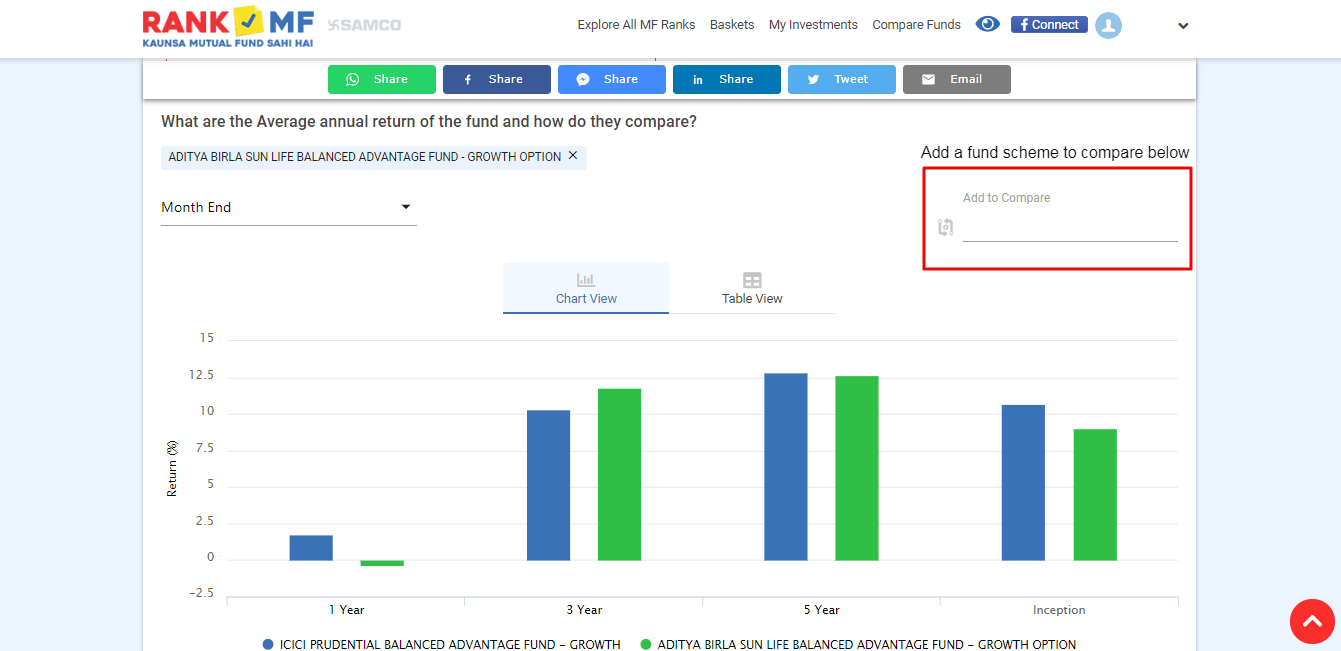

12. The performance tab also allows you to compare your selected fund scheme with another scheme to compare performances. You need to type the name of the scheme with which the comparison is to be made in ‘Add to Compare’ highlighted below.

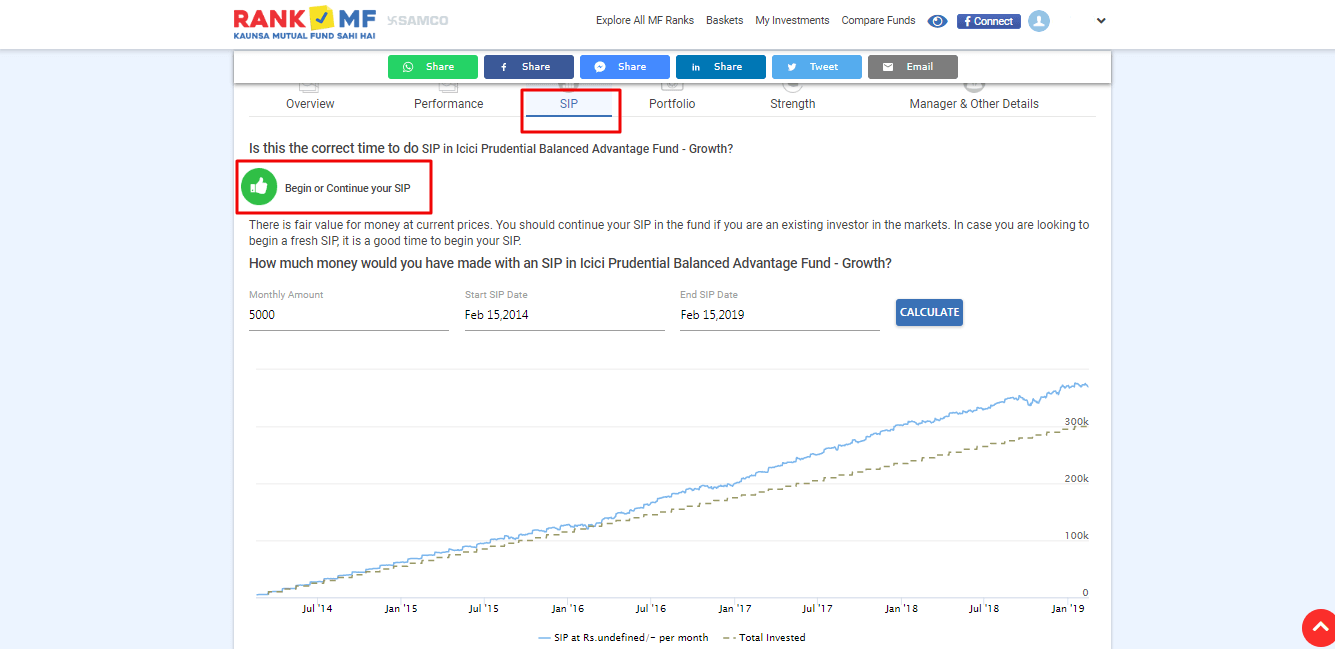

13. The SIP tab tells you the right time to invest which is reflected below with the green signal stating that you can begin/continue to invest and the red signal states that it is not recommended for investment by RankMF. It also provides you with SIP calculators to ascertain how much you would have made with a SIP in this scheme.

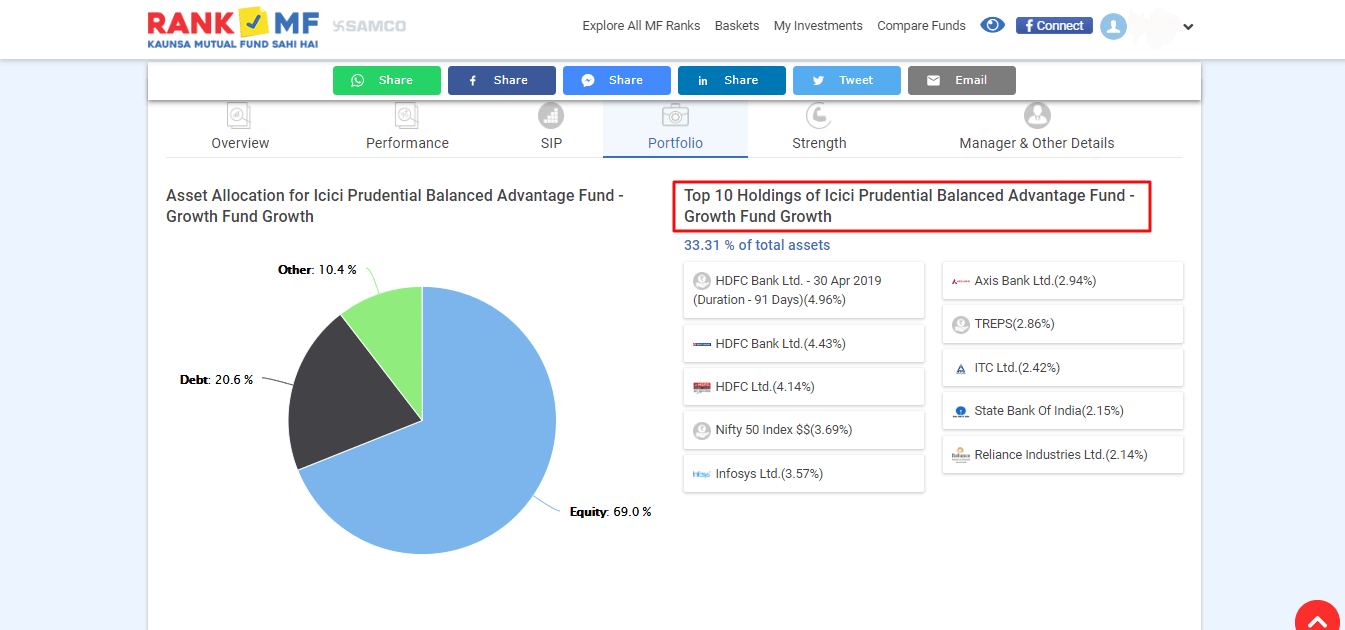

14. Under the Portfolio tab, you will find detailed information about the portfolio holding under each asset class, top 10 holdings under the fund scheme, asset allocation, composition of the scheme and a lot more.

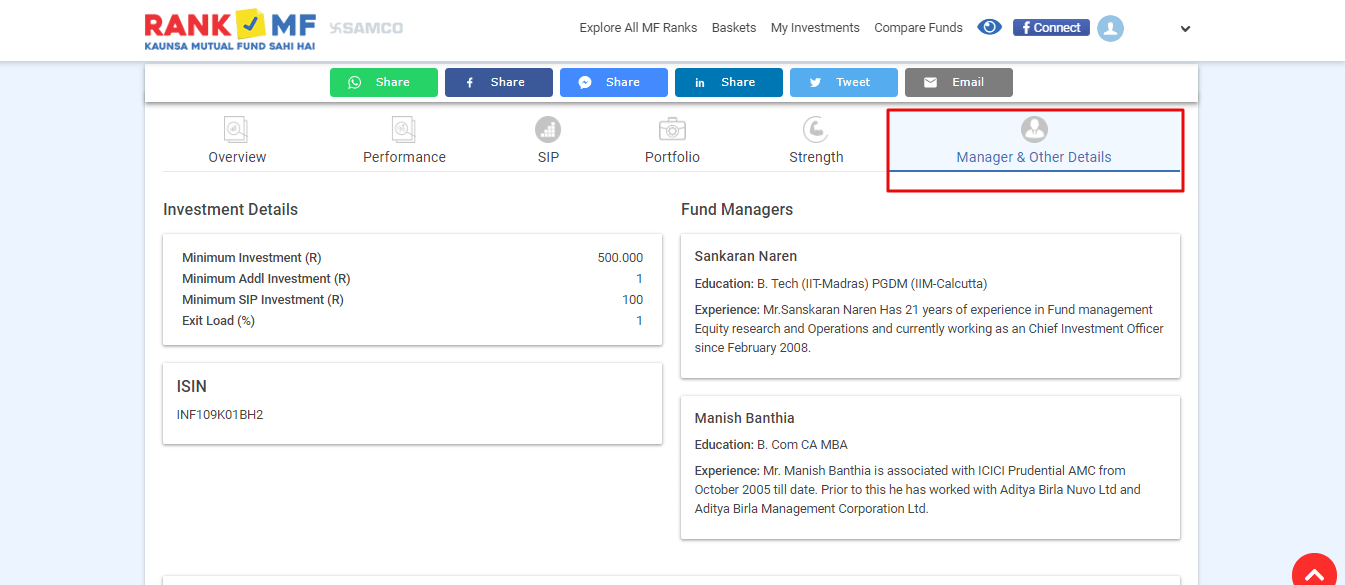

15. The Manager & Other Details tab provides you with basic details about the fund managers and the fund scheme related details.

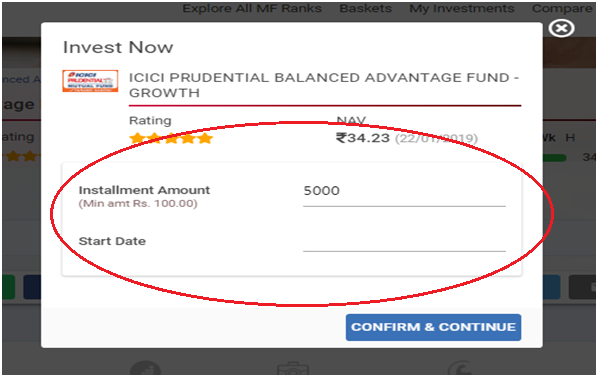

16. Once you have selected the appropriate fund for you, for making monthly payments using SIP mode, you have to click on the SIP button as shown in the image below for further process.

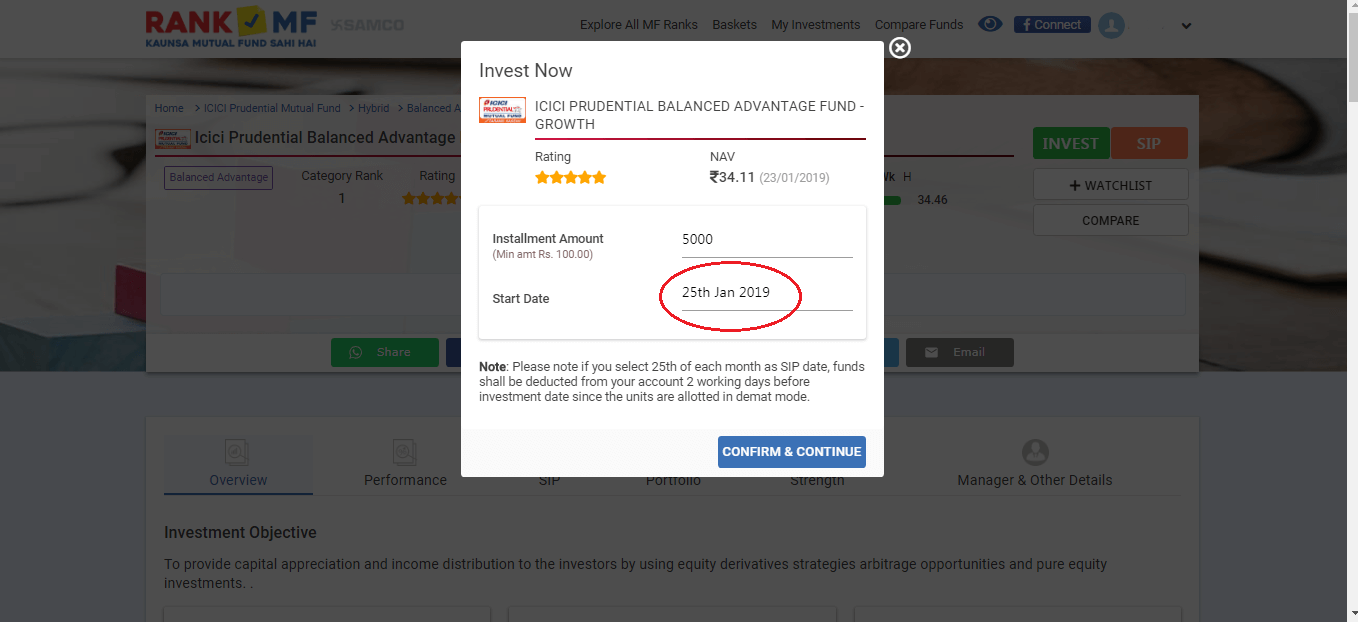

17. After you select the option to make a SIP order at the prevailing NAV of the fund, you have to enter the monthly investment amount (which should be equal to or higher than the minimum amount stated) and select a start date for the month on which your funds will be debited automatically from your bank account.

18. Select the date on which you want to invest in SIP every month. Let’s say the next dates available in the current month are as displayed in the image below. You can select from any available date. Let’s say 25th January, 2019. After that, click on confirm and continue.

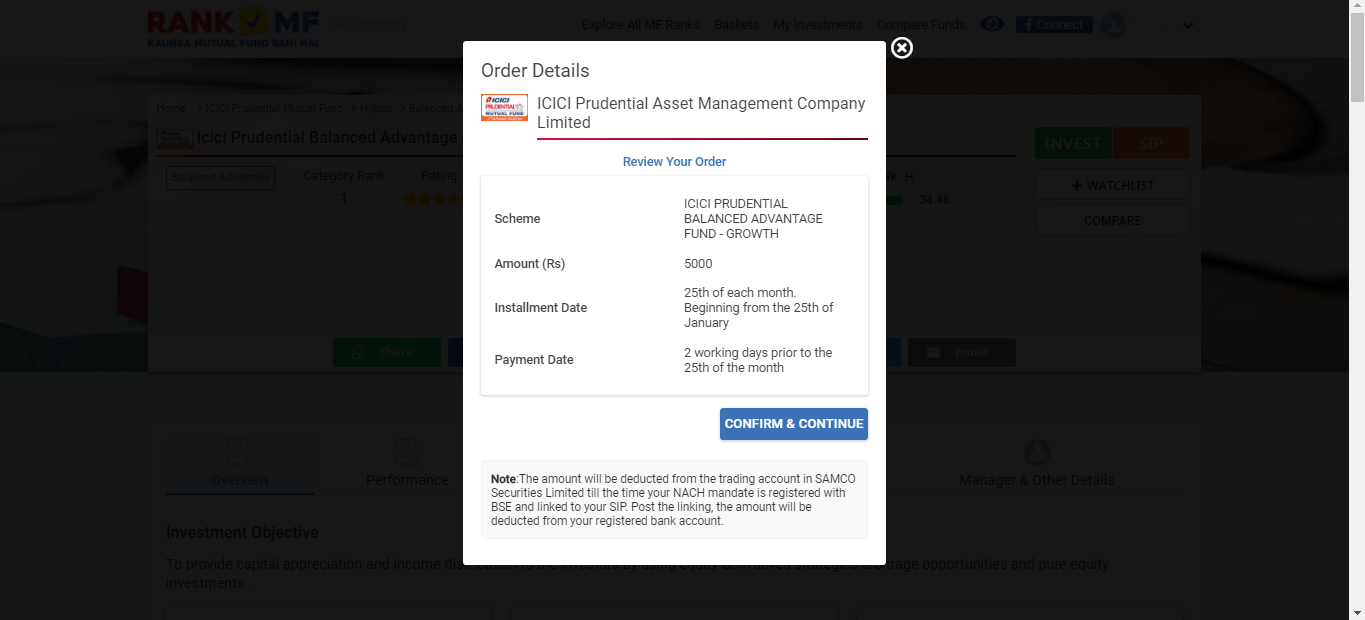

19. You will be provided your order details as shown below and you have to check the details again and proceed if everything is okay.

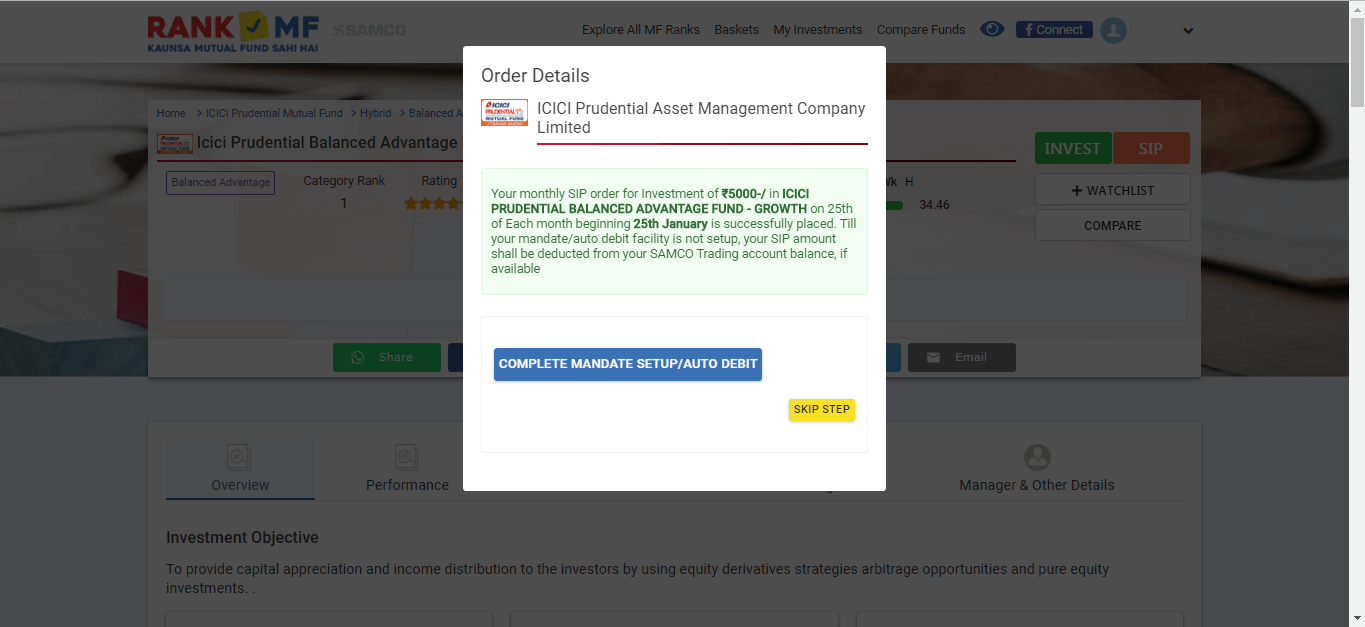

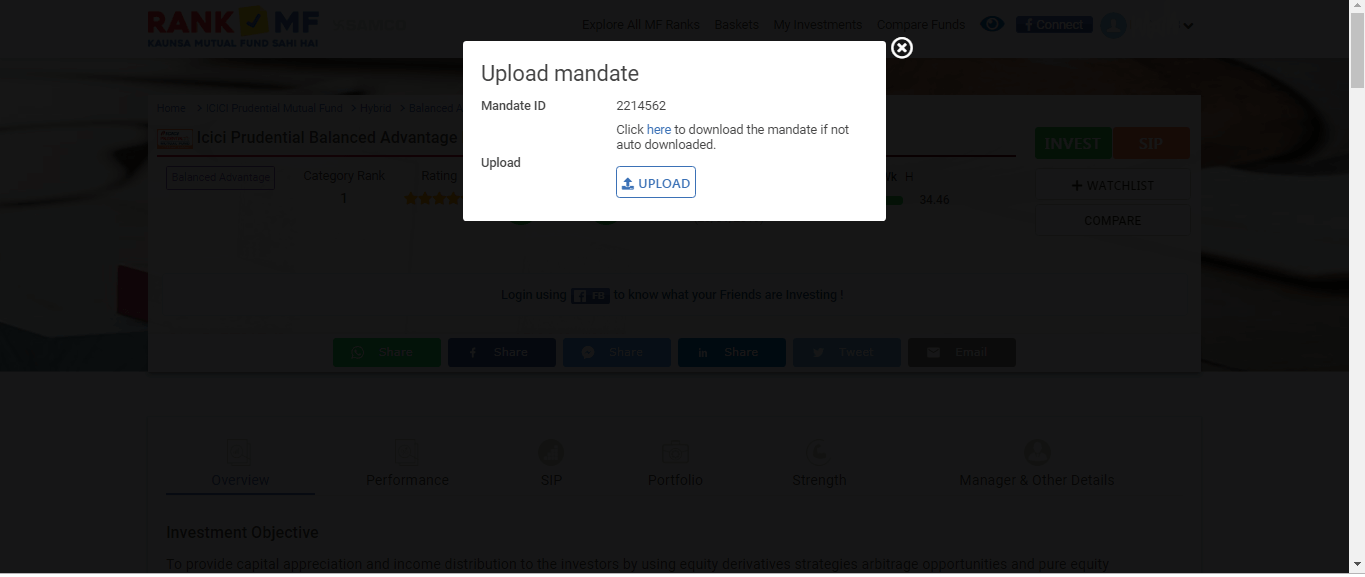

20. Once you confirm your transaction, you have to set up your mandate. When you click on ‘Complete Mandate Setup/ Auto Debit’, you’ll receive a notification on your mobile with a created mandate number attached with your bank account number asking you to download and upload the signed mandate on the website.

21. In the final step, you have to upload the signed mandate.

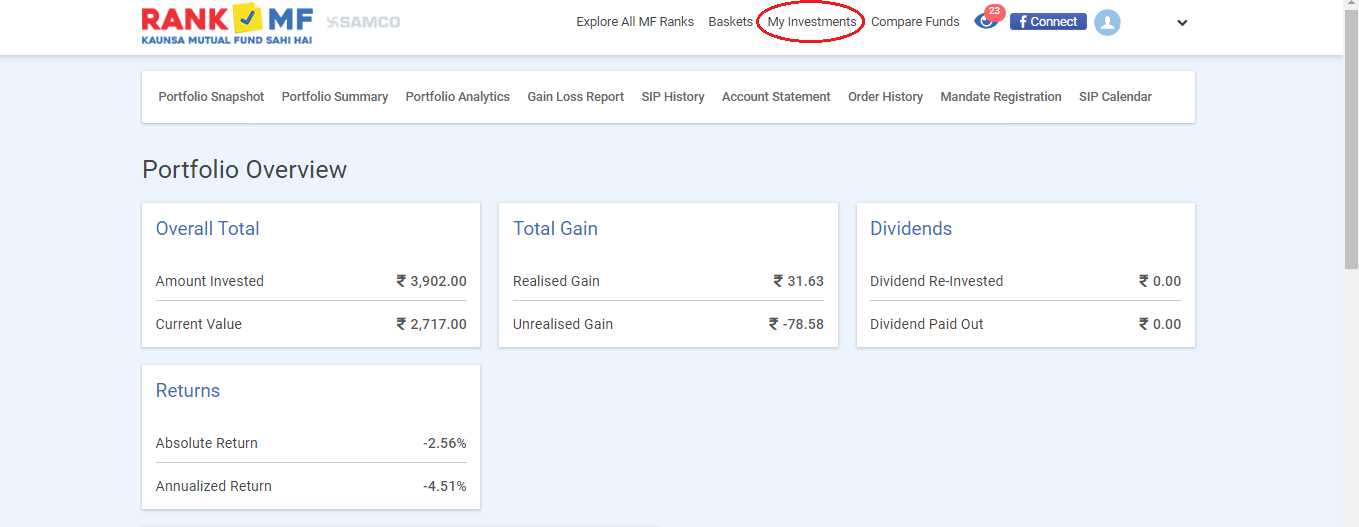

22. Once your mandate is set, your SIP gets registered. You can view your investment details under ‘My Investment’ tab as shown below.

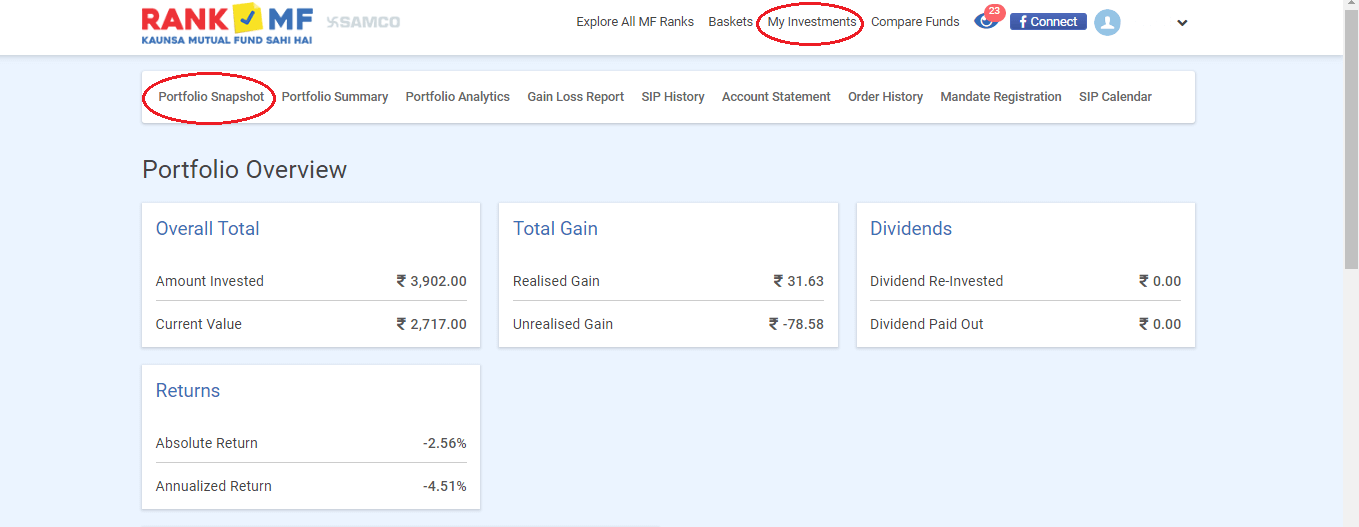

23. You can see your portfolio at a glance by going through the ‘Portfolio Snapshot’ under ‘My Investments’ tab on the dashboard. It will give you details regarding your portfolio holdings, the proportion of equity and debt, account statements of the investment, SIP mandate registration tracking as well as dates of your SIP.

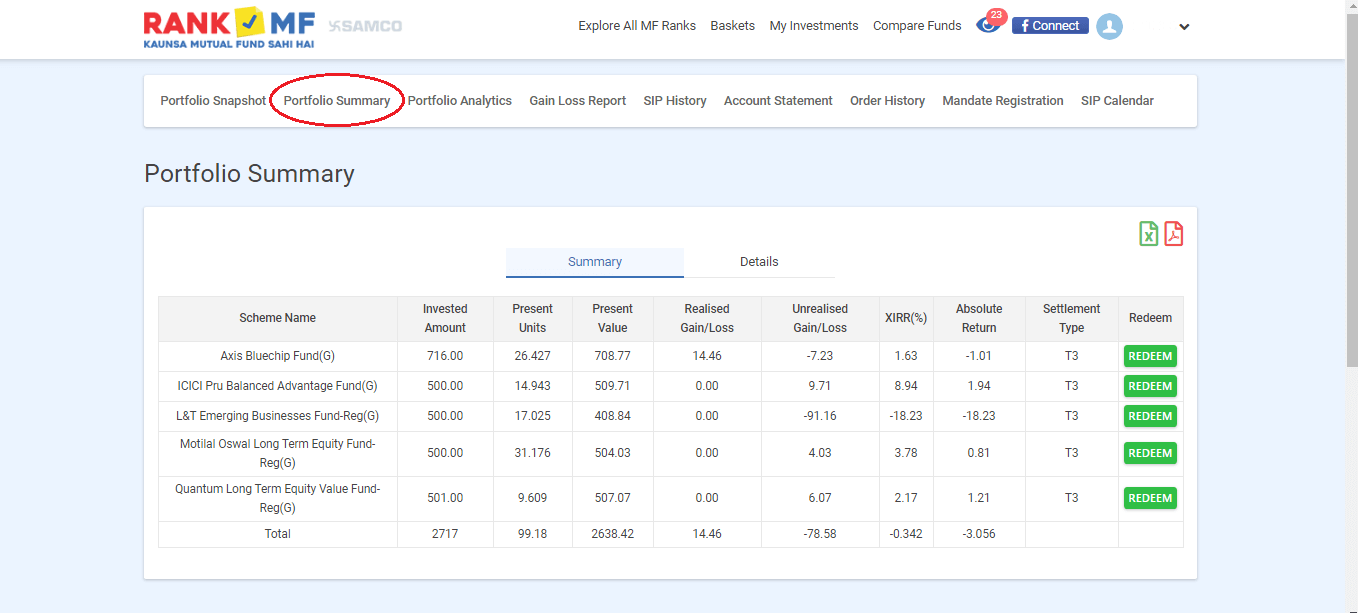

24. You can view the name, performance and profit/loss figure in your ‘Portfolio Summary’ under ‘My Investments’ tab.

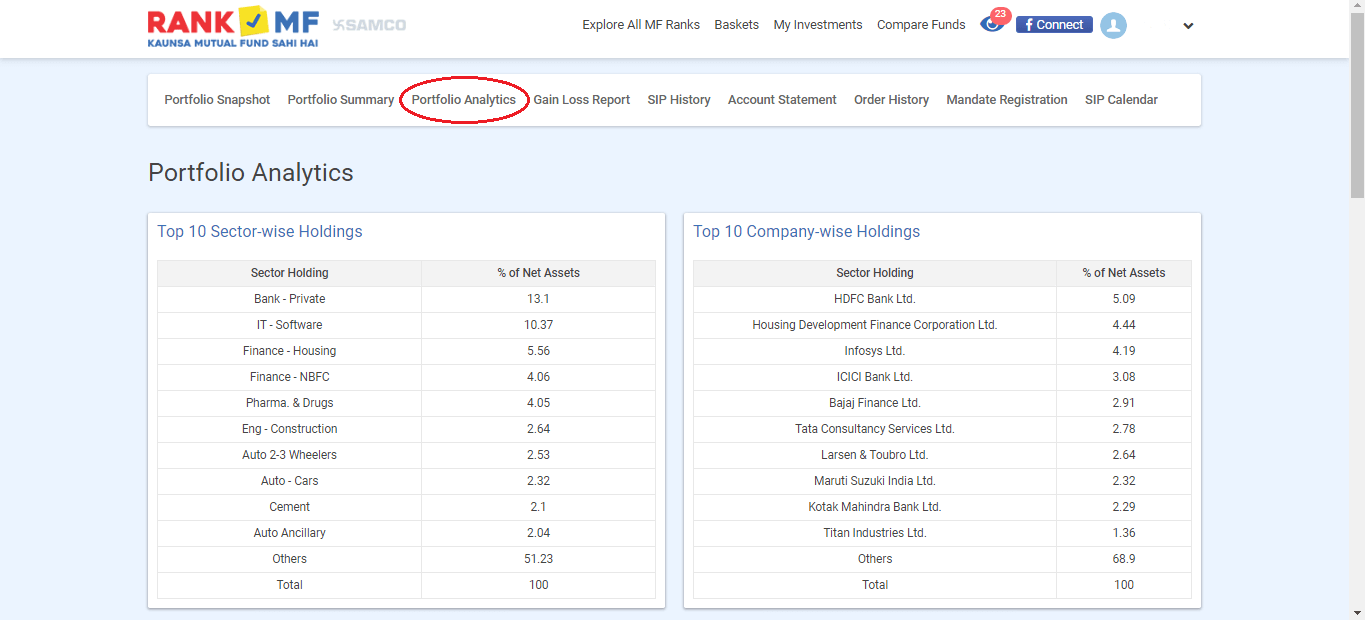

25. You can also see the sector wise and company wise holdings of your mutual fund investment under the ‘Portfolio Analytics’ tab. This is the most unique feature on RankMF which you won’t find on many brokerage platforms in India.

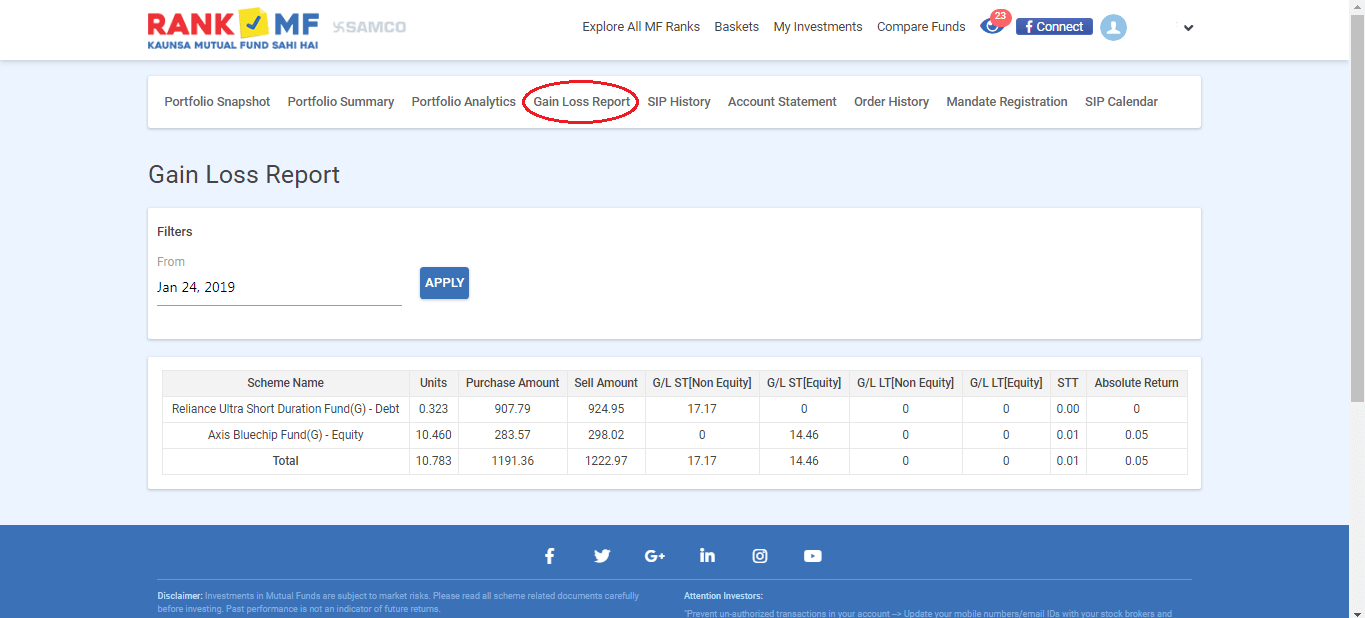

26. You can track your daily gain/loss under the ‘Gain Loss Report’ tab.

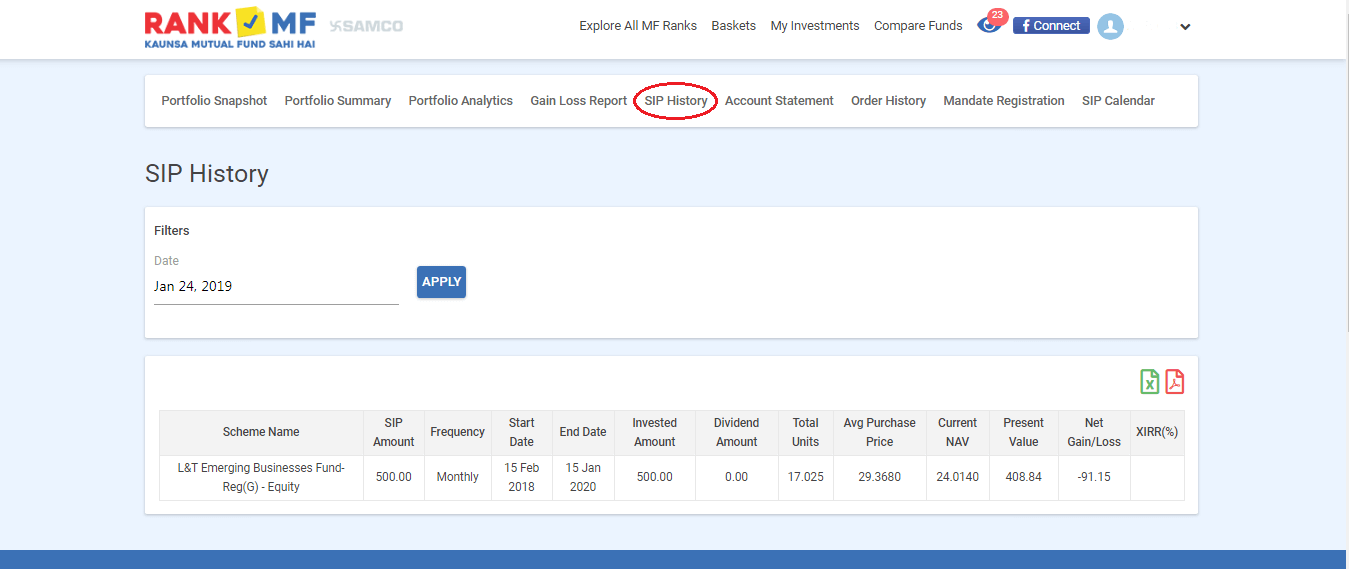

27. You can check the details of your SIP of previous months from ‘SIP History’ tab.

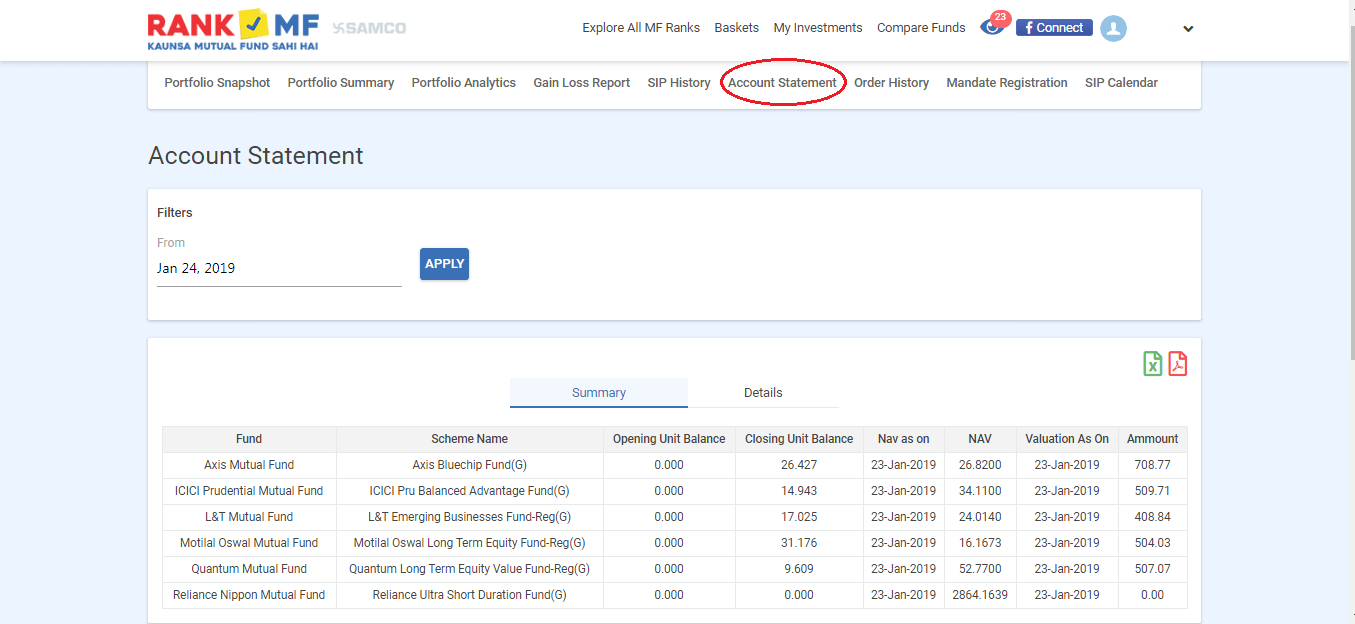

28. You can download a detailed account statement of your investments from the ‘Account Statement’ tab.

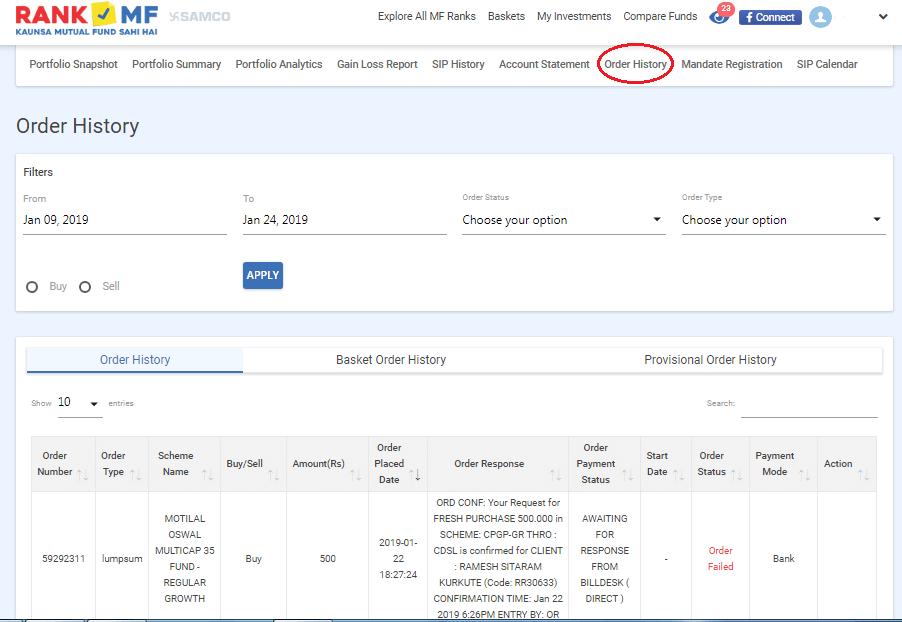

29. If you want to see the details of your order which you have placed, you can check it under the ‘Order History’ tab.

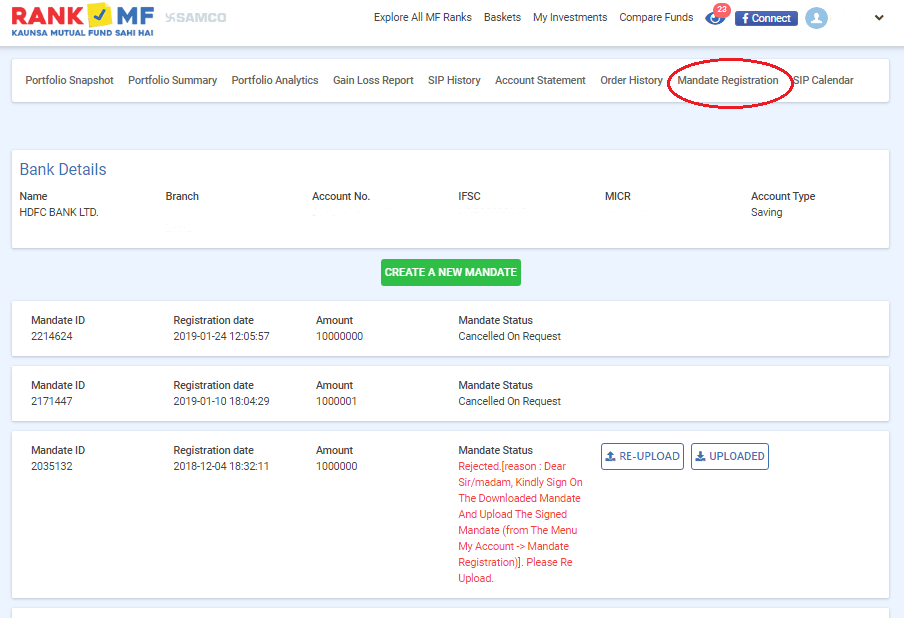

30. You can see your bank details, mandate details and create a new mandate for your SIP from the ‘Mandate Registration’ tab.

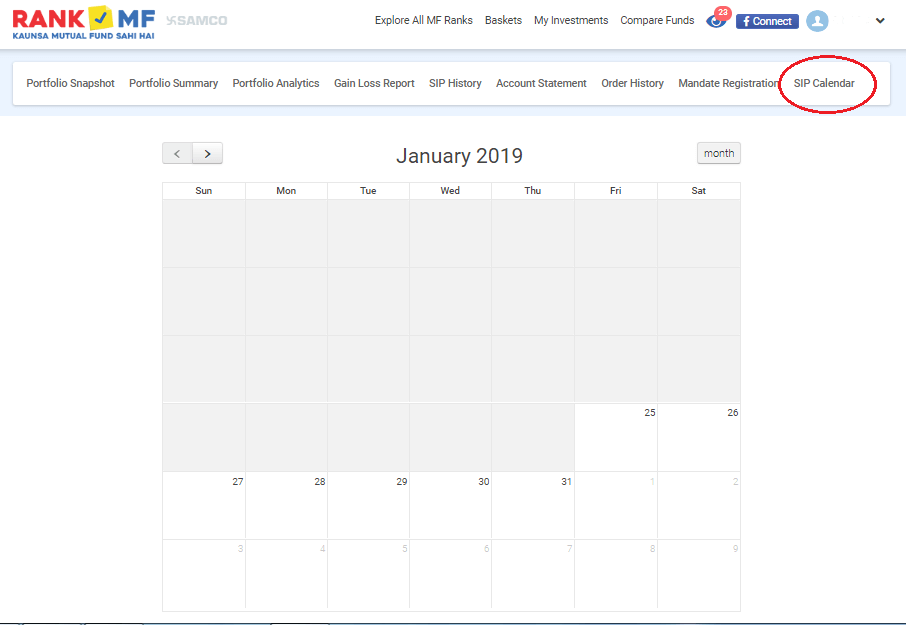

31. To see the SIP calendar of the next available dates, you can visit the ‘SIP Calendar’ tab.

For more details watch this video to understand what is SIP

With this, we conclude our article on how to invest in Mutual Fund through SIP method using RankMF. For more information about investing in mutual funds, stock trading and useful related articles, visit RankMF.com or our investor education center.

Easy & quick

Easy & quick

Leave A Comment?