When the initial trade gets executed, it becomes an open position i.e you have got an exposure to a particular scrip and the change in its price shall affect your profit and loss. Squaring off the open positions can be done in a few ways. The easiest and the simplest way is to enter into a contra (opposite) trade for the trade initiated earlier for creating the position. For e.g. If someone buys 1 lot Nifty in MIS (intraday) at 8950, the best way to square off the position is to sell 1 lot Nifty in MIS. Thus 1 buy and 1 sell shall square off the position and the trader will not be exposed to the price movement in Nifty anymore. This shall also result into realization of profit or loss on the position.

Please note that the product type in the contra order should be the same as the initial order or else it will a create a new position. For eg if the initial order was an MIS Buy Order, the square off order should be an MIS Sell Order. If the product type in contra order is selected as NRML, it will create a new short position for Carry Forward trade. The initial position for intraday (MIS) order would remain open and will get auto squared off by the RMS system.

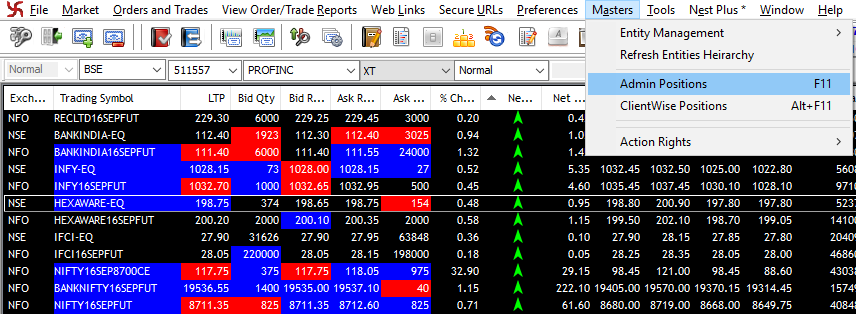

The other option for squaring off a position is from the Admin Positions window. For this, go to “Masters” Menu, select Admin Positions (Short cut – F11)

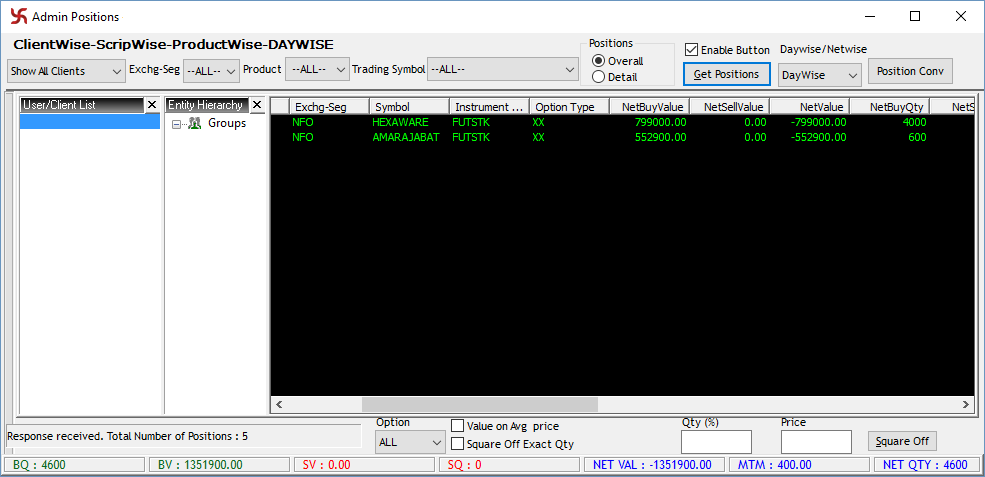

In the admin position window, you can see all the positions along with the unrealized and realized profits. Select the position which is required to be squared off and on the bottom right of the screen, click on the “Square Off ” button. You can enter the quantity and the price for squaring off.

Position conversion too if required can be done from the Admin positions window.

Additional Reference Links

Easy & quick

Easy & quick

Leave A Comment?