Cover Order Meaning?

Cover order is a 2 legged order type where putting a stop loss along with the initial order is compulsory. Thus, the loss in the trade is already covered and hence the name.

In Cover Order, the trader has to put 2 orders at a time:

- Position Initiation Order – This order will be a limit order to enter into a position

- Stop Loss Order – This order will be a market order

Cover order is one of the various product types offered by Samco for trading in the Indian stock markets. To know more about margin requirements while trading at Samco, refer the margin policy blog.

What is the difference in Cover Order vs Bracket Order

A cover order is a 2 legged order with an initial order and a stop loss order whereas a Bracket Order is a 3-in-1 order with a initial order, stop loss order and a target order.

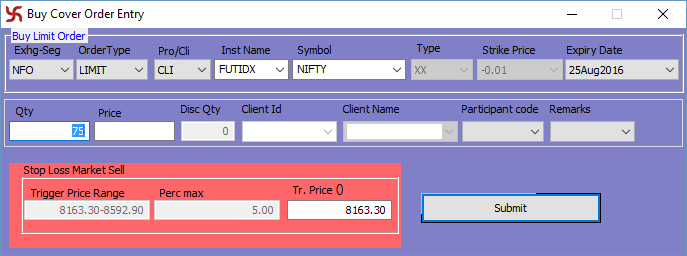

Placing a Cover Order at Samco

Cover order can be placed by following the steps as mentioned in the following table:

| Method and Commands | BUY Cover Order | SELL Cover Order |

| Market Watch | Right Click a script in the Market Watch -> Select Cover Order -> Buy Cover Order Entry | Right Click a script in the Market Watch -> Select Cover Order -> Sell Cover Order Entry |

| Orders and Trades Menu in Tool bar | Select Orders and Trades in the Tool bar -> Cover Order -> Buy Cover Order Entry | Select Orders and Trades in the Tool bar -> Cover Order -> Sell Cover Order Entry |

| ShortCut Key | Shift + F1 | Shift + F2 |

Suppose, some one wishes to buy reliance at Rs. 1000. In cover order, along with the buy order to purchase the share at Rs 1000, a stop loss price also needs to be entered. The stop loss price should be within a prespecified range mentioned in the order window. The initial order can be a limit order. However, the stop loss and the square off order would be compulsorily market orders.

Modification of Cover Order

- If the initial order is not traded, the limit price and the stop loss can both be modified

- If the initial order is traded, only the stop loss price can be modified

Exiting the Cover Order

The Cover Order can only be exited at the market price.

Since the loss is already covered, cover order requires lesser margins as compared to simple orders. You can check out the Samco Cover Order Margins on the Margin Calculator. The multiplier can go up to 20x in the cash market and more than 75x in the F&O market.

Cover Order is strictly an intra day trading product and cannot be converted into carry forward or delivery trades. The open cover orders would be squared off 15 mins before the market closure in equity & currency segment and 30 mins before market closure in commodity segment.

Cover order is available in NSE – Cash, FNO, Currency & MCX segment.

Easy & quick

Easy & quick

Leave A Comment?