What is a SmartSIP Order?

A SmartSIP order is a simple order type with 2 mutual fund schemes – one leg is the equity scheme and the other leg is a liquid scheme. It works as a multi-leg composite order where based on the Margin of Safety Index (MosDex TM ) of the Equity scheme, automatic adjustments are made between the equity schemes and the liquid scheme.

If the markets are expensive, the Margin of Safety (MosDex) value is low and if the markets are cheap, the Margin of Safety value is high. The values of the MosDex will range from 0 – 200, 100 being the average level of margin of safety.

The discipline of a SIP is maintained by the SmartSIP. A fixed amount of installment is drawn each month from the investor’s account and based on the level of margin of safety, allocations to equity or liquid scheme are made. The detailed working of how the SmartSIP order work is explained below.

Mr. Warren Buffett said, “The three most important words in investing are the margin of safety.”

The Margin of safety principle is a principle widely advocated by the world’s most famous investors Warren Buffett and Benjamin Graham. Mr. Buffett has also called the principle one of the “cornerstones of investing.”

The RankMF MosDex uses qualitative and quantitative parameters to determine a scheme’s intrinsic value or simply the underlying value. The scheme NAV is used as a reference point to compare if the margin of safety is high or low.

How does the SmartSIP orders work?

- If the margin of safety is between 80 to 90, then the monthly installment amount will be invested in a low-risk liquid fund instead of an equity fund, and in case the margin of safety goes below 80, some equity units would be sold to realize profits and the profits would then be invested into liquid funds to avoid buying at a higher NAV.

- If the margin of safety is between 90-105, then the monthly installment amount will continue to be invested in the your selected equity fund. Also the investments parked in the liquid fund will also be re-invested into the choice of your equity fund to buy units at a nominal NAV.

- If the margin of safety goes above 105, then in case of SmartSIP the monthly installment amount will be invested in the selected equity fund.

- If the margin of safety goes above 105 in case of SmartSIP plus then the monthly installment amount will be doubled in the selected equity fund to buy additional units as the NAVs will be really undervalued.

SmartSIP intelligently applied the principle of buy low, sell high to generate superior returns for its investors compared to a regular SIP. SAMCO

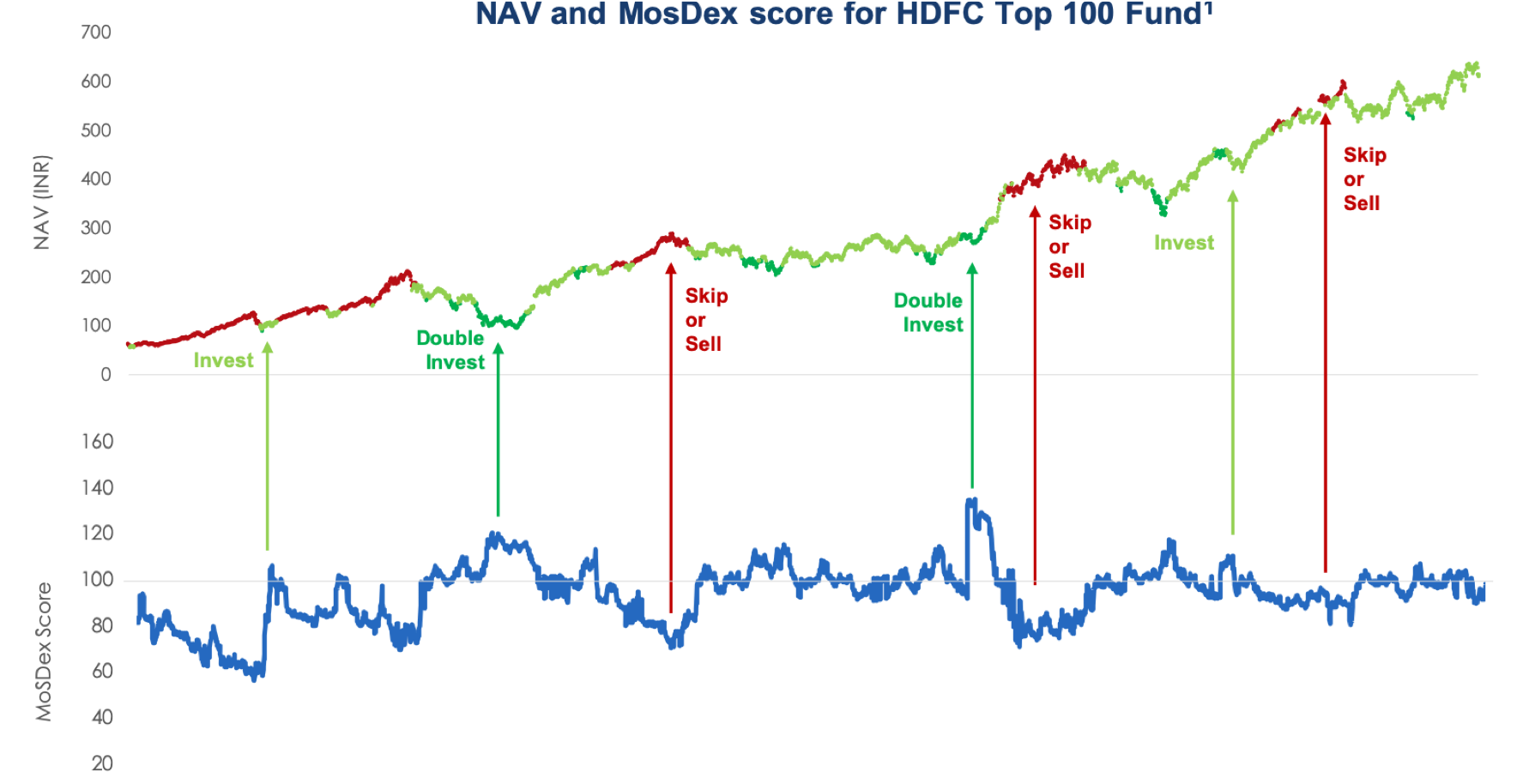

For example, if you observe the price/NAV chart of the HDFC Top 100, a normal regular SIP would have invested the same amount every month. If markets were expensive, you would have still continued your SIP.

However, the SmartSIP, as the name is smart enough to auto-adjust investments into the equity schemes and liquid schemes based on the market conditions. If you observe the chart below, there are several periods where markets are expensive and where the money is invested in liquid schemes and also several periods where markets were very cheap and higher investments were made in the equity schemes.

How to place a SmartSIP order?

To place a SmartSIP order on the RankMF platform, all you need to do is log in with your credentials or create an account with RankMF. Then click on the ‘Explore All MF Ranks’ which will redirect you to a new page. After this, in the below filter panel all you have to do is select ‘SmartSIP’. Below you will find all the funds that can invest in SmartSIP mode, all you have to do is click on the fund you want to invest in SmartSIP mode.

Important Note:

SmartSIP orders should only be selected if your investment horizon is greater than 5 years.

The MosDex data for each scheme are licensed for use to the end-user, and not sold to the end customer. The use of this data and license is subject to the client’s prior acceptance. Please refer to the complete terms and conditions.

How many schemes is the SmartSIP order type available?

Currently, only equity schemes are available for the SmartSIP order type and the same is not available for debt or hybrid schemes. One of the 3 modes of SmartSIP orders viz SIP Plus, SmartSIP and SmartSIP Plus is available for all the schemes. Specific availability of the order type can be found on the quote page of the scheme.

Why is SmartSIP superior to the regular SIP order?

A SmartSIP order is much superior to a regular SIP on account of the following:

- Higher returns

- Higher returns as compared to the conventional 70:30 Equity Debt SIP and also the only 100% Equity SIP mode

- Higher realisable value of the invested corpus

- The realisable value of the invested corpus is much higher as compared to the corpus value of the SIP investments

- Lower Risk

- When markets are expensive, instead of buying the expensive equity units, liquid units are bought which leads to lower risk

The outperformance of the SmartSIP vs SIP on the HDFC Top 100 Scheme

Returns of the SmartSIP vs the Conventional SIP

Observe that the SmartSIP system beats both the regular SIP and the conventional SIP almost each and every time. The average outperformance since 1st January 2005 is 5.76% on the regular SIP and 7.17% on the conventional 70:30 SIP.

- SIP Returns vs SmartSIP returns on HDFC Top 100 fund

Corpus value of the SmartSIP v/s the Conventional SIP Observe that the invested corpus under the SmartSIP system is significantly higher than the corpus value of a regular SIP.

- Realisable Corpus value in SIP vs SmartSIP

What are the variants of SmartSIP?

The SmartSIP order is available in 3 modes – SmartSIP, SmartSIP Plus, and the SIP Plus modes. The difference between them is that the SmartSIP mode like a regular SIP presumes that the SIP installment amount each month shall remain the same. So if your regular SIP amount is Rs. 10000 for 60 months over 5 years i.e. a total investment of Rs. 6,00,000, the amount under SmartSIP would also be equal to Rs. 6,00,000 i.e. Rs. 10,000 * 60 months. In the SmartSIP Plus mode, additional top-up amounts is drawn from the investor depending on the Margin of Safety. For Eg. if the Margin of Safety was 106 for a particular month on SIP day, instead of Rs. 10,000 which would otherwise be drawn, Rs. 20,000 is drawn for that month. This doesn’t happen every month but rarely since the margin of safety is not always high. It is a recommended strategy since more capital gets invested during cheap markets and more units get acquired. On average, the amount drawn over a 5 year period in the SmartSIP Plus is about 10% higher than normal SmartSIP i.e. instead of Rs. 6,00,000, the invested sum over 5 years would be ~ Rs. 6,60,000 which over the life of the SIP is not a very large difference.

Watch this video to understand SmartSIP

Disclaimer: Investments in Mutual Funds are subject to market risks. Please read all scheme related documents carefully before investing. Past performance is not an indicator of future returns.

Easy & quick

Easy & quick

Leave A Comment?