Stock Market Updates for June, 2024

21st June, 2024

Can Private Banks Lead from the Front Now

On June 19, 2024, the Bank Nifty reached a new high of 51,957. This milestone could be just the beginning, with potential for further acceleration and growth.

It’s a known fact that due to improved operational efficiencies, the implementation of the Insolvency and Bankruptcy Code and cautious lending practices by PSU banks have significantly enhanced their financials. This has sparked a remarkable rally in their share prices, resulting in 83% gains on a yearly basis. Consequently, the spotlight has shifted away from the country’s private banks.

Not only PSU Banks, but many major indices had performed better than Bank Nifty in the past year.

| Sr.No. | Company Name | 1 Year Returns |

| 1. | NIFTY Realty | 116.7% |

| 2. | NIFTY PSU Bank | 83.1% |

| 3. | NIFTY Auto | 71.7% |

| 4. | Nifty Smallcap 250 | 61.0% |

| 5. | NIFTY Metal | 56.5% |

| 6. | Nifty Midcap 150 | 55.3% |

| 7. | NIFTY Pharma | 48.4% |

| 8. | NIFTY 50 | 25.0% |

| 9. | NIFTY IT | 20.7% |

| 10. | NIFTY Bank | 17.4% |

| 11. | NIFTY Private Bank | 14.2% |

Rewards should reflect the level of contribution. In Q4FY24, Private Banks contributed approximately 20% of the total PAT from the 29 industries in Nifty 50 but only represented 15% of the total market capitalization. This discrepancy indicates that Private Banks are not being rewarded in proportion to their significant contribution.

| Sr.No. | Row Labels | PAT(In Rs.) | Market Cap (IN Crores) |

Proportion of PAT | Proportion of Market Cap |

| 1. | Bank - Private | 45,190 | 2,840,650 | 19.9% | 15.1% |

| 2. | IT - Software | 29,109 | 2,934,473 | 12.9% | 15.6% |

| 3. | Refineries | 26,135 | 2,141,049 | 11.5% | 11.4% |

| 4. | Other | 126,089 | 10,943,515 | 55.7% | 58.0% |

The proportion of market cap would increase significantly once the private banks are rewarded based on their fundamentals, thereby propelling the Bank Nifty to move higher.

Despite the Bank Nifty has conquered new highs, the difference between its current Price-to-Book Value (PBV) of 2.97 and its 5-year median PBV of 2.77 is relatively small, just 0.20. Similarly, the Nifty Private Bank Index shows a comparable pattern, with a current PBV of 2.9 and a median PBV since its inception of 2.73, indicating a variance of only 0.17.

Additionally, the ratio chart of the Nifty Private Bank Index to the Nifty PSU Bank Index supports this analysis. It shows that the ratio increases when the Private Bank Index outperforms the PSU Bank Index and decreases otherwise.

For the past 30 weeks, the charts have been consolidating and are currently near 3.45 which is close to the previous high of 3.5. A significant move in the Private Bank Index is expected if it closes above the 3.5 level in the near future. This serves as an additional confirmation.

So, as per fundamentals, technicals, and other macro factors, the Private banks would likely outperform in the coming future.

Technical Outlook

_1718973360.png)

Nifty once again marked a new high but traded within a tight range in the last week, hitting a high of 23,667 and a low of 23,398. Nifty ended the session at 23,501, with a marginal gain of 0.15% compared to the previous week.

The Indian market remained robust, buoyed by new highs in the US market. Sectorally, there was a mixed reaction, with Nifty IT gaining 1.74% while Nifty Auto and Nifty FMCG shed 2.45% and 2.16% respectively.

The India VIX currently stands at 13.18, having reversed below the mean, and is now expected to move higher. Nifty is trading above its short-term moving average with the Fibonacci retracement of 23.6% at 23,100 acting as strong support. The primary trend remains bullish but may weaken if the index slips below the 23,000 mark. Nifty appears overextended, suggesting some headroom for a correction.

14th June, 2024

5 Investing Lessons from Roger Federer’s Career

Roger Federer widely known to be one of the greatest player in tennis delivered an inspiring speech at Dartmouth College, primarily focused on his experiences in tennis and life. The valuable lessons are applicable to investing too. Federer's journey to becoming a tennis legend shows the importance of perseverance, self-belief, and continuous improvement. These qualities are relevant in the world of investing too.

Here are some of the key lessons from Federer’s speech:

1. Continuous Improvement & discipline:

Federer got a reputation for winning effortlessly which he believes is an ultimate achievement because of his discipline and continuous training for years. This approach is directly applicable to investing. Success in the stock market requires continuous learning and skill enhancement. Investors must remain committed to their investment strategies and plans with a disciplined approach, continuously updating their knowledge and strategies to navigate the complexities of the market effectively.

Federer got a reputation for winning effortlessly which he believes is an ultimate achievement because of his discipline and continuous training for years. This approach is directly applicable to investing. Success in the stock market requires continuous learning and skill enhancement. Investors must remain committed to their investment strategies and plans with a disciplined approach, continuously updating their knowledge and strategies to navigate the complexities of the market effectively.

2. Perseverance and Long-term Vision:

Federer highlighted that in tennis, maintaining focus and perseverance is crucial, especially after the initial hours of play when mental fatigue sets in. This long-term perspective is essential in investing as well. Many investors experience initial success known as beginner’s luck but they walk out of the market after facing losses. Federer's career highlights the importance of perseverance; he overcame numerous setbacks and continuously strived for success. Similarly, investors should stay committed to their back-tested investment strategies, even during market downturns. Enduring the volatility and short-term fluctuations of the market is key to achieving long-term success.

Federer highlighted that in tennis, maintaining focus and perseverance is crucial, especially after the initial hours of play when mental fatigue sets in. This long-term perspective is essential in investing as well. Many investors experience initial success known as beginner’s luck but they walk out of the market after facing losses. Federer's career highlights the importance of perseverance; he overcame numerous setbacks and continuously strived for success. Similarly, investors should stay committed to their back-tested investment strategies, even during market downturns. Enduring the volatility and short-term fluctuations of the market is key to achieving long-term success.

3. Emotional Control:

Roger said at the end of the day one wins and the other one goes home with an emotional setback pondering what went wrong in the game which is an acceptable normal tendency. After a loss even a champion question himself. This lesson is highly relevant for investors. After a loss-making trade, it is essential to analyze the mistakes and prepare for the next trade without being hindered by emotional setbacks. Maintaining emotional control helps investors make rational decisions and set themselves up for future success.

Roger said at the end of the day one wins and the other one goes home with an emotional setback pondering what went wrong in the game which is an acceptable normal tendency. After a loss even a champion question himself. This lesson is highly relevant for investors. After a loss-making trade, it is essential to analyze the mistakes and prepare for the next trade without being hindered by emotional setbacks. Maintaining emotional control helps investors make rational decisions and set themselves up for future success.

4. Nothing is too big to fail:

Federer’s dream of winning six consecutive Wimbledon titles was shattered when he lost to Rafael Nadal after five consecutive wins when he was referred to as the world champion. This experience teaches investors that even the most successful face failures. No matter how proficient an investor you are, setbacks are inevitable. Investors must be prepared for capital drawdowns and understand that it is impossible to be correct every time. Embracing failures as learning opportunities is crucial for long-term growth and resilience in investing.

Federer’s dream of winning six consecutive Wimbledon titles was shattered when he lost to Rafael Nadal after five consecutive wins when he was referred to as the world champion. This experience teaches investors that even the most successful face failures. No matter how proficient an investor you are, setbacks are inevitable. Investors must be prepared for capital drawdowns and understand that it is impossible to be correct every time. Embracing failures as learning opportunities is crucial for long-term growth and resilience in investing.

5. Risk reward ratio:

Federer’s career statistics are a significant lesson to investors about risk and reward. He played 1,526 matches, out of the total match points he scored only 54% points and still managed to win almost 80% of matches. This sets an example in front of investors that even if you have a high number of losing trades you can still make profits if you manage your risk well and don’t lose more on losing trades than you make on winning trades. Investors should focus on identifying opportunities with high reward potential.

Federer’s career statistics are a significant lesson to investors about risk and reward. He played 1,526 matches, out of the total match points he scored only 54% points and still managed to win almost 80% of matches. This sets an example in front of investors that even if you have a high number of losing trades you can still make profits if you manage your risk well and don’t lose more on losing trades than you make on winning trades. Investors should focus on identifying opportunities with high reward potential.

Federer's experiences provide a valuable roadmap for developing a disciplined and resilient investment approach. Following these key principles will help investors achieve success in the market.

Technical Outlook

_1718368696.png)

Nifty extended its upward momentum, closing the session at 23,465.60, marking a 0.75% gain over the week. The index sustained above the upper band of its rising channel and remains above its short-term moving averages, signaling prevailing strength.

The major support remains between the 22,900-23,000 zone, aligning with the daily middle Bollinger Band. The daily RSI is steady above 60 with no divergence indicating a bullish outlook.

Sector-wise, BSE Capital Goods emerged as the top performer, climbing 6.40% over the week while Nifty IT declined by 1.62%.

The India VIX, known as the fear gauge, dropped significantly by 24.05% to 12.82 and reflects a drastic cooling off in the volatility.

Overall, the chart setup remains bullish as long as the Nifty holds a 23,200 level and any dip towards these levels presents a buying opportunity while the 23,500 level is broken, we expect the Nifty might reach the 23,750-23,900 levels.

7th June, 2024

Why Investors Favor the FMCG Sector: A Closer Look

India completed a historic election this week, which had a roller-coaster effect on the share market and led to volatility surging to unprecedented levels. The broader market indices and several other sectoral indices fell sharply on the day of the election results. However, one sector successfully resisted the bearish sentiment and could become an investor favorite now. Yes, that's the FMCG sector. It rallied by around 5% on Wednesday after gaining 1% on the previous day when the market crashed sharply.

There are several reasons for FMCG becoming a preferred choice in today’s time. This year’s general election has been the most expensive, with estimated campaign expenditures by political parties reaching a record 1.35 lakh crore. A significant share of this pie moves into the pockets of rural India.

Additionally, as per the election verdict, an alliance government will come to power. Observing the less-than-expected support that BJP received from the people of India to cross the majority mark, it could be anticipated that the focus will shift slightly more on populist measures to increase rural income, welfare schemes, subsidies, etc. This will help them garner support in upcoming state elections. This will ultimately increase income for rural Indians, followed by an increase in consumer spending and revenue for FMCG companies. Moreover, expectations of better monsoons this year also provide a tailwind for the growth of the FMCG sector.

Another reason for the shift in preference to defensive stocks like FMCG is the reallocation taking place in investors’ portfolios. Since the government had a majority in the recently concluded term, PSU stocks were getting a premium owing to the ruling party's ability to make structural reforms and decisions swiftly. With an upcoming alliance, the government may lose its free hand over such decisions. The pace of capital expenditure and infrastructure investment might slow down. Therefore, PSU stocks witnessed a downward re-rating recently.

Until the full budget is declared, uncertainty about the government’s stance on various sectors will prevail. This has also caused a correction in capital goods stocks, which were trading at overvalued historic multiples. I mentioned the need to be cautious in the Capital Goods sector in one of my previous articles. Such upheavals in the market incline investors towards safety and thereby encourage them to go long on consumer goods stocks, given their low beta with the market. In one of my articles in March, I also discussed that it’s time to reduce risk by adding the FMCG sector to your portfolio.

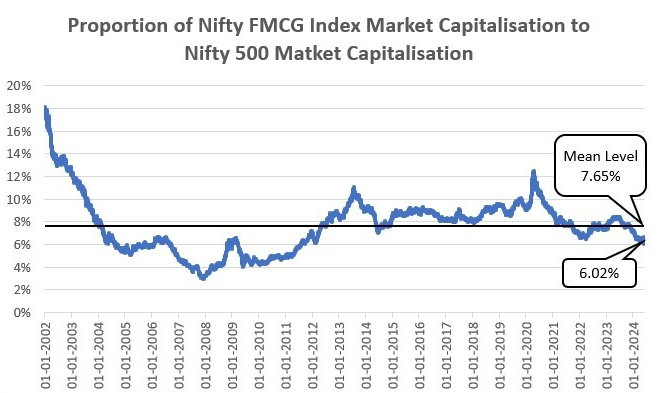

FMCG stocks are currently neglected by market participants and offer a good investing opportunity. If we look at the proportion of market capitalization of the Nifty FMCG Index to the market capitalization of the Nifty 500, we can observe that the current weightage of the FMCG Index is the lowest in the past twelve years at 6.02%, while the mean level is 7.65%. This indicates that the FMCG sector is at a support level and relatively undervalued currently. Hence, there are positive prospects for an upswing in the sector going forward.

Given the protection received from staples’ stocks in uncertain times and their strong fundamentals involving higher operating margins and return on capital employed, the stocks may experience a higher valuation multiple to be assigned by investors.

To sum up, optimistic spending expectations from the rural economy on consumer products, the reallocation happening in portfolios in favor of defensive stocks, their attractive valuation, and strong fundamentals are poised to make the FMCG sector a shining star in the time to come.

Technical Outlook

_1717764742.png)

Last week was highly volatile for the domestic market. On June 4th, Nifty plummeted 5.93%, touching a low of 21,282. However, it rebounded strongly and surpassed the June 4th high and ended the week at 23,290, up 3.37%.

Nifty IT led the gains with an 8.60% rise, while Nifty PSE slipped 2.04% for the week.

Nifty formed a dragonfly doji on the weekly chart, which usually occurs after a sideways correction within a longer-term uptrend.

The index is holding above the short-term 9 and 20 DMA, as well as the 50 DMA (Daily Moving Average). The daily RSI remains steady at 59. The India VIX, a fear gauge, fell sharply from a high of 31.71 to settle at 16.88, indicating that volatility is cooling.

Nifty is expected to remain sideways with a positive bias. Support levels are at 22,500 and 22,400, while resistance levels are at 23,620 and 23,800.

Easy & quick

Easy & quick