Stock Market Updates for October, 2023

20th October, 2023

Gold: Guiding Through Economic Signals

In the world of money, gold has always been fascinating. Its value is not merely measured in carats or purity but in its ability to provide a haven of stability in turbulent economic waters. Gold can act as a smart signal to understand if the economy is going well. Even when the economy is always changing, gold stays strong. It is like a lighthouse that shows a good way for people who know how to see its signals.

But here’s the thing: just looking at gold by itself doesn’t give us the whole picture. It’s like having one puzzle piece but not the whole puzzle. When we look at how gold connects to other financial things, it’s like finding hidden treasure. In this article, we will explore how gold links up with bond yields, crude oil, and the USD INR exchange rate.

Let us understand the effect of an increase in bond yields on the overall market. The 10-year US Government Bond Yield has surged to its highest level since 2007. This significant increase in bond yields is driven by rising interest rates and further fueled by geopolitical risks.

Higher bond yields can lead to increased borrowing costs for businesses and individuals, potentially affecting consumer spending and economic growth. Higher bond yields can further put downward pressure on stock markets, as they make equities comparatively less attractive thereby leading to increased market volatility and market corrections.

The above figure displays the ratio chart of Gold (US$/OZ) to the United States 10-year Government Bonds Yield. Notably, the current ratio of both variables is hovering near its lowest point since 2010.

This indicates that the days of underperformance of Gold and rising bond yields could end soon. Gold could outperform bond yields from here.

The following shows the US gold prices chart forming a cup and handle pattern. When US gold prices rise or fall, it can set a trend for gold prices worldwide, including India.

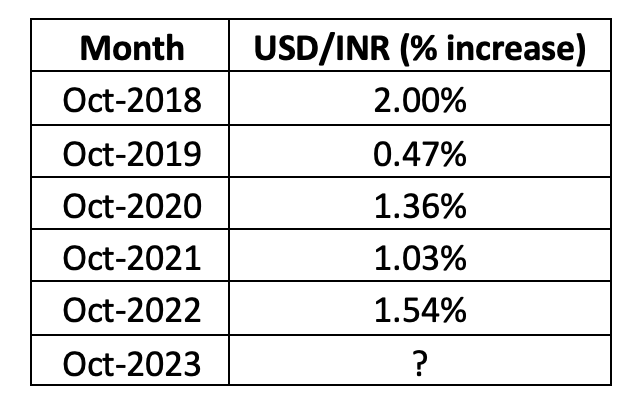

The table below displays the extent of USD/INR depreciation in the month of October over the past five years. A depreciation of the Indian Rupee (INR) can make gold, which is denominated in US dollars more expensive for Indian consumers and investors, potentially driving up demand for gold within the Indian market. Consequently, a depreciation of the INR is associated with higher gold prices in India.

Finally, as we observe the interplay between these elements, it becomes evident that gold’s role extends beyond its traditional allure and serves as a barometer of economic stability. Monitoring these interactions can provide a more comprehensive understanding of the financial markets.

Technical Outlook

This week, the markets experienced a 1.06 % decline, closing at 19,542.65. The markets continued to exhibit significant volatility, oscillating 338 points in the last week. The bearish trend was largely influenced by a global market sell-off. Equities, across the world, saw a decline amidst concerns of an escalation in the Middle East conflict, leading to higher prices for oil and gold.

The Nifty 50 remained range bound as strong call writing at 19,600 Strike and put writing 19,500 Strike, was witnessed. 19,500 remains a crucial support level for Nifty. A break of 19,500 levels can lead to the initiation of fresh shorts. A break below 43,500 in Bank Nifty will cause further selling while a close above 44,000 is required for the bulls to comeback.

The weekly chart revealed a formation of a bearish inside bar, while on the daily time frame, the Index remained below the 50-day moving average (DMA). The Relative Strength Index (RSI) skewed negatively, ending at 57 levels on a weekly time frame. In the past week, several sectors witnessed profit booking and ended in negative territory. Notably, Nifty Auto was the only sector to post marginal gains.

13th October, 2023

Maintaining Cool in Markets During War Hype

In the fast-paced world of financial markets, it's easy to become entrapped in the whirlwind of sensational headlines and breaking news. The media's constant barrage of information, often presented with a sense of urgency and drama, can have a profound impact on market participants.

The sensationalism that often accompanies such news can trigger knee-jerk reactions among investors, leading to erratic market movements. Media thrives on dramatic headlines, and the prospect of war is a topic that unfailingly grabs public attention.

As the Russia-Ukraine war continues with no resolution in sight, the recent attack by Hamas, a Palestinian militant group, killed over a thousand people in Israel over the last weekend. Hamas's recent aggressive actions against Israel have taken many by surprise.

When news is hyped with a sense of urgency and drama, it can trigger fear and panic among market participants. This fear-driven behavior can lead to a downward spiral in the markets, resulting in rapid sell-offs and increased volatility. Traders and investors, influenced by sensational headlines, may make impulsive and emotionally driven decisions, further exacerbating market declines.

Media news is primarily driven by the need to capture your attention, keep you engaged, and generate viewership or readership. This means they often exaggerate or sensationalize news stories, making them more compelling and captivating. The consequence of this sensationalism is that it can lead to increased market volatility, but it doesn't necessarily reflect the underlying fundamentals of the asset you own in question. When we base our financial decisions on these sensational narratives, we are at risk of making impulsive and irrational choices.

While staying informed is undoubtedly important, making trading and investment decisions solely based on news can be a treacherous path to follow. Instead, a more prudent approach involves anchoring your decisions in the bedrock of fundamental analysis.

News tends to have a short-term impact on market movements. Markets can be highly reactive to breaking news, resulting in rapid and sometimes unpredictable price swings. However, these fluctuations are often temporary and may not reflect the long-term value or prospects of an asset.

When the Russia-Ukraine war began in 2022, the market saw nearly a 5% decline. Thereafter, the market saw a recovery for the next 2 days and within a month and a half, it had already returned more than 5% to the investors.

This time too, the market was expected to react to the Israel-Hamas war, and we saw the market fall on Monday. However, the market saw a swift recovery the next day closing nearly a percent higher. In fact, the market saw nearly a 0.50% increase over the last week.

Seasoned investors understand that these moments, fraught with uncertainty and anxiety, offer unique investment opportunities. Instead of allowing themselves to be swayed by sensational war news, prudent investors rely on a well-informed, analytical strategy. Companies with strong fundamentals, including resilient business models, solid financial health, and competent management, remain attractive to investors looking to capitalize on discounted stock prices during turbulent times.This hype-driven market behavior is often short-lived, as the news cycle quickly moves on to the next story. It doesn't necessarily reflect the true fundamentals of the assets being traded. This is why it's crucial for market participants to maintain a long-term perspective, focusing on the underlying fundamentals of the assets rather than reacting to the sensationalism of the media. By doing so, they can make more informed and rational decisions that align with their financial goals and risk tolerance, ultimately avoiding the pitfalls of fear-driven market movements.

Technical Outlook

During the week, the Nifty50 gained 0.50 percent and ended at 19751.05. Bulls and bears engaged in a fierce battle in the 19600–19800 price range. The Index was somewhat under pressure mostly from the IT sector, as it fell 1.65% within a week. In comparison to the previous week, the trading range stayed slightly broader.

The upcoming earnings number would lead to sectoral push and stock specific action as well.

Technically, Nifty has formed a bullish candle with a long shadow on upside in the weekly chart. While on the daily intervals, it is trading below 20 EMA but having support of 50 DMA. The RSI is currently at 51, indicating a balance of optimism and pessimism. The index needs to move beyond the crucial level of 19,840 for the momentum to pick pace while on the downside, the level of 19,670 would act as immediate support.

6th October, 2023

Capital with Conscience: Applying Gandhi's 7 Sins to Ethical Investing

Mohandas Karamchand Gandhi, the leader of India's freedom movement, birthday is celebrated every October 2. His enduring legacy of nonviolence and his profound teachings continue to inspire people worldwide. His ideas remain highly relevant in our modern lives, reminding us of the power of peaceful resistance and the importance of living a principled life.

Gandhiji's 7 Social Sins, originally addressing individual conduct, find resonance in capital markets too. From greed to speculation, these vices manifest in financial realms, revealing the need for ethical investment practices and responsible financial behavior to foster a just and sustainable economic system.

1.Wealth without Work: This sin conveys accumulating wealth without genuine efforts. In capital markets, one should treat it as a business and not just a hobby. Real efforts should be made to understand the fundamental/technical concepts for making informed decisions and taking calculated risks. If not, possible efforts should be made to identify individuals who do money management with utmost importance and care.

2. Knowledge without Character: Here it underscores the importance of integrity and honesty. The history of capital markets is full of such instances, Individuals with a high level of knowledge lacked character leading companies and economies to collapse affecting all the stakeholders. Often people forget character along with knowledge is the only path to a sustainable wealth-creation process.

3.Politics without Principles: Warns against exploiting professional positions for personal gains. In the context of capital markets, Investors should focus on companies whose top-level executives are aligned with the organization’s morals & ethics. Lack of such principles may result in financial scams eventually eroding wealth. Investing in such companies would not favor the risk-to-reward criteria.

4.Commerce without Morality: This social sin of Gandhi, warns against profit-driven endeavors devoid of ethical considerations. In the capital markets, companies should prioritize societal value over mere financial gain. Investors should avoid engaging with companies or schemes that guarantee quick rich options instead of a gradual wealth creation process.

5.Science without Humanity: Through this sin, Gandhiji wants scientific innovation/discoveries should serve humanity's well-being and not be used for destructive purposes. In the world of capital markets, this principle can be related to ethical considerations in investing in industries that have potential negative social or environmental impacts. Responsible investors may avoid these companies that encourage such activities. For instance, a chemical company needs to adhere to several safety norms and pollution checks, a pharmaceutical company needs to comply with several FDA rules, and an auto company has to comply with many safety rules any failure in these aspects could impact the environment, humanity, and economy at large.

China's pursuit of global leadership in the chemical industry led to hasty approvals for companies, neglecting due diligence. This lack of scrutiny resulted in multiple plant explosions, causing human casualties and infrastructure damage, highlighting the consequences of inadequate safety measures in the industry.

Investors should keenly observe these developments on a regular basis and plan their investments accordingly.

6.Religion without Sacrifice: Gandhiji, warns against following the rituals without understanding its core principles. Similarly, investors should avoid investing aimlessly and prioritize purposeful, goal-based investing. This principle urges clarity in investment motives, aligning actions with well-defined financial objectives within the capital market. Eg: An investment with a horizon of 10 years should not be disturbed just because it has delivered negative returns in a shorter time period.

7.Pleasure without Conscience: Through this, he cautions against deriving joy from others' detriment. Large conglomerates, with control over the entire supply chain and having economies of scale, can stifle competition through aggressive price reductions, leading to lower profits and reduced margins. This makes it challenging for new entrants to thrive in the business ecosystem.

By addressing these sins at various levels, the wealth creation process becomes more purposeful and aligned with ethical principles leading to the overall development of shareholders’ values. This approach also aligns with Gandhian principles of wealth management.

Technical Outlook

There was a lot of shuffling in the Indian market last week mostly related to macroeconomic data and after the RBI monetary policy meeting. The Nifty Index meandered within a small range of 342 points, ending at 19653.50, with a marginal gain of 0.08% compared to last week.

The Index has currently surged above the support of the 50 DMA, forcing the bears to remain on the sidelines. Indicators such as RSI recovered from lower levels in the daily time frame.

Although the last three days the Index opened with gaps that were not filled would be somewhat concerning.

Coming to the OI Data, on the put side the highest OI witnessed at 19500 followed by 19400 strike prices would be acting as a support zone while on the call side, the highest OI remaining at 19900 strike prices would be acting as resistance.

India VIX has calmed down during the end of the last week signaling that put writers have been shifting their position to the higher side. Going forward, we believe a close above 19770 levels would be important for further extended rallies.

Easy & quick

Easy & quick