Mutual Funds Vs FDs is an age-old argument. Informed investors support mutual funds while conservative investors still think bank FDs are the best investment option. Even after countless proofs on why mutual funds are superior than bank FDs, investors still prefer bank FDs! Why do you think this happens? In ‘the psychology of money’, Morgan Housel states that every individual has a unique relationship with money. This relationship is based on an investors personal experience with money. For example: an investor who grew up during an era of high inflation invested less money in bonds. This was because he had experienced the effects of high inflation first hand. Similarly, an investor who witnessed the 2008 financial crisis will have a negative outlook towards the stock market. He may have never invested in stocks, but he’ll still have a negative view of the stock market. This is exactly what happens with investors who prefer bank fixed deposits over mutual funds. They might subconsciously agree that mutual funds are better than FDs but they’ll still end up investing in FDs. But it’s about time you change this. You must change your outlook towards the stock markets and mutual funds. But why is this change required? Simply because high inflation and low interest rates have made FDs a thing of the past. The truth is that investing in bank fixed deposits will no longer help you achieve your financial goals. But before you decide the winner of the Mutual Funds vs FDs fight, let us understand the key differences between mutual funds and FDs and then decide who is the real winner of the Mutual Funds vs FD battle in 2025? Let’s Begin.

Mutual Funds Vs FDs is an age-old argument. Informed investors support mutual funds while conservative investors still think bank FDs are the best investment option. Even after countless proofs on why mutual funds are superior than bank FDs, investors still prefer bank FDs! Why do you think this happens? In ‘the psychology of money’, Morgan Housel states that every individual has a unique relationship with money. This relationship is based on an investors personal experience with money. For example: an investor who grew up during an era of high inflation invested less money in bonds. This was because he had experienced the effects of high inflation first hand. Similarly, an investor who witnessed the 2008 financial crisis will have a negative outlook towards the stock market. He may have never invested in stocks, but he’ll still have a negative view of the stock market. This is exactly what happens with investors who prefer bank fixed deposits over mutual funds. They might subconsciously agree that mutual funds are better than FDs but they’ll still end up investing in FDs. But it’s about time you change this. You must change your outlook towards the stock markets and mutual funds. But why is this change required? Simply because high inflation and low interest rates have made FDs a thing of the past. The truth is that investing in bank fixed deposits will no longer help you achieve your financial goals. But before you decide the winner of the Mutual Funds vs FDs fight, let us understand the key differences between mutual funds and FDs and then decide who is the real winner of the Mutual Funds vs FD battle in 2025? Let’s Begin.

What are Fixed Deposits?

As the name suggests, fixed deposit is when you invest a lumpsum amount. This amount earns a fixed rate of interest and has a fixed maturity date. The interest rate and the maturity date are decided at the time of making the fixed deposit. Fixed deposits are offered by banks, corporates, Non-Banking Finance Companies (NBFCs)etc. The rates offered by corporates such as Mahindra Finance, Shriram Transport are much more attractive than bank FD rates. But fixed deposits with banks are more popular. [Suggested Reading: Best Tax Saving Fixed Deposits in India for 2021] The main reason behind the popularity of fixed deposits is ‘Safety’. Since banks are strictly monitored by the Reserve Bank of India (RBI) investors believe that Bank FDs are safe. But this is not true. As seen in the recent PMC Bank case, all bank FDs are not 100% safe.

What are Mutual Funds?

Mutual Funds are an investment option which pools money from various investors. This money is invested in multiple asset classes as per the fund’s objective. An equity-oriented mutual fund will invest the pooled money in stocks or equities of companies. They experience high fluctuations. A debt-oriented mutual fund will invest the collected money in ‘debt’ instruments. Since mutual funds invest in the markets, their returns are not guaranteed.

Mutual Fund vs FD – Returns

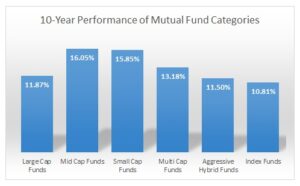

Bank fixed deposit rates have been on a steady decline in India. The 1-year FD rates were as high as 12% in 1995-96. But the rates offered by banks today is only 4%-6%! If you believe bank FDs will start giving double digit interest rates in near future, then you are wrong. As India goes from a developing to a developed economy, the interest rates will keep falling further. On the other hand, mutual fund returns have been consistently rising. Here’s how different categories of mutual funds have performed over the last 10 years.  As you can see above, even if you had invested in index funds, you would have still earned 10.81% average returns in the last 10 years. This is much better than earning mediocre 6%-7% FD returns.

As you can see above, even if you had invested in index funds, you would have still earned 10.81% average returns in the last 10 years. This is much better than earning mediocre 6%-7% FD returns.

Mutual Funds vs FD – Risk

The most common argument in the mutual funds vs FDs fight is ‘safety’. Yes, bank fixed deposits offer higher safety, but they aren’t 100% safe. Bank Fixed deposits are covered under the ‘Deposit Insurance and Credit Guarantee Corporation’ (DICGC) laws. As per DICGC, fixed deposit up to Rs 5 Lakhs are insured. So, in case your bank shuts down, ONLY fixed deposits up to Rs 5 Lakhs will be insured. For example: Suppose Ram deposited Rs 5 Lakhs in ABC Bank. Shyam deposited Rs 10 Lakhs in the same bank. The bank goes bankrupt. Now, Ram will get his entire Rs 5 Lakhs back from the bank. But Shyam will only get Rs 5 Lakhs. The remaining Rs 5 Lakhs will be Shyam’s loss. This is especially important for investors who maintain crores in bank deposits. So, the next time you think about investing in Bank FDs, remember that only Rs 5 Lakhs are safe! Recently, there have been multiple cases of banks being put under Prompt Corrective Action (PCA). The names Yes Bank, PMC Bank & Lakshmi Vilas Bank come to mind. While the State Bank of India saved Yes Bank, the fate of PMC and its deposit holders remains uncertain. Depositors invest in co-operative banks to earn a few extra percentages but run the risk of losing all of their hard-earned money if the bank goes bust! So, think twice before saying that Bank FDs are safe. They are not! Even mutual funds do not provide guaranteed returns. But since their inception in 1989, no mutual fund has gone bankrupt. Mutual funds are strictly regulated by Securities and Exchange Board of India (SEBI). The very purpose of SEBI is to safeguard investors interest. So, as far as bankruptcy is concerned, mutual funds are much more stable than banks. But mutual funds do face various types of risks. All mutual funds face market risk. Market risk is when the value of your investment falls due to fall in underlying stock prices. Debt mutual funds face credit risk, liquidity risk, and interest rate risks. So, while both bank FDs and mutual funds have risks, mutual funds provide superior risk-adjusted returns than bank FDs.

Mutual Funds vs FD – Inflation

Inflation is when the value of your money decreases over time. As inflation rises, the real return of your investment falls. Real Return = Return on Investment – Inflation Consider that your bank FD is offering a 1-year return of 6.5%. The current inflation rate in the country is 6%. Your real rate of return is only 0.5%! So, technically your investment of Rs 100 has grown by only 0.5% not 6%! The 1-year return of Axis Bluechip Fund in 2020 was 20.51%. Assuming an inflation rate of 6%, you still made a real return of 14.51%! So, which is better? – A real return of 0.5% or 14.51%?

Mutual Funds vs FD – Taxation

Mutual funds are much more tax efficient than Bank FDs. Mutual funds are taxed as per asset classes.

- Equity & Hybrid mutual funds – Equity taxation

- Debt & Gold mutual funds – Debt taxation

In equity mutual funds, long term capital gains below Rs 1 Lakhs is tax-free. In debt mutual funds, you get the benefit of indexation. No such benefit is available in bank FDs. In Bank FDs, TDS is applicable. For example: Suppose you fall in the 30% tax bracket. The interest on your Bank FD is 6.5%. Your post-tax return would be only 4.55%. Now assume a 6% inflation. Your real return is a negative 1.45%! Due to high taxes, your FD is costing you money instead of generating returns!

Mutual Funds vs FD – Withdrawals

Mutual funds are highly liquid. You can buy and sell mutual funds within a day. The redemption of equity mutual funds is received within T+2 working days. The redemption of liquid funds is received within T+1 day. Mutual funds do have an exit load period. But this is not a lock-in period. You can redeem from mutual funds anytime. Only if you redeem before a particular time (exit load period), then the fund charges a penalty. But Bank fixed deposits have strict lock-in periods. If you withdraw before the lock-in period, then 1%-2% penalty is charged. This reduces the overall bank FD returns.

Mutual Funds vs FD – Expense Ratio

Mutual fund houses charge a management fees in the form of ‘expense ratio’. This expense ratio is deducted from the fund’s returns. A high expense ratio directly reduces your returns. There is no concept of expense ratios in bank fixed deposits. This is because the banks are only holding your deposits; not managing them. While banks do not charge any expense ratio, they do cost you your financial goals by providing mediocre returns.

Mutual Funds vs FD – Which is More Profitable?

Let’s get to money question of the mutual funds’ vs FD fight. Which is more profitable? – Mutual Funds or Bank Fixed Deposits? The below chart shows the returns you would have made by investing Rs 5 Lakhs in mutual funds vs FD.  As evident above, the value of Rs 5 Lakhs invested in Bank FD would be only Rs 9.38 Lakhs even after 10 years! But if you had invested the same amount in a mid-cap fund, you would have made Rs 22.15 Lakhs! You would have earned an additional Rs 12.76 Lakhs! Let us quickly recap our mutual funds vs FD arguments:

As evident above, the value of Rs 5 Lakhs invested in Bank FD would be only Rs 9.38 Lakhs even after 10 years! But if you had invested the same amount in a mid-cap fund, you would have made Rs 22.15 Lakhs! You would have earned an additional Rs 12.76 Lakhs! Let us quickly recap our mutual funds vs FD arguments:

| Parameter | Mutual Funds | Fixed Deposits |

| Return | High Returns (12%-15%) | Mediocre Returns (6%-7%) |

| Risk | High Market Risk | High Default Risk |

| Taxation | Indexation Benefit | No Indexation. TDS is deducted |

| Withdrawal | No Lock-in period | Strict lock-in period |

| Expense ratio | Ranges between 0.1% - 2.50% | No Expense Ratio |

A careful risk-reward evaluation of the above parameters proves that mutual funds are much more superior to Bank FDs. But as we mentioned in the beginning, our experiences with money dictates our financial choices. Based on all the above parameters, mutual funds are the clear and deserving winner of the mutual fund vs FD fight. So, change your experience with money by taking a leap of faith and investing in mutual funds. They are safe, superior and a one-stop solution for all your financial goals. To take the first step towards mutual fund investments, open a FREE RankMF account and start investing in the best mutual funds in India today!

Easy & quick

Easy & quick

Leave A Comment?