Do you remember this scene from the movie Phir Hera Pheri? Akshay Kumar’s character roams around the city with a 1,000 rupee note. Everyone around him thinks he is rich. However, he cannot even buy a bus ticket! His Rs 1,000 looks good only on paper. In reality, he has zero liquidity!

Liquidity is the ability to convert an asset into cash easily. Your bank account is highly liquid. Real estate is not. It will take you months and a lot of paperwork to sell an apartment. Whereas you can withdraw cash from the ATM in minutes! This is liquidity.

Like Akshay Kumar’s character, even businesses face liquidity risk. Some businesses have decent assets on their balance sheet. But what is the use of such assets if the business fails to meet its short term liabilities?

Will you make long term investments in a company that cannot even pay its short term loans?

Of course not!

This is where the concept of liquidity ratio comes into picture. Liquidity ratios help investors and lenders evaluate a company’s ability to pay its short term liabilities.

Do you remember this scene from the movie Phir Hera Pheri? Akshay Kumar’s character roams around the city with a 1,000 rupee note. Everyone around him thinks he is rich. However, he cannot even buy a bus ticket! His Rs 1,000 looks good only on paper. In reality, he has zero liquidity!

Liquidity is the ability to convert an asset into cash easily. Your bank account is highly liquid. Real estate is not. It will take you months and a lot of paperwork to sell an apartment. Whereas you can withdraw cash from the ATM in minutes! This is liquidity.

Like Akshay Kumar’s character, even businesses face liquidity risk. Some businesses have decent assets on their balance sheet. But what is the use of such assets if the business fails to meet its short term liabilities?

Will you make long term investments in a company that cannot even pay its short term loans?

Of course not!

This is where the concept of liquidity ratio comes into picture. Liquidity ratios help investors and lenders evaluate a company’s ability to pay its short term liabilities.

What is Liquidity Ratio?

Liquidity ratio is one of the most important financial ratios used to analyse a company. It measures a company’s ability to pay short term liabilities without selling long term assets or borrowing fresh capital. Short term liabilities are loans payable within a year. Liquidity ratio is often confused with solvency ratio. However, they are not the same. Liquidity ratio considers short term liabilities. Solvency ratio measures a company’s ability to repay long term debts.- A company is solvent when its total assets are greater than total liabilities.

- A company is liquid when its current assets are greater than current liabilities.

- Total assets include both liquid and illiquid assets. These are assets which cannot be sold within 12 months. For example, factory, land, machinery etc.

- Current assets are assets that can be converted into cash within 12 months. For example: cash in bank, bank fixed deposits, mutual fund investments, treasury bills etc.

There are Three Types of Liquidity Ratios:

- Current Ratio

- Quick Ratio

- Cash Ratio

All these ratios help investors understand a company’s ability to pay off its debt over varying time periods. Let us understand each of these in detail.

All these ratios help investors understand a company’s ability to pay off its debt over varying time periods. Let us understand each of these in detail.

Current Ratio – Meaning, Formula and Implications

Current Ratio analyses a company’s ability to meet its debt obligations within 12 months. It is also known as Working Capital Ratio. Current Ratio formula = Current Asset / Current Liabilities Current assets can be converted into cash in less than 12 months. For example:- Cash in bank or cash in hand.

- Marketable securities - common stocks, commercial papers, treasury bills

- Bank or corporate fixed deposits

- Mutual fund investments

- Accounts receivable from debtors

- Inventory (raw materials or finished goods)

- Short term loans from creditors

- Wages and salaries

- Taxes

- Cash credit or overdraft

- Advance from customers

- Loan Instalments

The below table shows the current ratio of Top 5 BSE Sensex Companies.

| Company | Current Assets (Rs in Crores) | Current Liabilities (Rs in Crores) | Current Ratio |

| Reliance Industries | 2,58,269 | 4,12,916 | 0.63 |

| HDFC Bank | 6,69,309 | 2,75,640 | 2.43 |

| Bajaj Finance Ltd | 1,61,897 | 56,405 | 2.87 |

| Asian Paints | 7,580 | 4,380 | 1.73 |

| Larsen Toubro Ltd | 1,82,689 | 1,44,729 | 1.26 |

Ideal Current Ratio

- Current ratio of less than 1 means the company is not able to repay its creditors with existing assets. There are high chances of default. This happens when current liabilities are more than current assets.

- Current ratio of more than 1 means the company can comfortably take care of its short term payments. Investors prefer such companies.

- Ideal current ratio is between 1 and 3. Current ratio of more than 3 is not attractive. It can mean that the company is unnecessarily hoarding cash instead of investing it for growth and expansion.

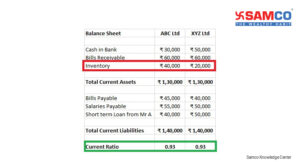

Both ABC Ltd and XYZ Ltd have the same current ratio, 0.93. But look closely. You will notice that ABC Ltd has more money in bills receivable and inventory than in cash! This means if the inventory is not sold, the company’s current ratio will drop to 0.64 which is average.

Hence only relying on a company’s current ratio will not show you the real picture. You need to dig deeper. This is what quick ratio does.

Current ratio is great for checking a company’s ability to meet its 1-year liabilities. But what happens if a company has to meet its obligations even earlier? Say within 3 months? This is where Quick Ratio helps.

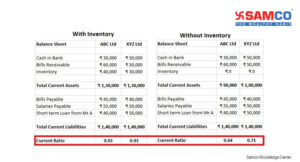

Both ABC Ltd and XYZ Ltd have the same current ratio, 0.93. But look closely. You will notice that ABC Ltd has more money in bills receivable and inventory than in cash! This means if the inventory is not sold, the company’s current ratio will drop to 0.64 which is average.

Hence only relying on a company’s current ratio will not show you the real picture. You need to dig deeper. This is what quick ratio does.

Current ratio is great for checking a company’s ability to meet its 1-year liabilities. But what happens if a company has to meet its obligations even earlier? Say within 3 months? This is where Quick Ratio helps.

Quick Ratio – Meaning, Formula and Implications

Quick Ratio shows a company’s ability to meet its ultra-short liabilities. These liabilities are payable in less than 3 months. Quick ratio is mostly used by conservative investors. It is also known as Acid Test Ratio. Quick ratio formula = Quick asset / Current liabilities. Quick ratio is calculated using quick assets. Quick assets are current assets excluding inventory. Inventory is excluded because it cannot be liquidated within 3 months. All other current assets like cash in bank, mutual funds, common stocks etc. can be liquidated within 3 months. Let us go back to the previous example to understand how quick ratio works. Suppose we remove inventory from the calculation. You’ll see that XYZ Ltd is a better alternative than ABC Ltd. This information was not available in current ratio.

The below table shows the Quick Ratio of Top 5 BSE Sensex Companies.

| Company | Quick Ratio | Industry |

| Reliance Industries | 0.45 | Oil & Gas |

| HDFC Bank | 2.43 | Housing Finance |

| Bajaj Finance Ltd | 2.87 | Finance |

| Asian Paints | 0.96 | Furniture - Paints |

| Larsen Toubro Ltd | 1.22 | Information & Technology |

Ideal quick ratio

- The ideal quick ratio is 1.

- Quick ratio of less than 1 means the company does not have sufficient cash to meet its ultra-short term obligations.

- A quick ratio of more than 1 means the company can meet its ultra-short term liabilities. But it can also indicate underutilisation of its assets.

Cash Ratio – Meaning, Formula and implications

Cash Ratio is the proportion of a company’s cash to its liabilities. Imagine a situation where the company fails to receive payments from debtors. It cannot even sell its shares or mutual funds. The company is 100% dependent on its cash reserves to take care of short term liabilities. Will the company default on its payments? Will it sustain itself? This is analysed using cash ratio. Cash ratio tells you whether a company can pay off its debt using only its cash assets. Cash Ratio Formula = Cash + Cash equivalentsCurrent Liabilities

Cash and Cash equivalents include:- Commercial Papers

- Certificates of Deposits

- Treasury Bills

- Liquid or Money Market Funds

- Bank Savings Account

- Demand Draft

Ideal Cash Ratio

- Cash Ratio of 1 means the company can manage its short term liabilities completely. It does not have to sell its assets even liquid ones like mutual funds. This is great news for investors.

- Cash Ratio of less than 1 means the company does not have enough cash assets to cover its short term liabilities. This can happen for numerous reasons like higher credit cycles. For example in dye industry the credit cycle is 3 months. So, companies might not have immediate cash but will have strong bills receivables.

- Cash Ratio of more than 1 means the company can manage its ultra-short term and short term liabilities. However, an abnormally high cash ratio can signal an inefficient management which is hoarding cash.

Summary

| Current Ratio | Quick Ratio | Cash Ratio | |

| Formula | Current Assets Current Liabilities | Current Assets – Inventory Current Liabilities | Cash + Cash equivalents Current Liabilities |

| Reflects | Company’s ability to pay off short term debts. | Company’s ability to pay off ultra-short term debt | Company’s ability to pay debt using only cash and cash equivalents |

| Time Duration of Debt | Less than 12 months | Less than 3 months | Less than 12 months |

| Ideal Ratio | 1-3 | 1 | 1-3 |

Easy & quick

Easy & quick

Leave A Comment?