The full form of BHEL is Bharat Heavy Electricals Limited. It is one of the largest manufacturing and engineering companies in India. BHEL is the largest producer of power plants in India. It was established in 1964 and is wholly owned by the Government of India. BHEL is also involved in construction, servicing, and evaluation of a wide range of products from key sectors like transportation, energy, water, oil and gas, defence, and transmission.

History of BHEL:

1955 – The Government of India and Associated Electrical Industries (AEI) established Heavy Electricals India Ltd. (HEIL) to manufacture heavy electrical equipment in India. 1964 – Bharat Heavy Electricals Limited was incorporated in the year 1964 with the aim of managing three plants for HEIL. 1974 – BHEL and HEIL were merged under one single entity BHEL. 1980s – BHEL had started supplying 500 MW thermal power equipment. 1990s – BHEL entered the field of wind energy, HVDC power transmission and the technology of superconductivity. They became the first public sector company to obtain an ISO 9000 and ISO 14000 accreditation. 2004 – BHEL received an MOU Award for Excellence in Performance. It was also awarded a FICCI Award for environmental conservation and pollution control in the year 2005-06. 2018 – BHEL signed a technology transfer agreement with Indian Space Research Organisation (ISRO) for the manufacture of space-grade Lithium-ion cells.

BHEL’s Logo

Key Personnel at BHEL:

- Dr. Nalin Shinghal- Chairman & Managing Director

- Shri Shashank Priya- Additional Secretary & Financial Adviser

- Shri Amit Mehta- Joint Secretary, Department of Heavy Industry

- Shri Subodh Gupta- Director (Finance)

- Shri Kamalesh Das- Director (E,R&D)

- Shri Anil Kapoor- Director (HR)

- Ms. Renuka Gera- Director (IS&P)

Latest Shareholding Pattern of BHEL (As on 8th September 2021)

| Shareholding Pattern | Mar 2020 | Jun 2020 | Sep 2020 | Dec 2020 | Mar 2021 |

| Promoters | 63.17% | 63.17% | 63.17% | 63.17% | 63.17% |

| Foreign Institutional Investors (FIIs) | 9.36% | 5.09% | 4.24% | 4.34% | 4.47% |

| Domestic Institutional Investors (DIIs) | 17.81% | 18.14% | 15.58% | 13.51% | 12.49% |

| Public | 9.66% | 13.60% | 17.01% | 18.98% | 19.87% |

Latest Profit and Loss Account of BHEL (As on 8th September 2021)

| Mar 2018 | Mar 2019 | Mar 2020 | TTM | |

| Sales | 28,827 | 30,441 | 21,490 | 17,309 |

| Expenses | 27,174 | 28,409 | 21,623 | 20,357 |

| Operating Profit | 1,653 | 2,032 | -133 | -3,049 |

| OPM | 6 | 7 | -1 | -18 |

| Other Income | 679 | 662 | 590 | 393 |

| Interest | 330 | 378 | 613 | 467 |

| Depreciation | 787 | 476 | 503 | 473 |

| Profit before tax | 1,215 | 1,840 | -659 | -3,596 |

| Tax | 64 | 46 | -123 | 25 |

| Net Profit | 441 | 1,005 | -1,466 | -2,697 |

[Read More: How to Read an Income Statement of a Company]

Latest Balance Sheet of BHEL (As on 8th September 2021)

| Mar 2018 | Mar 2019 | Mar 2020 | Mar 2021 | |

| Share Capital | 734 | 696 | 696 | 696 |

| Reserves | 31,601 | 30,208 | 27,964 | 25,287 |

| Borrowings | 110 | 2,598 | 5,077 | 4,951 |

| Other Liabilities | 31,495 | 30,987 | 27,589 | 25,025 |

| Total Liabilities | 63,940 | 64,490 | 61,327 | 55,960 |

| Fixed Assets | 3,073 | 2,970 | 2,817 | 2,491 |

| Cwip | 203 | 235 | 314 | 420 |

| Investments | 429 | 152 | 162 | 185 |

| Other Assets | 60,235 | 61,132 | 58,034 | 52,864 |

| Total Assets | 63,940 | 64,490 | 61,327 | 55,960 |

| Inventories | 6,730 | 8,356 | 9,451 | 7,914 |

| Trade Receivables | 14,065 | 11,863 | 7,109 | 4,035 |

| Cash & Bank | 11,176 | 7,504 | 6,419 | 6,701 |

| Loans and Advances | 14,282 | 14,720 | 13,042 | 14,084 |

| Trade Payables | 10,520 | 11,329 | 8,881 | 6,570 |

[Read More: How to Read a Balance Sheet of a Company]

Latest Key Financial Ratios of BHEL (As on 8th September 2021)

| Market Cap (Cr): 19256 | Face Value (₹): 2 | EPS (₹): -6.47 |

| Book Value (₹): 74.6 | Roce (%): -9.69 | Debt to Equity: 0.20 |

| Stock P/E: 0 | ROE (%): -9.88 | Dividend Yield (%): 0 |

| Revenue (Cr): 16,417 | Earnings (Cr): -1925 | Cash (Cr): 6,701 |

| Total Debt (Cr): 4,951 | Promoter’s Holdings (%): 63.17 |

Latest Mutual Funds Holdings & Trends of BHEL

| Schemes | Quantity | As on |

| ADITYA BIRLA SUN LIFE ARBITRAGE FUND – GROWTH | 2,483 | 31-08-2021 |

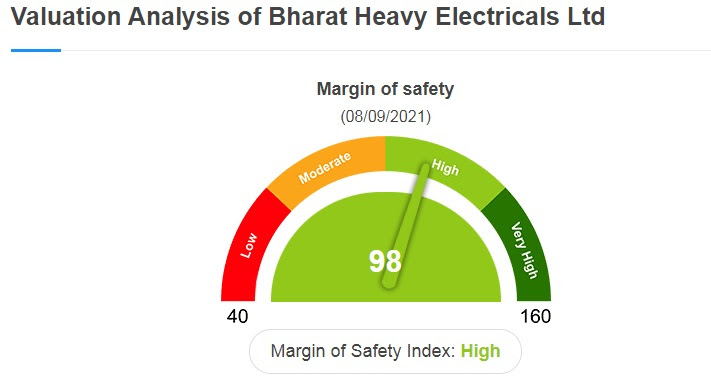

Valuation Analysis Of BHEL (As on 8th September 2021)

Valuation analysis helps you analyse how overvalued or undervalued a stock is using the margin of safety index. Watch this video to know how to find undervalued stocks in the market. It is the difference between the intrinsic value and the current value of a share. Intrinsic value is the true value of a share.

From the investor’s perspective –

If the market price is significantly lower than the stock’s intrinsic value, the stock has a high margin of safety. It is a buy signal.

From a seller’s point of view –

If the market price is significantly higher than the intrinsic value, it is a short sell opportunity. BHEL has a high margin of safety

Latest Samco Stock Ratings of BHEL : 0.5 out of 5 Stars (As on 8th September 2021) PROS

- Asset-Light Company: BHEL has a high asset turnover ratio of 5.22. A high asset turnover ratio is a powerful driver of return on equity and can boost shareholder returns. As the business increases its revenues and earnings, a higher asset turnover ratio will result in less dilution.

CONS

- Low Sustainable Return on Equity (ROE) in the Long Run: The company’s ROE is lower than its estimated cost of capital. This means that the underlying firm would lose value over time as a result of its inability to generate higher returns on capital.

- Low Return on Capital Employed: BHEL is unable to generate attractive ROCE. This impairs its ability to generate high returns of shareholders after accounting for taxes, depreciation etc.

- Poor Cash Flow Conversion: BHEL’s cash conversion ratio of -21.16%, is extremely poor. This means that increase in profits haven’t translated to higher cash flows for the company and increase in working capital investments, which is bad for shareholders.

- Negative operating earnings and interest coverage ratio:The company has negative operating earnings and a negative Interest coverage ratio of -6.53 times. This means that it does not have enough operating earnings to pay interest. This is extremely negative for investors.

- Highly Cyclical Industry: BHEL operates a highly cyclical business with unpredictably high earnings and cash flows. This will result in extremely high stock price volatility.

- Low pricing power and high competition: BHEL has extremely low pricing power but high competition which can significantly hurt shareholder’s returns.

- Poor Capital Allocation: BHEL has a disproportionately high amount of assets i.e. 94.47% tied up in working capital, cash, loans and advances. This reflects poorly on capital allocation strategy, which negatively impacts shareholders returns.

- Poor Working Capital Cycle: BHEL has a very poor working capital cycle of 626 days. This reduces its free cash flow generation and has a negative impact on shareholder value and returns.

- Extremely Speculative Stock: BHEL’s stock is extremely speculative, which is expected to have a negative impact on long-term shareholders.

- Low Shareholder Pedigree: BHEL’s long-term shareholder base is quite weak. Majority of its shareholders are short-term investors. This increases volatility and speculation in the stock which hurts the long-term investors.

Competitor Analysis of BHEL (As on 8th September 2021)

| Company | Price | Market Cap (Cr) | P/E | EPS (Rs) | Dividend Yield (%) | ROE (%) |

| BGR ENERGY SYSTEMS LTD. | 58.1 | 411 | 0 | -53.69 | 0 | -41.5 |

| Transformers & Rectifiers India Ltd | 28.3 | 378 | 28.4 | 1 | 0.35 | 2.11 |

| Swelect Energy Systems Ltd | 217.95 | 335 | 19.9 | 7.3 | 1.36 | 3.57 |

Visit Samco’s share pages to check the star ratings for every listed company. Search for stocks to get live prices, ratings, valuation and analysis. Open a FREE Demat account with Samco and experience world class trading.

Easy & quick

Easy & quick

Leave A Comment?