Equity mutual fund is one of the most sought-after type of mutual fund in India. Its popularity is visible through the humongous growth of 58.93% in their Assets under Management (AUM) between June 2020-21. Equity mutual funds offer retail investors an indirect route of investing in the stock market. They are super-affordable and the sheer variety of equity mutual funds is a big plus for investors. However, nothing beats the long-term growth potential and inflation-beating returns generated by equity mutual funds. But do you know that as of June 2021, there are 351 equity mutual fund schemes? So, how do you, a retail investor, go about finding the best equity mutual fund? If you think that best equity mutual fund is the one which has generated the highest return, then sadly you are wrong. It’s not that simple. Finding the best equity mutual funds is similar to searching for a needle in a haystack. But there are some parameters that can help you discover the best equity mutual funds. In this article, we will learn how to identify best equity mutual funds. This is a time-tested strategy which will change your mutual fund investing game forever. As a bonus, we will also reveal the list of the best equity mutual funds in 2025. Our list of best equity mutual fund will feature one best equity mutual fund from each of the 11 equity fund categories –

- Multi-cap Fund

- Large-cap Fund

- Large & Mid-cap Fund

- Mid-cap Fund

- Small-cap Fund

- Dividend Yield Fund

- Value Fund / Contra Fund

- Focused Fund

- Sectoral / Thematic Funds

- Equity Linked Savings Scheme (ELSS)

- Flexi-cap Fund

This will help you create a wholesome portfolio by picking the absolute best equity mutual fund from each category. However, this must be done in line with your goals and risk profile. For example: If you have already exhausted your 80C limit, then however good an ELSS fund is, you should not invest in it. Investors should avoid overstuffing their portfolio as it will do more harm than good. Now before we reveal the list of best equity mutual funds, let’s quickly go through the basics of equity mutual funds.

What is an Equity Mutual Fund?

An equity fund predominantly invests in equity shares of a company. These companies may belong to any market capitalisation bracket.

| Categories | Rank based on Market Capitalisation (Rs) |

| Large-cap | 1-100th stocks |

| Mid-cap | 101st – 250th stocks |

| Small-cap | 251st stocks onward |

Due to the huge growth potential, equity mutual funds generate higher returns than debt funds and fixed deposits. Equity mutual funds can be active or passive. In an active equity mutual fund, the fund manager aims to outperform the market index or benchmark. This is done by researching companies and sectors to find the best stock to invest in. On the other hand, passive equity fund manager builds a portfolio that replicates a popular market index, say Sensex or Nifty 50. The aim is to mirror the benchmark not outperform it. This is why passive equity mutual funds have lower expense ratios. But historically, active equity mutual funds have outperformed passive equity mutual funds.

Different Types of Equity Mutual Funds 2025

Before you invest in an equity mutual fund, you should be aware of the different types of equity mutual funds on offer. Market regulator, Securities and Exchange Board of India (SEBI) has put in place strict investment regulations for different types of equity mutual funds. The 11 types of equity mutual funds and their investment strategy is as follows –

| Sr. No. | Category of Schemes | Investment Mandate |

| 1 | Large-cap Fund | Large-cap mutual funds invest a minimum of 80% of total assets in equity stocks of large cap companies. |

| 2 | Large & Mid-cap Fund | Large & Mid-cap mutual funds invest 35% of their total assets in large-cap stocks and another 35% in mid cap stocks. |

| 3 | Mid-cap Fund | Mid-cap mutual funds invest minimum 65% of total assets in of mid cap stocks. |

| 4 | Small-cap Fund | Small-cap mutual funds invest minimum 65% of total assets in small cap stocks. |

| 5 | Dividend Yield Fund | Dividend yield funds invest minimum 65% of total assets in dividend yielding stocks. |

| 6 | Focused Fund | Focused funds must invest in a maximum of 30 stocks focusing on a specific sector – multi-cap, large-cap, mid-cap, small-cap. |

| 7 | Multi-cap Fund | Multi-cap funds should invest minimum 25% in each large, mid and small-cap stocks. |

| 8 | Flexi-cap Fund | Multi-cap funds are free to invest in stocks across large, mid and small-cap market capitalisation. |

| 9 | ELSS | An ELSS fund invests 80% of total assets in equity stocks in accordance with Equity Linked Saving Scheme, 2005 notified by Ministry of Finance. It is an open-ended equity linked saving scheme with a statutory lock in of 3 years and tax benefit. |

| 10 | Contra Fund & Value Fund | Contra funds follow contrarian investment strategy while value funds invest a minimum of 65% of total assets in equity stocks following value investing. |

| 11 | Sectoral/ Thematic | Sectoral/ Thematic funds invest 80% of total assets in stocks of a particular sector/ theme. |

Data as of 2021

Historical Returns Generated by Equity Mutual Funds 2025

The below table shows the performance of different types of equity mutual funds as on 4th October 2021.

Equity Mutual Fund Category | 1-Year | 3-Years | 5-Years | 10-Years |

| Large Cap | 54.35 | 18.79 | 13.77 | 14.9 |

| Mid Cap | 70.05 | 24.53 | 15.78 | 19.11 |

| Small Cap | 88.1 | 27.15 | 17.54 | 20.5 |

| Large and Mid Cap | 63.69 | 21.29 | 14.98 | 17.03 |

| Multi Cap | 70.94 | 23.13 | 15.9 | 17.62 |

| Flexi Cap | 58.52 | 20.55 | 14.69 | 15.85 |

| Focused | 58.48 | 20.03 | 14.74 | 16.01 |

| Contra | 66.85 | 21.56 | 16.13 | 16.81 |

| Value | 65 | 17.92 | 13.37 | 17.07 |

| Dividend Yield | 63.4 | 19.48 | 14.5 | 14.68 |

| ELSS | 58.67 | 19.75 | 14.49 | 16.47 |

Source: AMFI *Data as on 4th October 2021

How to choose a Mutual fund scheme to invest in?

With so many options to choose from, picking a mutual fund to invest in is not easy. Where do you even start? While a scheme may suit someone, it might not necessarily work for you. So, how do you know which mutual fund is the right one for you? The first step while deciding which is the right fund for you, is to identify your purpose and objective for investment. You should try to decide –

- How much return you want to make to achieve a certain goal or

- Set a time frame or

- Decide how much risk you are willing to take.

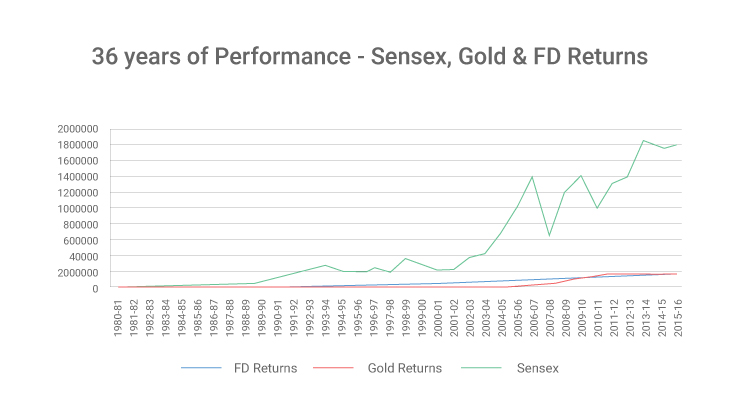

Equity mutual funds are ideally meant for investors with an investment horizon of at least 5 years or more. Here are some key things to consider while choosing a mutual fund scheme - 1. High Returns: Equity mutual funds are known to generate superior returns over the long-term in comparison to other asset classes. They are the best way for you to get inflation-beating returns. Hence, allocating a certain portion of your portfolio to equities will always help you maximize gains.

- FD: Rs.1.84 lakhs

- Gold: Rs. 1.94 lakhs

- Sensex: Rs. 17.96 lakhs.

FD has multiplied your wealth 18 times, while Gold grew your wealth by 19 times. But Sensex i.e. equity has outperformed these asset classes by a whopping 179 times. This proves that equity is the best asset class for long-term wealth creation. 2. Tax saving: If saving tax is your main objective, then you can invest in ELSS Funds. Here you get a tax exemption upto Rs 1.5 Lakhs under section 80C of Income Tax Act,1961. While ELSS funds come with a lock-in period of 3 years, this is much lower compared to other tax saving instruments like PPF, NSC etc. [Read More: Best ELSS Funds] 3. Exposure to a certain market cap (Large, Mid, Small): Equity mutual funds invest in companies based on their market size. Every market cap has a unique investment and risk characteristic. Large-cap funds deliver steady returns with relatively lower risk. This is different to mid and small-cap funds. Small cap funds are considered to be riskier than mid-cap funds but they also have the highest growth potential. So, always choose a mutual fund based on your risk appetite, return expectations and investment horizon. 3. Diversification: Diversification is a technique of reducing risk by investing in a variety of assets such as equities, gold, real estate, FDs etc. This reduces your exposure to a particular asset/ asset class and its risks. For instance, if you mostly invest in equities, then investing in gold or debt can be a good diversification tactic. It is a huge risk to put all your eggs in one basket, as you will incur heavy losses if that asset class doesn’t perform. Hence, the right portfolio mix can help you build an optimal portfolio which can diversify your risk and boost your returns. 4. Exposure to a specific sector: Sectoral funds give you exposure to a particular sector like Banking, Pharma, Consumer Goods etc. Investors who are bullish on a particular sector can invest in sectoral funds. However, sectoral funds are highly risky and historically, they aren’t worth the high risk. The table below shows the performance of sectoral funds against well-diversified equity mutual funds.

Sectoral Funds Vs Equity Mutual Funds 2025

Equity Fund Category | 1-Year | 3-Years | 5-Years | 10-Years |

| Sectoral-Technology | 82.38 | 34.29 | 29.47 | 23.24 |

| Small Cap | 88.10 | 27.15 | 17.54 | 20.5 |

| Mid Cap | 70.05 | 24.53 | 15.78 | 19.11 |

| Sectoral-Pharma and Healthcare | 33.99 | 27.72 | 13.31 | 18.24 |

| Multi Cap | 70.94 | 23.13 | 15.90 | 17.62 |

| Value | 65.00 | 17.92 | 13.37 | 17.07 |

| Large and Mid Cap | 63.69 | 21.29 | 14.98 | 17.03 |

| ELSS | 58.67 | 19.75 | 14.49 | 16.47 |

| Focused | 58.48 | 20.03 | 14.74 | 16.01 |

| Flexi Cap | 58.52 | 20.55 | 14.69 | 15.85 |

| Sectoral-Banking and Financial Services | 63.42 | 16.45 | 12.37 | 15.84 |

| Large Cap | 54.35 | 18.79 | 13.77 | 14.90 |

| Sectoral-Infrastructure | 85.61 | 20.53 | 13.21 | 12.78 |

Source: AMFI *Data as on 4th October 2021 Except for a few sectors, most of the sectoral funds have generated lower returns than equity mutual funds especially mid, small and multi-cap funds. 6. Theme based investing: Thematic funds invest in stocks within a particular theme. For example: International or Multi – Economies like investing in US stocks or Asian stocks; Commodities consumer trends, ESG investing, etc. Like sectoral funds, thematic funds are highly risky and hence not recommended for conservative investors. The table below shows the performance of thematic funds against equity mutual funds.

Thematic Funds Vs Equity Mutual Funds 2025

| Equity Fund Category | 1-Year | 3-Years | 5-Years | 10-Years |

| Small Cap | 88.1 | 27.15 | 17.54 | 20.5 |

| Mid Cap | 70.05 | 24.53 | 15.78 | 19.11 |

| Multi Cap | 70.94 | 23.13 | 15.90 | 17.62 |

| Thematic-MNC | 45.70 | 15.91 | 11.70 | 17.30 |

| Thematic-Consumption | 56.00 | 21.94 | 15.87 | 17.18 |

| Value | 65.00 | 17.92 | 13.37 | 17.07 |

| Large and Mid Cap | 63.69 | 21.29 | 14.98 | 17.03 |

| Contra | 66.85 | 21.56 | 16.13 | 16.81 |

| ELSS | 58.67 | 19.75 | 14.49 | 16.47 |

| Focused | 58.48 | 20.03 | 14.74 | 16.01 |

| Flexi Cap | 58.52 | 20.55 | 14.69 | 15.85 |

| Thematic-Others | 62.77 | 19.71 | 12.85 | 15.35 |

| Large Cap | 54.35 | 18.79 | 13.77 | 14.90 |

| Dividend Yield | 63.4 | 19.48 | 14.50 | 14.68 |

| Thematic-Energy | 82.91 | 23.12 | 17.55 | 14.30 |

| Thematic-International | 28.63 | 13.35 | 14.19 | 12.87 |

| Thematic-PSU | 67.21 | 15.54 | 8.18 | 7.71 |

Source: AMFI *Data as on 4th October 2021 Notice that most of the thematic funds have underperformed actively managed equity mutual funds. 7. Risk Appetite and Tolerance: This is very important while choosing mutual funds for investment. If a fund does not match your risk profile, then you should not invest in it. It doesn’t matter if the fund has generated superior returns. It’s not the right fund for you. The table below can help you decide your risk appetite and which fund is right for you.

Riskometer | Investor Type | Risk Profiling |

| Low | Conservative | Fixed maturity plans, gilt funds and income funds are suitable for conservative investors. In equity category, large-cap funds can be considered. |

| Moderately Low | Moderately Conservative | Short to medium term bonds, large-cap funds, arbitrage funds can be considered. |

| Moderate | Moderate | Debt-oriented hybrid funds, multi-cap funds, value funds, ELSS can be considered. |

| Moderately High | Moderately Aggressive | Large & mid-cap funds, flexi-cap funds, balanced advantage funds can be considered. |

| High | Aggressive | Mid-cap, small-cap, contra funds, sectoral, thematic funds can be considered. |

How to Evaluate Best Equity Mutual Funds?

With more than 351 equity mutual funds available and the dynamic nature of ratings, how will you know which is the best equity mutual fund? The ratings displayed on financial websites change randomly. One day a fund is 5-star rated and just a few months later, it becomes a 2-star rated fund. [Read More: Still Using Star Ratings to Select Mutual Funds? – Wake Up Before It’s Too Late!] As investors, it is difficult for you to track these ever-changing ratings. So, how will you decide which is the best equity mutual fund? Let’s find out. 1. Study the Underlying Portfolio: This is the first parameter while selecting best equity mutual funds. A mutual fund is nothing but a collection of stocks. Hence, its performance is 100% dependent on the performance of the underlying stocks. If the stocks are of good quality, then short-term underperformance is not a big deal. But unfortunately, most of the research houses pay very little attention to this big detail. They are mostly focused on past performance. But at RankMF, we study and rate each stock based on a variety of factors - profitability, balance sheet health, the industry they operate in, size of the business, efficiency and a lot more! This helps us and our investors look beneath the surface. For example: Franklin Bluechip Fund has generated a return of 69.76% in the last one year as of 4th October 2021. But look at the fund’s underlying portfolio. Majority of its underlying stocks are poor-quality stocks. Such schemes might generate decent returns when the markets are rallying but they are not suitable for long-term investing.

Best Equity Mutual Funds | RankMF Star Ratings | Category | 1-Year | 3-Years | 5-Year |

| Axis Bluechip Fund | 5-Star | Large-Cap Fund | 51.12% | 22.57% | 17.75% |

| Kotak Equity Opportunities Fund | 4-Star | Large & Mid-cap Fund | 55.30% | 22.38% | 15.36% |

| DSP Midcap Fund | 4-St | Mid-cap Fund | 51.00% | 24.22% |

|

| SBI Small-cap Fund | 4-Star | Small-cap Fund | 74.15% | 27.98% | 21.87% |

| BNP Paribas Multi-cap Fund | 3-Star | Multi-cap Fund | 66.50% | 21.49% | 14.88% |

| Motilal Oswal Flexi-cap Fund | 5-Star | Flexi-cap Fund | 41.05% | 15.04% | 11.57% |

| SBI Focused Equity Fund | 5-Star | Focused Fund | 66.78% | 24.86% | 17.80% |

| Axis Long Term Equity Fund | 5-Star | ELSS | 61.76% | 23.98% | 17.65% |

| Quantum Long Term Equity Value Fund | 4-Star | Value Fund | 56.57% | 13.56% | 10.76% |

| Kotak India EQ Contra Fund | 3-Star | Contra Fund | 58.86% | 20.07% | 16.70% |

| UTI Dividend Yield Fund | 5-Star | Dividend Yield Fund | 64.12% | 20.02% | 15.86% |

*Returns as on 4th October 2021 **Source: RankMF.com Notes on list of Best Equity Mutual Funds:

- All the above funds are open-ended, actively managed equity mutual funds.

- Only schemes with a corpus of at least Rs 250 crore are considered.

- Only those funds which had a buy recommendation on RankMF (based on our ranking parameters) are included.

- For a fund to qualify, the fund had to be in duration for at least 5 years.

Conclusion:

With this, we conclude our discussion on the Best Equity Mutual Funds. RankMF is India’s best mutual fund research and investment platform. RankMF’s research methodology considers over 20 million data points to review and evaluate mutual funds. Our platform aims to simplify your process of mutual fund research, analysis and investment. Follow the below steps to invest in the best equity mutual funds. How to Invest in Best Equity Mutual Funds You can invest in best equity mutual funds in 2021 in less than 15 minutes with RankMF. To invest in the best equity mutual funds, follow the below steps:

- Open a FREE RankMF account in less than 15 minutes!

- Complete your Know your Customer (KYC) formalities. This will take you less than 10 minutes.

- Shortlist the fund you want to invest in.

- Register SIP or make lumpsum investments in the best equity mutual funds and you’re done!

For more information about investing in mutual funds, stock trading and useful related articles, visit RankMF.com or our investor education center.

Easy & quick

Easy & quick

Leave A Comment?