The tax planning season is finally upon us. I’m sure, like most investors, even you are actively searching for the best tax saving instruments to save tax. And rightly so. But which instrument will help you save the most tax? Should you invest in traditional tax saving instruments like your parents and grandparents? Or should you invest in equity linked savings scheme (ELSS) to save tax in 2025? Are ELSS funds really better at saving tax than public provident fund (PPF) or 5-year bank fixed deposits (FDs)? If yes, which are the best ELSS funds in 2025? In this article, we will take a detailed look at the universe of ELSS funds in India. We will understand what are ELSS funds, where do they invest and most importantly, how ELSS funds help you save tax. So, let’s get started with what is an ELSS mutual fund.

In this article on 5 Best ELSS Mutual Funds in 2025

- What is ELSS Fund?

- Where do ELSS Funds Invest?

- How do ELSS Funds help you save tax?

- Taxation of ELSS Mutual Funds

- Which are the 5 Best ELSS Funds in 2022?

What is ELSS Fund?

An ELSS mutual fund is also known as a tax saving mutual fund. The Securities and Exchange Board of India (SEBI) defines an ELSS funds as, ‘an open-ended mutual fund scheme that must invest a minimum 80% of total assets in accordance with the Equity Linked Savings Scheme, 2005 as notified by the Ministry of Finance’. ELSS mutual funds carry a statutory lock-in period of three years. When you invest in ELSS funds, you can claim deduction up to Rs 1.5 Lakhs under section 80C of the Income Tax Act, 1961.

Where do ELSS Funds Invest

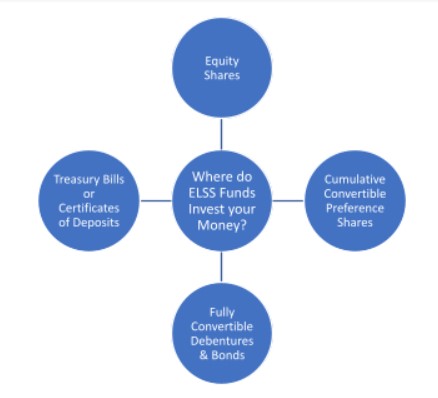

Now, as per the Equity Linked Savings Scheme, 2005, an ELSS mutual fund can invest in the following –

- Equity shares

- Cumulative convertible preference shares

- Fully convertible debentures and bonds

- Short term money market instruments like treasury bills, certificates of deposits etc.

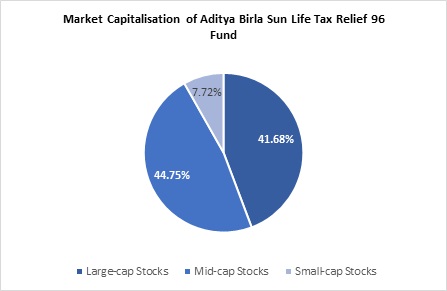

Portfolio as of 31st December 2021

The definition of ELSS funds simply states that ELSS funds invest in equity stocks. But which companies? Large cap, mid cap or small cap? The answer is all. Yes, ELSS funds have the freedom to invest across market capitalisation. Aditya Birla SL Tax Relief ’96 Fund invests 44.75% in mid cap stocks which is extremely risky. Axis Long Term Equity Fund is also one of the best ELSS fund for 2025. But the fund invests only 14.80% in mid cap stocks. Instead it is bullish on large cap stocks with 83.23% allocation. So, different ELSS funds invest in different combinations and hence they have unique risk-reward pay-offs. Now many investors assume that ELSS funds are like 5-year bank FDs. This is not true. They both help you save tax. But ELSS funds are equity mutual funds. The fund manager uses the corpus to buy shares of companies listed on the stock exchange. So, ELSS funds are prone to market ups and downs like any other mutual fund scheme. The only difference is that ELSS funds have a compulsory lock-in period of three years. So, once you invest in an ELSS fund, you cannot withdraw your money before completing three years. Redemption from ELSS funds is allowed only in the event of death of the investor. In this case, the legal heir or nominee can withdraw the ELSS investment after one year from the date of investment. Other than this, under no condition can you withdraw from an ELSS fund before three years. Let us now come to the big question … how do ELSS mutual funds help you save tax?

How do ELSS Mutual Funds Help You Save Tax?

Mr Ram is a salaried individual. He wants to file his tax return for FY 2020-21. He has the following sources of income –

| Sources of Income | Amount (Rs) |

| Salary | 10,00,000 |

| Interest Income | 50,000 |

| Rental Income | 1,50,000 |

He also incurred the following expenses –

- Interest on home loan - Rs 1.50 Lakhs

- Interest on personal loan - Rs 50,000.

- House Rent Allowance - Rs 50,000.

Now, let’s assume that Mr Ram does not invest in any tax saving instruments. He also does not have a Mediclaim. So, he cannot claim deductions under section 80D. In this case, the tax payable by Mr Ram is Rs 82,680 as per the old scheme. Table 1: Tax Payable without ELSS

| Gross Total Income | Rs 8,35,000 |

| Deductions | Rs 0 |

| Tax Due | Rs 82,680 |

Now, let us assume Mr Ram decides to invest in Axis Long Term Equity Fund, which is one of the best ELSS funds for 2022. He invests a total of Rs 1.5 lakhs. Now, Mr Ram’s tax payable has come down from Rs 82,680 to Rs 51,480. Table 2: Tax Payable with ELSS

| Gross Total Income | Rs 8,35,000 |

| Deductions | Rs 1,50,000 |

| Tax Due | Rs 51,480 |

Mr Ram saved Rs 31,200 in taxes by investing in the best ELSS funds for 2022. If you too want to save tax, then read on as we reveal the list of the five best ELSS Funds for 2022.

How are ELSS Mutual Funds Taxed?

An ELSS mutual fund is an equity-oriented fund. So, like every other equity fund, there are two types of taxes payable –

- Short-term capital gains tax

- Long-tern capital gains tax

Typically, equity mutual funds have a holding period of 12 months. But this is increased to 36 months or three years in the case of ELSS funds. Now we know that you cannot redeem from ELSS funds before the statutory lock-in period of three years. So, there is no concept of short-term capital gains tax for ELSS funds. You need to pay LTCG tax on ELSS funds after completing a period of three years. The LTCG on ELSS funds is 10% if your gains exceed Rs 1 Lakh in a financial year. If your ELSS fund investment has completed three years, and your gains are less than Rs 1 Lakh, then you do not have to pay tax on your ELSS investment. Let us now look at the five best ELSS funds for 2022.

Best ELSS Funds for 2025 – Top Performing ELSS Funds for 2022

Best ELSS Fund for 2025 #1: Axis Long Term Equity Fund

Axis Long Term Equity Fund is one of the most popular ELSS funds in India. The fund has an asset under management (AUM) of Rs 33,785 crore (as on 31st December 2021). It has managed to generate a return of 18.35% since its launch on 29th December 2009. The fund follows a growth investing strategy and is bullish on large cap stocks. Its portfolio is split as follows –

| Market Capitalisation | % Allocation |

| Large-cap | 83.23% |

| Mid-cap | 14.80% |

| Small-cap | 1.97% |

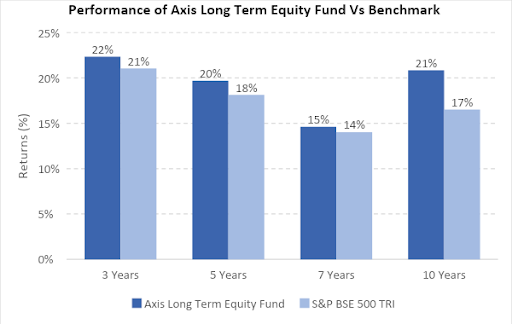

Axis Long Term Equity Fund has generated a one-year return of 23.91% (as of 12th January 2021). This is more or less in line with the return generated by the large-cap category (25.43%). When you are looking for the best ELSS funds, please ensure that the fund is able to generate consistent returns. It shouldn’t be a one-hit wonder. Axis Long Term Fund is truly one of the best ELSS funds in this regard. It has a rich history of generating benchmark beating returns.

Performance as on 12th January 2022

As you can see, the fund has outperformed its benchmark across all time frames – three, five, seven and ten years. With such great track record, there is no doubt that Axis Long Term Equity Fund is one of the best ELSS funds in 2022. Let us take a look at a few reasons that make Axis Long Term Equity Fund, one of the best ELSS funds in 2022.

- The fund holds a compact portfolio of 34 stocks of which 82.36% stocks are fundamentally strong. This is a good percentage.

- The fund has a low turnover ratio of 39%. This is 21% lower than other ELSS funds. This indicates that the fund is committed to holding stocks for the long-term.

- The fund has a mammoth AUM of Rs 33,784 crore. It is the biggest ELSS fund in India. This ensures that the fund has little to no redemption pressure.

- Despite being such an outperformer, the fund’s expense ratio is only 1.58%. This is 45% lower than the ELSS category average.

- The fund has generated an alpha of 2.20% over its benchmark, S&P BSE 500 TRI.

- The fund paid a dividend of Rs 2.25 per unit in 2021. This is 21% more than the dividend it paid in 2020 (Rs 1.85 per unit).

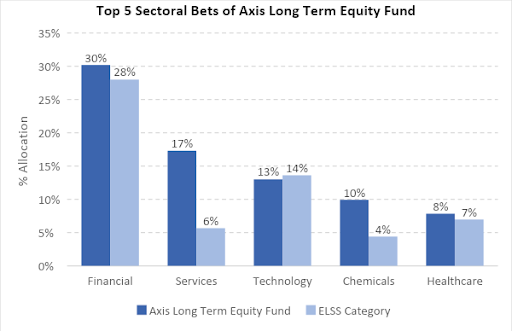

- The fund has benefitted from the fact that it has high exposure to service sector. Its biggest investment is in Avenue Supermarts Ltd (owner of D’mart). It holds 9.37% of its assets in the stock. The fund also invests in –

Portfolio as of 31st December 2021

The fund invests 17% in the service sector. Whereas other funds in the ELSS category invest an average 6% in the service sector. D’mart became extremely popular during the pandemic This can be one of the reasons why Avenue Supermarts and Axis Long Term Equity Fund have done so well in the last few years. Axis Long Term Equity Fund is a 5-star rated fund from RankMF. Here are some important details about the fund –

| Launch Date | 29th December 2009 |

| Return since launch | 18.35% |

| AUM | Rs 33,785 Crore |

| Expense Ratio | 1.58% |

| Sharpe Ratio | 0.82% |

| Alpha | 2.20% |

| Exit Load | Nil |

| Lock-in-period | 3 years |

| Minimum SIP amount | Rs 500 |

| 1-Year Return | 23.91% |

Let us now more on to the next best ELSS fund for 2022. I’m referring to Aditya Birla Sun Life Tax Relief ’96 Fund.

Best ELSS Fund for 2025 #2: Aditya Birla Sun Life Tax Relied ’96 Fund

Apart from being the best, Aditya Birla SL Tax Relief ’96 Fund is also one of the oldest ELSS funds in India. It was launched on 29th March 1996. The fund has generated a return of 12.94% in the last one year. Now the fund has underperformed its benchmark return of 30.81%. But over the long-term it has beaten its benchmark fairly. The fund’s 10-year return is 16.97% against a benchmark return of 16.52%. The fund is a highly aggressive fund. It follows a large cap growth investment style. But does hold a substantial portion of its assets in midcap stocks.

| Market Capitalisation | % Allocation |

| Large-cap | 47.53% |

| Mid-cap | 44.75% |

| Small-cap | 7.72% |

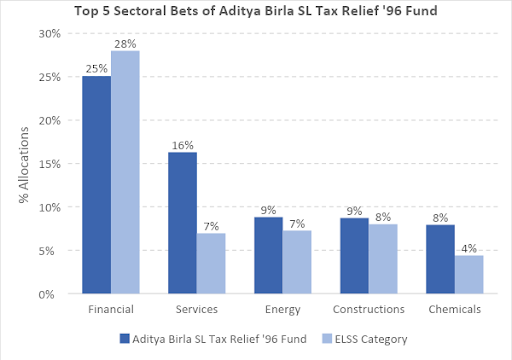

Portfolio as of 31st December 2021 Axis Long Term Equity Fund is bullish on services sector. But Aditya Birla SL Tax Relief ’96 Fund is bullish on healthcare sector. It holds healthcare stocks like Pfizer (6.56%), Glaxosmithkline Pharma (4.59%) etc. The below chart shows where the fund invests vs its benchmark investments.

Portfolio as of 31st December 2021

The fund is bullish on services, energy and chemicals sector. But it has below average exposure to financial sector stocks. This can be one of the reasons behind its underperformance in the last one year. Let us take a look at a few reasons that make Aditya Birla SL Tax Relief ’96 Fund, one of the best ELSS funds in 2022.

- The fund paid a dividend of Rs 8.22 per unit in 2020. It also has a solid track record of paying consistent dividends.

- The fund is a market veteran. It has survived multiple bull and bear markets and emerged stronger. This indicates strong, time-tested stock selection.

- Its AUM is a massive Rs 14,462 crore (as of 31st December 2021). This is 471% higher than other funds in the ELSS category.

- The funds turnover ratio is only 13%. This is lowest in the ELSS funds category and 73% lower than the ELSS fund category. This shows the strong conviction the fund has in its selected stocks.

- The fund’s expense ratio is 1.76%. This is 49% lower than ELSS category average.

- The fund has a decent Sharpe ratio of 0.43%.

Here are a few important details about Aditya Birla SL Tax Relief ’96 Fund –

| Launch Date | 29th March 1996 |

| Return since launch | 22.97% |

| AUM | Rs 14,463 Crore |

| Expense Ratio | 1.76% |

| Sharpe Ratio | 0.43% |

| Alpha | - |

| Exit Load | Nil |

| Lock-in-period | 3 years |

| Minimum SIP amount | Rs 500 |

| 1-Year Return | 13.54% |

Best ELSS Fund for 2025 #3: LIC MF Tax Plan

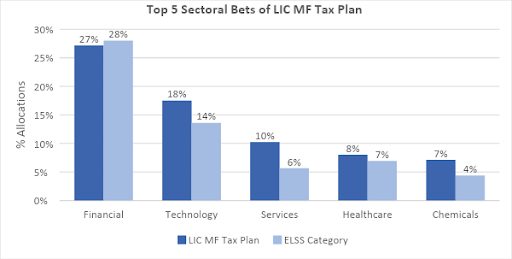

Our next best ELSS fund for 20225is LIC MF Tax Plan. It was earlier known as Dhan Tax Saver Fund. It was launched on 31st March 1997. It has given a return of 9.92% since its launch. The fund has generated a one-year return of 26.42% as of 12th January 2022. The fund is bullish on large cap stocks with 76.01% allocation. It also invests 21.51% in midcap and 2.47% in small cap stocks. The fund holds a big portfolio of 50 stocks. Let us take a look at where the fund is investing its corpus –

Portfolio as of 31st December 2021

The fund is bullish on financial (27.20%), and technology sector 17.51%). Its biggest holding is in Infosys Ltd (9.42%) and Tata Consultancy Services Ltd (5.55%). Here are a few reasons why LIC MF Tax Plan is one of the best ELSS funds in 2022.

- Its turnover ratio is only 12%. This is 71% lower than the average of the ELSS category.

- Its expense ratio is 2.54%. This is 90% lower than other schemes in the ELSS category.

- The fund has a decent Sharpe ratio of 0.63% and Sortino ratio of 0.58%.

- It has a solid dividend track record. It pays quarterly dividend of Rs 0.25 per unit.

Here are a few key details about LIC MF Tax Plan

| Launch Date | 31st March 1997 |

| Return since launch | 9.93% |

| AUM | Rs 408 Crore |

| Expense Ratio | 2.54% |

| Sharpe Ratio | 0.63% |

| Alpha | - |

| Exit Load | Nil |

| Lock-in-period | 3 years |

| Minimum SIP amount | Rs 500 |

| 1-Year Return | 27.01% |

Our next recommendation for the best ELSS fund for 2022 is Parag Parikh Tax Saver Fund.

Best ELSS Fund for 2025 #4: Parag Parikh Tax Saver Fund

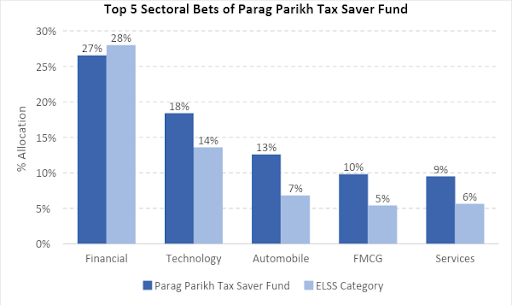

Parag Parikh Tax Saver Fund is fairly new to the Indian ELSS fund space. It was launched on 24th July 2019. It has generated a one-year return of 34.48%, which is the best in the ELSS fund category. For a newly launched fund, it has a decent AUM of Rs 375 crore. It holds an extremely compact portfolio of 26 stocks. Unlike its ELSS peers, the fund holds 14.70% in cash and cash equivalents. The balance 85.3% is held in large cap (77.37%), midcap (15.83%) and small cap stocks (6.81%). The fund has beaten its benchmark by a huge margin in the last one-year. This can be because of higher than average exposure to sectors like automobile (12.61%) and FMCG stocks (9.83%) etc. Parag Parikh Tax Saver Fund invests in the following key sectors –

Portfolio as of 31st December 2021

Here are a few reasons why Parag Parikh Tax Saver Fund is one of the best ELSS funds in 2022.

- It has generated the highest return of 34.48% in the last one year, among all other ELSS funds.

- Its turnover ratio is only 8.60%. This is 79% lower than the average of the ELSS category.

- Its expense ratio is 2.29%. This is 76% lower than other schemes in the ELSS category.

- The fund holds 14.70% in cash, making it slightly less aggressive than other ELSS funds.

Let us look at the key details of Parag Parikh Tax Saver Fund.

| Launch Date | 24th July 2019 |

| Return since launch | 30.45% |

| AUM | Rs 375 Crore |

| Expense Ratio | 2.29% |

| Exit Load | Nil |

| Lock-in-period | 3 years |

| Minimum SIP amount | Rs 500 |

| 1-Year Return | 34.48% |

And the fifth best ELSS fund for 2022 is DSP Tax Saver Fund.

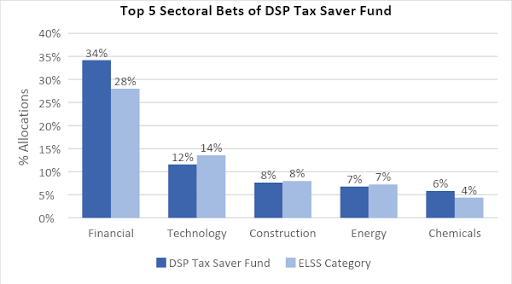

Best ELSS Fund for 2025 #5: DSP Tax Saver Fund

DSP Tax Saver Fund is the second best ELSS fund in 2025 as per last one-year return. It has generated a one-year return of 34.37% against a category average of 31.01%. It was launched on 18th January 2007 and has generated a return of 15.28% since then. The fund has a decent AUM of Rs 9,636 crore (as on 31st December 2021). It invests 64.86% in large cap, 30.67% in midcap and 4.47% in small cap stocks. The funds top holdings include –

Portfolio as of 31st December 2021

The fund is bullish on the financial sector. It invests 34% in financial stocks against a category average of 28%. It is also bullish on construction and energy stocks. In the construction sector, it holds Larsen & Toubro Ltd (2.04%), ACC Ltd (2.02%) and Ultratech Cement Ltd (2.00%). Let us look at the fund’s performance across different time periods.

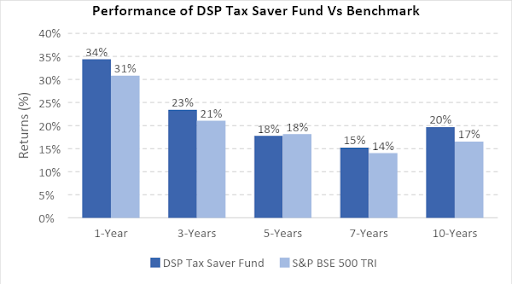

Performance as on 12th January 2022

As you can see, the fund has beaten its benchmark by a good 1-2% across time frames. So, it is a consistent long-term performer in the ELSS category. Here are some key details about the fund –

| Launch Date | 18th January 2007 |

| Return since launch | 15.30% |

| AUM | Rs 9,636 Crore |

| Expense Ratio | 1.78% |

| Sharpe Ratio | 0.82% |

| Alpha | 1.78% |

| Exit Load | Nil |

| Lock-in-period | 3 years |

| Minimum SIP amount | Rs 500 |

| 1-Year Return | 34.37% |

This concludes our list of the best ELSS funds for 2025. Majority of investors delay investing in ELSS funds to the end of the financial year. This way, you miss on the power of compounding and rupee-cost-averaging for the entire year. So, do not postpone investing in tax saving funds and invest in the best ELSS funds for 2022 with Samco. Open a FREE Demat account with Samco Securities in less than 15 minutes and get access to RankMF. This is India’s best mutual fund research and investment platform. Invest in India’s best ELSS funds for 2025 with India’s best stock broker, Samco Securities.

Easy & quick

Easy & quick

Leave A Comment?