Rakesh Jhunjhunwala’s stock list is probably one of the most in-demand items in the Indian stock market. Every trader and investor wants to know what the big bull is up to. Which stock is Rakesh Jhunjhunwala buying? Where has he increased or decreased his stake? What does Rakesh Jhunjhunwala’s portfolio look like? Which sector is he bullish on? These are some questions that a common investor wants to know about Rakesh Jhunjhunwala’s portfolio.

As of August 2022, there are a total of 32 stocks in Rakesh Jhunjhunwala’s portfolio where he holds more than 1% stake in the company. Now we are all aware of his love for the Tata group. After all, Titan Company Ltd is the biggest stock in Rakesh Jhunjhunwala’s portfolio. But Rakesh Jhunjhunwala’s portfolio is more than just Tata stocks. It is a healthy mix of large, mid and small cap stocks.

He currently owns large-cap stocks like Tata Motors Ltd, CRISIL Ltd, etc. Rakesh Jhunjhunwala’s portfolio also consists of small and micro-cap stocks. Take the example of Prozone Intu Properties Ltd. The stock has a market capitalisation of Rs 319 crore only as of August, 2022.

So, it’s safe to say that Rakesh Jhunjhunwala’s portfolio is sector and market cap-agnostic. We will discuss Rakesh Jhunjhunwala’s stock list in detail shortly. We will also understand the thought process behind Rakesh Jhunjhunwala’s portfolio construction. But first, a few words about the bull big himself.

Rakesh Jhunjhunwala’s love for the stock market started when he was in college. He is a Chartered Accountant by profession. But his passion lies with the stock market. He is both a trader and an investor. When he was young, Rakesh Jhunjhunwala actively traded in the market to create a sizeable corpus and become an investor.

Rakesh Jhunjhunwala is known by many names. For some, he is the Warren Buffett of India. Others call him the big bull. After all, he did create an empire worth Rs 31,833 crore as of August 2022 from a starting capital of just Rs 5,000.

As of August 2022, Rakesh Jhunjhunwala’s portfolio (networth) is worth a whopping Rs 31,833 crore. He also invests in the name of his wife, Rekha Jhunjhunwala. The total value of Rekha Jhunjhunwala’s portfolio is Rs 7,005 crore (as of 17th June 2022). Rakesh Jhunjhunwala makes all his investments through his private investment firm, RARE Enterprises Ltd.

Rakesh Jhunjhunwala invests in 32 stocks. Here is the list of stocks in Rakesh Jhunjhunwala’s portfolio as of August 2022.

Loving the valuable content? Invite friends to Samco to explore our informative blogs. Earn voucher rewards for each successful referral. Start referring now and reap the rewards

Rakesh Jhunjhunwala’s stock list is probably one of the most in-demand items in the Indian stock market. Every trader and investor wants to know what the big bull is up to. Which stock is Rakesh Jhunjhunwala buying? Where has he increased or decreased his stake? What does Rakesh Jhunjhunwala’s portfolio look like? Which sector is he bullish on? These are some questions that a common investor wants to know about Rakesh Jhunjhunwala’s portfolio.

As of August 2022, there are a total of 32 stocks in Rakesh Jhunjhunwala’s portfolio where he holds more than 1% stake in the company. Now we are all aware of his love for the Tata group. After all, Titan Company Ltd is the biggest stock in Rakesh Jhunjhunwala’s portfolio. But Rakesh Jhunjhunwala’s portfolio is more than just Tata stocks. It is a healthy mix of large, mid and small cap stocks.

He currently owns large-cap stocks like Tata Motors Ltd, CRISIL Ltd, etc. Rakesh Jhunjhunwala’s portfolio also consists of small and micro-cap stocks. Take the example of Prozone Intu Properties Ltd. The stock has a market capitalisation of Rs 319 crore only as of August, 2022.

So, it’s safe to say that Rakesh Jhunjhunwala’s portfolio is sector and market cap-agnostic. We will discuss Rakesh Jhunjhunwala’s stock list in detail shortly. We will also understand the thought process behind Rakesh Jhunjhunwala’s portfolio construction. But first, a few words about the bull big himself.

Rakesh Jhunjhunwala’s love for the stock market started when he was in college. He is a Chartered Accountant by profession. But his passion lies with the stock market. He is both a trader and an investor. When he was young, Rakesh Jhunjhunwala actively traded in the market to create a sizeable corpus and become an investor.

Rakesh Jhunjhunwala is known by many names. For some, he is the Warren Buffett of India. Others call him the big bull. After all, he did create an empire worth Rs 31,833 crore as of August 2022 from a starting capital of just Rs 5,000.

As of August 2022, Rakesh Jhunjhunwala’s portfolio (networth) is worth a whopping Rs 31,833 crore. He also invests in the name of his wife, Rekha Jhunjhunwala. The total value of Rekha Jhunjhunwala’s portfolio is Rs 7,005 crore (as of 17th June 2022). Rakesh Jhunjhunwala makes all his investments through his private investment firm, RARE Enterprises Ltd.

Rakesh Jhunjhunwala invests in 32 stocks. Here is the list of stocks in Rakesh Jhunjhunwala’s portfolio as of August 2022.

Loving the valuable content? Invite friends to Samco to explore our informative blogs. Earn voucher rewards for each successful referral. Start referring now and reap the rewards

List of Stocks in Rakesh Jhunjhunwala’s Portfolio

– Updated on 16 August 2022| STOCK | HOLDING VALUE (RS.) | QTY HELD |

| Titan Company Ltd. | 11,189.2 Cr | 44,850,970 |

| Star Health and Allied Insurance Company Ltd. | 7,091.6 Cr | 100,753,935 |

| Metro Brands Ltd. | 3,356.8 Cr | 39,153,600 |

| Tata Motors Ltd. | 1,744.7 Cr | 36,250,000 |

| Crisil Ltd. | 1,306.2 Cr | 4,000,000 |

| Fortis Healthcare Ltd. | 913.8 Cr | 31,950,000 |

| Federal Bank Ltd. | 838.2 Cr | 75,721,060 |

| Canara Bank | 826.0 Cr | 35,597,400 |

| Indian Hotels Company Ltd. | 826.2 Cr | 30,016,965 |

| NCC Ltd. | 511.9 Cr | 78,333,266 |

| Jubilant Pharmova Ltd. | 372.3 Cr | 10,770,000 |

| Rallis India Ltd. | 429.6 Cr | 19,068,320 |

| Nazara Technologies Ltd. | 432.7 Cr | 6,588,620 |

| Jubilant Ingrevia Ltd. | 366.1 Cr | 7,520,000 |

| Tata Communications Ltd. | 335.2 Cr | 3,075,687 |

| Aptech Ltd. | 213.2 Cr | 9,668,840 |

| Agro Tech Foods Ltd. | 155.9 Cr | 2,003,259 |

| Karur Vysya Bank Ltd. | 229.9 Cr | 35,983,516 |

| Va Tech Wabag Ltd. | 124.8 Cr | 5,000,000 |

| Geojit Financial Services Ltd. | 84.8 Cr | 18,037,500 |

| Edelweiss Financial Services Ltd. | 86.4 Cr | 15,125,000 |

| Wockhardt Ltd. | 69.0 Cr | 3,000,005 |

| Indiabulls Housing Finance Ltd. | 69.6 Cr | 5,500,000 |

| Dishman Carbogen Amcis Ltd. | 57.4 Cr | 5,000,000 |

| Anant Raj Ltd. | 67 Cr | 10,000,000 |

| Man Infraconstruction Ltd. | 40.8 Cr | 4,500,000 |

| D B Realty Ltd. | 30.8 Cr | 5,000,000 |

| Orient Cement Ltd. | 28.6 Cr | 2,500,000 |

| Bilcare Ltd. | 13.0 Cr | 1,997,925 |

| Prozone Intu Properties Ltd. | 7.4 Cr | 3,150,000 |

| Escorts Kubota Ltd. | 316.1 Cr | 1,830,388 |

| Autoline Industries Ltd. | 12.9 Cr | 1,751,233 |

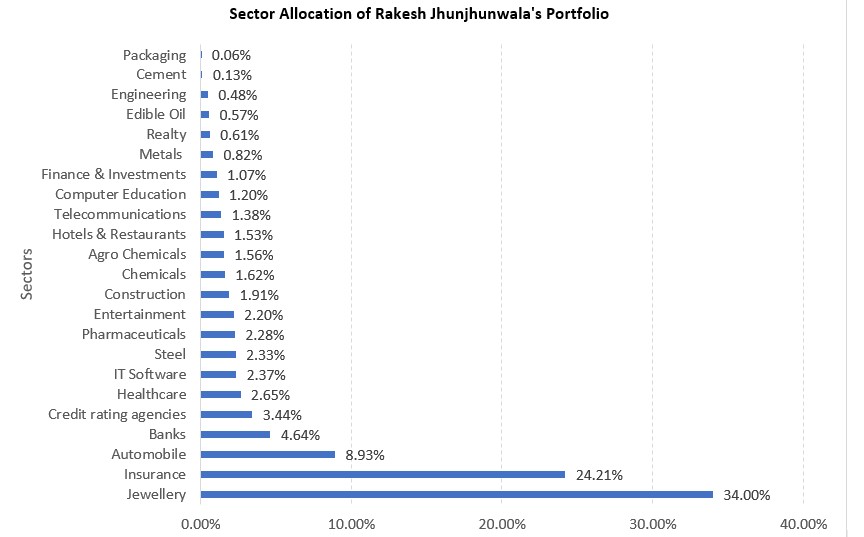

Sector-wise Split of Rakesh Jhunjhunwala’s Portfolio

Here are a few observations on Rakesh Jhunjhunwala’s portfolio – 1. The total value of Rakesh Jhunjhunwala’s portfolio is Rs 31,833 crore as of August 2022. It is diversified across 23 sectors. It includes stocks from popular sectors like banks, pharmaceuticals etc. It also includes stocks from lesser known sectors like agro chemicals, edible oils etc.

2. Rakesh Jhunjhunwala’s portfolio is bullish on Jewellery sector with 34% weightage in shares of Titan Company Ltd. He holds 4.48 crore shares of the company, valued at a mammoth Rs 8,685 crore as of August 2022.

3. As per his portfolio, Rakesh Jhunjhunwala is bullish on the following five sectors –

1. The total value of Rakesh Jhunjhunwala’s portfolio is Rs 31,833 crore as of August 2022. It is diversified across 23 sectors. It includes stocks from popular sectors like banks, pharmaceuticals etc. It also includes stocks from lesser known sectors like agro chemicals, edible oils etc.

2. Rakesh Jhunjhunwala’s portfolio is bullish on Jewellery sector with 34% weightage in shares of Titan Company Ltd. He holds 4.48 crore shares of the company, valued at a mammoth Rs 8,685 crore as of August 2022.

3. As per his portfolio, Rakesh Jhunjhunwala is bullish on the following five sectors –

| Sector | Weightage |

| Jewellery | 34.00% |

| Insurance | 24.21% |

| Automobile | 8.93% |

| Banks | 4.64% |

| Credit Rating Agency | 3.44% |

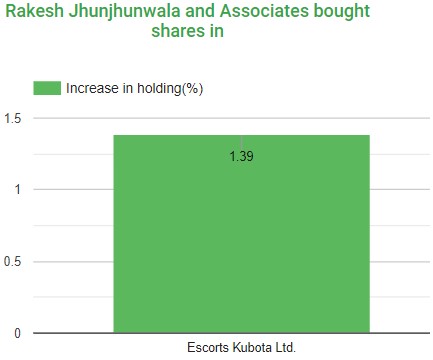

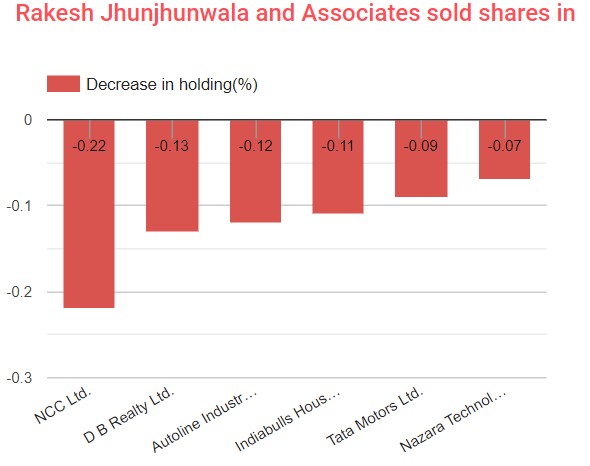

Rakesh Jhunjhunwala has also sold a few stocks in the August 2022 quarter…

Rakesh Jhunjhunwala has also sold a few stocks in the August 2022 quarter…

We will shortly take a look at the top five stocks in Rakesh Jhunjhunwala’s portfolio. But before that, let us first understand his philosophy while picking stocks.

We will shortly take a look at the top five stocks in Rakesh Jhunjhunwala’s portfolio. But before that, let us first understand his philosophy while picking stocks.

Rakesh Jhunjhunwala’s Stock Picking Philosophy

1. Rakesh Jhunjhunwala believes that one should focus on buying the business and not the stock. So, don’t pay too much attention to the price at which you are buying a stock. It will not make a huge difference in the grand scheme of things. Instead, focus on the business that you are buying. There is no harm in paying a little extra for a fundamentally strong business. Take the example of Rakesh Jhunjhunwala’s favourite stock Titan Company Ltd. The stock is up by 10.04% between December 16, 2021 and January 16, 2022. Despite being expensive, Rakesh Jhunjhunwala has increased 0.20% stake in the company in the December quarter. This is because he is buying the business and not the stock. Rakesh Jhunjhunwala knows how to pick stocks for the long-term. Afterall, he has been holding Titan stocks since 2002-03. Now the question is, do you know how to pick stocks for the long-term? Don’t worry if the answer is No. Simply watch this video where Apurva Sheth and Tushar Bohra discuss their strategies on picking stocks for the long-term.

*2021 data is as on June 2021. *Remaining numbers are as on December

5. Rakesh Jhunjhunwala is a big investor in companies with economic moats. This is another thing he has common with Warren Buffett. Rakesh Jhunjhunwala’s portfolio consists of many companies with strong economic moats. One such example is Delta Corp Ltd. This stock has nearly 1.72% weightage in Rakesh Jhunjhunwala’s portfolio. Delta Corp Ltd is the largest gambling company in India. It accounts for 55% of the market share of the organised casino market in India. Now opening a casino is a big headache with loads of government rules and regulations. Even the capital requirement is very high. The nearest competitor is Touchwood Entertainment Ltd. Its market capitalisation is only 121 crores. This is basically nothing compared to the 7,901-crore market capitalisation of Delta Corp Ltd. And finally, Rakesh Jhunjhunwala is strictly against investing based on hot stock tips. He wants investors to study a stock on their own without placing much emphasis on what he is investing or trading in. These are some of the filters that go into the construction of Rakesh Jhunjhunwala’s portfolio. Let us now quickly take a look at the top 5 stocks in Rakesh Jhunjhunwala’s portfolio.- Titan Company Ltd is the biggest investment in Rakesh Jhunjhunwala’s stock portfolio. The total value of Titan shares in his portfolio is worth a colossal Rs 11,189.2 crore as on August 2022. He first invested in the stock way back in 2002-03 when the share price was around Rs 3 to Rs 4. The stock is trading at Rs 2,492.90 as on August 16, 2022.

| Market Cap (Cr): 2,30,181 | EPS (₹): 19.69 | |

| Book Value (₹): 87.60 | ROCE (%): 13 | Debt to Equity: 0.82 |

| Stock P/E: 132 | ROE (%): 13.60 | Dividend Yield (%): 0.15 |

| Revenue (Cr): 26,079 | Earnings (Cr): 2,770 | Cash (Cr): 708 |

| Total Debt (Cr): 6,335 | Promoter’s Holdings (%): 52.9 | |

- The next stock in Rakesh Jhunjhunwala’s portfolio is Star Health and Allied Insurance Company Ltd. This is a new stock in Rakesh Jhunjhunwala’s portfolio. But his conviction in the stock is quite high as it occupies the second highest weightage in the portfolio. It is valued at Rs 6,275 crore (as of June 17, 2022). The stock got listed in the secondary market on 10th December 2021. But Rakesh Jhunjhunwala had invested in the stock way before its IPO.

| Market Cap (Cr):47,725 | EPS (₹): -15.06 | |

| Book Value (₹): 60.8 | Roce (%): -37 | Debt to Equity: 0.07 |

| Stock P/E: 0 | ROE (%): -32 | Dividend Yield (%): 0 |

| Revenue (Cr): 0 | Earnings (Cr): -997 | Cash (Cr): 1,879 |

| Total Debt (Cr): 250 | Promoter’s Holdings (%): 0 | |

- The next big stock in Rakesh Jhunjhunwala’s portfolio is Tata Motors Ltd. He holds Tata Motors Ltd.’s stocks worth Rs 1,526.60 crore. He says that Tata Motors Ltd is one of the largest investments of his life.

| Market Cap (Cr): 1,82,521 | Face Value (₹): 2 | EPS (₹): -40.29 |

| Book Value (₹): 135 | Roce (%): 5.82 | Debt to Equity: 3.39 |

| Stock P/E: 0 | ROE (%): -22.9 | Dividend Yield (%): 0 |

| Revenue (Cr): 292,067 | Earnings (Cr): 34,866 | Cash (Cr): 34,604 |

| Total Debt (Cr): 148,872 | Promoter’s Holdings (%): 42.39 | |

- Escorts Ltd is the fourth biggest stock (in terms of value) in Rakesh Jhunjhunwala’s portfolio. He owns 64 Lakh shares of Escorts Ltd valued at Rs 1,196 crores. Escorts Ltd is one of the biggest players in the tractor segment in India. Apart from agricultural tractors, they also manufacture hydraulic shock absorbers for railway coaches, internal combustion engines etc.

- The company is almost debt free. It has a debt to equity ratio of 0.01. This is a great thing considering that commercial vehicle is a capital-intensive sector.

- The company’s net profits have increased by 84.53% between March 2020 and 2021.

- Escorts Ltd.’s 5-year compounded profit growth is a whopping 65%.

- Its return on capital employed was 26% as of March 2021. Since 2017-18, it has managed to deliver a CAGR of more than 18%.

| Market Cap (Cr): 25205 | Face Value (₹): 10 | EPS (₹): 67 |

| Book Value (₹): 394 | Roce (%): 26.1 | Debt to Equity: 0.01 |

| Stock P/E: 27.9 | ROE (%): 19.7 | Dividend Yield (%): 0.27 |

| Revenue (Cr): 7,647 | Earnings (Cr): 1,134 | Cash (Cr): 310 |

| Total Debt (Cr): 55 | Promoter’s Holdings (%): 36.59 |

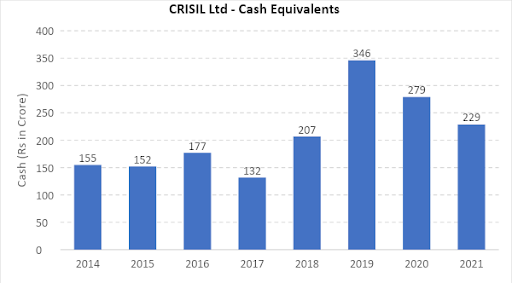

- CRISIL Ltd is also one of Rakesh Jhunjhunwala’s favorite stocks. He owns 40 lakhs shares of CRISIL Ltd valued at Rs 1,244 crores (as of June 17, 2022). His stake in the company has remained a steady 5.50% since the last few years.

| Market Cap (Cr): 21736 | Face Value (₹): 1 | EPS (₹): 56.01 |

| Book Value (₹): 197 | Roce (%): 37.4 | Debt to Equity: 0.00 |

| Stock P/E: 53.4 | ROE (%): 28.1 | Dividend Yield (%): 1.11 |

| Revenue (Cr): 2,192 | Earnings (Cr): 567 | Cash (Cr): 229 |

| Total Debt (Cr): 0 | Promoter’s Holdings (%): 67.13 |

Easy & quick

Easy & quick

Leave A Comment?