List of Paper Stocks in 2025

Paper stocks are a great addition to an investment portfolio if you are looking for medium term gains. JK Paper Ltd. is the biggest paper stock in India. It has rallied by nearly 374% in last five years between July 23, 2019 and July 23, 2024. Then comes West Coast Paper Mills Ltd. This is the second largest paper stock in India. It is also up by 174% in the same period. So, all in all, paper stocks are in the limelight. The paper sector plays an important role in the economic growth of our country. Yes, the same paper that we use in our daily lives to write, read newspapers, print office documents, etc. is an important cornerstone of India’s economic growth. Did you know that the Indian paper and pulp sector contributes nearly Rs 5,000 crore to the government’s revenue? And this is not all. The paper sector provides direct employment to 5 Lakh individuals and indirect employment to 1.5 million individuals. India is also the fastest growing paper market across the globe. We account for nearly 5% of the total paper produced in the entire world. And herein lies the good news. You too can become a stakeholder in the growth story of the Indian paper sector. How? By simply investing in paper stocks. But there are nearly 50 paper stocks in India. So, which paper stocks offers the best opportunities? Which paper stocks can change the game in 2024? We will answer all these questions and much more in today’s article on paper stocks in 2025.

In this article on paper stocks in 2025 –

An Overview of the Indian Paper Sector

When we talk about paper, we are not just talking about the paper that we write or print on. The paper industry is much more than a white sheet of paper. It includes –

- Tissue paper

- Filter paper

- Light-weight online coated paper

- Medical-grade coated paper

- Cardboard boxes used for packaging

- Packaging and paperboards etc.

India has been making paper since the 1950s. But it was in the year 1991 that the paper sector in India started its true revolution. What prompted this turnaround? Well, July 1991 the Indian government decided to de-license the Indian paper sector. Since then, there has been no looking back.

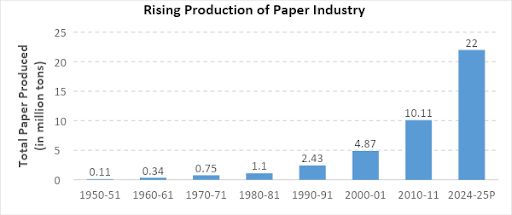

*2024-25 is estimated production

Look how far the Indian paper industry has come. It grew by 12% between 1950-51 and 1960-61. Since then, the Indian paper industry has grown steadily by 7%-8%. But things changed during the pandemic. There was a gigantic fall in the overall demand for paper. But the print and writing (P&W) segment was the worst-hit as it fell by 25-30% in FY 2020-21. Why such a drastic fall? Well there are three main reasons for the fall in the P&W segment -

- Due to the lockdown, schools and colleges were completely shut. Children moved to digital education. This greatly reduced the demand for notebooks and textbooks.

- The demand for billboards fell sharply as everyone was locked in their homes. So, the revenue from advertising companies nose-dived.

- The government also banned printing and distribution of diaries, calendars, festive greetings etc. This helped them promote digitalisation and cut costs in PSUs.

Apart from P&W, the newsprint segment was the hardest hit. It saw a complete shutdown as consumers switched to online news apps. The paperboard segment also took a growth hit of 4-7% in FY 2020-21.

Outlook for 2024-25 - What is the Future of the Paper Sector?

The demand for paper is expected to continue to grow despite a push to go digital. According to Indian Pulp and Paper Technical Association, the size of the industry is currently estimated at Rs 80,000 crore and the total annual production of paper is more than 25 million tonnes. Does the expected growth of the Indian paper sector excite you? Well, you are not alone. Check out this video on 5 paper stocks giving price and volume breakout now!

However, the paper industry has its own struggles. Let us look at the key challenges faced by the Indian paper industry.

Key Challenges of the Indian Paper Industry

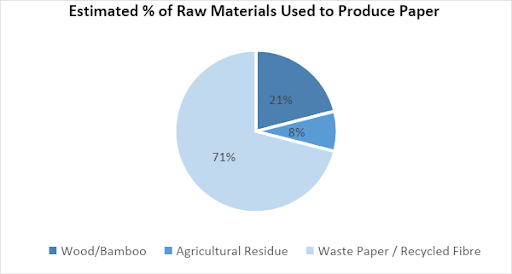

- Shortage of Raw Materials: Making paper is not easy. You need various raw materials like wood, bamboo, agricultural residue like bagasse, wheat straw etc. But the most important raw material required to make paper is waste paper or recycled fibre. Nearly 71% of waste paper is used to manufacture paper.

Now herein lies the biggest problem. In 2017, the forest cover of India was 7.08 Lakh sq.km. In 2019, this increased to 7.12 Lakh sq.km. But still, India is a wood-deficit country. Why? Well, there are a few reasons for this.

- The availability of wood in India is very less compared to the United States and Europe. And most of the land is owned by the government. This reduces the land available with the paper industry for plantations.

- Then there is the resistance faced from environmentalists on cutting down trees for producing paper. This is why India depends heavily on its imports to meet the demand for raw materials.

- Earlier, agricultural residue was used to produce paper. But now this residue can be used to produce alternative fuels. Hence, the agricultural residue is redirected to the Auto and Sugar industries.

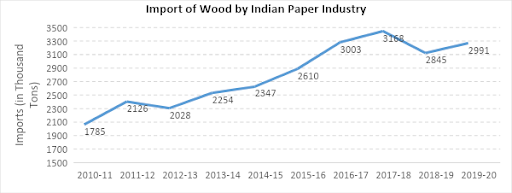

This shortage in raw materials has forced the Indian paper industry to import wood. The import of wood in India has increased by 5.30% y-o-y between 2010 and 2020. This clearly means higher outflow of foreign reserves, which is detrimental to the economy in the long-run.

- Poor Waste Paper Collection Mechanism: Which is the most used raw material required to produce paper? The answer is recycled fibre or waste paper. Now unfortunately there is no set process for collecting, sorting and grading of recycled paper in India. This is why India has to import recycled paper from the USA and European countries. But even China is a big importer of recycled fibre. This inflates the price of recycled fibre in the global markets. This leads to an increase in the cost of raw materials. Now obviously, this will result in higher cost of final paper. All this hassle can be easily eliminated if we set a standard operating procedure for waste paper collection.

- Outdated Mills and Technologies: Do you know that there are around 800-850 paper mills in India? Yes. And their combined production capacity is over 19 million tons. While impressive, we are far behind the global production capacity. Most of these mills use very high energy, water and other resources. This increases the overall cost of producing paper. What is the problem? The outdated technology and machinery used by majority of these paper mills. Upgrading this technology is both expensive and time-consuming. This is why Indian paper mills are yet to achieve their full potential in producing paper. Then there is the issue of availability of container and shipping liners to bring recycled paper home. Since waste paper is a low-priced item, only four to five liners operate in the paper industry. This leads to a delay in procuring raw materials. So, the demand-supply gap widens. These were a few of the many challenges faced by the paper industry in India. Let us now look at the key drivers of the paper industry in India.

Key Drivers of the Indian Paper Industry

- Low per Capita Consumption of Paper: This is the biggest driver of the Indian paper industry. The average per capita consumption of paper in India is around 13kgs. This is way below the global per capita consumption of 57 kgs. Now, as the consumption of paper increases due to high literacy rate, the growth of the paper industry is more or less guaranteed.

- Growth in the Education Sector: There is no doubt that the growth of the paper sector is directly linked with the education sector. The level of literacy is on the rise in India. This will lead to an increase in the demand for notebooks, textbooks etc. And there is good news in this department. The literacy rate in India has grown exponentially from 64.80% in 2009 to 75% in 2021-22. Initiates like the Sarva Shiksha Abhiyan (SSA) will further contribute to the growth of the paper industry in India.

- Growth in Lifestyle: The standard of Indian consumers has increased vastly in the last few decades. Growing literacy and lifestyle changes has increased the demand for packaged goods and speciality papers, including tissue paper. Even the demand for newspapers and magazines has gone up. The printing and packaging industry in India has been growing at CAGR of over 15% since 1989.

- Increase in Demand for Packaging: The growth of the Fast Moving Consumer Goods (FMCG) sector will take the paper sector to new heights. And there is great news in this area. The FMCG sector is the fourth largest sector of the Indian economy. It is expected to grow at a CAGR of 23.15% in FY 2021. This high growth in the FMCG sector will drive the demand for packaging paper and boxes. This will help in the overall growth of the paper industry.

- Capitalise on Paper Export Potential: India is an importer of raw materials used to make paper. But did you know that we also export paper to other countries. Yes, we export paper to the Middle East, Africa and South Asia. The main items exported include paper, paperboards and printed materials.

With improvement in technology and machinery, we can become independent paper producers. And by improving the quality of our paper, we can also export to European and North American markets. This will help us earn foreign reserves. And the contribution of the paper sector to India’s GDP will also increase. Let us now take a look at all the paper stocks listed in the Indian stock exchanges.

List of Paper Stocks in 2025

Company Name | Closing Price | Market Cap (In Crores) | PE | ROE (%) | Debt/Equity | ROCE (%) |

559.85 | 9483.99 | 10.51 | 25.97 | 0.63 | 25.18 | |

690.65 | 4561.67 | 9.58 | 33.05 | 0.08 | 40.29 | |

590.90 | 2350.01 | 6.92 | 39.04 | 0.03 | 51.07 | |

365.00 | 2301.99 | 8.88 | 15.20 | 0.01 | 20.24 | |

270.60 | 1872.84 | 9.00 | 21.96 | 0.96 | 20.60 | |

169.30 | 1477.37 | 8.04 | 15.15 | 0.53 | 17.86 | |

133.56 | 1335.60 | 6.32 | 30.07 | 0.57 | 20.58 | |

57.42 | 1218.37 | 195.71 | 0.40 | 0.20 | 2.29 | |

122.59 | 1163.99 | 11.86 | 16.06 | 0.13 | 19.39 | |

254.95 | 1005.01 | 20.65 | 27.21 | 0.49 | 28.38 | |

139.51 | 844.02 | 10.01 | 16.00 | 1.23 | 10.45 | |

486.00 | 827.13 | 6.59 | 16.95 | 0.21 | 22.29 | |

25.14 | 646.41 | 114.17 | -3.00 | 0.55 | 0.19 | |

246.36 | 505.31 | 26.32 | 18.77 | 1.16 | 16.30 | |

143.23 | 427.47 | 8.69 | 19.69 | 0.11 | 23.97 | |

309.15 | 427.39 | 4.89 | 27.53 | 0.13 | 31.27 | |

263.80 | 411.75 | 6.43 | 11.63 | 0.00 | 14.86 | |

51.35 | 341.02 | 13.80 | 0.00 | 5.76 | 34.55 | |

21.10 | 311.27 | 0.96 | 2.57 | 0.31 | ||

125.94 | 198.37 | 12.48 | 13.46 | 0.01 | 16.26 | |

3.59 | 170.12 | 2.69 | 0.35 | 5.25 | ||

27.99 | 130.15 | -12.09 | 0.47 | -7.92 | ||

24.54 | 79.07 | 0.00 | -1.52 | -44.53 | ||

41.31 | 70.47 | 78.74 | -88.56 | 19.18 | -4.29 |

*As on 12th July 2024

Let us now look at the top five paper stocks in India in 2025.

Top Five Paper Stocks in India in 2025

Paper Stock #1: JK Paper Ltd

This is the biggest paper stock in India in 2024. Its market capitalisation is Rs 9,484 crore (as of July 12, 2024). JK Paper Ltd is a leader in office papers, coated papers and packaging boards. You must have heard or seen a red coloured packet containing A4 size papers in your office. The company has over 300 trade partners and 4,000 dealers. In 2019, it acquired Sirpur Paper Mills which owns a paper manufacturing unit in Telangana. This helped JK Paper Ltd increase their manufacturing capacity from 4.55 Lakh TPA to 5.91 TPA.

Key Financials of JK Paper Ltd. as of July 12, 2024

Market Cap (Cr): | 9,484.0 | Face Value | 10 | EPS: Rs. 66.2 |

299 | 25.18 | Debt to Equity: 0.63 | ||

10.51 | 25.97 | Dividend Yield (%): 1.42% | ||

Promoter’s Holdings (%): | 49.60% | Total Debt (Cr) | Rs. 1630 |

Paper Stock #2: West Coast Paper Mills Ltd

This paper stock is one of the oldest paper and packaging company in India. It was established in 1955 at Dandeli, Karnataka. The company is present in the printing, writing, publishing and stationery business. Its paper production capacity in FY 2020 was 3.10 Lakh TPA. In 2019, the company acquired 55% stake in International Paper APPM Ltd. This was later renamed to Andhra Papers Ltd.

Key Financials of West Coast Paper Mills Ltd. as of July 12, 2024

Market Cap (Cr): | 4,561.7 | Face Value | 2 | EPS: Rs. 104.77 |

Book Value: | 491 | Roce (%) | 40.29 | Debt to Equity: 0.09 |

Stock PE | 6.16 | ROE (%) | 33.05 | Dividend Yield (%): 1.25% |

Promoter’s Holdings (%): | 56.50% | Total Debt (Cr) | Rs. 140 |

Paper Stock #3: Andhra Paper Ltd

This paper company produces P&W papers, copier paper and a wide variety of speciality papers. This includes tissue paper, photos, cups etc. Its paper production capacity is 2.48 Lakh Million TPA. The second largest paper company, West Coast Paper Mills Ltd. acquired 55% stake in the company in 2019.

Key Financials of Andhra Paper Ltd. as of July 12, 2024

Market Cap (Cr): | 2,350.0 | Face Value | 10 | EPS: Rs. 85.43 |

Book Value: | 476 | Roce (%) | 51.07 | Debt to Equity: 0.06 |

Stock PE | 6.97 | ROE (%) | 39.04 | Dividend Yield (%): 1.7% |

Promoter’s Holdings (%): | 72.30% | Total Debt (Cr) | Rs. 47 |

Paper Stock #4: Seshasayee Paper & Boards Ltd

This is also one of the oldest paper companies. It was incorporated in Chennai in the year 1960. The company produces printing and writing paper. Its total production in 2019, was 2.09 TPA. It also exports paper overseas to the USA, Srilanka, Nepal and Middle East.

Key Financials of Seshasayee Paper & Boards Ltd. as of July 12, 2024

Market Cap (Cr): | 2,302.0 | Face Value | 2 | EPS: Rs. 35.89 |

Book Value: | 291 | Roce (%) | 20.24 | Debt to Equity: |

Stock PE | 9.65 | ROE (%) | 15.20 | Dividend Yield (%): 1.47% |

Promoter’s Holdings (%): | 42.80% | Total Debt (Cr) |

Paper Stock #5: Tamil Nadu Newsprint & Papers Ltd.

This paper stock manufactures paper, paperboard, cement and power generation. The company is a leader in producing paper using bagasse. It is the only paper company in India that uses the waste generated from paper mills into high grade cement. Currently, cement makes up for nearly 4% of the company’s revenue. The company’s total manufacturing capacity is 13.58 TPA.

Key Financials of Tamil Nadu Newsprint & Papers Ltd. as of July 12, 2024

Market Cap (Cr): | 1,872.8 | Face Value | 10 | EPS: Rs. 35.89 |

Book Value: | 264 | Roce (%) | 20.60 | Debt to Equity: 0.86 |

Stock PE | 8.77 | ROE (%) | 21.96 | Dividend Yield (%): 1.47% |

Promoter’s Holdings (%): | 35.30% | Total Debt (Cr) | Rs. 880 |

This concludes our discussion on the top paper stocks in 2025. Paper stocks offer exciting investment opportunities. Want to know which are the best paper stocks to buy? All you need to do is visit Samco’s star ratings page and check the ratings for free! These ratings are calculated using more than twenty million data points. It also mentions the ratios and pros and cons of investing in the company. So, researching stocks just got simpler. To invest in paper stocks, open a Demat account with Samco.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?