Best Practices for Risk Management for Investors

Introduction: Unpredictable and volatile moves in the market, as it goes from one crisis to another, have brought a tight focus on risk management. The shock losses many investors have suffered when bubbles burst have highlighted the need for guidance in this regard. Following are some of the best practices that investors should follow to minimize risk to their portfolios and mitigate losses arising from unexpected events. BSE data is used as reference. The need: Imagine a new investor in early 2014. Punjab National Bank (PNB) has come out of a re-branding exercise and the investor saw that the stock price is rising. He decided to invest in PNB in April 2014. Below is a chart showing how the stock has moved over the last 5 years: [caption id="attachment_2575" align="aligncenter" width="762"] Punjab National Bank Stock Chart - 2014[/caption]

He needs some cash two years later in March 2016. But he is shocked to find that he has lost value on his investments. This could have been easily avoided if the investor had followed some simple risk management principles.

Investment in PNB on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 55,904.00

Gain/ (Loss): (44.09%)

Portfolio Diversification: Risks caused by factors like inflation, political instability or wars cannot be overcome by managing the portfolio better and are called undiversifiable risks or systematic risks. On the other hand, diversifiable risks can be reduced and sometimes eliminated by diversification of the investment portfolio. This ensures that not all of the investments react to market highs and lows in a similar manner.

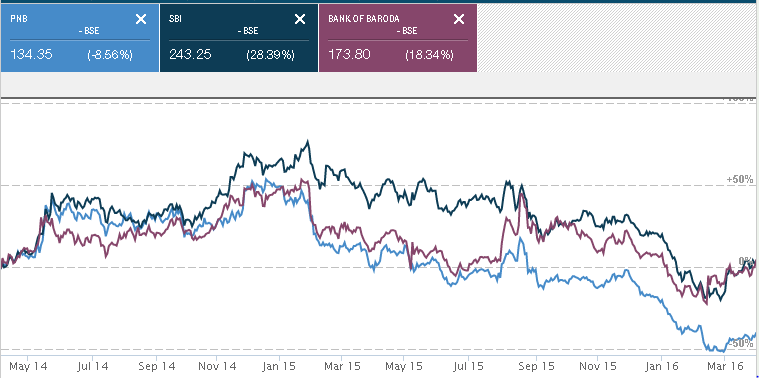

The risk when the portfolio is limited to a single stock is easy to see from the example above. Investing in more than one stock would have mitigated the loss he suffered if the cause for the price movement was something which was happening within PNB. If the hypothetical investor had chosen to invest in three different banks - PNB, State Bank of India (SBI) and Bank of Baroda instead of just PNB:

[caption id="attachment_2576" align="aligncenter" width="759"]

Punjab National Bank Stock Chart - 2014[/caption]

He needs some cash two years later in March 2016. But he is shocked to find that he has lost value on his investments. This could have been easily avoided if the investor had followed some simple risk management principles.

Investment in PNB on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 55,904.00

Gain/ (Loss): (44.09%)

Portfolio Diversification: Risks caused by factors like inflation, political instability or wars cannot be overcome by managing the portfolio better and are called undiversifiable risks or systematic risks. On the other hand, diversifiable risks can be reduced and sometimes eliminated by diversification of the investment portfolio. This ensures that not all of the investments react to market highs and lows in a similar manner.

The risk when the portfolio is limited to a single stock is easy to see from the example above. Investing in more than one stock would have mitigated the loss he suffered if the cause for the price movement was something which was happening within PNB. If the hypothetical investor had chosen to invest in three different banks - PNB, State Bank of India (SBI) and Bank of Baroda instead of just PNB:

[caption id="attachment_2576" align="aligncenter" width="759"] Comparison of stocks performances - Charts of SBI, PNB and BOB[/caption]

As can be seen from the chart above, the quantum of loss suffered would have been less as SBI (shown in black) and Bank of Baroda lost far less value than PNB (shown in blue) over the same period. If the Rs. 1000 investment was equally distributed among the three stocks:

Investment as on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 18,634 (PNB) + Rs. 33,497 (SBI) + Rs. 31,595 (BoB) = Rs. 83,726.00

Gain/ (Loss): (16.27%)

Sectoral Exposure: The chart above also showcases another risk - all the three move together. This is because stocks in a sector tend to move together as they react similarly to broad economic factors that impact the industry. This is further highlighted by the BSE banking index chart below:

[caption id="attachment_2577" align="aligncenter" width="761"]

Comparison of stocks performances - Charts of SBI, PNB and BOB[/caption]

As can be seen from the chart above, the quantum of loss suffered would have been less as SBI (shown in black) and Bank of Baroda lost far less value than PNB (shown in blue) over the same period. If the Rs. 1000 investment was equally distributed among the three stocks:

Investment as on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 18,634 (PNB) + Rs. 33,497 (SBI) + Rs. 31,595 (BoB) = Rs. 83,726.00

Gain/ (Loss): (16.27%)

Sectoral Exposure: The chart above also showcases another risk - all the three move together. This is because stocks in a sector tend to move together as they react similarly to broad economic factors that impact the industry. This is further highlighted by the BSE banking index chart below:

[caption id="attachment_2577" align="aligncenter" width="761"] BSE Bankex Index Chart[/caption]

The chart of S&P BSE Bankex shows a trend similar to the three banks shown earlier. This index is made up of 10 bank stocks - including PNB, SBI and Bank of Baroda.

Investment in the index on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 1,26,537.00

Gain/ (Loss): 26.54%

It can be seen that while investing in the index would have mitigated the losses from PNB better than investing in the three stock portfolio shown earlier. It would not have helped against any slump banking as a whole would have faced.

An investor should be aware that no investment is without a corresponding risk. If the risk associated with an asset cannot be assessed, it is best to not invest in the same. It is also important to remember that if two investments have the same projected returns, an investor should always choose the one which has higher risk-adjusted return among them. While it is impossible to eliminate risk, following some of the best practices suggested below will help reduce them to a reasonable level while ensuring a tidy profit.

It is equally important that the funds are not spread too thin in the name of diversification. If very small investments are made into far too many assets - the risk of losses will definitely go down, but the returns from the investment will be far below the benchmarks. When taking inflation into consideration, such an over-diversified portfolio may actually incur a loss in real terms.

BSE Bankex Index Chart[/caption]

The chart of S&P BSE Bankex shows a trend similar to the three banks shown earlier. This index is made up of 10 bank stocks - including PNB, SBI and Bank of Baroda.

Investment in the index on April 2, 2014: Rs. 1,00,000.00

Value on March 31, 2016: Rs. 1,26,537.00

Gain/ (Loss): 26.54%

It can be seen that while investing in the index would have mitigated the losses from PNB better than investing in the three stock portfolio shown earlier. It would not have helped against any slump banking as a whole would have faced.

An investor should be aware that no investment is without a corresponding risk. If the risk associated with an asset cannot be assessed, it is best to not invest in the same. It is also important to remember that if two investments have the same projected returns, an investor should always choose the one which has higher risk-adjusted return among them. While it is impossible to eliminate risk, following some of the best practices suggested below will help reduce them to a reasonable level while ensuring a tidy profit.

It is equally important that the funds are not spread too thin in the name of diversification. If very small investments are made into far too many assets - the risk of losses will definitely go down, but the returns from the investment will be far below the benchmarks. When taking inflation into consideration, such an over-diversified portfolio may actually incur a loss in real terms.

Best practices for risk management

- Avoid single stock exposure: As can be seen from the example above, investing all the monies in a single stock is extremely risky. Smart investors never put all their eggs in a single basket. The best never invest more than 15% of their total portfolio in a single stock. This proactive management of risk goes a long way when a crisis hits.

- Avoid sectoral exposure: It is equally important to remember that stocks in the same sector move together and industry-specific factors would have a similar impact on all of them. This makes sectorial exposure, or investing heavily in a single sector very risky. The best practice is to ensure that no single sector makes up over 35% of the portfolio. By following this simple practice of investing across sectors, many investors would have escaped bankruptcy after the dot com crash in 2000s and other crashes that have happened since.

- Avoid market cap exposure: Macroeconomic factors tend to have a similar impact on companies with comparable market capital. Therefore, it is important to have a balanced portfolio that has stocks from large-cap, mid-cap and small-cap companies. The best practice is to have 40%-50% large-cap, 30%-40% mid cap and 20%-30% small cap. With this ideal balance, an investor can achieve benchmark or above-benchmark returns.

- Low correlation between investments: As a whole, the three best practices listed above work to reduce correlation between each of the investment that makes up the portfolio. In simple terms, correlation means interdependence of the investments. Low correlation would ensure that assets move up and down at different points in time, ensuring that the overall portfolio is stable despite the bears and bulls of the market.

Easy & quick

Easy & quick

Leave A Comment?