Why Isn’t Suzlon’s Share Price Reviving?

In this article:

- About the company

- Suzlon share price – Out of winds or winds in sails?

- Suzlon’s trajectory after 2008 crisis

- Suzlon’s financial outlook

- Suzlon’s current shareholding pattern

- Signs of revival and risks involved

Suzlon Energy Ltd. is probably one of the most speculative stock in the Indian share market. The stock lies dormant in many portfolios with investors hoping for a revival in Suzlon share price. Today Suzlon is considered as a penny stock. But this wasn’t always the case. In 2008, Suzlon share price was at its peak at Rs 459 (4th January 2008). But as on 9th November 2021, Suzlon share price has plummeted to Rs 7.15. Suzlon is a penny stock now. A stock once adored by the stock market has now turned to be a wealth destructor. In this article, we will try to identify the reasons for such a catastrophic decline in Suzlon share price.

Suzlon Energy: Out of wind or wind in the sails?

Suzlon energy is a curious case of two opposites – Bulls and Bears. Formerly Suzlon share price was at the peak of Indian business landscape. However, the story of this wind power giant is a great academic case study. In the past one year, Suzlon share price has registered a slight turnaround as the company has reduced debt and is expecting renewed demand ahead. But in the past year the company’s sales growth has reduced by 25%.

This is even though India’s total wind capacity has grown by 4% in FY 2020. So what happened to Suzlon share price? Why did the stock plummet from Rs 459 to Rs 7.10? What went wrong with Suzlon share price? . The fall in Suzlon share price points towards over ambitious promoters who dared to chew more than they could digest. Suzlon’s share price took a turn for worse when promoters started to ignore Indian markets in order to acquire international markets. This move provided ample opportunities to competitor companies like Gamesa, GE, Enercon and Vestas to snatch away domestic market share from Suzlon.

Suzlon’s trajectory after 2008 crisis

Suzlon energy was also caught on a completely wrong foot during the financial crisis of 2008. When Lehman Brothers collapsed, order flow from two of the biggest energy markets of the world – Europe and the US stopped completely. Suzlon share price decline started as credit flow almost stopped. This led to shutting down of its blade making factory in Pipestone, Minnesota. In the next year, the company’s net profit had fallen by 335% despite achieving 100% top line growth (Y-O-Y). It even registered a loss for six straight years starting from FY10 to FY15. Servicing its debt became a major problem for the company.

Suzlon Energy Ltd. acquired 66% stake in RE Power from its French rival Areva. The move was considered to be a masterstroke but Suzlon Energy couldn’t deliver. In order to restructure its debt, the company decided to sell off its most priced asset – RE Power (operating under the name of Senvion) in 2015. This move reduced its debt to Rs Rs.17,323.23 crores. Due to this move, Suzlon’s share price showed a little recovery by making a high of Rs.21 in 2015. But it did not sustain for long. Post-acquisition, interest cost kept ballooning and the company missed out on exploiting huge growth potential offered by India. It also missed out on other emerging markets due to high debt on its books and liquidity shortage. You can find out how Suzlon Energy started and became one of the biggest wind energy companies in the world and largest in Asia. How taking too much debt on the balance sheet hampered company and what other factors led to it’s fall. CA Paras Matalia digs deeper in to Suzlon and shares his views on whether you should hold or exit from this company.

Now that you know the history of Suzlon share price, let us understand the future of Suzlon share price. For this, let’s study key financial aspects of the company.

Financial and Business Outlook on Suzlon Share Price

. ROCE reflects how well a company is deploying its capital employed. Deducting current liability from total assets is capital employed into a business. The ROCE of Suzlon is 11% in FY 21. Thisindicates that the company is unable to deploy its capital efficiently. This reflects on Suzlon’s share price and low return on equity after accounting for taxes, interests and other stakeholders.

- Cash flow conversion

The cash flow conversion of Suzlon is 39%. This means that only 39% of operating earnings get converted into operating cash flow. The increasing profit is not helpful for increasing cash flows required in business operation.

- Highly cyclical industry

Unpredictable order book and earnings causes Suzlon’s share price to be highly volatile.

- Below average growth rate

Negative sales growth, low price earnings growth (PEG) ratio all indicate a slow paced growth. This is why Suzlon Ltd. is not a wealth creator stock.

Current Shareholding Pattern

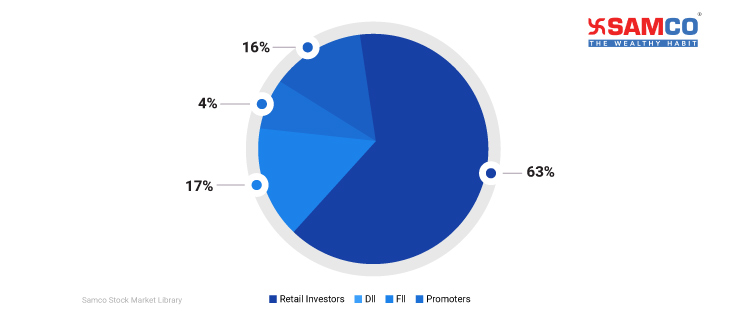

Data as on September 2021[/caption]

Data as on September 2021[/caption]Even though domestic institutional investors (DII) own 17% of Suzlon Energy Ltd shares, it does not indicate a positive outlook. Investors should not misinterpret this information. They should know that this investment by public sector units (PSUs) is a factor of debt converted into equity. Hence, this holding can be called as a forceful one.

Risks

- Supply chain risk – Fluctuation in prices of underlying materials like steel, copper etc, is a big risk for Suzlon and may impact Suzlon share price negatively.

- Execution struggles – Suzlon and wind industry as a whole has been struggling to execute projects. This is due to the delay in land approvals, central and state level auctions, project lifecycle risks etc. Timely execution of project is important as it is a capital-intensive business.

- Covid19 risk: The pandemic has introduced a new array of risks like interest rate risk, credit risk, foreign exchange risk that Suzlon is already trying to mitigate.

Signs of revival in Suzlon Share Price?

The COVID-19 pandemic still continues to impact global economies and global energy demand. In 2020, there was a 4% contraction in global energy demand. But the demand is expected to rise by 4.2% in 2021. This is on the back of rapidly evolving technology, declining production cost etc. The policy reforms by various governments presents perfect scenario for renewable energy companies like Suzlon. India has set a target of 175 gigawatts (GW) of renewable energy by 2022. This includes 60 GW wind energy. India has already crossed ~32 GW wind installations out of which Suzlon possesses cumulative installations to over 11 GW in India and over 17 GW globally. Market outlook for the global wind industry looks positive.

Current government initiatives like – Make in India, 24×7 power, Atmanirbhar India are all aiming to create low carbon energy systems. This in turn will boost use of renewable energy at a very large scale. Suzlon Energy Ltd has launched 2 variants of a new turbine model and optimized previous models to generate higher yield. These promising developments show that Suzlon’s management is focused on spending for research & development of technologies. Despite scope and management efforts, Suzlon’s share price is low due to several risks. Suzlon energy’s downfall finds its root in an over ambitious promoter trying to capture more in one shot. But this strategy seldom works. Recent thrust of Government of India to reduce its dependence on coal to meet its energy requirements will see resurgence of renewable sector.

Suzlon’s improved balance sheet in last couple of years points towards a better future but will it be able to survive and compete with global giants with firm footprint? Only the time will tell. For more useful articles on trading, investing and market knowledge, visit our stock market library section. (Note: The above list is for information purpose only. Avoid trading and investing based on the information given above. Before investing in stocks do your own due diligence).

Easy & quick

Easy & quick

Leave A Comment?