In this article, we will discuss:

- Maximising Profits and Minimising Risks: What Do They Entail?

- Striking the Right Balance Between Maximum Profit and Minimum Risk

- Find the Optimal Risk-Reward Balance with Options B.R.O

Did you know that 9 out of 10 options traders — or around 90% of retail participants in the F&O segment — suffered losses in the market in FY22? A study by the Securities and Exchange Board of India (SEBI) revealed these alarming statistics. Additionally, the losses were not penny change; they amounted to ₹1.1 lakhs on average!

At Samco Securities, we decided to take a closer look at this alarming state of affairs to decode the reasons behind these losses. Is it because traders do not maximise their profits adequately, or because they do not focus on minimising the risks involved?

Ultimately, it is a combination of the two.

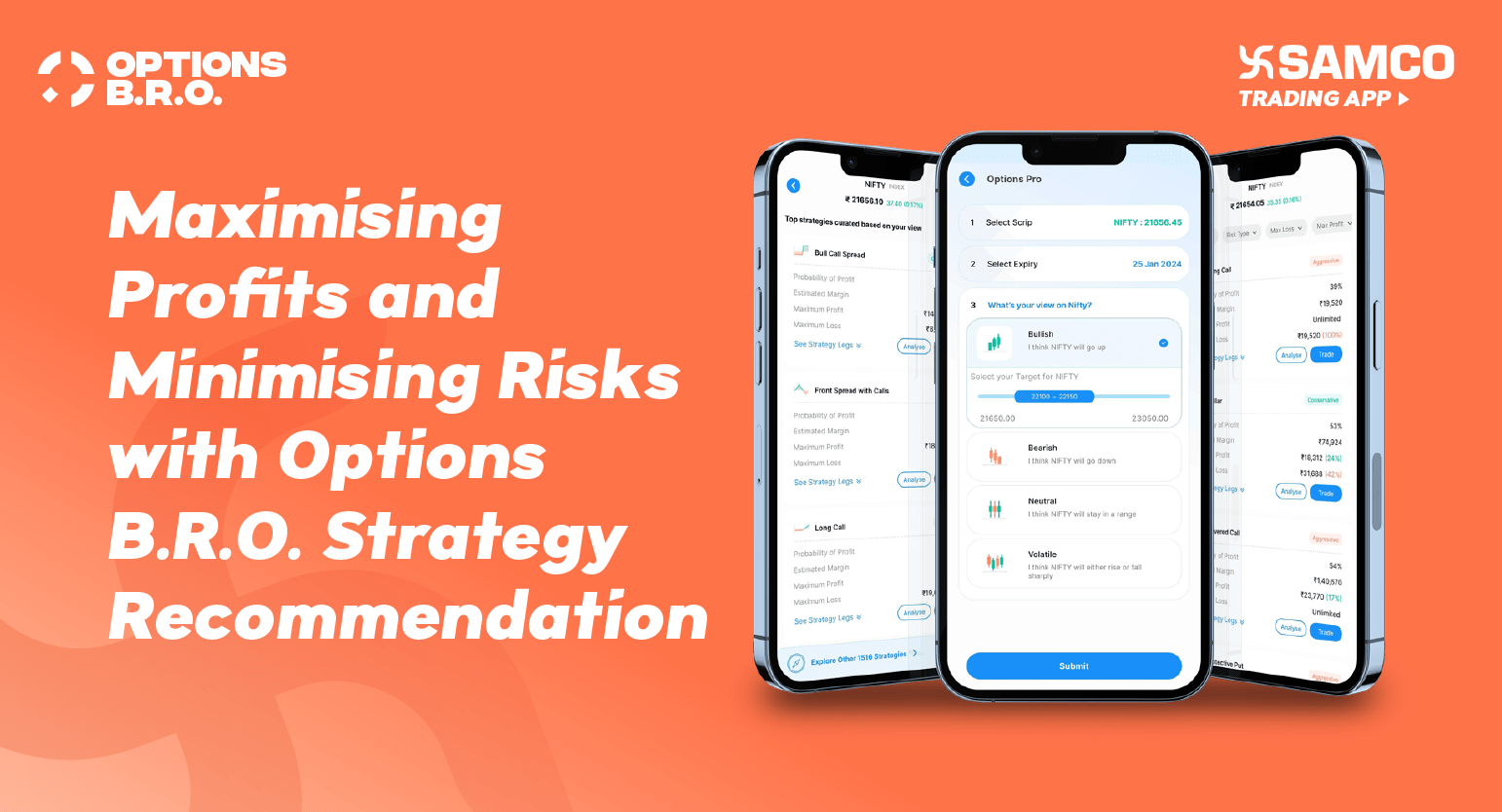

To help option traders in India overcome these twin hurdles and identify winning strategies that simultaneously improve the probability of profits and cut down the possibility of losses, we have launched Options B.R.O. — a new flagship feature in the Samco trading app. With this feature, you can filter out option trading strategies that align with your market view and sort them based on various crucial parameters like maximum profit or loss, probability of profit and even Samco’s proprietary risk-reward ratio.

But why even attempt to find the optimal risk-reward scenario? How does that work? And how can Options B.R.O. in the Samco trading platform help you with this? These are the questions we’ll attempt to answer here.

Maximising Profits and Minimising Risks: What Do They Entail?

To earn the maximum possible profit while taking the minimum possible risk, it takes a lot more than just choosing an option to trade in. Let’s break down the finer details of these two primary goals of every option trader in India.

Maximum Profits

To maximise profits in options trading, you need to have a solid grasp of market trends and volatility. You must also pay close attention to the assets underlying your options and evaluate how their prices are likely to move.

The type of options you need to trade in depends largely on your market outlook. For instance, you can profit from rising markets if you buy call options, but to gain in declining markets, put options may be more ideal. Timing is crucial too; entering and exiting trades at the right moments can significantly enhance your gains.

Additionally, the strategy you choose can greatly influence the profit potential of your trades. A few, like spreads or straddles, can maximise the returns while also offering some level of protection from downside risks.

Minimum Risks

To minimise risks in options trading, you need to adopt a disciplined approach and have a clear risk management strategy. You can start by only investing money you can afford to lose, as options trading can be speculative and carries a high level of risk. It also helps if you utlise stop-loss orders to limit potential losses on trades that don’t work in your favour.

Strategies like covered calls or protective puts can help mitigate losses because they provide some level of insurance against adverse price movements. Another way to effectively spread and manage your risk more effectively is to diversify your portfolio across different types of options and underlying assets.

To do this, however, you need to thoroughly research and understand the options you're trading in, including how they react to the underlying asset’s price (delta and gamma), their time decay (theta) and how they're affected by market volatility (vega).

Striking the Right Balance Between Maximum Profit and Minimum Risk

Let's take the example of the butterfly spread strategy — a multi-legged approach that helps you maximise profits while minimising risks in a neutral market. This strategy is especially useful if you expect a stock’s price to move slightly but not significantly in either direction.

So, for instance, say you're tracking a stock that is currently priced at ₹500, and you predict it will not move dramatically in the time till expiry. To capitalise on this expected stability, you decide to set up a butterfly spread as outlined below.

Setting Up a Butterfly Spread

First, you buy one in-the-money (ITM) call option with a lower strike price (say ₹450) and one out-of-the-money (OTM) call option with a higher strike price (say ₹550). Both these options must have the same expiration date. Next, you sell two at-the-money (ATM) call options with a strike price of ₹500, which is where the stock is currently trading.

The two long positions at either side of the market price form the ‘wings’ of the butterfly, while the two short positions at the market price make up its body, so to speak.

Maximising Profits with the Butterfly Spread

Your goal is for the stock to be as close to the strike price of the short positions (₹500) as possible at expiration. If the stock ends up exactly at ₹500, the call options you sold will expire worthless, so you can profit from the option premiums. Meanwhile, the value of the long call options (the wings) increases (though not significantly because one is ITM and the other is OTM).

The maximum profit occurs if the stock price is at or near the strike price of the sold calls at expiration. This profit is the difference between the premiums received and paid, minus the initial cost of setting up the spread.

Minimising Risks with the Butterfly Spread

The net upfront costs that you incur to set up the butterfly spread make up the maximum risk you're exposed to. The beauty of this strategy lies in its built-in risk management. Unlike other strategies that can expose you to unlimited losses, your maximum loss in the butterfly spread is limited to your initial investment alone.

Furthermore, by choosing strike prices carefully based on your market outlook and the stock's volatility, you can tweak the strategy to favour either a bullish or bearish scenario slightly. This adds a layer of flexibility to your risk management techniques.

Find the Optimal Risk-Reward Balance with Options B.R.O

Every option trading strategy has its pros and cons. Options B.R.O. makes it easy for you to evaluate these two sides of the coin effortlessly, within seconds, in the Samco trading app itself. This way, you do not miss out on crucial options trading opportunities.

To use this new analytical tool in the Samco trading platform, simply enter a few key details like the option you want to trade in, its expiry and your market outlook. Options B.R.O from Samco then analyses thousands of options contracts and strategies and performs lakhs of computations within seconds — to recommend the top 3 strategies for your market outlook, according to your risk profile.

You can further streamline the risk-reward balance in each strategy by checking how the expected profit/loss varies across different target dates. What’s more, you can even filter the hundreds of strategies that align with your outlook based on the risk they carry, the maximum loss, the maximum profit and the probability of profits in each strategy.

With so many options to refine your strategy choice, the sky’s the limit with Options B.R.O. You can tailor your trade to be as risk-heavy or safe as you’re comfortable with. Ultimately, whether you are a conservative, moderate or aggressive investor, try Options B.R.O. in the Samco trading app today and discover winning trading strategies that align with your risk profile and your market outlook — all free of cost!

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?