In this article, we will discuss:

- Introduction

- What Are The Strategy Legs?

- What Will Be The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Understanding Strategy Greeks

- Things To Keep In Mind

Introduction

Options are derivative contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on a certain date. Options can be used for various purposes, such as hedging, speculation, income generation, or arbitrage.

One of the option strategies that can be used by traders who have a slightly bearish view on the market is the Front spread with puts strategy. This strategy involves buying one put option (usually at the money) and selling two put options (usually out of the money) such that the strike price of the put option sold is lower than the strike price of the put option bought. All the put options belong to the same underlying security and have the same expiration date.

The Front spread with puts strategy is also known as the Put ratio vertical spread or the Put ratio front spread. The ratio represents the number of puts bought or sold, and the front indicates that there are more short contracts than long ones.

What Are The Strategy Legs?

The Front spread with puts strategy has three legs:

- Buy one put option at the money (ATM)

- Sell two put options out of the money (OTM)

For example, suppose Nifty 50 is trading at 17,800 on February 24, 2024. A trader who expects Nifty 50 to decline moderately in the next month can implement the Front spread with puts strategy by:

- Buying one put option with a strike price of 17,800 and an expiration date of March 31, 2024, for a premium of ₹185

- Selling two put options with a strike price of 17,700 and an expiration date of March 31, 2024, for a premium of ₹100 each

The net premium received by the trader is ₹15 (100 x 2 - 185).

What Will Be The Payoff?

The payoff of the Front spread with puts strategy depends on the price of the underlying security at expiration. The maximum profit, maximum loss, and breakeven points are as follows:

- Maximum profit = ( [strike price of put option bought - strike price of put option sold] + net premium received) x lot size

- Maximum loss = unlimited below the lower breakeven point

- Breakeven point = strike price of put option sold - ( [strike price of put option bought - strike price of put option sold] + net premium received)

In the example above, the maximum profit, maximum loss, and breakeven point are:

- Maximum profit = ( [17,800 - 17,700] + 15) x 50 = ₹5,750

- Maximum loss = unlimited below 17,485

- Breakeven point = 17,700 - ( [17,800 - 17,700] + 15) = 17,485

The trader will make a profit if Nifty 50 closes between 17,485 and 17,815 on March 31, 2024. The maximum profit of ₹5,750 will be achieved if Nifty 50 closes at 17,700. The trader will start making a loss if Nifty 50 closes below 17,485, and the loss will increase as Nifty 50 declines further. The trader will break even if Nifty 50 closes at 17,485 or 17,800.

Who Can Deploy This Strategy?

The Front spread with puts strategy is suitable for traders who have a moderate risk appetite and a slightly bearish outlook on the market. Since this strategy involves unlimited risk, it requires careful management and monitoring. This strategy is not recommended for beginners or risk-averse traders.

When Should This Strategy Be Deployed?

The Front spread with puts strategy should be deployed when the trader expects the underlying security to decline moderately, but not sharply, in the near term. If the trader is extremely bearish on the market, then this strategy should be avoided or modified by buying the put options at a deeper out of the money strike price.

Understanding Strategy Greeks

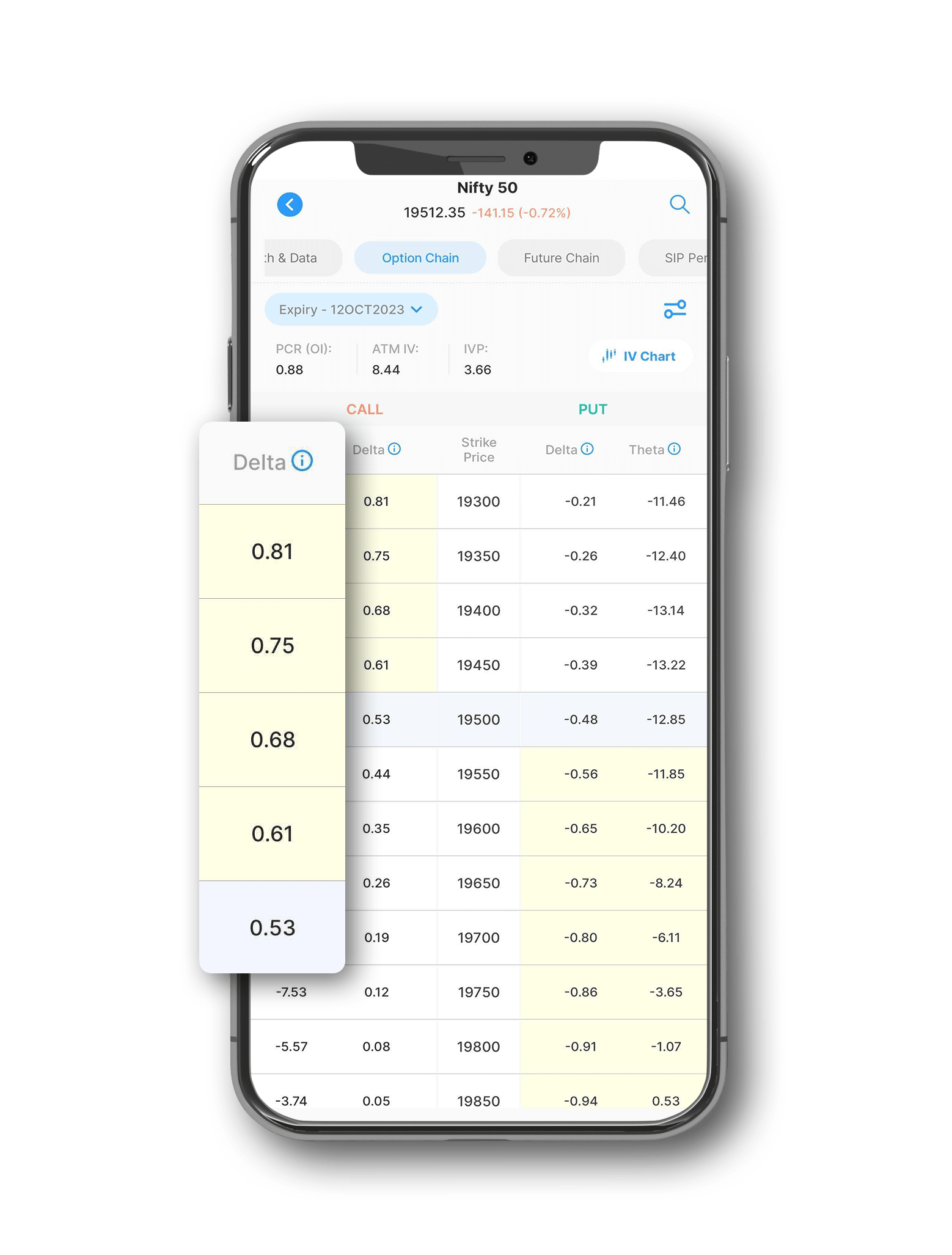

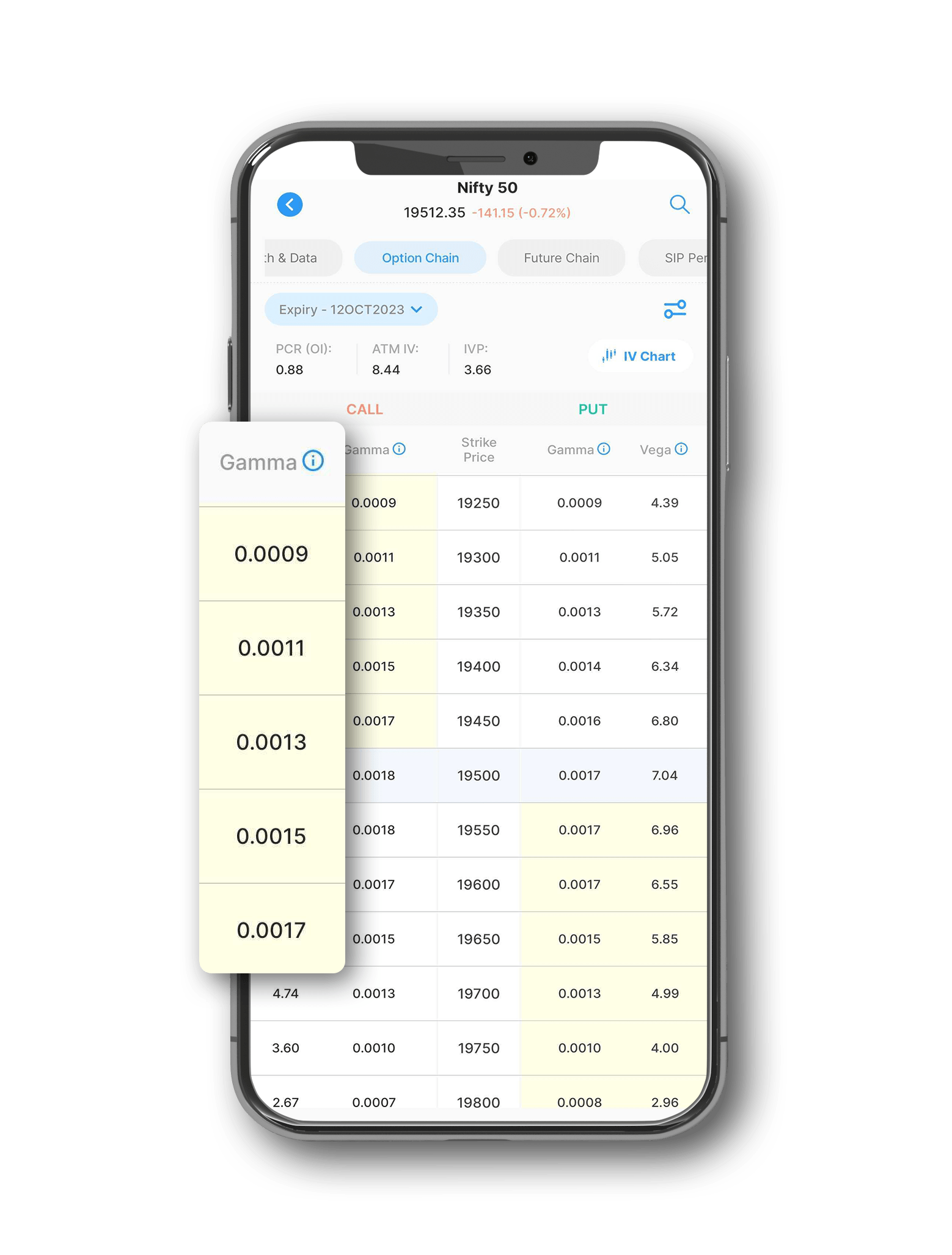

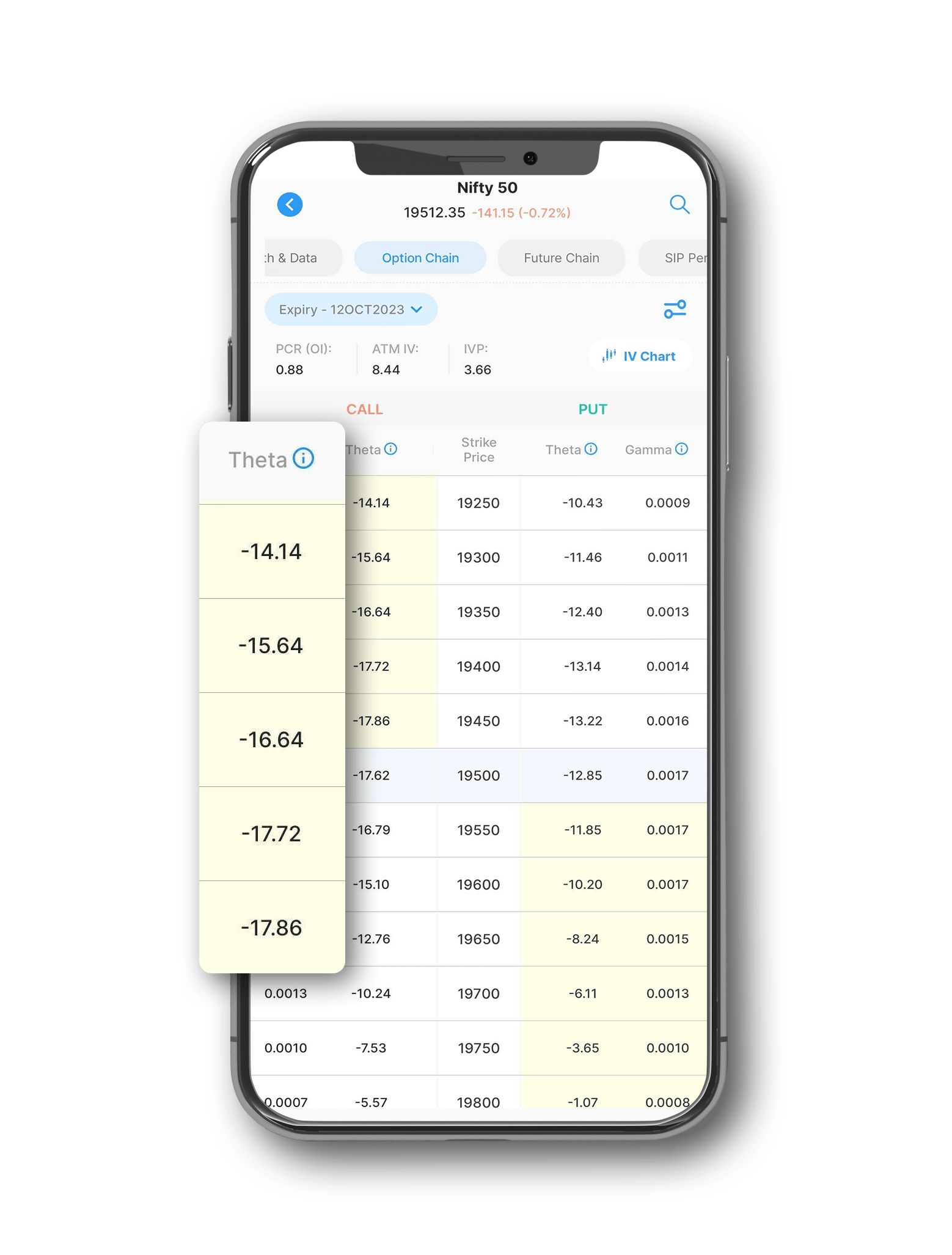

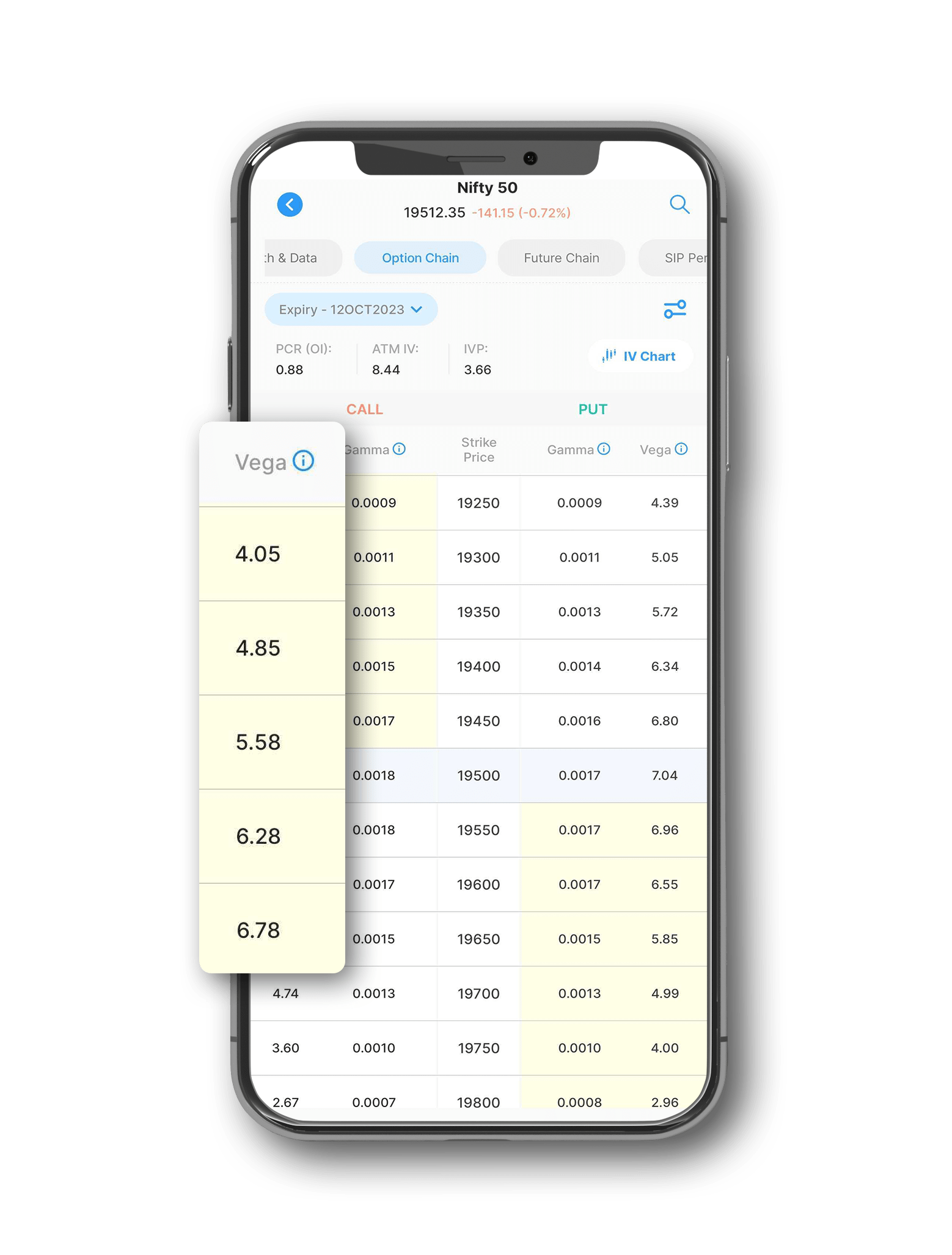

The Greeks are the parameters that measure the sensitivity of an option's price to various factors, such as the price of the underlying security, the volatility of the market, the time to expiration, and the interest rate. The main Greeks that affect the Front spread with puts strategy are delta, gamma, theta, and vega.

Delta measures the change in the option's price for a unit change in the price of the underlying security. The Front spread with puts strategy has a negative delta, meaning that the value of the strategy decreases as the price of the underlying security increases, and vice versa.

Gamma measures the change in the option's delta for a unit change in the price of the underlying security. The Front spread with puts strategy has a negative gamma, meaning that the delta of the strategy becomes more negative as the price of the underlying security decreases, and vice versa. This implies that the strategy becomes more sensitive to the price movements of the underlying security as it moves away from the strike prices of the put options.

Theta measures the change in the option's price for a unit change in the time to expiration. The Front spread with puts strategy has a positive theta, meaning that the value of the strategy increases as the time to expiration decreases, and vice versa. This is because the strategy benefits from the decay of the extrinsic value of the put options, especially the ones that are sold.

Vega measures the change in the option's price for a unit change in the volatility of the underlying security. The Front spread with puts strategy has a negative vega, meaning that the value of the strategy decreases as the volatility of the underlying security increases, and vice versa. This is because the strategy suffers from the increase in the extrinsic value of the put options, especially the ones that are sold.

Things To Keep In Mind

The Front spread with puts strategy is a complex and risky option strategy that requires careful planning and execution. Some of the things that the trader should keep in mind while deploying this strategy are:

- The trader should have a clear and realistic view on the direction and magnitude of the price movement of the underlying security.

- The trader should select the strike prices and expiration date of the put options based on the risk-reward profile and the break-even point of the strategy.

- The trader should monitor the market conditions and the Greeks of the strategy regularly and adjust the position accordingly.

- The trader should have a contingency plan in case the market moves against the view. For example, the trader can buy another put option with a lower strike price to limit the downside risk in case of a sharp decline in the underlying security.

- The trader should be aware of the margin requirements and the transaction costs of the strategy and factor them in the profitability analysis.

Samco Options B.R.O. is a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?