In this article, we will disucss:

- What Are Strategy Legs?

- What Will Be The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Understanding Strategy Greeks

- Things To Keep In Mind

What Are Strategy Legs?

A bull call spread is a type of vertical spread, which means it involves buying and selling options of the same type (calls or puts) and the same expiration date, but with different strike prices. In a bull call spread, the trader buys one call option and sells another call option such that the strike price of the call option sold is higher than the strike price of the call option bought. Usually, the strike price of the call option bought is around at the money level, which means it is close to the current market price of the underlying asset.

For example, suppose a trader is bullish on Nifty, which is currently trading at 15,000. The trader can create a bull call spread by buying a Nifty call option with a strike price of 15,000 and an expiration date of one month, and selling a Nifty call option with a strike price of 15,500 and the same expiration date. The trader pays a premium of ₹200 for the call option bought and receives a premium of ₹100 for the call option sold. The net premium paid is ₹100, which is also the maximum loss that the trader can incur in this strategy.

The two options involved in a bull call spread are called the strategy legs. The call option bought is called the long leg, while the call option sold is called the short leg.

What Will Be The Payoff?

The payoff of a bull call spread depends on the price of the underlying asset at the expiration date. The trader can close the position before the expiration date by reversing the trades, but for simplicity, we will assume that the trader holds the position till the expiration date.

The maximum loss that the trader can incur in a bull call spread is limited to the net premium paid. This happens when the price of the underlying asset is below or equal to the strike price of the long leg at the expiration date. In this case, both the options expire worthless and the trader loses the net premium paid.

The breakeven point of a bull call spread is the strike price of the long leg plus the net premium paid. This is the price at which the trader neither makes a profit nor a loss. In our example, the breakeven point is 15,000 + 100 = 15,100.

The maximum profit that the trader can make in a bull call spread is limited by the strike price of the short leg. This happens when the price of the underlying asset is above or equal to the strike price of the short leg at the expiration date. In this case, the long leg is in the money and the short leg is at the money. The trader exercises the long leg and buys the underlying asset at the strike price of the long leg, and sells it at the strike price of the short leg. The difference between the two strike prices is the gross profit, which is reduced by the net premium paid. In our example, the maximum profit is (15,500 - 15,000) - 100 = 400.

The profit increases as the price of the underlying asset moves above the breakeven point, until it reaches the strike price of the short leg. The profit becomes stagnant after the price of the underlying asset reaches the strike price of the short leg.

The following table summarises the payoff of a bull call spread at different prices of the underlying asset at the expiration date.

Price of underlying asset | Payoff of long leg | Payoff of short leg | Net payoff |

Below or equal to 15,000 | -200 | +100 | -100 |

Between 15,000 and 15,500 | -200 + (price - 15,000) | +100 | -100 + (price - 15,000) |

Above or equal to 15,500 | -200+ (price - 15,000) | +100 - ( Price - 15500) | 400 |

Who Can Deploy This Strategy?

A bull call spread is a suitable strategy for traders who are moderately bullish on the underlying asset and expect a mild rise in its price in the near term. It is also a strategy for beginners who have a conservative risk approach. Since this strategy involves limited profit and limited loss, the trader's capital is relatively safe in this strategy. At the same time, the trader's losses are also capped.

A bull call spread is also a cheaper way of buying a call option, as the premium paid is reduced by the premium received from selling another call option. This lowers the breakeven point and increases the probability of making a profit.

When Should This Strategy Be Deployed?

A bull call spread suits a trader bullish on the asset but uncertain of the extent. Clear target price and time horizon are essential. Consider underlying assets and option implied volatility. High volatility increases chances of short leg strike hit, affecting profit potential. High implied volatility impacts net premium and break even point. Choose strike prices carefully for risk-reward ratio. For high confidence, sell deep out of the money call for "high risk high reward." For less upside, sell slightly higher strike call to narrow strike price differences.

Understanding Strategy Greeks

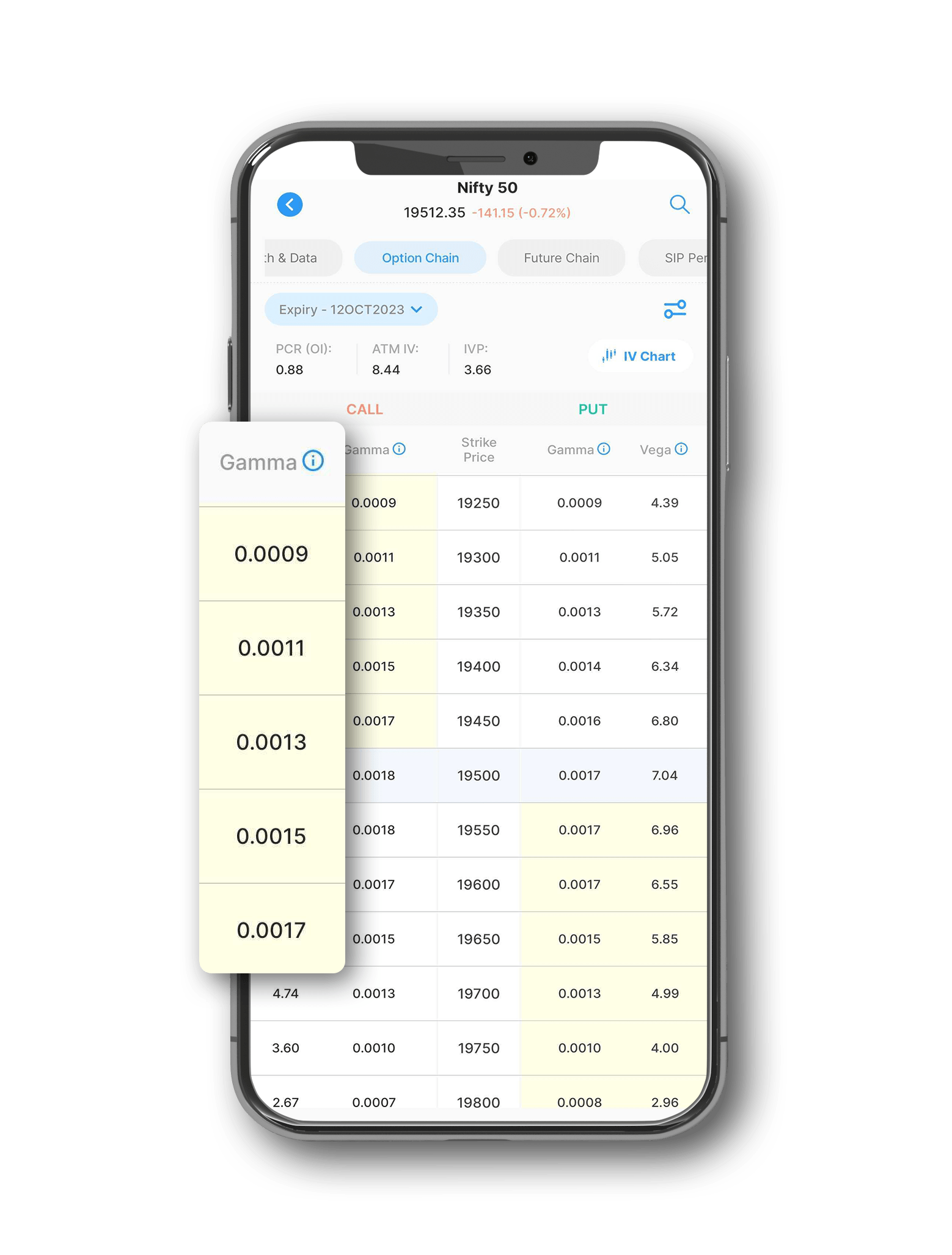

Gamma measures the delta change relative to the underlying asset's price. In a bull call spread, it's positive. Gamma increases as expiration nears.

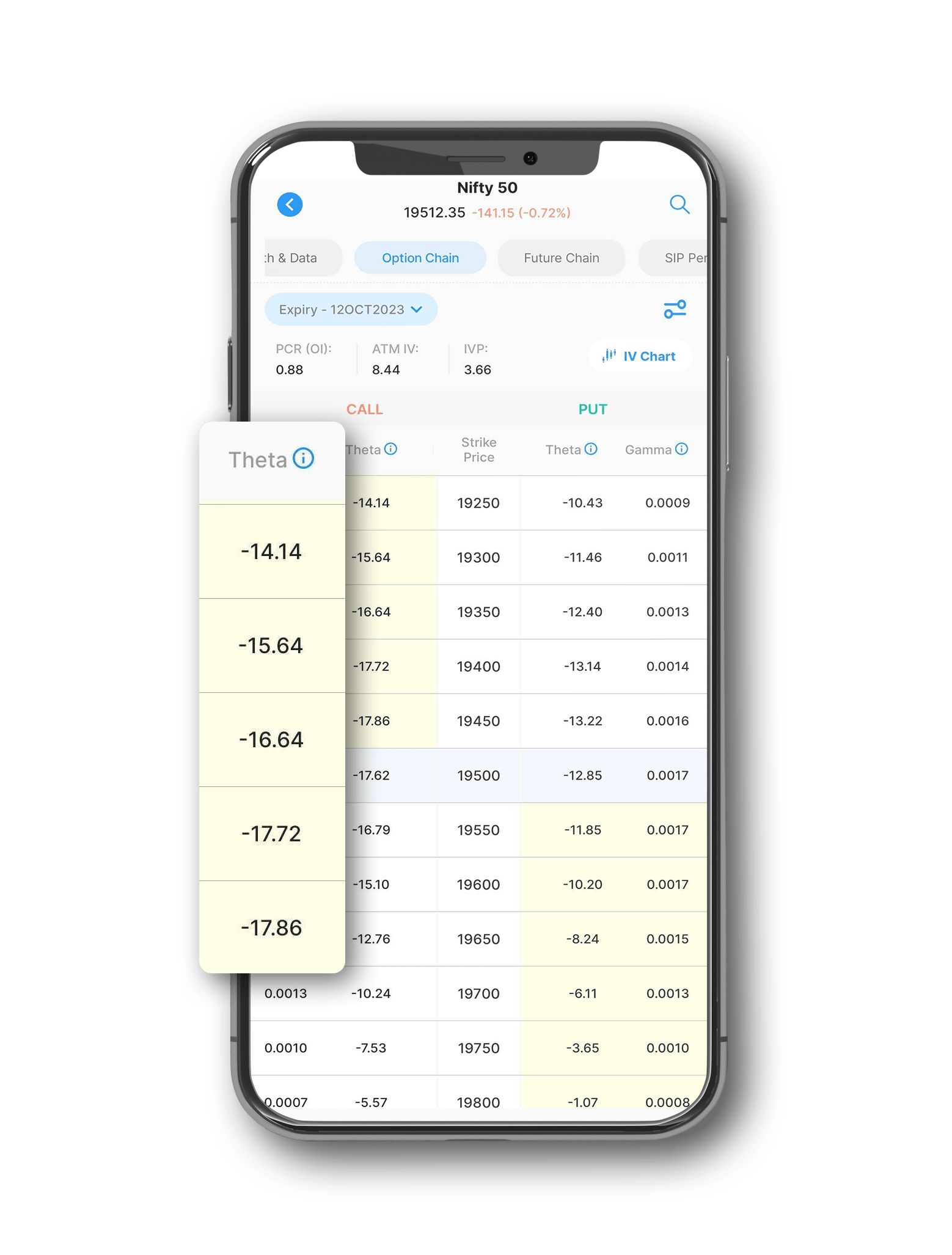

Theta measures price change with time to expiration. Bull call spreads have negative theta, losing value as expiration nears. Theta in bull call spread is lower than a long call strategy because short call in the bull call spread helps to reduce time value.

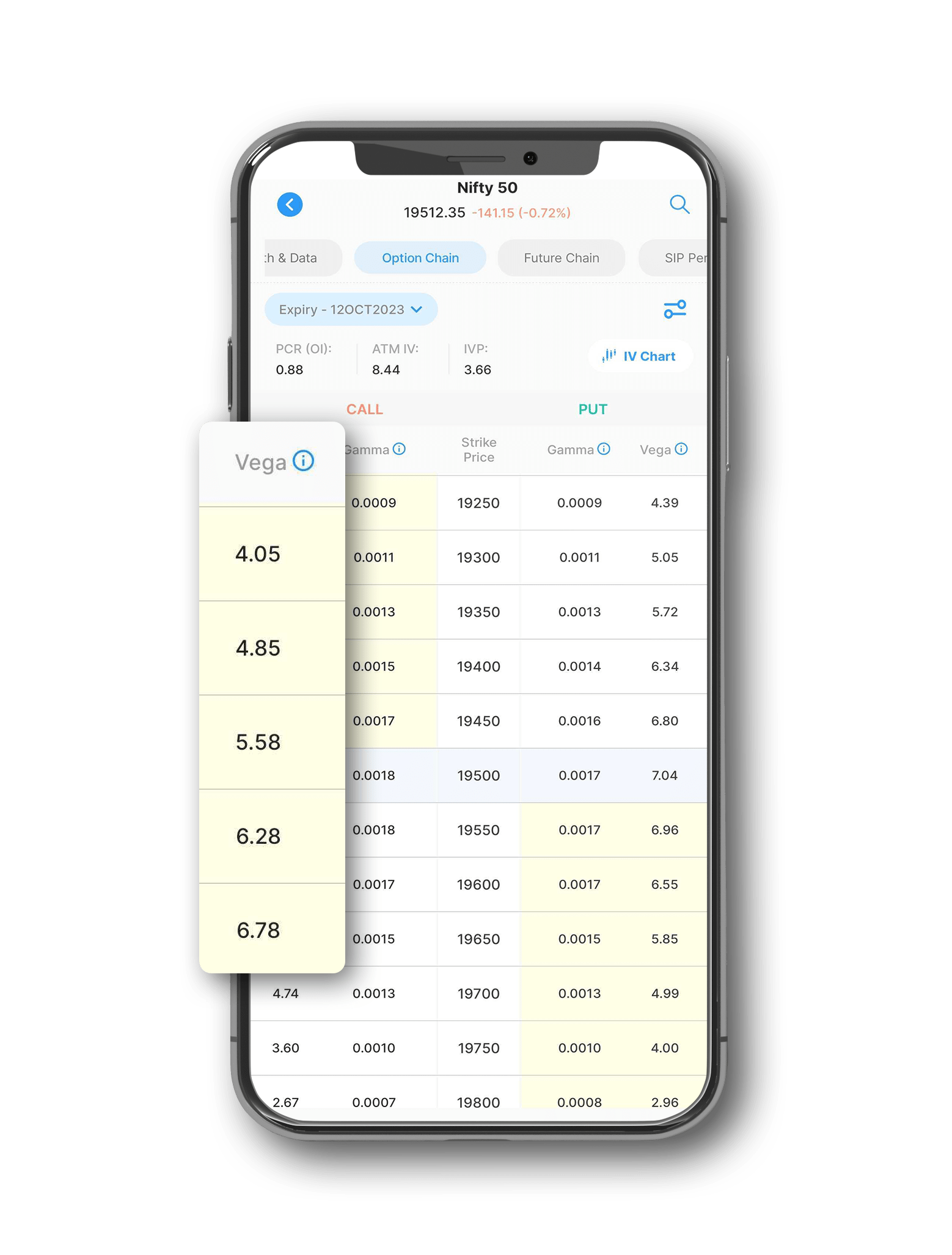

Vega measures price change with implied volatility. Bull call spreads have positive vega, gaining value with increased volatility and losing with decreased volatility. Vega is lower than in a long call and highest near the long leg's strike price.

Things To Keep In Mind

A bull call spread is a simple and effective strategy for bullish markets, but it also has some limitations and risks that the trader should be aware of. Some of the things to keep in mind while deploying a bull call spread are:

- Since this strategy involves limited risk, there is no need to maintain a stop loss. However, the trader should monitor the position regularly and close it if the market view changes or the target price is reached.

- Since this strategy is a complete hedge, the trader can trade with less margins as well. However, the trader should ensure that the sequence of order placement is buying a call option and then selling a call option, to get the most out of the hedge benefits on margin.

- The trader should also consider the impact of dividends, corporate actions, and other events that may affect the price of the underlying asset and the options. These events may alter the payoff and the breakeven point of the strategy, and may require adjustments or early exit.

- The trader should also be aware of the liquidity and the bid-ask spread of the options involved in the strategy. A low liquidity and a high bid-ask spread may affect the execution and the profitability of the strategy.

A bull call spread is a versatile and popular strategy for options traders who are moderately bullish on the underlying asset. By choosing the appropriate strike prices and expiration dates, the trader can customise the risk-reward ratio and the breakeven point of the strategy. By understanding the strategy of Greeks and the factors that affect them, the trader can optimise the performance and the profitability of the strategy. By keeping in mind the limitations and the risks of the strategy, the trader can avoid potential losses and maximise the gains. Try out Samco’s Options B.R.O. a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?