In this article, we will discuss:

- What Are Strategy Legs?

- What Will Be The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Understanding Strategy Greeks

- Things To Keep In Mind

A bull put spread is a type of options trading strategy that involves selling and buying put options with different strike prices. It is a bullish strategy that aims to profit from a moderate rise in the price of the underlying stock.

What Are Strategy Legs?

A bull put spread consists of two legs: a short put and a long put. A short put is an option contract that gives the seller an obligation to buy the underlying stock at a specified price (called the strike price) on a certain date (called the expiration date). A long put is an option contract that gives the buyer the right to sell the underlying stock at a specified price on expiry date.

In a bull put spread, the trader sells one put option and buys one put option such that the strike price of the put option bought is lower than the strike price of the put option sold. For example, suppose a trader expects the price of Reliance Industries Ltd. (RIL) to rise from its current level of ₹2,000 per share. The trader can sell a put option with a strike price of ₹1,900 and buy a put option with a strike price of ₹1,800, both expiring in one month. The trader will receive a net premium of ₹50 per share for this trade.

What Will Be The Payoff?

The payoff of a bull put spread depends on the price of the underlying stock at the expiration date. The maximum profit, maximum loss, and breakeven point of a bull put spread can be calculated as follows:

- Maximum profit: The maximum profit occurs when the price of the underlying stock is above the strike price of the short put at expiration. In this case, both the put options expire worthless and the trader keeps the net premium received. The maximum profit is equal to the net premium received multiplied by the number of shares. For example, if the trader sells and buys 100 put options of RIL, the maximum profit is ₹5,000 (₹50 x 100).

- Maximum loss: The maximum loss occurs when the price of the underlying stock is below the strike price of the long put at expiration. In this case, the trader has to buy the underlying stock at the strike price of the short put and sell it at the strike price of the long put, resulting in a loss. The maximum loss is equal to the difference between the strike prices of the put options minus the net premium received, multiplied by the number of shares. For example, if the trader sells and buys 100 put options of RIL, the maximum loss is ₹5,000 (₹100 - ₹50 x 100).

- Breakeven point: The breakeven point is the price of the underlying stock at which the trader neither makes a profit nor a loss. It is equal to the strike price of the short put minus the net premium received. For example, if the trader sells and buys 100 put options of RIL, the breakeven point is ₹1,850 (₹1,900 - ₹50).

Who Can Deploy This Strategy?

A bull put spread is a suitable strategy for beginners who have a conservative approach to options trading. Since this strategy involves limited profit and limited loss, the trader's capital is relatively safe in this strategy. At the same time, the trader's losses are also capped, which reduces the risk of losing more than the initial investment. A bull put spread also requires less margin than a naked put, which means the trader can use leverage more efficiently.

When Should This Strategy Be Deployed?

A bull put spread is deployed when the trader is bullish on the underlying stock, but not too bullish. If the trader is very confident of the stock's upward movement, a simple long call or a bull call spread might be a better alternative, as they offer better profit potential. However, if the trader expects the stock to move up slowly or stay within a certain range, a bull put spread can be a good choice, as it allows the trader to profit from the time decay and the volatility decrease of the options.

Understanding Strategy Greeks

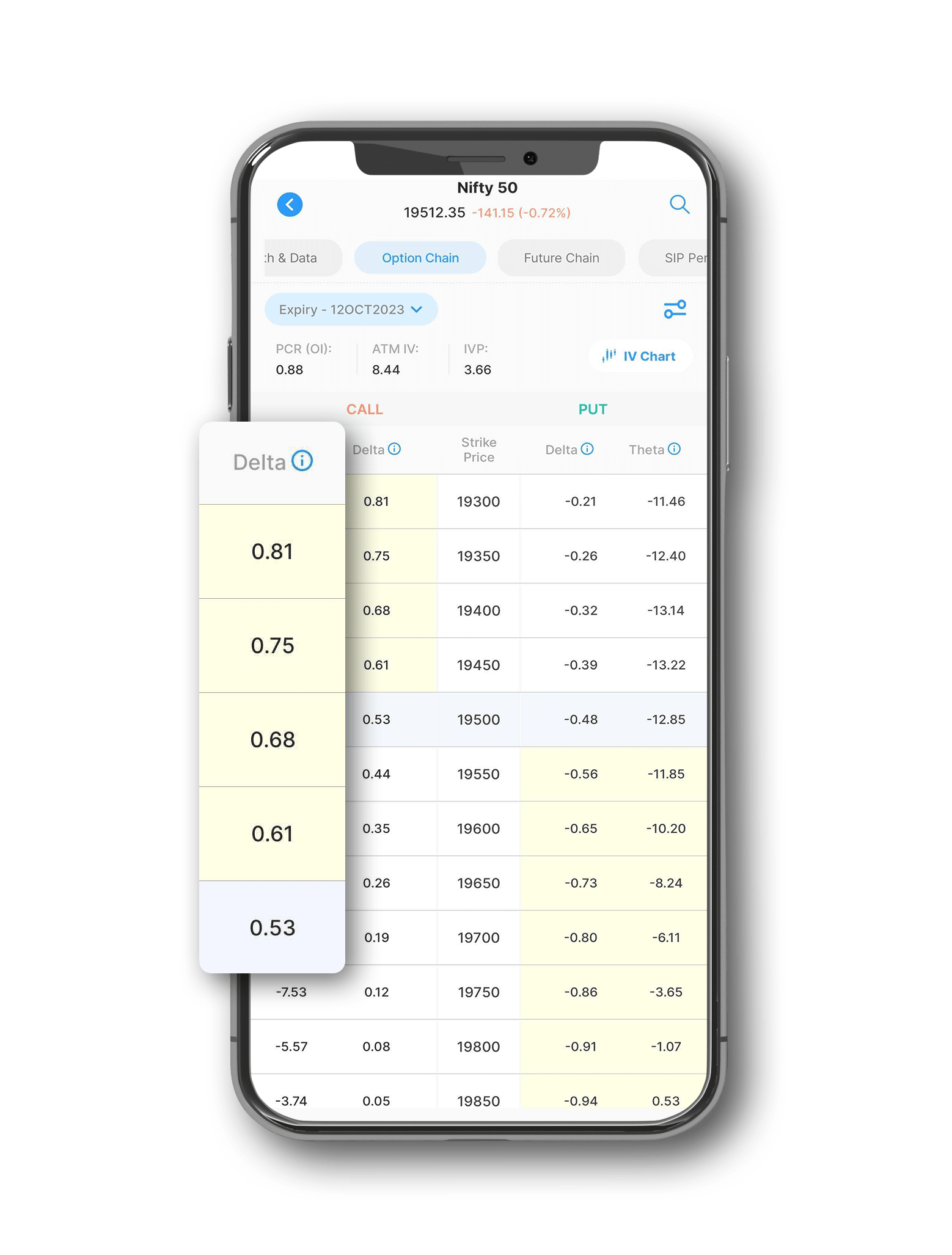

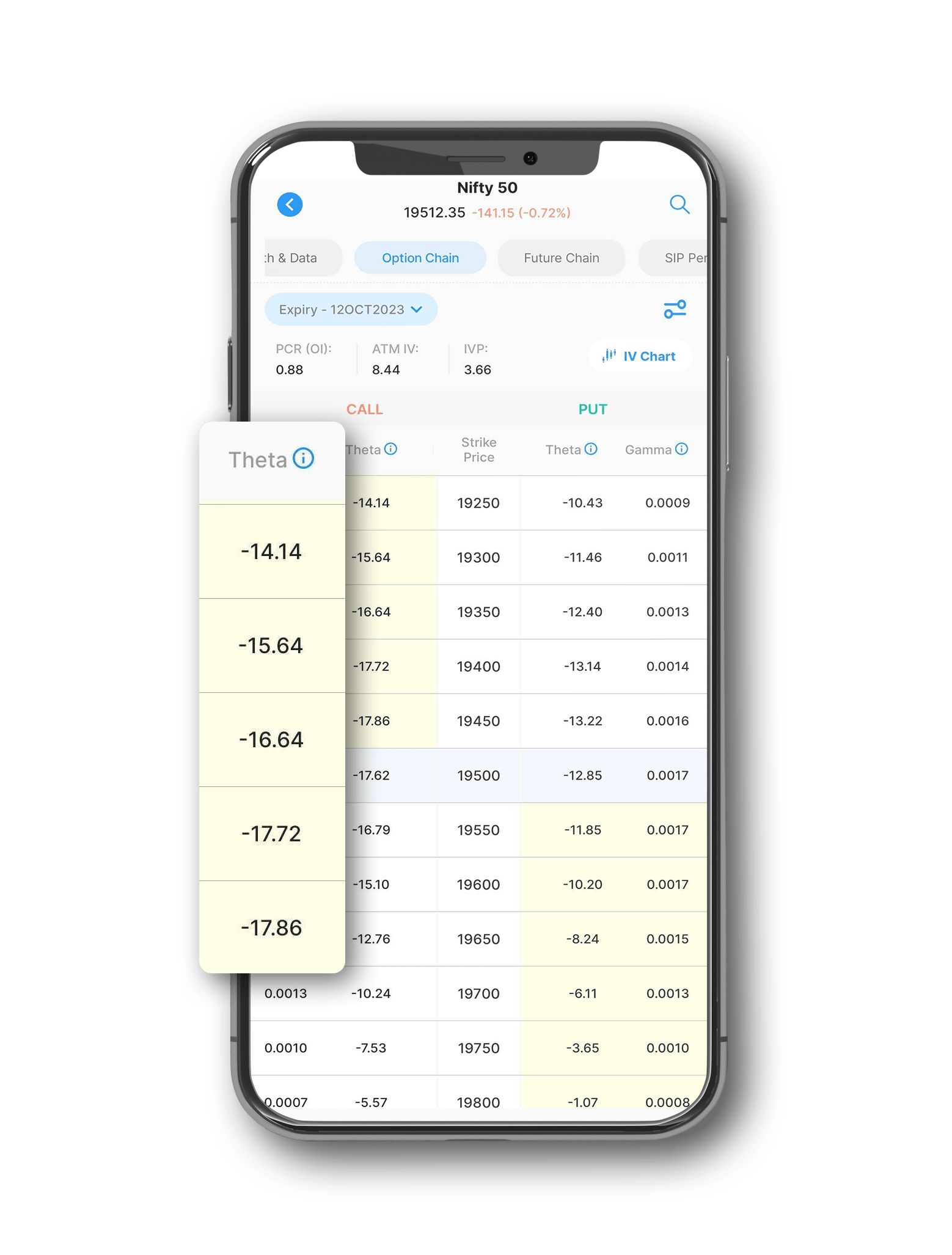

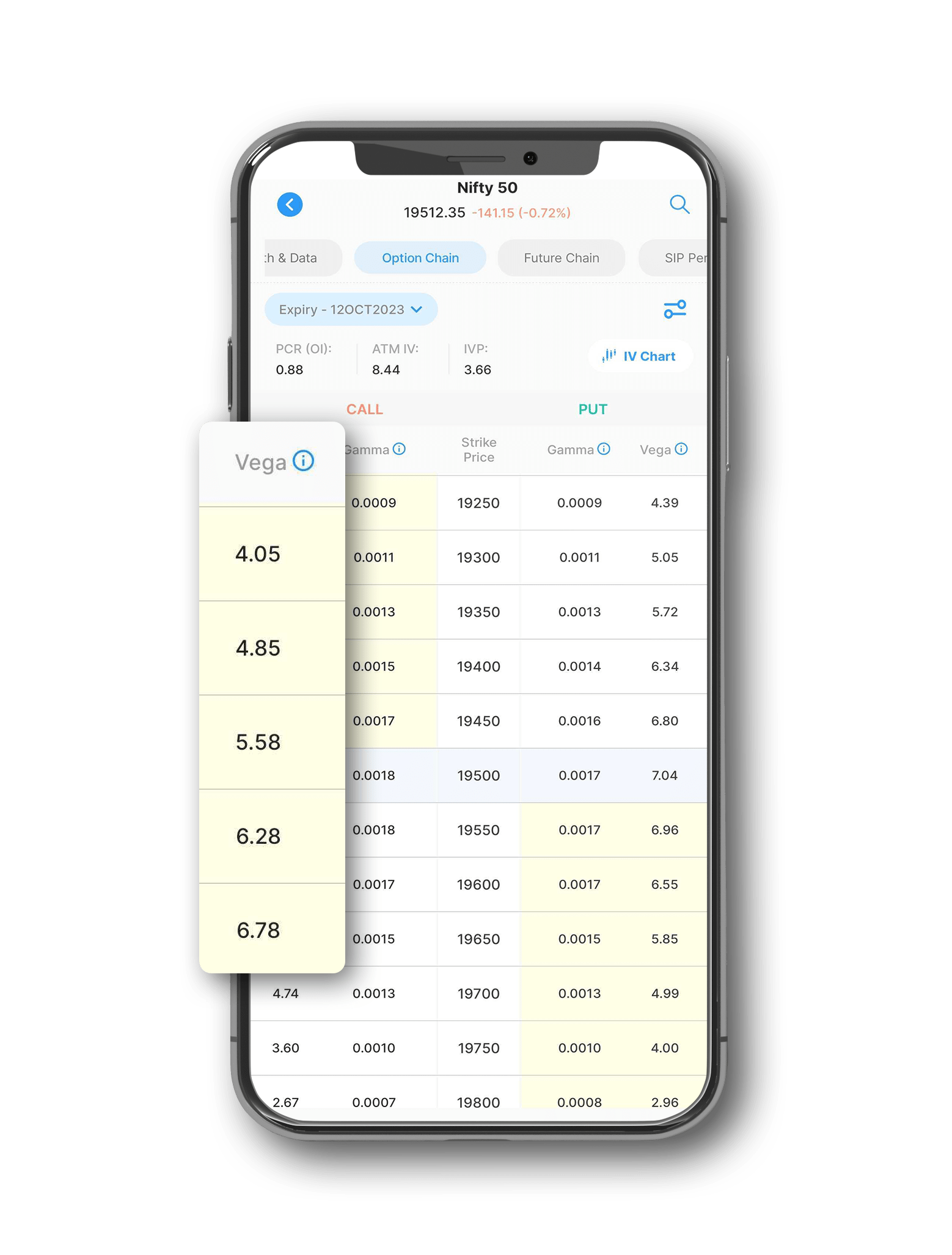

The Greeks are the parameters that measure the sensitivity of an option's price to various factors, such as the stock price, the time to expiration, the volatility, and the interest rate. The main Greeks that affect a bull put spread are delta, theta, and vega.

Delta measures the change in the option's price for a unit change in the stock price. A bull put spread has a positive delta, which means it benefits from a rise in the stock price. The delta of a bull put spread is equal to the difference between the deltas of the short put and the long put. For example, if the delta of the short put is -0.4 and the delta of the long put is -0.2, the delta of the bull put spread is 0.2 ( -0.4 - (-0.2) ). This means that for every ₹1 increase in the stock price, the bull put spread gains ₹0.2 in value.

Theta measures the change in the option's price for a unit change in the time to expiration. A bull put spread has a positive theta, which means it benefits from the passage of time. The theta of a bull put spread is equal to the difference between the thetas of the short put and the long put. For example, if the theta of the short put is 0.05 and the theta of the long put is 0.03, the theta of the bull put spread is 0.02 ( 0.05 - 0.03 ). This means that for every day that passes, the bull put spread gains ₹0.02 in value.

Vega measures the change in the option's price for a unit change in the volatility. A bull put spread has a negative vega, which means it benefits from a decrease in volatility. The vega of a bull put spread is equal to the difference between the vegas of the short put and the long put. For example, if the vega of the short put is -0.1 and the vega of the long put is -0.08, the vega of the bull put spread is -0.02 ( -0.1 - (-0.08) ). This means that for every 1% increase in volatility, the bull put spread loses ₹0.02 in value.

Things To Keep In Mind

A bull put spread is a simple and effective strategy for bullish traders who want to limit their risk and profit from time decay and volatility decrease. However, there are some things to keep in mind before deploying this strategy:

- Since this strategy involves limited risk, there is no need to maintain a stop loss. However, the trader should monitor the stock price and the option prices regularly and be ready to exit the trade if the market conditions change unfavourably.

- Since this strategy is a complete hedge, the trader can trade with less margins than a naked put. However, the trader should be aware of the margin requirements and the margin calls of the broker and the exchange, and maintain sufficient funds in the trading account.

- To get the most out of the hedge benefits on margin, the sequence of order placement should be buying a put option and then selling a put option. This way, the trader can reduce the margin requirement and lock in the net premium received.

- A bull put spread can be closed before expiration by buying back the short put and selling the long put. The trader should compare the costs and benefits of each method and choose the one that maximises the profit or minimises the loss.

Try out Samco’s Options B.R.O. a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?