Introduction:

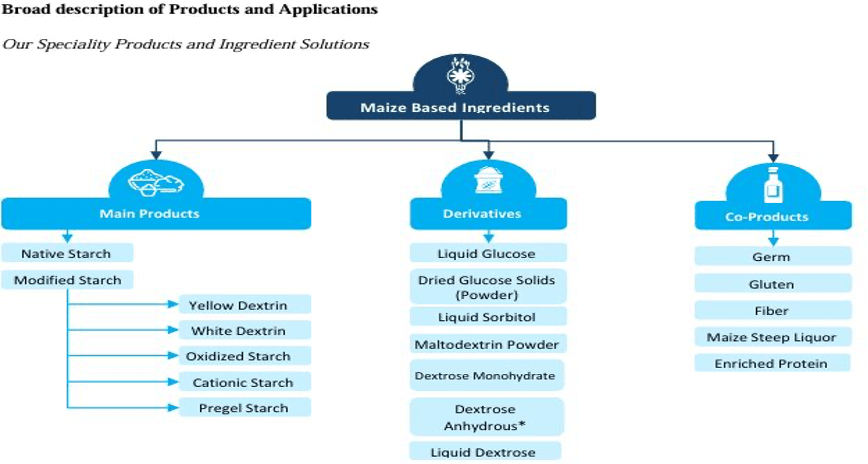

One of the major manufacturers of plant-based specialty products and ingredient solutions in India for food, animal nutrition and other industrial applications.

With an installed capacity of 3,63,000 tons per annum (1,100 tons per day), they are the 5th largest manufacturer of maize based specialty products and ingredient solutions in India.

Few of their products include –

- Liquid Glucose

- Dried Glucose Solids

- Modified Maize Starches

- And many more

Their products are exported to nearly 49 countries across Asia, Africa, Middle East, Americas, Europe and Oceania, during Fiscal 2024.

IPO Details:

IPO Date | 19th July-2024 to 23rd July-2024 |

Face Value | ₹ 2/- per share |

Price Band | ₹ 90 to ₹ 95 per share |

Lot Size | 150 shares and in multiples thereof |

Issue Size | ₹ 510 crores |

Fresh Issue | ₹ 397 crores |

OFS | ₹ 113 crores |

Expected Post Issue Market Cap (At upper price band) | ~ ₹ 1,731 crores |

Objects of Issue:

- Funding the capex requirement for expansion of the Dhule Facility

- Repayment of certain borrowings

- General Corporate Purposes

Key Strengths:

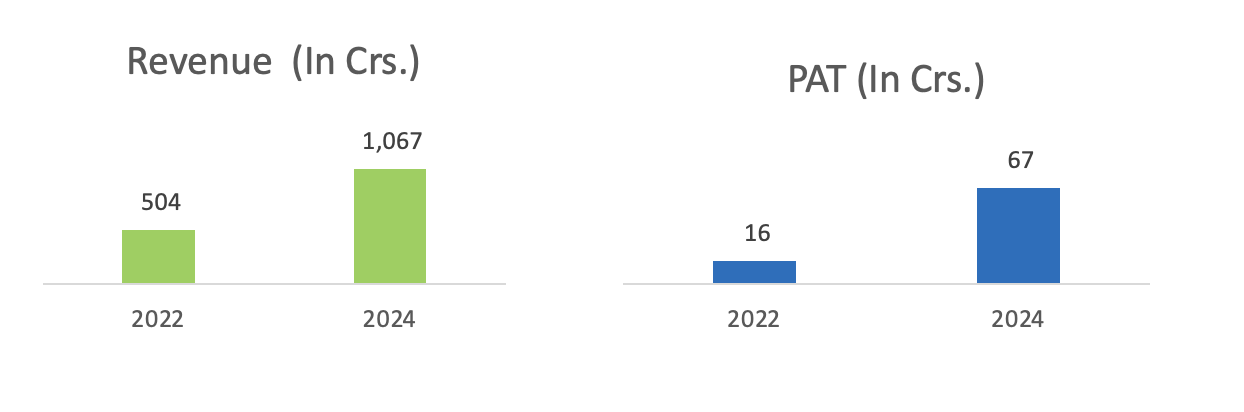

- Strong financial growth along with robust performance metrics. The revenues grew at a CAGR of 45% and PAT by 105% from fiscal 2022-24.

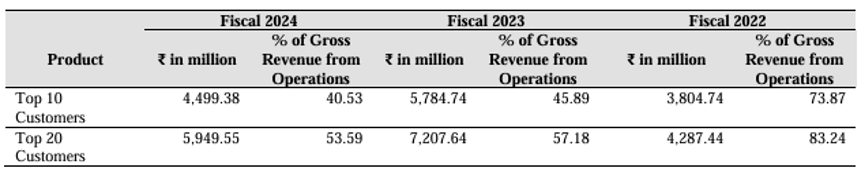

- Large, diversified customer base with long lasting relationships.

- Diverse product portfolio covering diverse industry segments would act as a catalyst for company’s growth.

- Global presence in a market with high entry barriers

Risks:

- With already low PAT margins, any vide fluctuations in raw material prices can affect product pricing and impact the company's financial health.

- Lack long-term supplier contracts due to which any shortages of raw materials would result in rising costs harming the business and operations.

- Storing maize from peak harvest until processing blocks a large portion of the working capital.

- Operates in a highly competitive market scenario due to which their bargaining power reduces.

Financial Snapshot:

Particulars | FY24 | FY23 | FY22 |

Revenue from operations (Rs. In Crores) | 1,067 | 1,205 | 504 |

YoY Growth | -11% | 139% | |

EBITDA (Rs. In Crores) | 98 | 72 | 40 |

YoY Growth | 36% | 80% | |

EBITDA Margin | 9.2% | 6.01% | 7.87% |

PAT (Rs. In Crores) | 67 | 42 | 16 |

PAT Margin | 6.17% | 3.46% | 3.15% |

RoCE | 25.43% | 23.82% | 23.19% |

Conclusion:

The listed peers namely Gujarat Ambuja Exports, Gulshan Polyols, Sukhjit Starch and Chemicals are trading at 18x, 70x, and 15x earnings valuations and Sanstar is expected to bring its IPO at 20 times valuations and the RoCE stands at 18.2%, 4.31% and 12.6% respectively while Sanstar is at 25.43%. These comparisons suggests that Sanstar’s IPO is fairly valued.

Additionally, the financials reveal some concerns, as the revenues declined from FY2023 to FY2024. However, the bottom line improved because of lowering of raw material costs and other expenses.

Considering the company’s growth potential, financials, and valuations we would suggest our investors to subscribe to this IPO for listing gains.

Easy & quick

Easy & quick

Leave A Comment?