Business Overview:

It is an Indian company that manufactures textile yarn. Its operations are divided into three business verticals:

- Polyester yarn products

- Cotton yarn products

- Yarns for technical textiles and Industrial uses.

The company's products are manufactured at its facility in Silvassa, India. The company was incorporated in 2005 as Sanathan Textiles Private Limited and converted into a public limited company in 2021. it is one of the few companies in India with a presence across the polyester, cotton, and technical textiles sectors.

It derives majority of its revenue from domestic sales made in the states of Gujarat, Maharashtra, and Punjab. The company also exports its products to 7 countries, and in Sep-24 it had 925 distributors.

IPO Details:

IPO Date | 19th Dec-24 to 23th Dec-24 |

Face Value | ₹ 10/- per share |

Price Band | ₹ 305 to ₹ 321 per share |

Lot Size | 46 shares and in multiples thereof |

Issue Size | ₹ 550 crores |

Fresh Issue | ₹ 400 crores |

OFS | ₹ 150 crores |

Expected Post Issue Market Cap (At upper price band) | ~ ₹ 2709 crores |

Objects of the Issue:

- Repayment or pre-payment, of certain outstanding borrowings (Rs. 160. Crores)

- Investment in its subsidiary, Sanathan Polycot Private Limited, for repayment of borrowings availed by it (Rs. 140 Crores)

- Balance general corporate purposes

Strengths:

- One of the few companies in India with a presence across the polyester, cotton, and technical textiles This diversity helps the company to insulate itself from economic upheavals and uncertain events.

- Focus on product development of new products through process innovation.

- Strong customer relationships and a vast distribution network: It has a strong long-term relationship with its customers. As of Sep-24, STL had 925 distributors in 7 countries, including 916 distributors in India.

- High-capacity utilization: As of June 30, 2024, STL's facility in Silvassa had a production capacity of 223,750 MTPA. Interestingly its capacity utilization is over 100%.

Risks:

- Highly dependent on distributors, during the FY-24, sales through its distributors accounted for 94.5% of the company's revenue from operations.

- Concentrated Risk, derives the majority of its revenue from sales in the states of Gujarat, Maharashtra, and Punjab (~65.1%)

- The textile industry is very cyclical, a global economic slowdown could lead to a decrease in demand for products, impacting the company’s revenues and profitability.

- Operates in a competitive industry, faces competition from both domestic and international yarn manufacturers. If it fails to compete effectively, it could lose market share.

- Since the company is operating at max capacity it has to incur significant capex to increase it revenues.

Financial Highlights:

Particulars | FY2024 | FY2023 | FY2022 |

Revenue from operations (Rs. In Crores) | 2,975 | 3,329 | 3,185 |

Growth in Revenues | -10.6% | 4.5% |

|

EBITDA (Rs. In Crores) | 227 | 259 | 538 |

Growth in EBITDA | -12.4% | -51.8% |

|

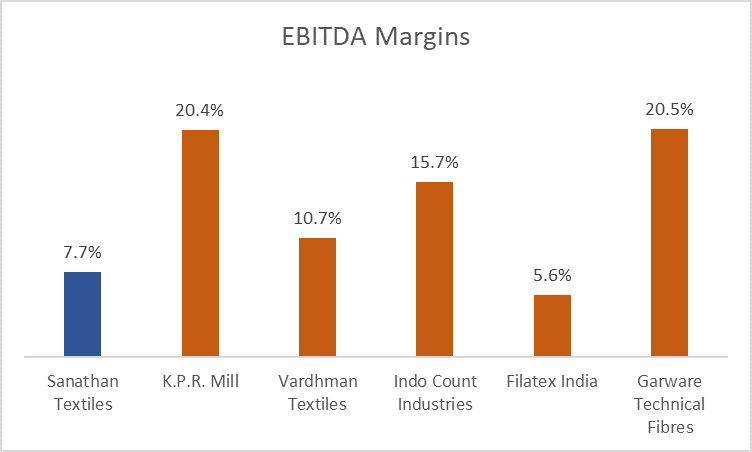

EBITDA Margins | 7.7% | 7.8% | 16.9% |

PAT (Rs. In Crores) | 134 | 153 | 355 |

PAT Margins | 4.5% | 5% | 11.1% |

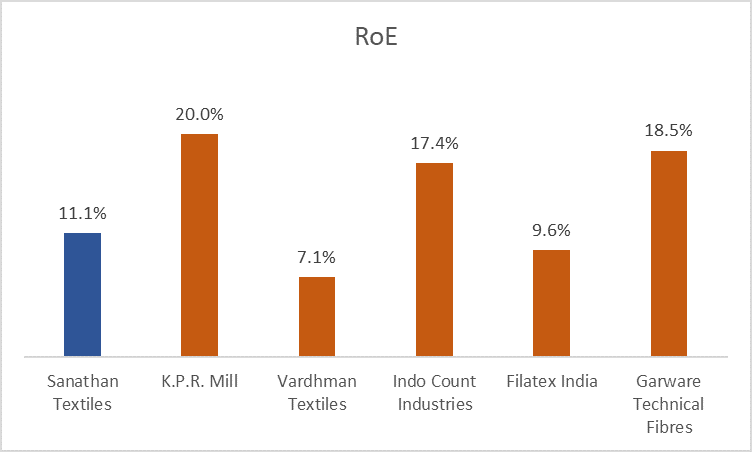

RoE | 11.1% | 14.4% | 44% |

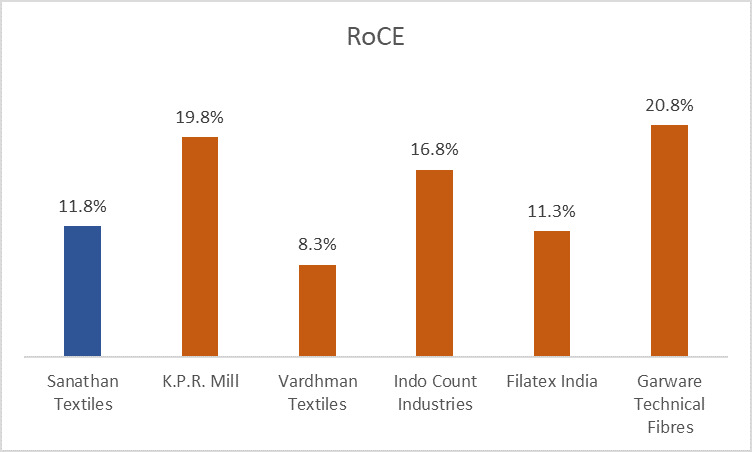

RoCE | 11.8% | 15.5% | 35.8% |

Conclusion:

Indian Textile and Apparel Industry Growth

The Indian textile and apparel market is projected to grow at a CAGR of 6.0-7.0% between Fiscal 2024 and 2028 to become a market of Rs. 12,500 Bn by fiscal 2028.

Further, domestic sales and exports are projected to grow at an average CAGR of 5%, 7.5% respectively till fiscal 2028.

Indian Textile Yarn Market Growth:

The overall cotton yarn production is expected to grow at a CAGR of 5.5 - 6.5% from fiscals 2024 to 2028.

Indian Technical Textile Industry Growth:

The Indian technical textile industry is projected to grow at a CAGR of 11.5-12.5% between fiscals 2024-28.

Few factors that are driving the growth are increasing demand for apparel, growth of E-commerce platforms, increase in discretionary income, rising urban population, government policies, and etc.,

The margins are on the lower side then compared with its peers resulting in lower RoE and RoCE being 11.1% and 11.8% respectively.

Comparing the efficiency ratios and margins of its peer’s, and growth potential - earnings valuation of 17x seems to be fair. However, due to the cyclical nature of the industry, low margins leaving no space for better margin of safety, it is advised to avoid this IPO.

Easy & quick

Easy & quick

Leave A Comment?