Gold is a very big part of our lives. From buying gold at birth, weddings, or even as a graduation gift, gold is truly the ‘shining metal’.

Since ages, gold has maintained its value and is the perfect way of passing wealth from one generation to another. While retail investors consider gold as a precious metal, for traders, gold as a commodity is perfect for trading.

Due to its high demand for gold among retail investors and traders, it has remained a popular asset-class for fund managers.

Today let us explore:

Gold is a very big part of our lives. From buying gold at birth, weddings, or even as a graduation gift, gold is truly the ‘shining metal’.

Since ages, gold has maintained its value and is the perfect way of passing wealth from one generation to another. While retail investors consider gold as a precious metal, for traders, gold as a commodity is perfect for trading.

Due to its high demand for gold among retail investors and traders, it has remained a popular asset-class for fund managers.

Today let us explore:

- Gold as a commodity investment

- History of gold

- Investing in gold as a commodity

- The Gold Contract

- The other contracts (Gold Mini, Gold Guinea, Gold Petal

- Gold Spot price

- The historical price movement of gold

Gold as a Commodity

Gold as a commodity can be profitable because:- Unlike other commodities such as oil, rice, wheat, etc. gold cannot get used up or consumed.

- Once gold is mined, it stays in the world forever in the form of jewellery or is kept as reserves against cash, used as collateral against loans, etc.

- Gold is a scarce resource and the process of discovering and mining gold is difficult, ensuring the demand is always higher than supply.

History of Gold

Unlike any other commodity, gold has been a fascination of emperors since historical times. Empires and kingdoms were built and destroyed in an attempt to get more gold. Gold was also used as currency across the world. Fundamentally, gold is considered to be a hedge against inflation. [Recommended reading: History of commodity trading in India]Investing in Gold as a Commodity

Physical Gold can be bought and stored in the form of jewellery like necklaces, earrings, bracelets, bangles, anklets, etc which involves high making charges, ranging from 15% to 20% of the total amount of gold. When you try to sell the same jewellery to a jeweller, he will buy the gold below market rates and cut the making charges too hence, investing in physical gold is not a profitable idea. The easiest way to gain exposure to gold as a commodity is through the stock market, via which you can invest in actual gold bullion or Sovereign Gold Bonds with highly pure gold through your Demat accounts. You can invest in Gold through these options:-

Gold ETF

-

Gold Futures

The Gold Contract

Gold is a very actively traded contract on MCX with a daily trading volume of above Rs. 4,500 Crores. Gold comes in many variants that an investor can choose to trade-in. New investors as well as experienced commodity traders often get confused with these contracts, not knowing the difference between them. Different types of Gold contracts –- Gold (The Big Gold)

- Gold Mini

- Gold Guinea

- Gold Petal

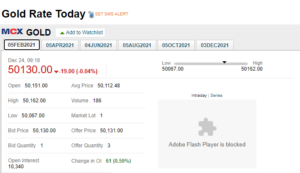

- The above price quotation is for 10 grams of Gold and it shows the last traded price of gold futures on MCX.

- The lot size of “The Big Gold is 1KG (1,000 grams)” we can calculate the contract value – (1000* 50,130) = Rs. 5,01,30,000

- The Margin required to trade in ‘big gold’ would be roughly around 10% of the total amount.

- The contracts expire on the 5th day of every 2 months. Gold contracts are introduced every 2 months, and each contract stays in the system for a year. At any point, you will have 6 contracts to choose from. In the above example, it is 5th February, 5th April, 5th June, etc.

The Other Contracts (Gold Mini, Gold Guinea, Gold Petal)

In the ‘big gold contract,’ a heavy amount of margin is required. Hence lots of traders refrain from trading in the big gold contracts. This is the reason the exchanges have introduced contracts with much lesser margin requirement in the following variants:- Gold Mini

- Gold Guinea

- Gold Petal

| Price Quote | Lot Size | Tick Size | P&L/tick | Expiry | |

| Gold Mini | Rs. per 10 gm | 100 gm | 1 rupee | Rs.10 | 5th day |

| Gold Guinea | Rs. per 8 gm | 8 gm | 1 Rupee | Rs.1 | Last day |

| Gold Petal | Rs. per 1 gm | 1 gm | 1 Rupee | Rs.1 | Last day |

- Tick size is the minimum price change between the different bids and ask prices of an asset traded on an exchange platform.

- P&L/tick is the profit/loss according to each tick movement.

Gold Spot Price:

The spot price of gold represents the current rate at which gold can be purchased or sold at a specified place and time. This price defines the explicit value of gold in the market.| Lot Size | Prices | |

| The Big Gold | 1 KG | Rs. 4,87,70,000 |

| Gold Mini | 10 gm | Rs. 48,770 |

| Gold Guinea | 8 gm | Rs. 39,016 |

| Gold Petal | 1 gm | Rs. 4,877 |

Historical Price Movement in Gold

This chart contains the average annual price for gold from 1964 – present.| Year | Price (24 karat per 10 grams) | Year | Price (24 karat per 10 grams) |

| 1964 | Rs.63.25 | 1992 | Rs.4,334.00 |

| 1965 | Rs.71.75 | 1993 | Rs.4,140.00 |

| 1966 | Rs.83.75 | 1994 | Rs.4,598.00 |

| 1967 | Rs.102.50 | 1995 | Rs.4,680.00 |

| 1968 | Rs.162.00 | 1996 | Rs.5,160.00 |

| 1969 | Rs.176.00 | 1997 | Rs.4,725.00 |

| 1970 | Rs.184.00 | 1998 | Rs.4,045.00 |

| 1971 | Rs.193.00 | 1999 | Rs.4,234.00 |

| 1972 | Rs.202.00 | 2000 | Rs.4,400.00 |

| 1973 | Rs.278.50 | 2001 | Rs.4,300.00 |

| 1974 | Rs.506.00 | 2002 | Rs.4,990.00 |

| 1975 | Rs.540.00 | 2003 | Rs.5,600.00 |

| 1976 | Rs.432.00 | 2004 | Rs.5,850.00 |

| 1977 | Rs.486.00 | 2005 | Rs.7,000.00 |

| 1978 | Rs.685.00 | 2006 | Rs.8,400.00 |

| 1979 | Rs.937.00 | 2007 | Rs.10,800.00 |

| 1980 | Rs.1,330.00 | 2008 | Rs.12,500.00 |

| 1981 | Rs.1,800.00 | 2009 | Rs.14,500.00 |

| 1982 | Rs.1,645.00 | 2010 | Rs.18,500.00 |

| 1983 | Rs.1,800.00 | 2011 | Rs.26,400.00 |

| 1984 | Rs.1,970.00 | 2012 | Rs.31,050.00 |

| 1985 | Rs.2,130.00 | 2013 | Rs.29,600.00 |

| 1986 | Rs.2,140.00 | 2014 | Rs.28,006.50 |

| 1987 | Rs.2,570.00 | 2015 | Rs.26,343.50 |

| 1988 | Rs.3,130.00 | 2016 | Rs.28,623.50 |

| 1989 | Rs.3,140.00 | 2017 | Rs.29,667.50 |

| 1990 | Rs.3,200.00 | 2018 | Rs.31,438.00 |

| 1991 | Rs.3,466.00 | 2019 | Rs.35,220.00 |

| 2020 | Rs.50,130.00 |

Easy & quick

Easy & quick

Leave A Comment?