In our daily lives, we pay tax on everything. From basic necessities like food, clothing, shelter to electricity, internet, movie tickets etc. While we cannot avoid paying taxes, there are various ways through which we can minimise the amount of tax we pay. In this article, we will discuss the 10 best tax saving options in India.

In our daily lives, we pay tax on everything. From basic necessities like food, clothing, shelter to electricity, internet, movie tickets etc. While we cannot avoid paying taxes, there are various ways through which we can minimise the amount of tax we pay. In this article, we will discuss the 10 best tax saving options in India.

In India, taxes are classified as:

- Direct taxes like income tax, property tax, tax on assets etc. &

- Indirect taxes like GST, VAT, excise tax etc.

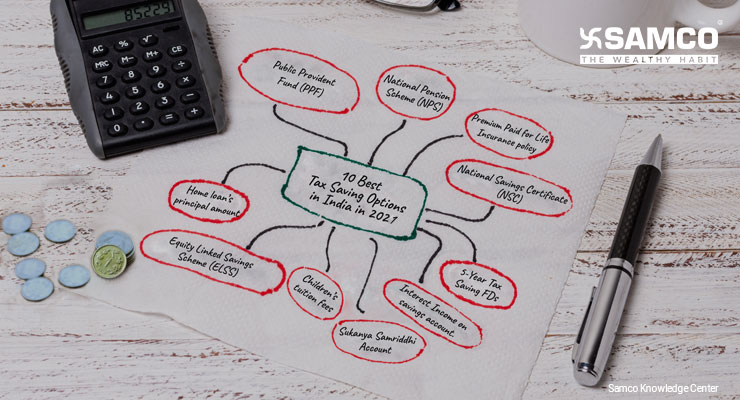

Let us now understand how you can utilise these 10 tax saving options to save tax.

-

Public Provident Fund (PPF)

-

National Pension Scheme (NPS)

-

Premium Paid for Life Insurance policy

-

National Savings Certificate (NSC)

-

Equity Linked Savings Scheme (ELSS)

-

Home loan’s Principal Amount

-

5-Year Tax Saving FDs

-

Sukanya Samriddhi Account

-

Children’s Tuition Fees

-

Interest Income on savings account

Easy & quick

Easy & quick

Leave A Comment?