In this article, we will discuss:

- The Importance of Strategy Selection for Options Traders

- What Goes into Building a Winning Options Strategy?

- Introducing Samco’s Options Strategy Builder Tool

- A 3-Step Guide to Building a Winning Options Trading Strategy with Options BRO

- Why Options BRO from Samco Securities is a Game-Changing Tool for Traders

India’s options trading segment has become a hotbed for retail investors looking to turn quick profits. But recent data has regulators and market experts worried. Instead of taking calculated risks and selecting options trading strategies in an informed manner, most retail traders in this segment continue to regard derivatives trading as mere speculation.

The average time over which individual traders in India hold an options contract is less than 30 minutes! This alarming state of affairs points to one key challenge — India’s options traders currently do not have competent options strategy builder tools required to curate winning strategies.

At Samco Securities, we’re committed to changing this issue, which is why we’ve introduced Options BRO — our proprietary options strategy builder tool. Traders using the Samco trading app can access this industry-first feature free of cost.

The Importance of Strategy Selection for Options Traders

Whether you're looking to hedge your portfolio, speculate on market movements or generate income, the right strategy can help you achieve your goals. However, you need to choose from over 1,000 available options strategies — ranging from simple calls and puts to more complex spreads and combinations.

If you frequently trade in the options segment, it is crucial to select the right one for your trading goals, depending on how you expect the market to move. The strategy you choose can significantly impact your overall profitability or loss.

For instance, say you expect a moderate near-term price increase in a stock. In this case, you may choose to merely buy a call option. But with Samco’s Options strategy builder tool, you may act on the recommendation to execute a bull call spread — where you buy a call option at a lower strike price and sell another call option at a higher strike price. This may limit your upside potential, but it also significantly reduces your risk — making it a smart choice if you're optimistic about the stock but wary of a downturn.

On the other hand, say you believe a stock’s price is due for a decline. Without the right tools, you may speculate and simply purchase a put option. However, with the help of a competent options strategy builder tool like Options BRO in the Samco trading app, you may get to explore a bear put spread — where you buy a put at a higher strike price and sell a put at a lower strike price. This is a more cost-effective way to profit from the expected downturn while also limiting risk.

Moreover, in periods of high market volatility, strategies like iron condors or butterflies can help you capitalise on the lack of directional movement. These strategies, which involve multiple options positions, allow you to profit from the erosion of option premiums over time, provided the underlying asset remains within a specific price range.

What Goes into Building a Winning Options Strategy?

To build a winning options strategy, there are several key factors you need to consider to align your trades with your financial goals and risk tolerance. They include the following:

Options Greeks like delta, theta, gamma and vega tell you how sensitive an option’s price is to various factors. The delta is how much an option's price changes for every ₹1 move in the underlying asset. The gamma tells you how quickly the delta changes as the market moves. The theta, on the other hand, shows the rate at which an option's value decreases as it gets closer to expiration. And the vega reflects how an option reacts to changes in the implied volatility of the underlying asset.

Market Trends and Outlook

Your options strategy must also align with your expectations from the market. If you anticipate a bullish market, you need to consider strategies that profit from upward movements. For a bearish outlook, however, it’s crucial to select strategies that benefit from declines. In sideways markets, on the other hand, you must look for strategies that exploit the lack of price movement.

High implied volatility often leads to higher option premiums, which can be advantageous for sellers. Conversely, low volatility can benefit buyers. Choose strategies that align with the current and anticipated volatility levels.

Before committing to a strategy, understand its maximum potential loss and gain. Opt for strategies that offer a favourable risk-reward balance, ensuring the potential returns justify the risks involved.

Introducing Samco’s Options Strategy Builder Tool

As you can see, it takes a lot to build a winning options trading strategy. In a market that moves a mile a minute, it is practically impossible to perform the mathematical computations required and analyse all the metrics like Greeks, risks, reward, IV and more manually.

Fortunately, Options BRO, our options strategy builder tool, takes care of this for you. This tool leverages advanced analytics to simplify the process of constructing and analysing options strategies. It allows you to customise your strategies based on your personal market views, risk tolerance and investment objectives.

A 3-Step Guide to Building a Winning Options Trading Strategy with Options BRO

To pinpoint the winning strategies for your specific goals and outlook, it only takes the options strategy builder tool in the Samco trading platform three simple steps, as outlined below:

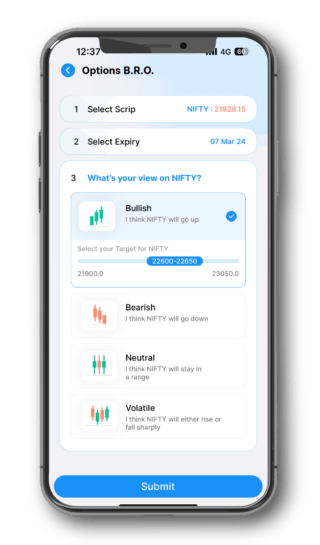

Step 1: Receiving Your Input

The first step involves receiving your input about the market and your trading preferences. You need to select the option contract you wish to trade in, the relevant expiry for the scrip and your market outlook — which is essentially how you expect the option’s price to move before the expiration.

This outlook can be any of the following:

- Bullish: If you think the price will go up

- Bearish: If you think the price will go down

- Neutral: If you think the price will be in the same range you selected

- Volatile: If you think the price will either go up or go down sharply

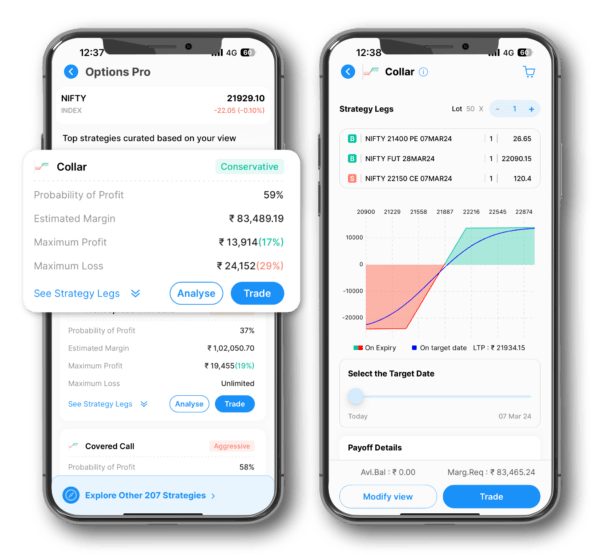

Step 2: Strategy Selection

Based on your input, the options strategy builder tool in the Samco trading app will analyse over 1,000 strategies and recommend the top 3, one for each risk profile as follows:

- Aggressive: This strategy is for traders who are comfortable with taking risks

- Moderate: This strategy is for traders who want to find a balance between risks and rewards

- Conservative: This strategy is for traders who want to play it very safe

With each of the above strategy recommendations, Samco’s options strategy builder tool also includes essential details like the probability of profit, maximum profit, maximum loss and risk-reward ratio — all of which can help you choose the best from the 3 strategies recommended.

Step 3: One-Click Trade

Once you choose the ideal strategy for your trade based on what our options strategy builder tool recommends, you can execute it with just one click. Enter the number of options, the order type (market or limit) and the type of order execution (one by one or all at once). Then, simply hit the trade button to execute your strategy immediately.

Why Options BRO from Samco Securities is a Game-Changing Tool for Traders

Options BRO tool from Samco Securities is a game-changing resource for traders. Unlike other platforms, this options strategy builder tool doesn't just filter strategies based on market outlook; it deeply analyses and ranks each strategy using a comprehensive array of data points. This includes the intricacies of implied volatility (IV) and the critical aspects of option Greeks like delta, theta, gamma, and vega, which are all essential for understanding market dynamics and option sensitivities. Moreover, Options BRO integrates upcoming market events and technical indicators too, so you are well-prepared for any potential market movements.

What sets Options BRO apart is that it is available free of cost in the Samco trading app. In a market where even the most fundamental metrics and analytical tools are hidden behind paywalls, we’ve ensured that our options strategy builder tool is available to all traders in the Samco trading community at no extra cost. To leverage the benefits of Options BRO and create winning options trading strategies within seconds, switch to Samco Securities today.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?