Samco Mutual Fund is the latest entrant in the asset management industry, Samco Mutual Fund received its final nod from Securities and Exchange Board of India (SEBI) in July 2021. They are launching their first new fund offer (NFO) with Samco Flexi Cap Fund. It opens for subscription on January 17 2022 and closes on January 31, 2022.

In this article, we shall cover

- Samco Mutual Fund's Investment philosophy

- Samco Flexi Cap Fund - Samco Mutual Fund's 1st NFO

- Samco Flexi Cap Fund Investment Strategy

- Samco Flexi Cap Fund Scheme Details

- How to Invest in Samco Flexi Cap Fund

You can also watch the video where I share important information about Samco Flexicap Fund before you make your investment decision.

Samco Mutual Fund's Investment Philosophy

Samco Mutual Fund is India’s youngest asset management company. It is also the first AMC to introduce stress-tested investing.

Stress Testing is a strategy to put to work money with businesses that can endure and survive in a variety of stressful situations. This helps in generating superior long-term risk-adjusted returns.

It relies on understanding the resilience of companies based on Samco’s HexaShield framework which tests and evaluates every company and institution on the six most important facets of risks and stress.

These tests measure every company’s ability to maintain enough buffer to stay afloat under extreme scenarios. The HexaShield tests understands if these companies can generate high cash returns on capital employed in a variety of economic conditions including extremely adverse economic conditions.

They will launch funds and schemes only comprising of companies passing Samco’s proprietary HexaShield stress test framework.

Samco Mutual Fund will be the first AMC in India to transparently disclose Active Share daily and endeavours to launch truly active funds with a high active share.

Samco Flexi Cap Fund - Samco Mutual Fund's 1st NFO

Samco Flexi Cap Fund NFO opens on January 17, 2022 and closes on January 31, 2022. You can apply for this NFO with your RankMF account.

Samco Flexi Cap Fund Investment Strategy

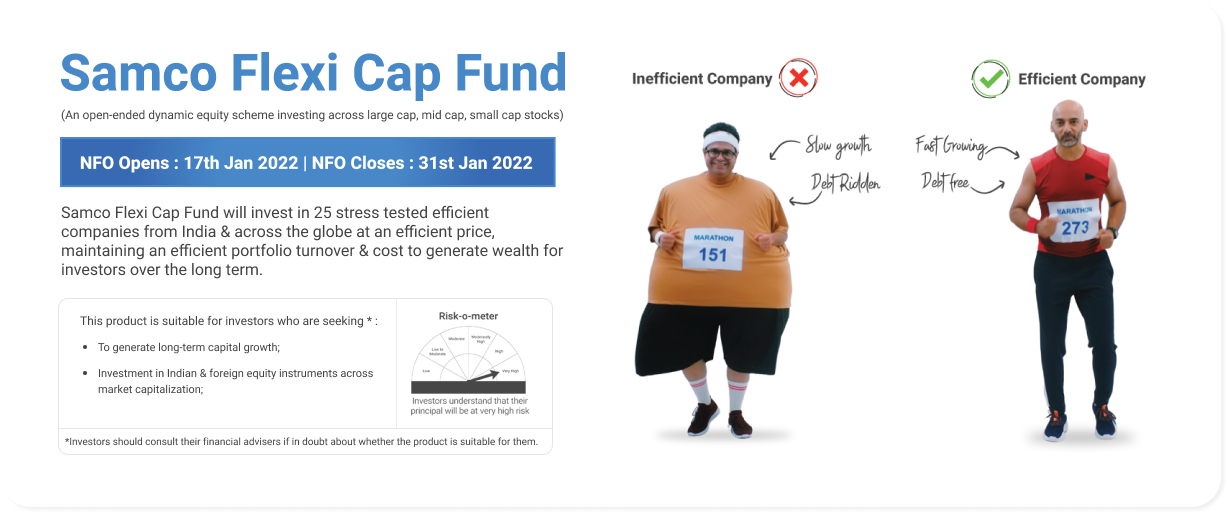

Samco Flexi Cap Fund will invest in 25 stress-tested companies from India and across the globe following the E3 strategy.

It will buy efficient companies at an efficient price and maintain an efficient portfolio turnover and cost to generate superior returns for investors over the long term.

Let us look at the E3 strategy in detail.

1.Invest in Efficient Companies

The scheme shall invest in efficient companies that have the ability to sustainably generate a high return on capital in cash adjusted for discretionary growth expenditures. Samco targets to invest in businesses earning more than 25% adjusted return on capital.

The scheme shall invest in 25 stocks across market caps from India and the world in a proportion of 65% and 35% respectively. These stocks shall be from a universe of 125 companies that have passed Samco’s HexaShield framework.

2. At an Efficient Price:

The scheme will only invest in securities at reasonable or efficient prices when the relative yield for stocks is reasonable compared to the other stocks in the universe.

3. Maintain an Efficient Portfolio Turnover and Cost:

The third pillar of the strategy is aimed at reducing hidden dealing costs and improving performance. Investors believe that the Total expense ratio is the only cost that is incurred by them as a part of their investments. But there is also a hidden cost that is not disclosed in any of these figures: the cost of dealing within the fund.

When a fund manager or an investor deals in stocks, he or she pays brokerage commissions, securities transaction tax at 0.1%, exchange transaction charges, stamp duty, SEBI fees and the difference between the broker’s bid and offer prices (the spread) often referred to as the impact cost.

The total cost of investments incurred by investors = the expense ratio (TER) of scheme + voluntary dealing cost

Samco Mutual fund is the first mutual fund in India that will transparently disclose all voluntary dealing costs. Voluntary dealing costs are all costs incurred by the fund manager for purchases and sales excluding the costs incurred for involuntary transactions such as fund inflows/outflows. This shall be computed as a percentage of the assets under management (AUM). This will help investors compute the total cost of investments which is a sum of the TER and voluntary dealing cost

Samco Flexi Cap Fund Scheme Details

| NFO period | January 17, 2022, to January 31, 2022 |

| Type of scheme | An open-ended dynamic equity scheme investing across large-cap, mid-cap, small-cap stocks |

| Plans | Regular Plan-Growth & Direct Plan-Growth |

| Minimum Application Amount of scheme | ₹ 5000 and in multiples of ₹ 1/- thereafter |

| Minimum Additional Application Amount | ₹ 500 and in multiples of ₹ 1/- thereafter |

| Minimum SIP Amount | ₹ 500 and in multiples of ₹ 1/- thereafter |

| Entry Load | Not applicable |

| Exit Load | – 2.00% if the investment is redeemed or switched out on or before 365 days from the date of allotment of units – 1.00% if the investment is redeemed or switched out after 365 days but on or before 730 days from the date of allotment of units. – No Exit Load will be charged if the investment is redeemed or switched out after 730 days from the date of allotment of units. |

| Fund Manager | Mrs Nirali Bhansali- Fund Manager – Equity Mr. Dhawal Dhanani-Dedicated Fund Manager for overseas investments |

| Benchmark Index | Nifty 500 Index TRI |

Read: How is Samco Flexicap Fund Different?

How to Invest in Samco Flexi Cap Fund?

- Login to your RankMF Account

- Click on NFO Option in the top menu

- Further, click on the Samco Flexi Cap Fund option and Invest

For more information write to support@samco.in

Easy & quick

Easy & quick

Leave A Comment?