Introduction Bajaj Housing Finance IPO:

Bajaj Housing Finance is a non-deposit-taking Housing Finance Company (HFC) registered with the National Housing Bank (NHB) since September 2015. The company has been engaged in mortgage lending since Fiscal 2018 and was categorized as an ‘Upper Layer’ NBFC (NBFC-UL) by the RBI on September 30, 2022.

The company primarily focuses on providing retail housing loans, loans against property, lease rental discounting, and developer loans across all customer segments. Bajaj Housing Finance offers tailored financial solutions to individuals and corporate entities for the purchase and renovation of homes and commercial spaces.

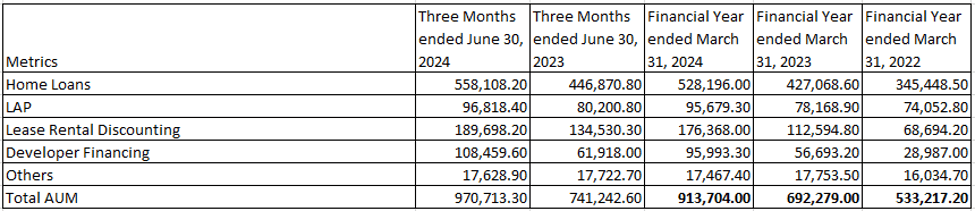

As of June 30, 2024, Bajaj Housing Finance operates through a network of 215 branches, spanning 174 locations in 20 states and 3 union territories. It is the 2nd largest HFC in India, with 323,881 active customers, 83.2% of whom are home loan customers. The company has a significantly high average ticket size of ₹46 lakh for home loans, with an average loan-to-value ratio of 69.3%. Additionally, 75.5% of the home loan AUM has been disbursed to customers with a CIBIL score above 750. The company's AUM reached ₹97,071.33 crore as of June 30, 2024.

The overall housing loan market in India (excluding PMAY loans) was valued at approximately ₹28.7 trillion as of March 2023. With an estimated shortage of ₹50 trillion to ₹60 trillion, this indicates significant growth potential in the housing finance sector, presenting a substantial opportunity for business expansion for Bajaj Housing Finance.

IPO Details:

IPO Date | 9th Sept-2024 to 11th Sept-2024 |

Face Value | ₹ 10/- per share |

Price Band | ₹ 66 to ₹ 70 per share |

Lot Size | 214 shares and in multiples thereof |

Issue Size | ₹ 6,560 crores |

Fresh Issue | ₹ 3,560 crores |

OFS | ₹ 3,000 crores |

Expected Post Issue Market Cap (At upper price band) | ₹ 58,297 crores |

Objects of Issue:

- Net Proceeds from the Fresh Issue will be used to form the capital base to meet future lending business requirements of the Company.

- To enhance the brand name of the company.

- General corporate purposes.

Key Strengths:

- Strong Brand Image: As a part of the renowned Bajaj Group, founded in 1926, the company benefits from the strong reputation and trust associated with one of India’s leading conglomerates, known for its diverse business interests across various sectors.

- Second-Largest HFC in India: Bajaj Housing Finance is the second-largest Housing Finance Company (HFC) in India, with seven years of operational experience. The company's Assets Under Management (AUM) have grown at a Compound Annual Growth Rate (CAGR) of 9% from Fiscal 2022 to Fiscal 2024 indicating the growth potential of the company.

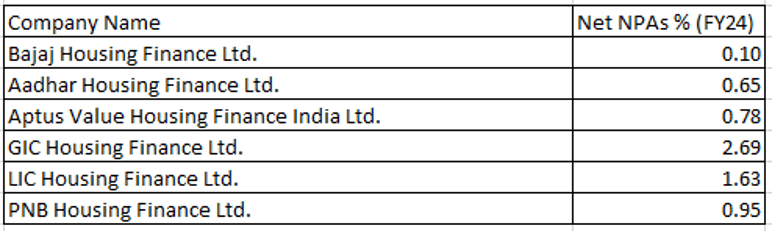

- Strategic Focus on Low-Risk Lending: The company primarily focuses on housing finance, which has the low non-performing assets (NPAs) among all lending segments. Additionally, it lends predominantly to customers with CIBIL scores above 750, ensuring high credit quality and reducing the risk of loans turning into NPAs. As of June 30, 2024, home loans made up 57.5% of the overall portfolio, with 90.8% of these loans disbursed to low-risk salaried and self-employed professional customers.

- Improving Operational Efficiency: The company’s operating expense ratio has been decreasing, reflecting improved operational efficiency and cost management, which is a positive indicator for future profitability.

Risks:

- Limited Geographical Exposure: The company’s AUM is heavily concentrated in just 5 states, making up 88.2% of its total. Depending too much on these few regions could lead to significant business risks which can adversely impact the business.

- Regulatory Challenges: Recent years have seen the government tightening its policies for Non-Banking Financial Companies (NBFCs). New regulations and stricter rules could impact the company's operations.

- High Competition: The NBFC sector is highly competitive, and despite not accepting deposits, NBFCs may face rising borrowing costs due to slower deposit growth in banks. This could strain the company’s financial performance.

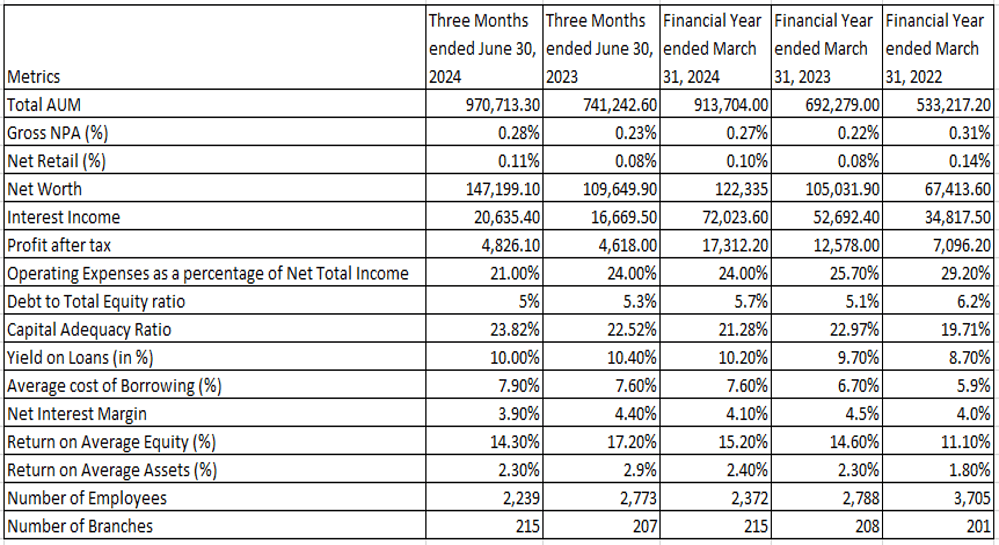

Financial Snapshot:

Conclusion:

Bajaj Housing Finance's IPO offers an attractive investment opportunity, underpinned by the company’s strong fundamentals and strategic positioning in India’s rapidly growing housing finance sector. As the second-largest HFC, Bajaj Housing Finance benefits from its affiliation with the reputable Bajaj Group, a robust AUM growth rate, and a focus on low-risk lending to high-credit-quality customers.

With India's housing market poised for significant expansion, driven by a ₹50-60 trillion shortage and favourable macroeconomic conditions, the company is well-positioned to capitalize on this growth. While challenges like regional concentration and regulatory risks exist, the company’s solid operational efficiency and strategic approach make it a promising long-term investment in the current economic landscape.

Considering the company’s growth potential and low valuations, we suggest our investors subscribe to this IPO for the long term.

Easy & quick

Easy & quick

Leave A Comment?