- What is the meaning of inventory turnover ratio?

- How to calculate inventory turnover ratio?

- How does inventory turnover ratio work in stock analysis?

- FAQs on inventory turnover ratio.

What is the meaning of inventory turnover ratio?

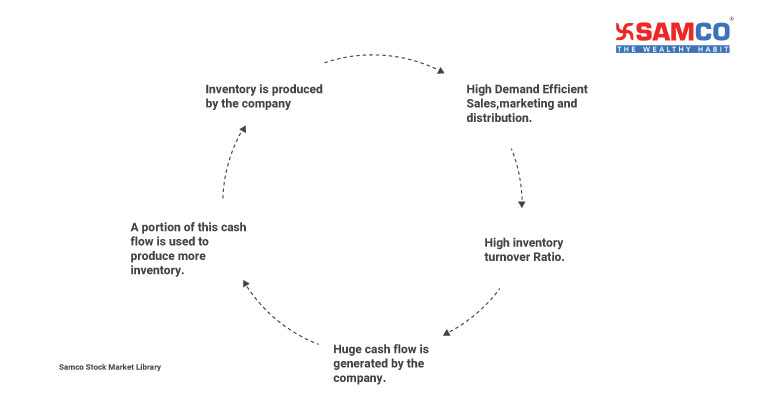

Inventory turnover ratio is the number of times a company sells its entire inventory in a year. Hindustan Unilever Ltd.’s inventory turnover ratio is 6.98. This means that HUL sells its entire inventory 6.98 times in a year. Whereas the inventory turnover ratio of Jindal Steel & Power Ltd is only 1.74. Inventory turnover ratio is also known as stock turnover ratio or stock turns. It is an activity ratio which shows the number of times a company sells, restocks or consumes its inventory. A high inventory turnover ratio is ideal. It shows that a company’s products are in high demand. It also tells you that the company is selling its products at a faster rate. More sales means more revenue. A high stock turnover ratio frees up a company’s cash flows. So, it can produce more goods and make more money. It is an endless cycle.

Understanding Inventory Turnover Ratio with an Example

Let us understand how inventory turnover ratio works with this simple example. You want to buy a cake. So, you visit a cake shop, but the cakes are not fresh. They are yesterday’s unsold cake. Will you buy this stale cake? Most probably not. You will instead visit another cake shop which is selling freshly baked cakes. For the cake shop owner, cakes are inventories. The frequency at which he sells the cakes is his inventory turnover ratio. He has to maintain a high turnover ratio as customers will not buy stale cakes. The more cakes he sells, the more money he has to bake fresh cakes. This will bring in more customers and increase his profits. Notice how inventory turnover ratio is closely tied to a company’s profits. The below table shows the turnover ratio of top companies in 2/3 wheeler sector.| 2/3 Wheeler Companies | Inventory Turnover Ratio | Market Capitalisation (Rs Cr) |

| Bajaj Auto Ltd | 15.3 | 1,22,313 |

| Eicher Motors Ltd | 7.07 | 73,999 |

| Hero MotoCorp Ltd | 14.2 | 58,078 |

| TVS Motor Company Ltd | 10.1 | 29,202 |

| Maharashtra Scooters Ltd | 2.33 | 4,267 |

| Atul Auto Ltd | 8.6 | 418 |

| Scooters India Ltd | 1.36 | 329 |

| Majestic Auto Ltd | 5.8 | 141 |

| Kinetic Engineering Ltd | 0.49 | 93 |

How to Calculate Inventory Turnover Ratio?

Inventory turnover ratio formula = Cost of Goods Sold (COGS) / Average Inventory. To calculate inventory turnover ratio, you have to divide COGS by average inventory. COGS is the actual cost of making a product. We can calculate it by subtracting gross profit from the selling price. It is readily available in the company’s income statement. For example: The sale price of iPhone 12 Pro Max is Rs 1,53,500. Let’s assume that Apple makes a profit of Rs 20,000 per unit. In this case, the COGS will be Rs 1,33,500 (Rs 1,53,500 – Rs 20,000). While calculating inventory turnover ratio, use average inventory instead of closing inventory. The reason being, a company’s inventory levels fluctuate widely. Especially during holiday seasons or for the companies which are cyclic in nature. Avenue Supermarts Ltd (D’mart) might have huge amounts of inventory before Diwali. However, this will drop drastically post the festivities. Hence, average inventory is considered to calculate inventory turnover ratio. It helps us find a better estimate of the ratio. Average Inventory = (Opening Inventory + Closing Inventory)/ 2. Both opening and closing inventory is available in a company’s balance sheet. Some investors use annual sales instead of COGS. But this can show an inflated figure. Sales also include a profit mark-up and are not the same as COGS. Hence, always consider COGS instead of annual sales to calculate inventory turnover ratio.What is the Ideal Inventory Turnover Ratio?

The ideal stock turnover ratio varies across sectors. Luxury products usually have lower inventory turnover ratio. Let’s understand this with an example.- The turnover ratio of Page Industries Ltd. is 2.0.

- The inventory turnover ratio for Rupa & Company Ltd. is 1.46.

- Whereas the turnover ratio for Dollar Industries Ltd.’s is 1.43.

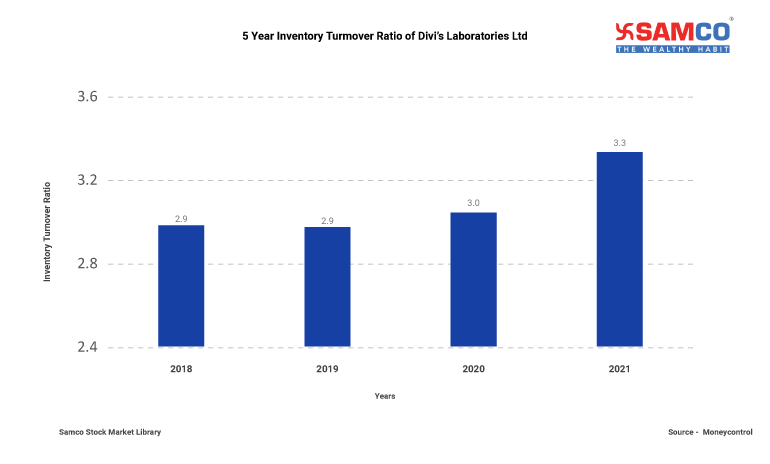

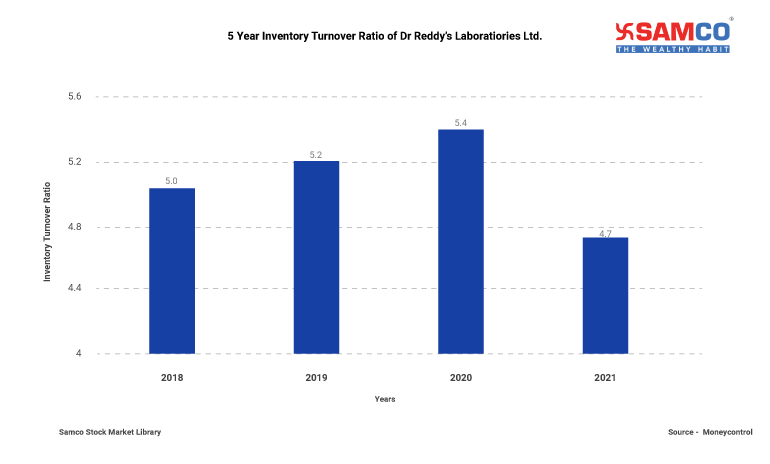

How to Use Inventory Turnover Ratio in Stock Analysis

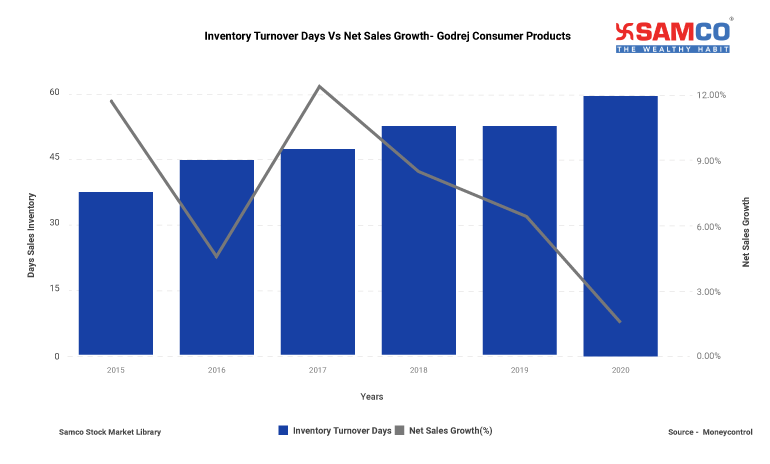

There are two ways to use inventory turnover ratio in stock analysis:- Analysing five year trend

- Analysing against industry turnover ratio

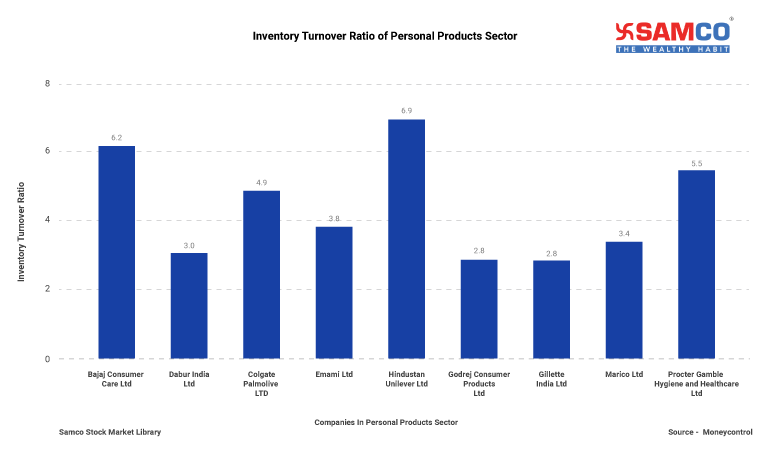

Analysing against industry turnover ratio

Every sector has a different turnover ratio. Average industry turnover ratio of Departmental stores is 3.55. Whereas it’s 7.53 times for cars and utility vehicles sector. Hence inter-sector comparison is pointless. You can find out which company has the best growth prospects by comparing its inventory turnover ratio with its peers.

FAQs on Inventory Turnover Ratio

- What is inventory turnover ratio?

- Is a high inventory turnover good or bad?

- What does an inventory turnover ratio of 5 mean?

- Is a low inventory turnover ratio good?

- How do I calculate inventory turnover ratio?

- How do you calculate Days sales of inventory?

- What is average inventory?

Easy & quick

Easy & quick

Leave A Comment?