In this article, we will discuss:

- Introduction

- What Are The Strategy Legs?

- What Is The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Greeks Corner

- Things To Keep In Mind

Introduction

A bear call spread is a type of vertical spread that involves selling a call option and buying another call option with a higher strike price on the same underlying asset and expiry date. This strategy is used when the trader expects the price of the underlying asset to fall moderately or remain range-bound in the near term. The trader receives a net credit for initiating the trade, which is the maximum profit potential of the strategy. The risk is limited to the difference between the two strike prices minus the net credit received.

What Are The Strategy Legs?

To implement a bear call spread, the trader needs to execute the following two legs:

- Sell one call option (short call) with a lower strike price

- Buy one call option (long call) with a higher strike price

- Both options should have the same underlying asset and expiry date. The strike price of the long call should be higher than the strike price of the short call.

For example, if the trader is bearish on Nifty 50, which is trading at 15,800, he can sell a 15,700 call option and buy a 15,900 call option for the same expiry date.

What Is The Payoff?

The payoff of a bear call spread depends on the price of the underlying asset at expiry. There are three possible scenarios:

- If the price of the underlying asset is below the strike price of the short call, both options expire worthless and the trader keeps the net credit received as the maximum profit.

- If the price of the underlying asset is between the strike prices of the two options, the short call is in the money and the long call is out of the money. The trader has to pay the difference between the price of the underlying asset and the strike price of the short call, which reduces the net credit received. The profit decreases as the price of the underlying asset increases.

- If the price of the underlying asset is above the strike price of the long call, both options are in the money and the trader has to pay the difference between the two strike prices, which is the maximum loss of the strategy. The loss increases as the price of the underlying asset increases.

Who Can Deploy This Strategy?

A bear call spread is a suitable strategy for traders who have a moderately bearish outlook on the underlying asset and want to limit their risk and capital requirement. This strategy can be deployed by beginners who have a conservative approach, as it involves limited profit and limited loss. The trader does not need to worry about stop loss or margin calls, as the trade is fully hedged. However, the trader should also be aware of the trade-offs, such as lower profit potential, higher commission costs, and lower probability of success compared to a naked short call.

When Should This Strategy Be Deployed?

Deploy a bear call spread when anticipating a moderate drop or range-bound movement in the underlying asset's price, factoring in volatility and time decay of options. Best suited for high implied volatility expected to decrease, enhancing the net credit received. Consider option expiry time, benefiting from theta decay, especially in short calls. Choose strike prices based on risk-reward and probability of success. Lower short call strike yields higher net credit,but also lower breakeven and lower success probability. Higher long call strike results in higher net credit, higher max loss, but higher profit potential.

Greeks Corner

The Greeks are the sensitivity measures of the options that indicate how the option price changes with respect to various factors, such as the price of the underlying asset, the volatility, the time to expiry, and the interest rate. The main Greeks that affect a bear call spread are delta, theta, and vega.

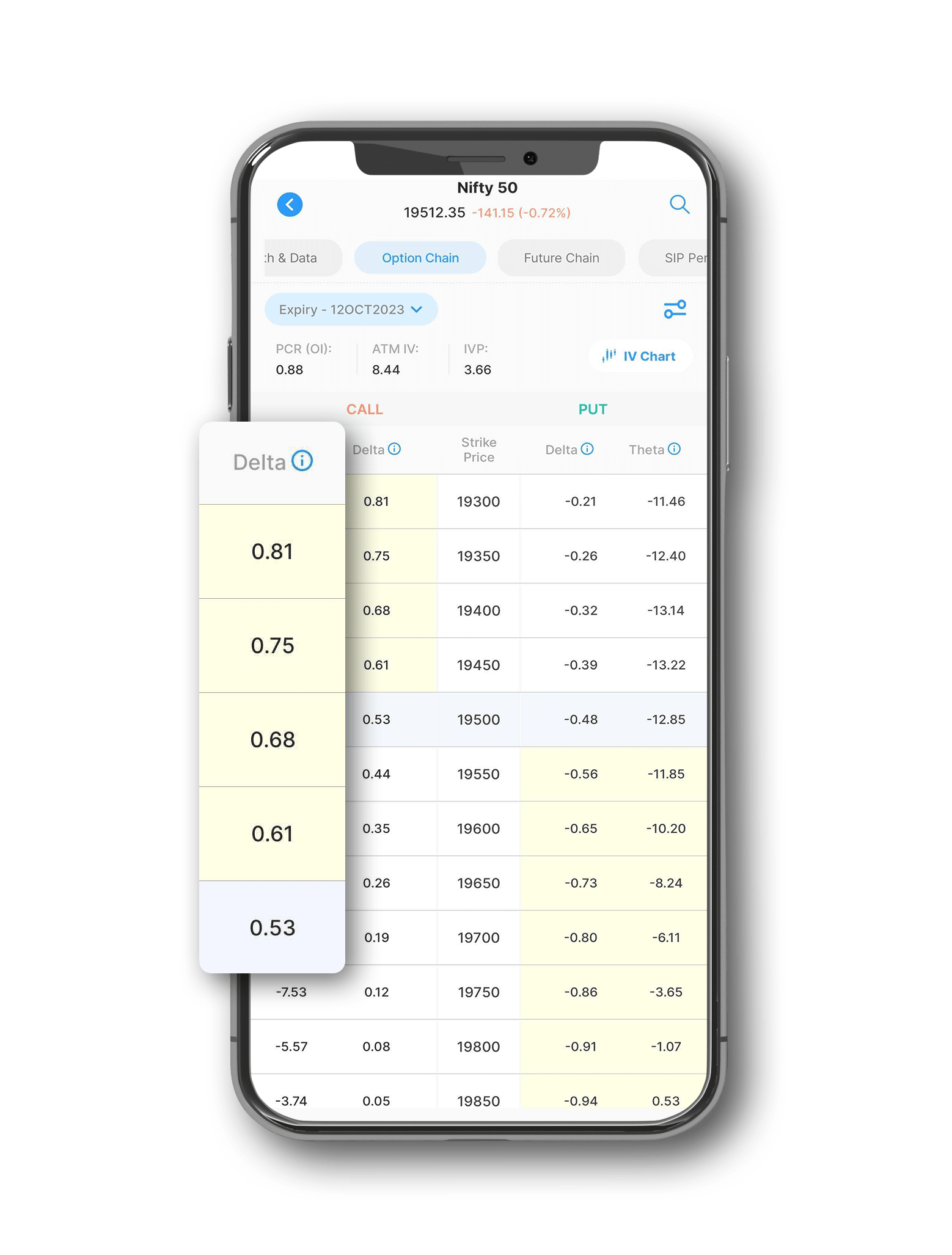

Delta measures the change in the option price with respect to the change in the price of the underlying asset. A bear call spread has a negative delta, which means the value of the strategy decreases as the price of the underlying asset increases, and vice versa. The delta of a bear call spread is equal to the delta of the short call minus the delta of the long call. The delta of a bear call spread is always between -1 and 0, and it approaches 0 as the price of the underlying asset moves away from the strike prices of the options.

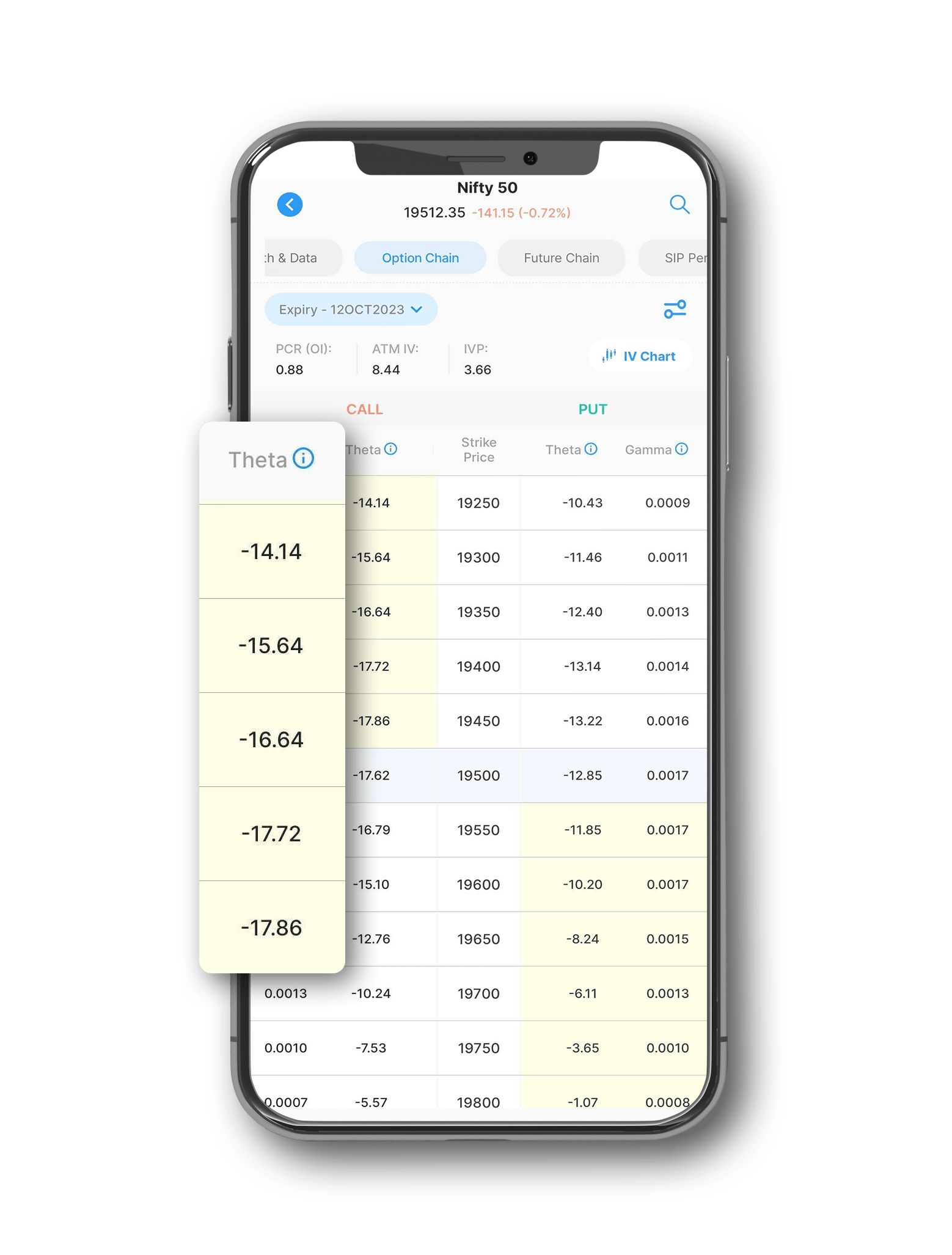

Theta measures the change in the option price with respect to the change in the time to expiry. A bear call spread has a positive theta, which means the value of the strategy increases as the time to expiry decreases, and vice versa. The theta of a bear call spread is equal to the theta of the short call minus the theta of the long call. The theta of a bear call spread is always positive, and it is highest when the price of the underlying asset is near the strike price of the short call.

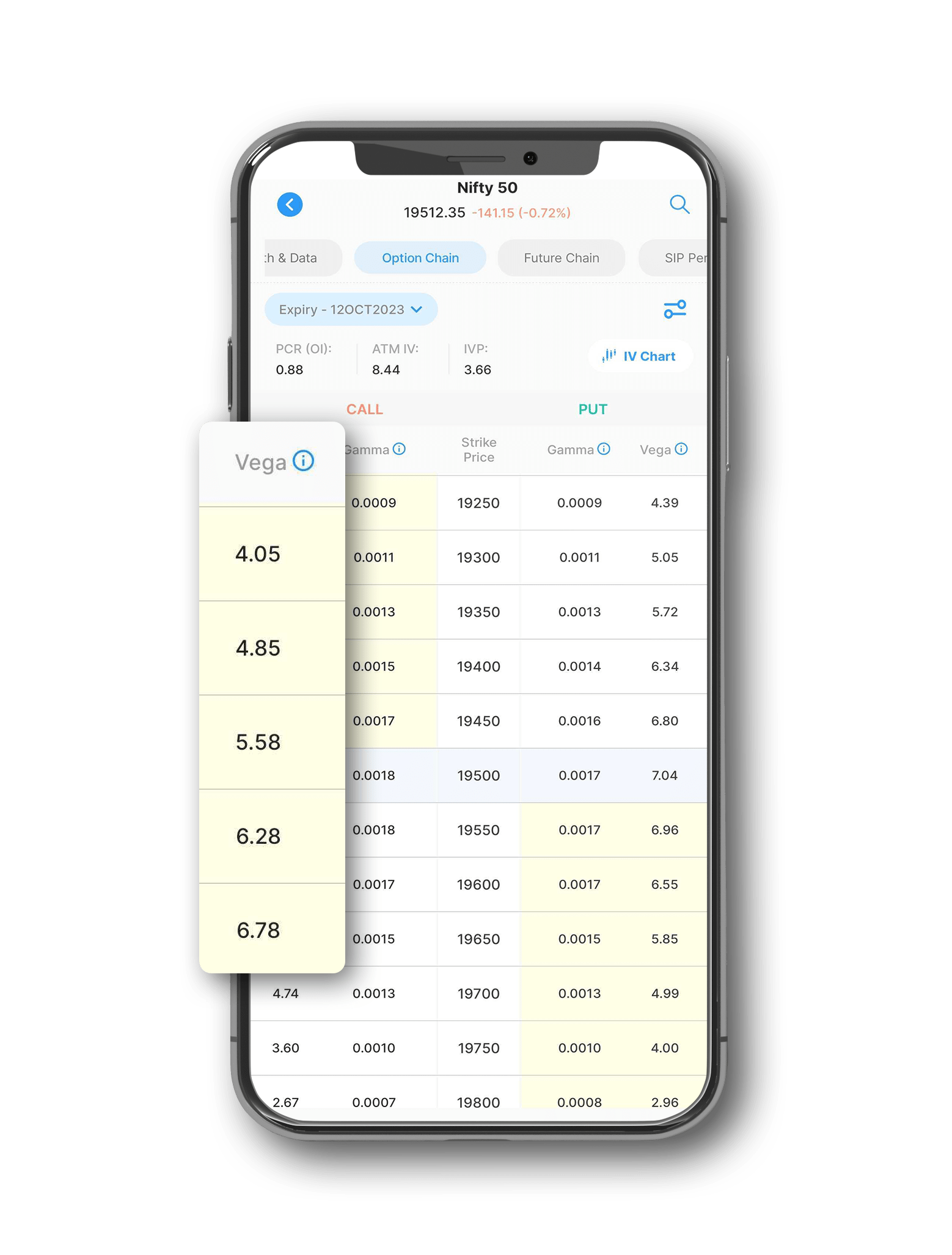

Vega measures the change in the option price with respect to the change in the implied volatility of the underlying asset. A bear call spread has a negative vega, which means the value of the strategy decreases as the implied volatility of the underlying asset increases, and vice versa. The vega of a bear call spread is equal to the vega of the short call minus the vega of the long call. The vega of a bear call spread is always negative, and it is highest when the price of the underlying asset is near the strike prices of the options.

Things To Keep In Mind

A bear call spread is a simple and effective strategy for traders who have a moderately bearish outlook on the underlying asset and want to limit their risk and capital requirement. However, there are some things to keep in mind before deploying this strategy:

- Since this strategy involves limited risk, there is no need to maintain a stop loss. However, the trader should monitor the price movement of the underlying asset and the implied volatility of the options, and be ready to adjust or exit the trade if the market conditions change.

- Since this strategy is a complete hedge, the trader can trade with less margins as well.

- To get the most out of the hedge benefits on margin, the sequence of order placement should be buying a call option and then selling a call option. This way, the trader can lock in the net credit received and reduce the margin requirement.

Try Options B.R.O. It is a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Easy & quick

Easy & quick

Leave A Comment?