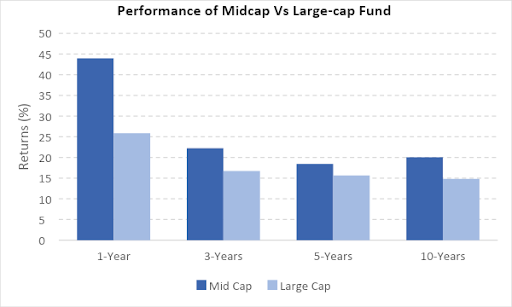

Mid cap mutual funds are one of the most lucrative types of mutual funds in India. They have generated an average return of 43.95% (as on 27th December 2021) in the last one-year. This is much higher than the 25.85% return of large-cap funds. But high returns come with high risks. Midcap mutual funds are one of the riskiest types of mutual funds in India. This is because they invest in mid-sized, relatively lesser-known companies. This makes them more prone to market ups and downs. The best way to manage the high-risk of midcap mutual funds is to invest in only the best mid cap mutual funds for 2025. Do you know that there are 28 midcap mutual funds in India? But not all of them are worth investing. This is why the experts at RankMF have shortlisted the five best midcap mutual funds for 2025. These five best midcap funds have the potential to create superior long-term wealth. Our list of best midcap mutual funds for 2022 is unique. You see, these five best midcap funds have been chosen after evaluating all 28 midcap funds on more than 20 million data points. One of our recommended best midcap mutual funds for 2025 has generated a one-year return of 45.52%. This is 3.57 times more than the midcap category average. We will reveal this list of best midcap funds for 2022 shortly. In the end, we will also share a secret strategy using which you can increase your SIP returns instantly! So, stay tuned. Let’s begin this discussion on best midcap mutual funds for 2025 by understanding what are midcap funds.

In this article on Best Mid cap Mutual Funds in 2025:

- What is a Midcap Mutual Fund?

- Advantages of Midcap Mutual Funds

- Taxation of Midcap Mutual Funds

- List of Best Midcap Funds in 2022

What is a Mid cap Mutual Fund?

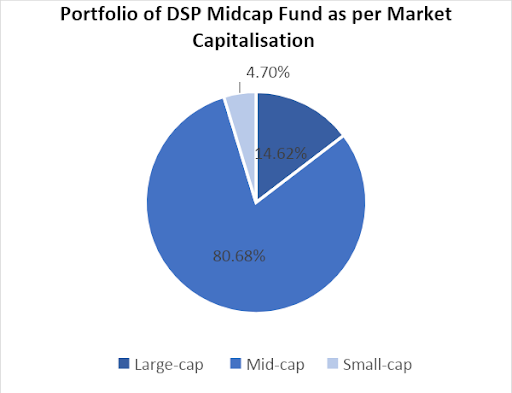

As per the Securities and Exchange Board of India (SEBI), ‘a midcap mutual fund must invest a minimum 65% of its total assets in equity of midcap companies.’ So, if the total corpus of a midcap fund is Rs 100, then it must invest Rs 65 in stocks of midcap companies. Now your next question might be, ‘What are midcap companies?’. The entire stock market is divided into three main categories based on market capitalisation –

- The top 100 companies are known as large-cap or blue chip stocks. These include stocks like Reliance Industries, Infosys, HDFC Bank etc.

- The next 150 companies are midcap stocks. They rank between 101st to 250th in terms of market capitalisation. Some common midcap stocks are Emami Ltd, IPCA Laboratories etc.

- Stocks starting from 251 rank in terms of market capitalisation are known as small cap stocks. Think about Kajaria Ceramics, Minda Industries, Radico Khaitan etc.

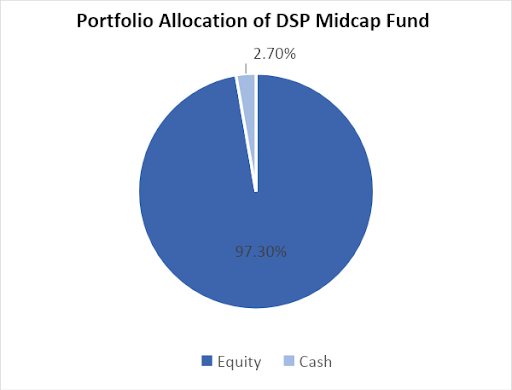

Now, our midcap mutual funds will only invest in stocks that fall in the 101st to 250th zone as per market capitalisation. Where is the remaining 35% invested? The fund manager is free to invest this 35% in large-cap or small-cap stocks. He can even invest in debt or cash instruments like bonds, debentures, certificates of deposits etc. Let us take a look at the portfolio allocation of DSP Midcap Fund, which is one of the best midcap mutual funds for 2022. The fund invests 97.30% in equity stocks and 2.70% in cash instruments.

Advantages of Midcap Mutual Funds

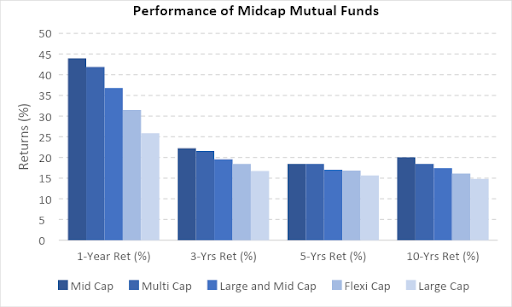

- Superior Returns: This is the biggest advantage of midcap funds as far as investors are concerned. Midcap mutual funds have generated a return of 22.24% in the last three years and 18.45% in the last five years. The graph below shows the performance of midcap funds against other equity mutual funds.

*Data as on 27th December 2021

Notice that midcap mutual funds have outperformed multi, large, flexi and large and midcap mutual funds across all time frames.

- Access to Mid-sized companies: Majority of investors end up investing in the same 100 companies. This includes stocks like Reliance Industries, Mahindra & Mahindra, Tata Consultancy Services Ltd etc. These companies have already experienced their growth spurt. Hence, they generate stable, not superior returns.

But midcap mutual funds invest in 101st to 250th companies. These companies are still finding their footings in the economy. Hence, they have a huge upside potential. Consider this example -

- TCS Ltd is a blue chip Information and Technology (IT) stock. Its market capitalisation is a whopping Rs 13,74,401 crore. The stock is up by 28% in the last one year.

- KPIT Technologies Ltd is a midcap IT company. Its market capitalisation is Rs 15,874 crore. Its share price is up by 333% in the last one year.

This is what I mean when I say midcap mutual funds give you access to mid-sized companies with huge growth potential. The table below shows the performance of midcap mutual funds vs large-cap mutual funds –

*Data as on 27th December 2021

So, midcap mutual funds give you the chance to invest in the lesser known companies and benefit from their growth spurt.

- Superior Performance During Bull Markets: Midcap mutual funds outperform large-cap or value funds during bull markets. So, investing in midcap funds is ideal especially if you are in the beginning phases of a bull run. Let's take an example to prove this…

Axis Midcap Fund is one of the best midcap mutual funds for 2022. Let us compare its performance with Canara Robeco Bluechip Equity Fund. We will compare the funds across both bull and bear cycles.

| Bull Phase | Bull Phase | Bull Phase | |

| Scheme Name | 20/Dec/11 To 03/Mar/15 | 25/Feb/16 To 14/Jan/20 | 23/Mar/20 To 16/Mar/21 |

| Axis Midcap Fund | 40.35 | 19.53 | 86.45 |

| Canara Robeco Bluechip Equity Fund | 25.19 | 18.90 | 73.54 |

Notice the performance of Axis Midcap Fund across various bull markets. It has managed to outperform a large-cap fund (Canara Robeco Bluechip Equity Fund) by a huge margin everytime.

Taxation of Midcap Mutual Funds

Midcap mutual funds follow equity taxation. The holding period is 12 months or one year.

- If you sell your midcap mutual fund before 12 months, you pay a short-term capital gains (STCG) tax of 15%.

- If you sell units of your midcap mutual fund after 12 months, you pay a long-term capital gains (LTCG) tax of 10%. But only if your gains exceed Rs 1 Lakh in a financial year. If your gains are below Rs 1 Lakh, you pay no tax.

- Dividend income from midcap mutual funds are taxed at individual tax slabs. This is only if your dividend income exceeds Rs 10 Lakhs in a financial year.

List of Best Midcap Mutual Fund for 2025

We are starting off our list of best midcap mutual funds for 2025 with the best one… Kotak Emerging Equities Fund.

Best Midcap Mutual Fund for 2025 #1: Kotak Emerging Equities Fund

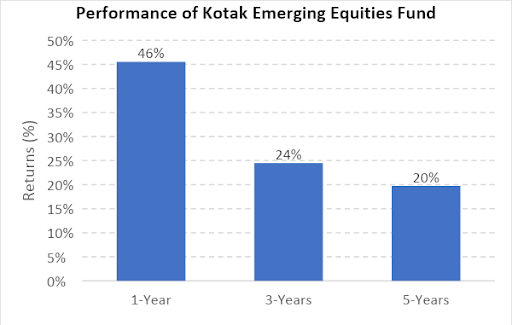

Kotak Emerging Equities Fund is one of the best midcap mutual funds for 2025. It has the highest AUM of Rs 16,705 crore in the midcap category. It has generated a return of 14.19% since its launch on 30th March 2007. Kotak Emerging Equities Fund is one of the only midcap funds that has beaten its benchmark, Nifty Midcap 150 TRI. The fund has generated a return of 45.52% in the last one year and 24.47% in the last three years. Let’s take a look at the fund’s performance across time horizons –

*Data as on 27th December 2021

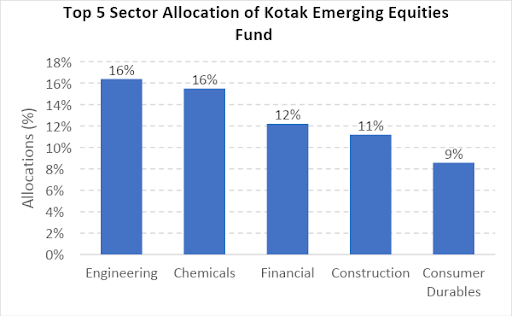

The fund is well-diversified with a portfolio of 68 stocks. The superior performance of the fund can be due to its high exposure to the engineering and chemicals sector. The fund is bullish on the following five sectors –

*Data as on 27th December 2021

Let us look at the key financials of the best midcap mutual fund for 2025 – Kotak Emerging Equities Fund

| Launch Date | 30th March 2007 |

| Return since launch | 14.19% |

| Assets under management | Rs 16,705 Crores |

| Expense ratio | 1.81% |

| 1-year return | 45.52% |

| 3-year return | 24.47% |

| 5-year return | 19.73% |

| Sharpe ratio | 0.91% |

| Sortino ratio | 0.91% |

Data as of 2022

Best Midcap Mutual Fund for 2025 #2: Invesco India Midcap Fund

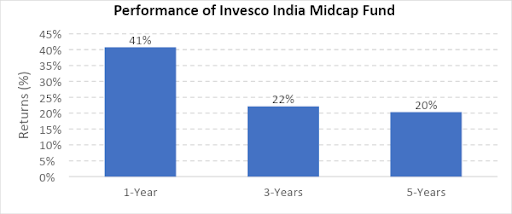

Invesco India Midcap Fund is the second-best performer in the midcap category. It has generated a return of 40.73% in the last one year. Despite such superior performance, its AUM is only Rs 2,059 crores. It was launched on 19th April 2007. The fund has generated a return of 15.86% since its launch. Let us look at the fund’s performance across time periods –

*Data as on 27th December 2021

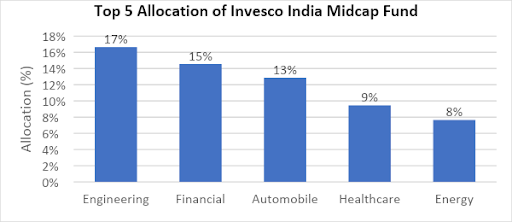

The fund invests in 43 stocks. Unlike its peers the fund is bullish on the engineering and automobile sector.

*Data as on 27th December 2021

Let us look at the key financials of the best midcap mutual fund for 2025 – Invesco India Midcap Fund

| Launch Date | 19th April 2007 |

| Return since launch | 15.86% |

| Assets under management | Rs 2,059 crores |

| Expense ratio | 2.29% |

| 1-year return | 40.73% |

| 3-year return | 22.15% |

| 5-year return | 20.33% |

| Sharpe ratio | 0.87% |

| Sortino ratio | 0.90% |

Data as of 2022

Best Midcap Mutual Fund for 2025 #3: Axis Midcap Fund

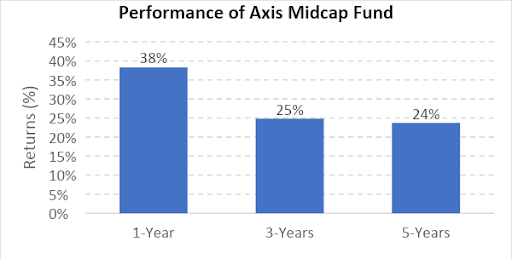

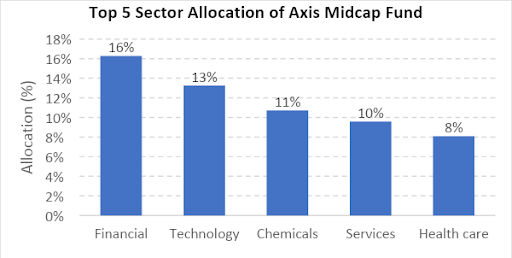

Axis Midcap Fund is the second biggest midcap fund in India. Its AUM is a whopping Rs 16,101 crores. The fund was launched on 18th February 2011. It has generated a return of 19.33% since its launch. The fund has beaten a majority of its peers with a one-year return of 38.29%. Let’s take a look at the fund’s performance across time horizons –

*Data as on 27th December 2021

The fund invests in 62 stocks with maximum allocation to financial services sector stocks like Cholamandalam Investment & Financial Company, ICICI Bank etc. The fund is also betting big on technology stocks like Coforge Ltd. Here’s a look at the fund’s top 5 allocations –

*Data as on 27th December 2021

Let us look at the key financials of the best midcap mutual fund for 2025 – Axis Midcap Fund

| Launch Date | 18th February 2011 |

| Return since launch | 19.33% |

| Assets under management | Rs 16,101 Crores |

| Expense ratio | 1.82% |

| 1-year return | 38.29% |

| 3-year return | 24.82% |

| 5-year return | 23.71% |

| Sharpe ratio | 1.14% |

| Sortino ratio | 1.15% |

Data as of 2022

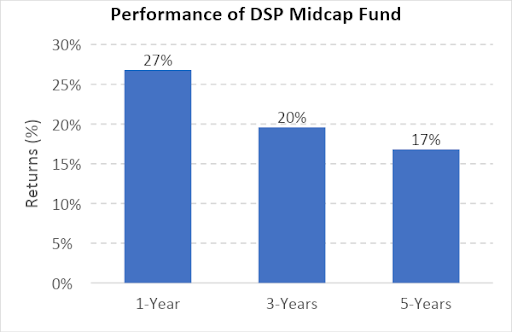

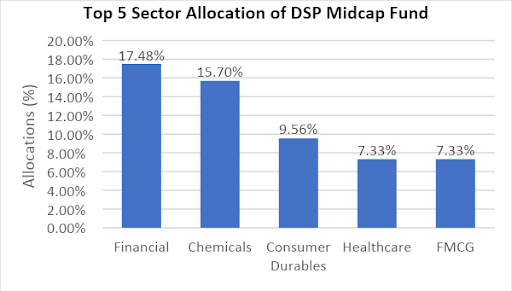

Best Midcap Mutual Fund for 2025 #4: DSP Midcap Fund

DSP Midcap Fund is our next pick as the best midcap mutual fund for 2022. It has an asset under management of Rs 13,785 crore as of 27th December 2021. The fund has generated a return of 26.80% in the last one-year. The fund has also generated a return of 16.82% in a period of five years. The fund also gives decent dividends. It paid a dividend of Rs 2.47 per unit on 25th March 2021. Here’s a look at the fund’s performance as of 27th December 2021.

*Data as on 27th December 2021

DSP Midcap Fund invests in a total of 51 stocks. It holds 97.30% of the assets in equities and the balance 2.70% is in cash. The fund follows a blend of growth and value style investing. The fund is bullish on the following five sectors -

*Data as on 27th December 2021

Let us look at the key financials of the best midcap mutual fund for 2025 – DSP Midcap fund.

| Launch Date | 14th November 2006 |

| Return since launch | 15.53% |

| Assets under management | Rs 13,785 crores |

| Expense ratio | 1.79% |

| 1-year return | 26.80% |

| 3-year return | 19.58% |

| 5-year return | 16.82% |

| Sharpe ratio | 0.81% |

| Sortino ratio | 0.82% |

Data as of 2022

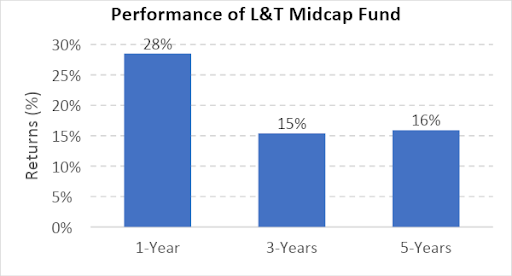

Best Midcap Mutual Fund for 2025 #5: L&T Midcap Fund

L&T Midcap Fund is our final pick as the best midcap mutual fund for 2022. It has generated a return of 18.87% since its launch on 9th April 2004. The fund has an AUM of Rs 6,667 crores. Performance-wise, the fund has given a one-year return of 28.50% (as of 27th December 2021). The fund has given a dividend of Rs 3.50 per unit in 2021, which is one of the best among midcap mutual funds. Here’s a look at the fund’s performance as of 27th December 2021.

*Data as on 27th December 2021

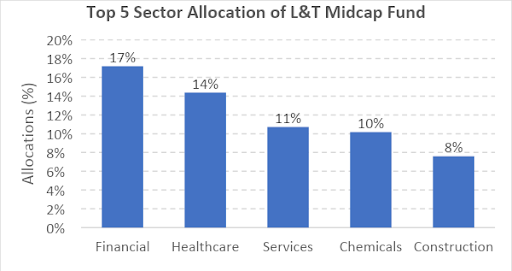

L&T Midcap Fund is a well-diversified fund. It invests in 63 stocks. Its assets are invested 97.3% in equities and 2.70% in cash. The fund is bullish on the following five sectors. Unlike other best midcap funds, L&T Midcap fund is bullish on services, chemicals and construction sectors.

*Data as on 27th December 2021

Let us look at the key financials of the best midcap mutual fund for 2025 – L&T Midcap Fund

| Launch Date | 9th August 2004 |

| Return since launch | 18.87% |

| Assets under management | Rs 6,667 Crores |

| Expense ratio | 1.89% |

| 1-year return | 28.50% |

| 3-year return | 15.39% |

| 5-year return | 15.89% |

| Sharpe ratio | 0.59% |

| Sortino ratio | 0.60% |

Data as of 2022

This brings us to the end of the list of best midcap mutual funds in 2025. Now as promised, I have a unique strategy for you which will help you earn superior returns. Now you must have heard of a systematic investment plan (SIP). We all know that a SIP helps you in cost-averaging and uses the power of compounding to make your corpus grow. But what if there was something better than a SIP? Seems unlikely? Well, there is … introducing RankMF’s SmartSIP. Kotak Emerging Equities Fund is one of the best midcap mutual funds for 2025. A SIP in the fund in the last five years would have generated 18.27% return. But you can earn 19.02% return from the same scheme. All you need to do is choose SmartSIP instead of a regular SIP. What does this mean? A SmartSIP is a unique RankMF feature. It works on the principle of buy low and sell high. When your mutual fund scheme is overvalued, your SIP is invested in a liquid fund. Your SIP is invested in an equity fund when the scheme is undervalued. This helps you earn much higher returns than a regular SIP. Check out SmartSIP for FREE here… Let us see how SmartSIP works. Suppose you start a SIP of Rs 5,000 in Kotak Emerging Equities Fund for 20 years. Your corpus at the end would look like this -

| Corpus with SIP | Corpus with SmartSIP |

| 12,195,925 | 13,639,070 |

There is a 11.83% difference in corpus of a regular SIP and a SmartSIP. This difference grows to 20.06% over a 30-year period. This is why selecting SmartSIP is the smartest thing to do. And the best part is that SmartSIP is absolutely FREE. You simply need to open a FREE Demat account with India’s best stockbroker Samco Securities. You can then get access to RankMF for absolutely FREE, shortlist your favourite midcap fund for 2022, select SmartSIP and you are done! But remember, you must invest in midcap funds only if you are an aggressive investor. Also, you must have a long-term investment horizon. Midcap funds, even the best ones are not without risk. Invest wisely with RankMF today!

Easy & quick

Easy & quick

Leave A Comment?