What do you look at when you choose amongst investment options? Accessibility, lock-in, expenses, best returns on mutual funds, ease in investment, safety, minimum investment and so on are some of the parameters you consider. Returns have always been the most popular and vitally important benchmarks for making an investment decision. We as investors constantly look for a higher ROI as it indicates that investment is profitable in earning returns on our investments. Thereby to make your selection process easier, we at RankMF have come up with a list of top mutual funds with best returns across various categories for the selected period. Furthermore, we provide you information about the basics of mutual funds and all other details about mutual funds you will need.

Equity Categories Provides Best Returns On Mutual Funds:

1) Sbi Small Cap Fund - Regular Growth

This fund was launched on 7th Sept, 2009. It is a small cap fund & it majorly invests in Engineering-Industrial Instrument, Consumer food, Hotels, Textile, Air Conditioners, etc. The risk involved in this fund is moderately high. It has given returns of 17.86% from the date of inception.

Objective - To provide investors with long term growth in capital along with the liquidity of an open-ended scheme by investing predominantly in a well-diversified basket of equity stocks of small-cap companies.

A. Key Information:

| Scheme Details: | |

| Category | Small Cap fund |

| Inception Date | 07/09/2009 |

| NAV | Rs 51.14 |

| AUM | Rs. 1604.50 |

| Expense Ratio | 2.44% |

| Exit Load | 1% on or before 1 year Nil after 1yr |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | -10.64% |

| 3 Year (%) | 18.83% |

| 5 Year (%) | 28.41% |

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

This fund has given 250.17% return whereas the benchmark index has given a return of 121.51%.

C. Portfolio Holdings

a. Asset Allocation

90.8% of the total assets are invested in equities and remaining in other assets.b. Top 10 holdings

| Securities | Weight(%) |

| TREPS | 7.64% |

| JK Cement Ltd. | 4.87% |

| HDFC Bank Ltd | 4.01% |

| Kewal Kiran Clothing Ltd | 3.86% |

| Emami Ltd | 3.17% |

| Bharat Heavy Electricals Ltd | 3.17% |

| Hatsun Agro Product Ltd | 3.12% |

| Galaxy Surfactants Ltd | 3.11% |

| Chalet Hotels Ltd. | 3.08% |

| Blue Star Ltd | 3.04% |

D. Fund Manager Details:

R. Srinivasan

Education: B.com, AICWA

Experience: Srinivasan has been heading Equity since June 2011 and oversees equity assets worth over Rs. 16000 crores. He joined SBI MF as a Senior Fund Manager in May 2009 and manages various Equity schemes. He brings with him over 19 years of experience in capital markets. He has earlier worked with FCH Principal PNB AMC Oppenheimer & Co Indosuez WI Carr and Motilal Oswal among others.

2. Reliance Small Cap Fund - Growth Plan

This fund was launched on 16th Sept, 2010. It is a small cap fund and it majorly invests in Chemicals, Private Banks, Households & personal products, pharmaceuticals, etc. It has given returns of 16.75% from the date of inception.

Objective - It objective is to generate long term capital appreciation by investing in equities & equity related instruments of small cap companies & also to generate consistent best returns on mutual funds by investing in debt and money market securities.

A. Key Information:

| Scheme Details: | |

| Category | Small cap fund |

| Inception Date | 16/09/2010 |

| NAV | Rs 39.84 |

| AUM | Rs 72244.94Cr |

| Expense Ratio | 2.3% |

| Exit Load | 1% on or before 1Y Nil after 1Y |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | -11.15% |

| 3 Year (%) | 18.68% |

| 5 Year (%) | 25.99% |

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

C. Portfolio Holdings:

a. Asset Allocation

Equity - 88.7% Debt - 9.8% Others - 1.5%b. Top 10 holdings

| Securities | Weight (%) |

| Axis Bank Limited | 2.50% |

| Deepak Nitrite Limited | 2.29% |

| Housing Development Finance Corporation Limited | 2.28% |

| Vindhya Telelinks Limited | 2.12% |

| Zydus Wellness Limited | 2.09% |

| Orient Electric Limited | 2.02% |

| VIP Industries Limited | 1.99% |

| Housing Development Finance Corporation Limited | 1.95% |

| Cyient Limited | 1.88% |

| Navin Fluorine International Limited | 1.81% |

D. Fund Manager Details:

Samir Rachh

Education: B.Com

Experience: Samir Rachh has graduated in commerce from Mumbai University. He has total experience of more than 25 years. Of which, five and half years with Capital Market Magazine as Assistant Editor, 3 Years Running own research and investment advisory firm Anvicon Research as managing partner, Five years with Hinduja Finance managing funds and research, four years with Emkay Global Financial Services Ltd, of which two years as Head of Institution Research and two years as head of PMS. He is working with RMF for the last eight years. He specializes in mid-cap/small cap stocks.

3. Mirae Asset Emerging Bluechip Fund - Regular Plan - Growth Option:

This Fund was launched on July 9th, 2010. It is a Large & Midcap fund and it majorly invests in private banks, Pharma, NBFCs, IT Sector, etc. The risk involved in this fund is moderately high. It has given returns of 20.20% from the date of inception.

Objective - The objective of this fund is to generate income & capital appreciation by investing in Indian equities of mid-cap & large-cap companies.

A. Key Information:

| Scheme Details: | |

| Category | Large & Mid Cap Fund |

| Inception Date | 09/07/2010 |

| NAV | Rs 57.57 |

| AUM | Rs 6443.82 Cr |

| Expense Ratio | 1.96% |

| Exit Load | 1% on or before 1Y(365D) Nil after 1Y(365D) |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 1000 |

| Returns: | |

| 1 Year (%) | 4.73% |

| 3 Year (%) | 20.35% |

| 5 Year (%) | 25.40% |

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

This fund has outperformed giving a return of 216.49% whereas the benchmark index - Sensex has given a return of 80.03%.

C. Portfolio Holdings:

a. Asset Allocation

Equity: 99.6% Others: 0.4%b. Top 10 holdings

| Securities | Weight (%) |

| HDFC Bank Limited | 5.91% |

| ICICI Bank Limited | 4.94% |

| Axis Bank Limited | 4.39% |

| Reliance Industries Limited | 4.04% |

| Tata Steel Limited | 2.89% |

| Bharat Financial Inclusion Limited | 2.87% |

| Voltas Limited | 2.81% |

| Kotak Mahindra Bank Limited | 2.74% |

| Info Edge (India) Limited | 2.66% |

| Infosys Limited | 2.66% |

D. Fund Manager Details:

Mr. Neelesh Surana

Mr. Neelesh Surana is Chief Investment Officer at Mirae Asset Global Investments (India) Pvt. Ltd. He joined Mirae Asset in 2008. He is responsible for the managing existing funds of Mirae Asset (India), as well as, providing research support for the global mandate. An engineering graduate with an MBA in Finance, Neelesh has over 19 years of experience in equity research and portfolio management.

Debt Category:

1) Aditya Birla Sun Life Government Securities Fund - Growth

This Fund was launched on Oct 11th, 1999. It is Gilt Fund. There is moderate risk involved in it. It has given returns of 8.81% since inception date.

Objective - The scheme's aim is to generate income and capital appreciation through investments exclusively in Government Securities.

A. Key Information:

| Scheme Details: | |

| Category | Gilt Fund |

| Inception Date | 11/10/1999 |

| NAV | Rs 51.65 |

| AUM | Rs231.31Cr |

| Expense Ratio | 1.18% |

| Exit Load | 0.50% on or before 90 days; Nil after 90 days |

| Minimum Investment | 1000 |

| Minimum SIP Amount | 1000 |

| Returns: | |

| 1 Year (%) | 8.76% |

| 3 Year (%) | 9.48% |

| 5 Year (%) | 10.46% |

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

Aditya Birla Sun Life Government Securities Fund has given 63.65% return in 5 yrs & has performed better than Crisil 10 Yr Gilt Index which gives a return of 46.65 % return on investment of Rs 10,000.

C. Portfolio Holdings:

a. Asset Allocation

Debt - 72.3% Others - 27.7%b. Top 10 holdings

| Securities | Weights (%) |

| Government of India(08/01/2028) | 35.14% |

| 41 DAYS CASH MANAGEMENT BILL 18MAR19 | 32.33% |

| Clearing Corporation of India Limited | 30.67% |

| Government of India (11/06/2022) | 2.24% |

| Government of India (28/08/2032) | 2.19% |

| State Government Securities (12/03/2019) | 0.22% |

| State Government Securities (12/12/2028) | 0.18% |

| Government of India (02/07/2040) | 0.00% |

| Net Receivables / (Payables) | -2.96% |

D. Fund Manager Details:

Pranay Sinha

Education: Graduation - IIT Kharagpur B.Tech in Aerospace Engg, Post Graduation from IIM Calcutta PGDM (Finance)

Experience: Mr. Pranay Sinha has an overall experience of around 10 years in financial markets. Prior to joining BSLAMC he was working as a Trader - Interest Rates in BNP Paribas Bank (October 2010 - August 2014)

Ashish Kela

Education: B.Tech, IIT

Experience: He has over 10 years of experience in the capital markets and has been with the fixed income investments team at Birla Sun Life Asset Management Company Ltd. since June 2012

2) Icici Prudential All Seasons Bond Fund - Growth

This Fund was launched on Jan 10th, 2010 and it is Gilt Fund. There is a moderate risk involved in it. It has given returns of 9.42% since inception date.

Objective - To generate income through investing in a range of debt and money market instruments of various duration while maintaining the optimum balance of yield safety and liquidity.

A. Key Information:

| Scheme Details: | |

| Category | Gilt Fund |

| Inception Date | 10/01/2010 |

| NAV | Rs 22.83 |

| AUM | Rs 2018.35 |

| Expense Ratio | 1.3% |

| Exit Load | 0.25% on or before 1 month; Nil after 1 month |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 100 |

| Returns: | |

| 1 Year (%) | 6.74% |

| 3 Year (%) | 9.41% |

| 5 Year (%) | 10.33% |

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

Icici Prudential All Seasons Bond Fund has given 63.60% return in 5 yrs & has performed well in comparison to Crisil 1 Yr T- Bill Index which has given 42.95% returns.

C. Portfolio Holdings:

a. Asset Allocation

Debt - 88.8% Others - 11.2%b. Top 10 holdings

| Securities | Weight (%) |

| Net Current Assets | 7.98% |

| Sansar Trust November 2018 A1 (Originator is Shriram Transport Finance Company Ltd.) | 5.41% |

| Aspire Home Finance Corporation Ltd. | 4.94% |

| Nayara Energy Ltd. | 4.94% |

| Promont Hillside Private Ltd. | 4.88% |

| Reliance Industries Ltd | 4.85% |

| Vedanta Ltd. | 4.81% |

| Government Securities | 4.66% |

| Housing and Urban Development Corporation Ltd. | 3.98% |

| Indiabulls Housing Finance Ltd. | 3.64% |

D. Fund Manager Details:

Manish Banthia

Education: B. Com, CA, MBA

Experience: Mr. Manish Banthia is associated with ICICI Prudential AMC from October 2005 till date. Prior to this, he has worked with Aditya Birla Nuvo Ltd and Aditya Birla Management Corporation Ltd.

Anuj Tagra

Education: BBA(H), MBA - Capital Markets

Experience: Mr. Anuj Tagra is associated with ICICI Prudential AMC from February 2013. Prior to this, he has worked with Union Bank Of India and Fidelity Investments.

3) Reliance Gilt Securities Fund - Growth Option

This Fund was launched on 18th Aug 2008. It is Gilt Fund. There is a moderate risk involved in it. It has given returns of 8.83% since inception date.

Objective- The primary investment objective of the scheme is to generate optimal credit risk-free returns by investing in a portfolio of securities issued and guaranteed by the Central Government and State Government.

A. Key Information:

| Scheme Details: | |

| Category | Gilt Fund |

| Inception Date | 18/08/2009 |

| NAV | Rs 24.50 |

| AUM | Rs. 929.40 |

| Expense Ratio | 1.59% |

| Exit Load | 0.25% on or before 15 days; Nil after 15 days |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 9.61% |

| 3 Year (%) | 9.38% |

| 5 Year (%) | 10.27% |

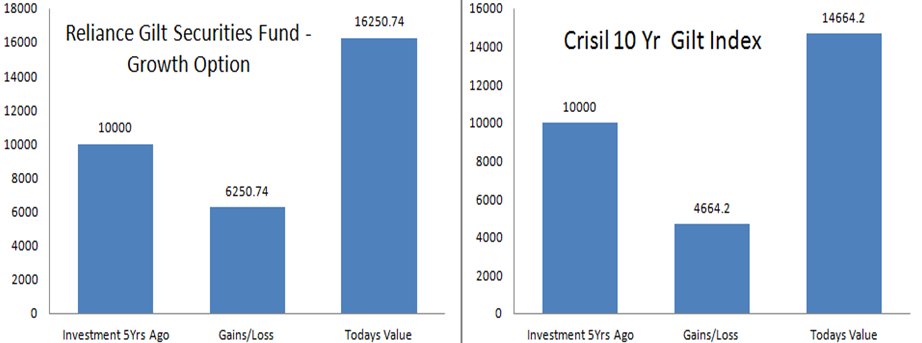

B. Fund Performance:

Performance of the Fund vis-a-vis the Benchmark

Reliance Gilt Securities Fund has given 62.25% Return in 5 years and outperformed its benchmark - Crisil 10 Year Gilt Index which has given 46.64%

C. Portfolio Holdings:

a. Asset Allocation

Debt - 88.8% Others - 11.3%b. Top 10 holdings

| Securities | Weight (%) | Securities | Weight (%) |

| 7.32% Government of India | 8.15% | 41 Days CMB | 13.41% |

| 8.08% State Government Securities | 5.28% | 7.37% Government of India | 13.01% |

| 7.17% Government of India | 30.11% | 8.28% State Government Securities | 12.85% |

| 8.08% State Government Securities(8.08% State Government Securities | (3.17%) | 8.24% Government of India | 1.12% |

| Triparty Repo | 27.84% | 7.88% Government of India | 0.55% |

D. Fund Manager Details:

Prashant Pimple

Education: B.Com, MMS, CTM (ICFAI)

Experience: Mr. Prashant R. Pimple has a total experience of 14 years in debt fund management. He has a total experience of nearly a decade in managing fixed income portfolios with Reliance Nippon Life Asset Management Limited (formerly Reliance Capital Asset Management Limited). Prior to this, he worked as a portfolio manager with Fidelity International Limited Asset Management Company and as Portfolio Manager in Investment Advisory Services (Debt Institutional) in ICICI Bank Ltd.

Liquid Fund Category:

1. Franklin India Liquid Fund - Super Institutional Plan

This fund was launched on Aug 29th, 2005. It is a Liquid Fund and it has a low risk as compared to other funds. It has given 7.84% since inception.

Objective - To provide income with high liquid through 100% investment in debt and money market instruments.

A. Key Information:

| Scheme Details: | |

| Category | Liquid Fund |

| Inception Date | 29/08/2005 |

| NAV | Rs 2776.02 |

| AUM | Rs 11908.77 |

| Expense Ratio | 0.17% |

| Exit Load | Nil |

| Minimum Investment | 10000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 7.59% |

| 3 Year (%) | 7.25% |

| 5 Year (%) | 7.86% |

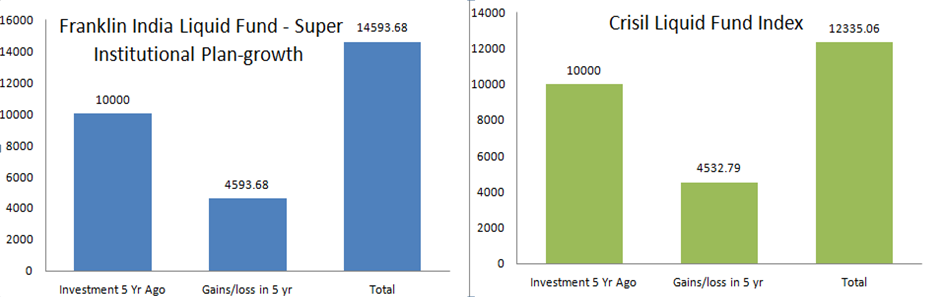

B. Mutual Fund Performance:

Franklin India Liquid Fund has given returns of 45.93% whereas Crisil Liquid Fund index has given 45.32% in 5 years.

C. Portfolio Holdings:

a. Asset Allocation

Debt - 92.9% Others - 7.2%b. Top 10 holdings

| Securities | Weights (%) | Securities | Weights (%) |

| Call Cash & Other Assets | 7.10% | Reliance Jio Infocomm Limited (08-Mar-2019) | 3.36%) |

| Lic Housing Finance Ltd(02-May-2019) | 4.15% | L&T Finance Ltd (28-Mar-2019) | 2.72% |

| Reliance Retail Ltd(20-Mar-2019) | 3.98% | Reliance Retail Ltd (22-Mar-2019) | 2.51% |

| Edelweiss Asset Reconstruction Co Ltd (05-Mar-2019) | 3.77% | Bharat Heavy Electricals Ltd (29-Mar-2019) | 2.51% |

| Reliance Jio Infocomm Limited (26-Mar-2019) | 3.76% | Axis Bank Ltd (10-May-2019) | 2.48% |

D. Fund Manager Details:

Pallab Roy Education: MBA (Fin.), M.Com., DBF Experience: Mr. Pallab Roy is responsible for Investments and Fund Management. He has been with Franklin Templeton Asset Management (India) Pvt. Ltd. since June 2001 till today. He is responsible for Liquidity Management & Portfolio MIS as Fixed Income funds.2. Jm Liquid Fund - Growth Option

This fund was launched on Dec 29th, 1997. It is a Liquid Fund and it has a low risk involved.

Objective- To provide income by way of dividend (dividend plans) and capital gains (growth plan) through investing in Debt and money market securities with a maturity of upto 91 days only. There can be no assurance that the investment objectives of the scheme will be realized. The scheme does not guarantee/ indicate any returns.

A. Key Information:

| Scheme Details: | |

| Category | Liquid Fund |

| Inception Date | 29/12/1997 |

| NAV | Rs 50.72 |

| AUM | Rs 2558.74Cr |

| Expense Ratio | NA |

| Exit Load | NA |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 7.50% |

| 3 Year (%) | 7.25% |

| 5 Year (%) | 7.81% |

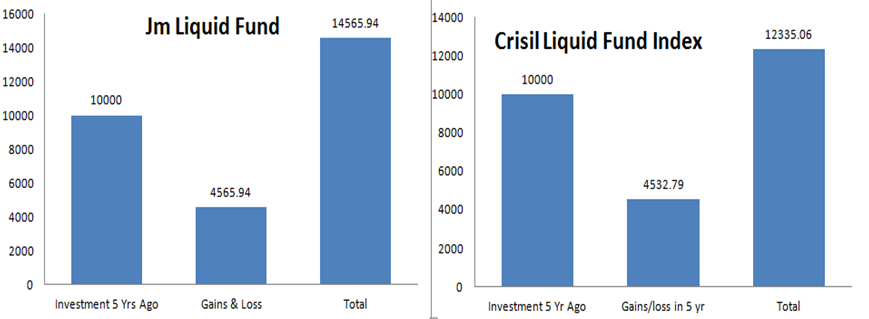

B. Fund Performance:

Jm Liquid fund has given returns of 45.65% in 5 years whereas the Crisil Liquid Fund Index has given comparatively equal returns in 5 years.

C. Portfolio Holdings:

a. Asset Allocation

Debt - 90.2% Others - 9.8%b. Top 10 holdings

| Securities | Weights (%) | Securities | Weights (%) |

| TREPS | 9.81% | Vijaya Bank CD | 4.88% |

| L&T Finance Ltd CP | 7.81% | Vedanta Ltd. CP | 3.91% |

| Reliance Jio Infocomm Ltd.CP | 7.81% | Shriram Transport Finance Company Ltd.CP | 3.91% |

| Reliance Retail Ltd. CP | 6.25% | IDFC First Bank Ltd. CD | 3.91% |

| Federal Bank CD | 4.88% | Reliance Industries Ltd. CP | 3.90% |

D. Fund Manager Details:

Shalini Tibrewala

Education: B.Com, A.C.A., C.S.

Experience: Ms. Shalini Tibrewala has over 14 years of experience in the financial services sector. She has been with the Fund for over 14 years. Prior to joining the AMC, she was working with a firm of Chartered Accountants.

3. Baroda Liquid Fund Plan A - Growth

This fund was launched on Feb 2nd, 2009 and it is a Liquid Fund. This fund has low risk and it has given 7.77% returns since inception.

Objective - The main objective of the scheme is to generate income with a high level of liquidity by investing in a portfolio of money market & debt securities.

A. Key Information:

| Scheme Details: | |

| Category | Liquid Fund |

| Inception Date | 2/2/2009 |

| NAV | Rs 2129.65 |

| AUM | Rs 7884.11 Cr |

| Expense Ratio | 0.27% |

| Exit Load | Nil |

| Minimum Investment | 5000 |

| Minimum SIP Amount | 500 |

| Returns: | |

| 1 Year (%) | 7.55% |

| 3 Year (%) | 7.26% |

| 5 Year (%) | 7.81% |

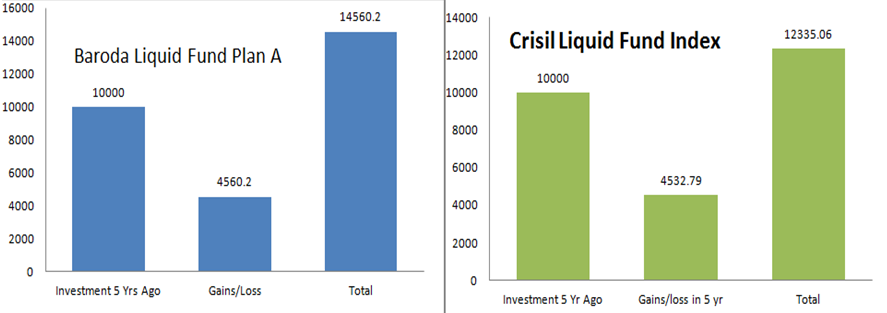

B. Fund Performance:

Baroda Liquid Fund Plan as given 45.60% return over 5 years whereas Crisil Liquid Fund Index has given an equal return over 5 years.

C. Portfolio Holdings:

a. Asset Allocation:

Debt - 64.6% Others - 35.5%b. Top 10 holdings

| Securities | Weights (%) | Securities | Weights (%) |

| Larsen & Toubro Ltd. | 5.07% | Reliance Industries Ltd. | 3.17% |

| CBLO | 30.76% | Reliance Jio Infocomm Ltd. | 3.17% |

| Vijaya Bank | 3.86% | Bajaj Housing Finance Ltd. | 3.17% |

| L&T Finance Ltd. | 3.79% | Piramal Enterprises Ltd. | 3.16% |

| Reliance Industries Ltd. | 3.75% | L&T Housing Finance Ltd. | 2.85% |

D. Fund Manager Details:

Alok Sahoo

Education: BE, MBA (Finance), CFA, FRM

Experience: Mr. Alok Sahoo has been working in the investment area in the asset management industry for 13 years now. Prior to this, he was fixed-income fund manager at UTI MF and HSBC MF. He was also the Fund Manager for Employee Provident Fund at HSBC Asset Management. He has experience in the credit research of companies as well.

Note:

1) All the above funds are open-ended funds and growth options.

2) All the above data has been taken from RankMF.com as on 13/03/2019. Returns calculated from Crisil Indices have been taken from the Crisil website.

3)The funds have been ranked on the basis of top returns generated under each category. This list would differ from the rankings on RankMF as the parameters used on RankMF differ.

This covers the vast subject of mutual funds with best returns. For more useful articles on Mutual Funds, trading, investing and market knowledge, visit our Investor Education section.

(Note: This content is for information purpose only. Avoid trading and investing based on the information given above. Before investing in stocks or mutual funds, please conduct proper due diligence.)

Easy & quick

Easy & quick

Leave A Comment?