In this article, we will cover,

- What are Broking Stocks?

- List of Broking Stocks in 2023 – NSE & BSE

- Top Eight Broking Stocks in 2023 as per Market Capitalisation

Broking industry is one of the few industries that saw massive growth during the Covid-19 pandemic. There was a remarkable growth in the number of Demat accounts opened. On average, 4 Lakh Demat accounts were opened every month in the financial year 2020. This increased to 29 Lakh Demat accounts by November 2021, which moderated to an average of 25 lakh accounts per month in FY 2023 Even the size of the broking industry has grown from Rs. 135 Billion in FY 2016 to Rs. 195 Billion in FY 2019, with nearly doubling to Rs. 382 billion in FY 2023. This is a growth of 16.02%. The biggest benefactor of this growth is the broking companies. Now please understand something Zerodha is the market leader in the broking sector when it comes to the number of active clients. It dominates roughly 19.2% of the broking industry in India. But it is not a listed broker. So, you cannot invest in this broking company. Now please understand something, Zerodha is the market leader in the broking sector when it comes to the number of active clients. It dominates roughly 19.06% of the broking industry in India. But it is not a listed broker. So, you cannot invest in this broking company. But there are other listed broking stocks which can help you capitalize on the growth in the broking sector. ICICI Securities Ltd is one such broking stock. Did you know that ICICI Securities Ltd is the biggest broking stock in 2023? Yes, this broking stock has a market capitalization of Rs 16,308 crore (as on, May 30, 2023). The stock has rallied by 30.56% in the last one year. Another popular broking stock is 5Paisa Capital Ltd which has shown a growth of 26% in the last one year. So, if you choose wisely, you can create ample wealth with broking stocks. In this article, we will take a look at the structure of the broking industry in India. We will also share a list of all the broking stocks in 2025, listed on both the National Stock Exchange & the Bombay Stock Exchange. In the end, we will also share the names of the best broking stocks in 2025 that you should watch out for.

What are Broking Stocks?

Broking companies are engaged in the business of facilitating buying and selling of financial securities. They help retail and institutional investors buy and sell equity shares, currency, commodities and other financial assets. Before the digital revolution, majority of Demat accounts were held with full-service brokers. These brokers used to provide research to clients and execute their trades. But the scenario has changed. Today, discount brokers have taken over the broking industry. By offering low-cost-flat fee structure instead of percentage on trading volume, discount brokers have made trading cost-effective for retail investors. One such discount broker, who has changed the broking game completely by leveraging technology is Samco Securities. Superior technology is what sets Samco apart from the crowd. We offer unique facilities like StockPlus and CashPlus. We were also awarded as the best stockbroker by CNBC Away. That’s not all. In addition to broking, Samco has three other verticals, specially curated to help you achieve your varied investment objectives.

- Are you bullish on a particular sector but not sure which stocks to buy to achieve the right balance? Don’t have time to monitor your portfolio and make timely changes? Check out StockBasket – expert-curated baskets of stocks, in the right proportion and create wealth without any worry.

- Buying individual stocks is not your cup of tea? Don’t worry. RankMF has you covered. RankMF is India’s best mutual fund investment and research platform. Check out if you are investing in the right mutual funds by opening a FREE account with RankMF today.

- Have you invested enough in long-term stocks? Want to now make some money via trading? Check out Samco’s KyaTrade – A unique platform that gives you instant intraday trading ideas with a single swipe.

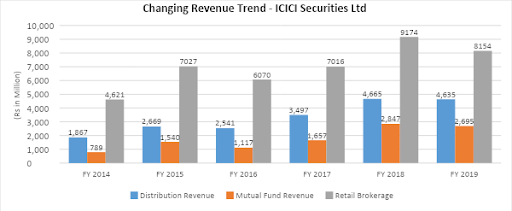

The primary source of revenue for broking companies is the brokerage received from their clients. But with changing times, a major chunk of this revenue is derived from selling products like insurance, mutual funds and loans etc. With heavy competition from discount brokers, traditional brokers have changed their revenue model, for the good. There are a total of 5,316 registered stock brokers in India (SEBI statistics as of May 30, 2023). However, a majority of them are not listed on the stock exchange. Of these, only 78 broking stocks are listed on Indian stock exchanges. Here’s a list of all the broking stocks in 2023 listed on NSE and BSE. Let us take the example of ICICI Securities Ltd. to understand the changing trends in the broking industry.

rived from selling products like insurance, mutual funds and loans etc. With heavy competition from discount brokers, traditional brokers have changed their revenue model, for the good. There are a total of 5,316 registered stock brokers in India (SEBI statistic as of May 30, 2023). But a majority of them are not listed on the stock exchange. Of these, only 78 broking stocks are listed on Indian stock exchanges. Here’s a list of all the broking stocks in 2023 listed on NSE and BSE. Let us take the example of ICICI Securities Ltd. to understand the changing trends in the broking industry.

*Source: ICICI Securities Ltd Annual Report The company’s revenue from the mutual fund business grew from Rs 789 million to Rs 2,695 million between 2014 and 2019. This was a growth of 187% on an absolute business. During the same period, the revenue from the retail brokerage business grew by only 76.46% on an absolute basis. With heavy competition from discount brokers, traditional brokers have changed their revenue model, for the good. There are a total of 4,812 registered stock brokers in India (SEBI statistic as of March 7, 2022). But a majority of them are not listed on the stock exchange. Of these, only 39 broking stocks are listed on Indian stock exchanges. Here’s a list of all the broking stocks in 2022 listed on NSE and BSE.

List of Broking Stocks in 2025 – NSE & BSE

Company Name | 52-week High (RS.) | 52-week Low (RS.) | Market Cap (Rs. Cr) |

722 | 181 | 32,488 | |

866 | 601 | 25,282 | |

3,896 | 1,452 | 20,985 | |

4,270 | 1,538 | 20,129 | |

451 | 168 | 7,763 | |

405 | 234 | 6,253 | |

60 | 30 | 3,364 | |

116 | 46 | 2,366 | |

169 | 43 | 2,321 | |

690 | 279 | 1,747 | |

183 | 71 | 1,658 | |

758 | 386 | 1,548 | |

183 | 59 | 914 | |

247 | 128 | 818 | |

84 | 38 | 726 | |

26 | 10 | 655 | |

87 | 40 | 559 | |

12 | 3 | 190 |

Data as on 2024

Top Eight Broking Stocks in 2025 as per Market Capitalization

- Broking Stock in 2024 #1: ICICI Securities Ltd

- Broking Stock in 2024 #2: Motilal Oswal Financial Services Ltd

- Broking Stock in 2024 #3: IIFL Securities Ltd.

- Broking Stock in 2024 #4: Angel One Ltd (Angel Broking Pvt. Ltd)

- Broking Stock in 2024 #5: Edelweiss Financial Services Ltd

- Broking Stock in 2024 #6: Share India Securities Ltd

- Broking Stock in 2024 #7: Geojit Financial Services Ltd

- Broking Stock in 2024 #8: 5Paisa Capital Ltd.

Broking Stock in 2025 #1: ICICI Securities Ltd

ICICI Securities Ltd.’s market capitalization is a whopping Rs. ₹ 25,366 Cr (as of 10 July 2024). This makes it the biggest broking stock of 2024. The company is a subsidiary of ICICI Bank Ltd, one of the largest private sector banks in India. The business of ICICI Securities Ltd is divided into four verticals -

- Retail and Institutional Broking

- Distribution of financial products

- Wealth Management

- Investment Banking

Despite the pandemic, the company has managed to nearly double its revenue from Rs.1,721 crore in March 2020 to Rs. 3,416 crore in March 2023. Even its net profit has more than doubled from Rs. 542 in March 2020 to Rs. 1,118 crore I-n March 2023. From 2019, it managed to on-board 4.7 million clients. This is a 20% CAGR increase from its client base in 2019.

Key Financials of ICICI Securities Ltd as on 10 July 2024.

Market Cap: ₹ 25,366 Cr | Face value: ₹ 5.00 | EPS: ₹ 52.5 |

Book Value (₹): 6.45 | ROCE%: 19.7 | Debt to Equity: 4.3 |

Stock P/E: 14.9 | ROE %: 50.1 | Dividend yield %: 3.72 |

Revenue: ₹ 1,543 Cr | Earnings: ₹ 537 Cr | Cash: ₹ 11,251 Cr |

Total Debt: ₹ 16,887 Cr | Promoter’s Holdings%: 74.7 |

Broking Stock in 2025 #2: Motilal Oswal Financial Services Ltd

This is a 4.5 star rated broking stock as per Samco stock rating. The company is a market leader and has perfectly blended technology with its 360-degree product basket. It offers services in retail broking, insurance, and mutual fund distribution, portfolio management services, IPOs, bonds, fixed deposits, etc. The company has the following AUM across its various verticals –

- Broking – Rs 21,300 crore

- Asset Management – Rs 45,620 crore

- Wealth Management – Rs 52,000crore

- Home Finance – Rs. 3,840 crore

Like ICICI Securities, Motilal Oswal Financial Services Ltd. Also managed to almost double its revenue from Rs.2,358 crores in FY20 to Rs.4,177 crores in FY23. The company’s net profit also nearly increased by 5x from Rs 183 crore in March 2020 to Rs 935 crore in March 2023. The company also has a ROE of 17.5%. for FY23.

Key Financials of Motilal Oswal Financial Services Ltd as on 10 July 2024.

Market Cap: ₹ 32,210 Cr. | Face value: ₹ 1 | EPS: ₹ 41 |

Book Value (₹): 3.62 | ROCE% : 20.7 | Debt to Equity: 1.58 |

Stock P/E: 13.2 | ROE %: 32.6 | Dividend yield %: 0.65 |

Revenue: ₹ 2,141 Cr. | Earnings: ₹ 723 Cr. | Cash : ₹ 12,071 Cr. |

Total Debt : ₹ 13,787 Cr. | Promoter’s Holdings% : 69 |

Broking Stock in 2025 #3: IIFL Securities Ltd.

This next broking stock comes from the affluent IIFL Group. They provide retail and institutional advisory and execution in the following domains –

- Equities

- Financial Products Distribution

- Commodity & Currency broking

- Investment Banking

- Financial Planning

- Wealth Management

IIFL Securities Ltd. had a decent 2023. They managed to increase their revenue from Rs 1,295 crore to Rs 1,352 crores between March 2022 and 2023. However, its net profit dipped by 22%. The company has managed to generate a ROE of 23.4% in the last three years

Key Financials of IIFL Securities Ltd as on 10 July 2024.

Market Cap: ₹ 5,851 Cr. | Face value: ₹ 2.00 | EPS: ₹ 16.6 |

Book Value (₹): 3.23 | ROCE% : 34.8 | Debt to Equity: 0.65 |

Stock P/E: 11.4 | ROE %: 32.7 | Dividend yield %: 1.53 |

Revenue: ₹ 686 Cr. | Earnings: ₹ 180 Cr. | Cash : ₹ 4,468 Cr. |

Total Debt : ₹ 1,154 Cr. | Promoter’s Holdings% : 30.9 |

Broking Stock in 2025 #4: Angel One Ltd (Angel Broking Pvt. Ltd)

Angel One Ltd is the second biggest broking stock in 2023 with a market capitalization of Rs. 10,903 crore. It is also the second largest broker in terms of active client base with a market share of 13.1% It is also one of the few traditional brokers who have managed to adapt to the changing times without hurting its revenue. Angel One Ltd dominates roughly 12% of the broking industry in India. The company prides itself on its active client base. Their active client base percentage is nearly 32%,. It is among the top 5 digital brokers that have a share of 60% in NSE Active Clients in India. The company is a market leader in the following domains –

- Retail and Institutional broking

- Research reports and recommendations

- Investment advisory

- Margin trading facility, loan against shares

- Distribution of banking, financial and insurance products

The company’s total revenues have grown consistently in the past few years. It grew from Rs. 748 crore in 2017 to Rs. 3,002 crore in 2023.From 2020, , its net profit has increased by 11x from Rs.82 crores to Rs.890 crores in 2023.The company has managed to deliver an average ROE of 44.3% in the last three years.

Key Financials of Angel One Ltd as on 10 July 2024.

Market Cap: ₹ 20,051 Cr. | Face value: ₹ 10.0 | EPS: ₹ 134 |

Book Value (₹): 6.21 | ROCE% : 38.7 | Debt to Equity: 0.84 |

Stock P/E: 17.8 | ROE %: 43.3 | Dividend yield %: 1.79 |

Revenue: ₹ 1,357 Cr. | Earnings: ₹ 340 Cr. | Cash : ₹ 9,844 Cr. |

Total Debt : ₹ 2,541 Cr. | Promoter’s Holdings% : 35.7 |

Broking Stock in 2025 #5: Edelweiss Financial Services Ltd

This is another popular broking stock. They provide investment advisory, financial planning, currency trading, trading in derivatives and equity segments, mutual funds, gold ETFs etc. It is the second largest company in the wealth management space. It recently demerged its Nuvama Wealth management business, which will be listed as a separate entity by August 2023. The company managed to post a revenue of Rs 8,841 crore as of March 2023. This was a 17.1% increase from the previous year. The company posted a net profit of Rs 406 crore, almost doubling from FY22 wherein it reported a profit of Rs.212 crore.

Key Financials of Edelweiss Financial Services Ltd as on 10 July 2024.

Market Cap: ₹ 6,358 Cr. | Face value: ₹ 1.00 | EPS: ₹ 4.46 |

Book Value (₹): 1.34 | ROCE% : 11.5 | Debt to Equity: 4.27 |

Stock P/E: 15.1 | ROE %: 7.31 | Dividend yield %: 2.26 |

Revenue: ₹ 2,967 Cr. | Earnings: ₹ 169 Cr. | Cash : ₹ 3,331 Cr. |

Total Debt : ₹ 20,358 Cr. | Promoter’s Holdings% : 32.8 |

Broking Stock in 2025 #6: Share India Securities Ltd

Our next top broking stock of 2023 is Share India Securities Ltd. The company has five main verticals –

- Broking and Depositories – Equity and Derivatives, currency, commodity etc.

- Merchant Banking – IPO valuation, advisory and mergers and acquisitions.

- Mutual Funds and Debt Products – Mutual Fund schemes, NPS, Capital gains bonds etc.

- Insurance Broking– General and Life Insurance

- Non-Banking Financial Services – Loan against shares, small and micro loans, personal loans etc.

The company has to grow its revenue by 4x from Rs 228 crore in March 2020 to Rs 1,088 crore in March 2023. Its net profit also increased 8 manifold from Rs 41 crore to Rs 331 crore between March 2020 and 2023. The company has managed to deliver a ROE of 46.1% in the last three years, which is one of the best among other listed broking stocks.

Key Financials of Share India Securities Ltd as on 10 July 2024.

Market Cap: ₹ 6,047 Cr. | Face value: ₹ 2.00 | EPS: ₹ 22.2 |

Book Value (₹): 3.38 | ROCE% : 38.3 | Debt to Equity: 0.23 |

Stock P/E: 14.2 | ROE %: 31 | Dividend yield %: 0.55 |

Revenue: ₹ 465 Cr. | Earnings: ₹ 116 Cr. | Cash: ₹ 2,018 Cr. |

Total Debt: ₹ 403 Cr. | Promoter’s Holdings%: 52.3 |

Broking Stock in 2025 #7: Geojit Financial Services Ltd

Geojit Financial Services is one of the leading listed broking stocks in India. Its AUM under the mutual fund division has grown from Rs. 3,750 crore in financial year 2020 to Rs. 11,200 crore in financial year 2023. Like its peers, Geojit Financial Services Ltd is present in investment advisory, broking, financial services distribution and wealth management domains. The company’s revenue grew at a CAGR of 10% from Rs.306 crores in 2020 to Rs. 439 crores in 2023.. The company’s net profit has also grown from Rs. 51 crores in 2020 to Rs. 101 crores in 2023. It has also managed to generate a high ROE of 19.5% in the last three years.

Key Financials of Geojit Financial Services Ltd as on 10 July 2024.

Market Cap: 2,414 Cr. | Face value: 1 | EPS: 6.06 |

Book Value (₹): 2.9 | ROCE% : 18.8 | Debt to Equity: 0.48 |

Stock P/E: 16.6 | ROE %: 18.6 | Dividend yield %: 1.46 |

Revenue: 208 Cr. | Earnings: 50.6 Cr. | Cash: 1,073 Cr. |

Total Debt: 398 Cr. | Promoter’s Holdings%: 54.6 |

Broking Stock in 2025 #8: 5Paisa Capital Ltd.

5Paisa Capital Ltd. is one of India’s fastest growing technology-driven brokers. It was established in the year 2007 and its promoter is Mr. Nirmal Jain, who is also the promoter of IIFL group. The company is highly popular in the following areas –

- Online discounted stock broking

- Depository services

- Research and distribution of financial products

- Peer-to-Peer lending

- Mutual Fund Advisory and Distribution

- Insurance

- Commodities Trading

This broking stock has shown strong revenue growth jumping 3x from Rs 108 crore in 2020 to Rs 338 crore in 2023. It posted a net profit of Rs 44 crore in 2023, making a turnaround from a loss of Rs 8 crore in 2020. This broking stock has achieved a compounded profit growth rate of 30.1% in the last five years.

Key Financials of 5Paisa Capital Ltd. as on 10 July 2024.

Market Cap: ₹ 1,551 Cr. | Face value: ₹ 10.0 | EPS: ₹ 17.4 |

Book Value (₹): 2.9 | ROCE% : 13.4 | Debt to Equity: 0.62 |

Stock P/E: 28.5 | ROE %: 10.8 | Dividend yield %: 0 |

Revenue: ₹ 113 Cr. | Earnings: ₹ 5.78 Cr. | Cash: ₹ 1,637 Cr. |

Total Debt: ₹ 336 Cr. | Promoter’s Holdings% : 32.8 |

This completes our discussion on the top broking stocks in 2023. Now, there is no doubt that broking is a lucrative business. But the coming decade will be a testing time for all of these broking stocks. With high-speed-low-cost technology eating into their profit margins, broking companies will have to up the ante or else fintech companies will win this battle. What do you think of these broking stocks? Do comment and tell us of your views. In the meanwhile, here is our playlist on some of the best investment ideas, especially for you. Open a Demat account with Samco Securities – India’s best stock broker and enjoy lowest brokerage in India.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?