But when it comes to the formation of the pattern on a chart, there is so much involved in it. So, without further delay, let’s explore everything about the cup and handle pattern.

In this article:

But when it comes to the formation of the pattern on a chart, there is so much involved in it. So, without further delay, let’s explore everything about the cup and handle pattern.

In this article:

- What is a cup and handle pattern?

- The components and psychology behind the formation of cup and handle pattern

- How to trade using the cup and handle pattern?

- Real-life examples of the cup and handle pattern

What is a Cup and Handle Pattern?

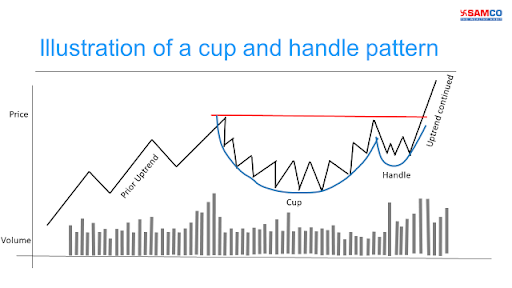

A cup and handle pattern is a bullish continuation pattern. It can help to identify that the uptrend in price is going to continue. The pattern resembles the appearance of a tea cup and hence it is named as the cup and handle pattern. But before we understand the cup and handle pattern, let’s understand what is a bullish continuation pattern.What Is a Bullish Continuation Pattern?

A bullish continuation indicates that the uptrend is going to sustain in the future. So, a continuation pattern would occur in the middle of an uptrend and signal that once the pattern is complete and once you receive a confirmation, the uptrend will resume. Now let’s look at the cup and handle pattern and take a look at its formation and components. The cup and handle pattern has two major components.

The cup and handle pattern has two major components.

- Cup

- Handle

The Psychology Behind the Formation of Cup and Handle Pattern

Firstly, there is a prior uptrend in the stock. During this uptrend, traders get quite optimistic about the stock. Few traders who bought the stock at the beginning of the uptrend or during the rally are making good profits.

But, few naive traders who do not follow the charts buy the stock at the resistance level (the red straight line) thinking that the stock price would rise further. But as the stock is near to the resistance level, smart traders who had bought the stock at the beginning of the uptrend start to book profits which increases the selling pressure pushing the stock prices down. This initiates the formation of the left side of the cup (the red part on the inside of the cup).

Now, if the stock has good fundamentals, eventually fund managers, institutional investors and smart investors will step in to buy the stock when it is undervalued. This will generate demand and form a support level which is called the bottom of the cup.

Once the bottom of the cup is established, the stock starts climbing higher which forms the right side of the cup (the green part on the inside of the cup). This up move is a sign that big investors are buying the stock which increases demand and the stock price goes up.

The up move pauses near the red line…but why is it so? That’s because the traders who had bought the stock at the left edge thinking that the stock would go up didn’t sell the stock and saw the entire cup formation. At this point they are no longer expecting a profit, all they want is their capital back. So, they sell the shares and the selling pressure leads to the formation of a resistance line.

The reflection of human emotions is seen in the chart and the formation of the handle takes place.

Firstly, there is a prior uptrend in the stock. During this uptrend, traders get quite optimistic about the stock. Few traders who bought the stock at the beginning of the uptrend or during the rally are making good profits.

But, few naive traders who do not follow the charts buy the stock at the resistance level (the red straight line) thinking that the stock price would rise further. But as the stock is near to the resistance level, smart traders who had bought the stock at the beginning of the uptrend start to book profits which increases the selling pressure pushing the stock prices down. This initiates the formation of the left side of the cup (the red part on the inside of the cup).

Now, if the stock has good fundamentals, eventually fund managers, institutional investors and smart investors will step in to buy the stock when it is undervalued. This will generate demand and form a support level which is called the bottom of the cup.

Once the bottom of the cup is established, the stock starts climbing higher which forms the right side of the cup (the green part on the inside of the cup). This up move is a sign that big investors are buying the stock which increases demand and the stock price goes up.

The up move pauses near the red line…but why is it so? That’s because the traders who had bought the stock at the left edge thinking that the stock would go up didn’t sell the stock and saw the entire cup formation. At this point they are no longer expecting a profit, all they want is their capital back. So, they sell the shares and the selling pressure leads to the formation of a resistance line.

The reflection of human emotions is seen in the chart and the formation of the handle takes place.

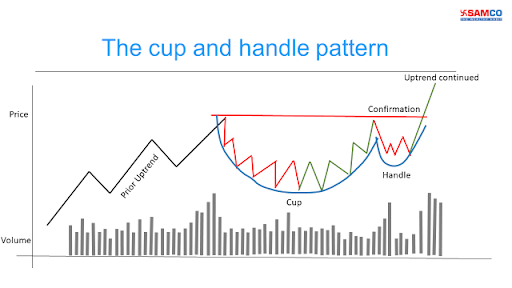

But what is the psychology behind the formation of the handle?

The handle is a section where fearful traders sell off their stocks at small profits, breakeven or even at a small loss.- The traders who had bought the stock at the left edge of the cup have experienced the entire dip in the stock. When the stock pulled back to the right edge, they still didn’t cover their position at the breakeven point (the resistance level). So, when they see a dip in the share price because of the prior selling pressure they prefer booking a nominal loss with the fear that the prices will dip to the closest support line (the base of the cup).

- The traders who had bought the stock at the bottom of the cup think that the stock is near to the previous highs and they book profits at the resistance level which adds up to the selling pressure.

- Few traders who think that there has been a reversal enter into the short position too.

How to Trade Using the Cup and Handle Pattern?

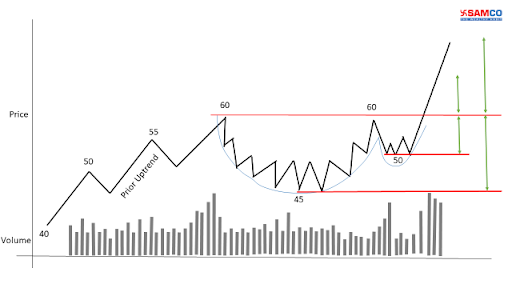

On the same chart, we have plotted prices. So, initially, the stock rallies from Rs. 40 to Rs. 60 to form the left edge of the cup. It then goes down to Rs. 45 to form the base of the cup and again rallies back to Rs. 60, hits the resistance line and forms the right edge.

Because of selling pressure, the stock forms a handle and hits a low of Rs. 50.

We all know by now, you must place a trade after the stock breaks out of the resistance level and closes above it for a few days. In this case, you can enter into the position above Rs. 60.

On the same chart, we have plotted prices. So, initially, the stock rallies from Rs. 40 to Rs. 60 to form the left edge of the cup. It then goes down to Rs. 45 to form the base of the cup and again rallies back to Rs. 60, hits the resistance line and forms the right edge.

Because of selling pressure, the stock forms a handle and hits a low of Rs. 50.

We all know by now, you must place a trade after the stock breaks out of the resistance level and closes above it for a few days. In this case, you can enter into the position above Rs. 60.

But, when is the right time to exit the trade?

There are two methods to calculate it. The first way is determining a smaller price target. All you need to do is measure the height of the handle and add it above the resistance level. In this case, the height of the handle is Rs. 10 (Rs. 60 - Rs. 50). So, your first target price would be Rs. 70. The second way is determining a bigger price target. Here you need to add the height of the cup and add it above the resistance level. In this case, the height of the cup is Rs. 15 (Rs. 60 - Rs. 45). So, your second price target will be Rs. 75. It is obvious that the higher the price target, the more time it will take for you to achieve the target. So, if you are a short term trader you can go with the smaller price target. Long term investors can prefer going with the bigger price target. Now, let’s talk about risks. We all know that there is no surety that the stock will reach the price targets we have determined and hence it is important to place a stop loss. You can place a stop loss near the price where the handle was formed. In this case, it is Rs. 50.Real-Life Examples of a Cup and Handle Pattern

The cup and handle pattern formed in Affle India

We can see a perfect example of a cup and handle pattern in Affle India. Before the formation of the pattern, the stock was in an uptrend from 29th October 2020 to 5th March 2021. The stock price rallied from Rs. 503.10 to Rs. 1,250.50. The depth of the cup is formed at Rs. 767. The depth of the handle is formed at Rs. 245.75. The resistance level is at Rs. 1,253.70. So, after the breakout, you could place a trade with a stop loss of Rs. 1,008.90 with Rs. 1,739.00 as the higher price target and Rs. 1,498.45 as the smaller price target. On 14th January 2022, the stock hit a high of Rs. 1,507.45 which is just above our smaller price target.

The cup and handle pattern formed in Adani Enterprises

The cup and handle pattern in Adani enterprises is an ongoing example. The stock has been in an uptrend from August 2020 to June 2021. We have seen a huge bullish rally from Rs. 165 to Rs. 1,726.45. As we can see, the cup and handle pattern is quite evident with a resistance level of Rs. 1,797.90. As this is an ongoing pattern, we have just seen a breakout in the stock. The smaller target according to the calculation is Rs. 2,005.85 and the higher target is Rs. 2,355.70. The stop loss according to the handle Rs. 1,576.95. One thing to notice here is that even if we have seen a breakout, the volumes are light which indicates a weak momentum.

Easy & quick

Easy & quick

Leave A Comment?