- The current ratio of Tata Consultancy Services Ltd (TCS) is 2.13.

- The current ratio of Shriram Transport Finance Company Ltd (SRTRANSFIN) . is 10.9.

In this article:

- What is the current ratio?

- How to calculate current ratio?

- What is the ideal current ratio?

- Current ratio analysis & interpretation

- Limitations of current ratio

- FAQs on current ratios

What is Current Ratio?

Current ratio measures the ability of a company to repay its short-term debt. This is debt due within one year and must be repaid using current assets only. Ideally, a company must have enough assets to repay its debt without raising fresh capital and diluting its shareholding. Current ratio compares a company’s current assets and current liabilities. It is also known as working capital ratio. Current assets are those which can be converted into cash within one year. It includes: · Cash · Mutual fund investments · Money market instruments like treasury bills, commercial papers etc. · Inventory (raw materials, work in progress and finished goods) · Accounts receivables (from vendors or customers) · Prepaid expenses (advance payments to suppliers) Current Liabilities are debt or loans payable within one year. It includes: · Accounts payable (to suppliers) · Outstanding expenses (salary, wages, electricity bills, rent etc). · Advance received from customers · Deferred taxes · Declared but not yet paid dividendsHow to Calculate Current Ratios?

To calculate the current ratio, divide a company’s current assets with its current liabilities. This data is available in the company’s balance sheet. [Read More: How to Analyse Balance Sheet of a Company] Let us calculate the current ratio of Tata Consultancy Services Ltd for the year ending 31st March 2021.| Current Assets | (Rs in Crores) |

| Inventory | ₹ 8 |

| Investments | ₹ 29,160 |

| Trade Receivables | ₹ 30,079 |

| Unbilled Receivables | ₹ 6,583 |

| Cash and cash equivalents | ₹ 6,858 |

| Bank Balances | ₹ 2,471 |

| Loans | ₹ 11,472 |

| Miscellaneous financial assets | ₹ 1,394 |

| Other assets | ₹ 11,255 |

| Total Current Assets | ₹ 99,280 |

| Current Liabilities | (Rs in Crores) |

| Lease liabilities | ₹ 1,292 |

| Trade payables | ₹ 7,860 |

| Other financial liabilities | ₹ 6,150 |

| Unearned and deferred revenue | ₹ 3,650 |

| Other liabilities | ₹ 4,068 |

| Provisions | ₹ 1,394 |

| Employee benefit obligations | ₹ 3,498 |

| Income tax liabilities (net) | ₹ 6,243 |

| Total Current Liabilities | ₹ 34,155 |

What is the Ideal Current Ratio?

· Current Ratio > 1 is a good sign. It means the company’s current assets are greater than current liabilities. Such companies have solid cash flows and have minimum credit risk. · Current Ratio < 1 is a potential red flag for investors. This happens if a company’s current assets are less than its current liabilities. Such companies may have to raise additional funds or sell long-term assets to pay their loans. They carry high credit risk. · Current Ratio = 1 This happens when a company’s assets and liabilities are equal. It means a company has just enough assets to repay its loans. But even a small decrease in cash flow can lead to credit defaults. Hence it is recommended to invest in companies with a current ratio more than one. Generally, a high current ratio is ideal. But a current ratio of more than three can be bad for investors. An exceptionally high current ratio means that the company is hoarding cash. This is not a productive use of investor’s money. Hence, the ideal current ratio lies between one and three.How to Use Current Ratio in Stock Analysis

There are two ways in which current ratio can be used in stock analysis: · Analysis of historical current ratio trend. · Current ratio Vs industry ratio analysis.Current Ratio Trend Analysis

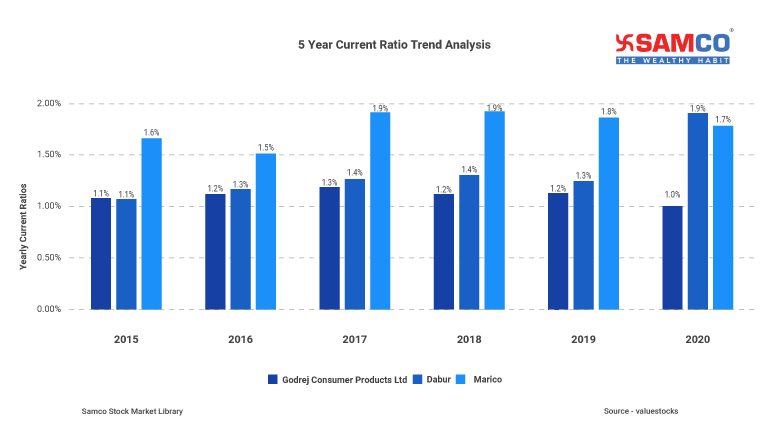

What is the goal of long-term investing? To invest in consistently sound companies. You don’t want to invest in one-hit wonders. Similarly, a company might have a good current ratio in a particular year. But this is not enough. You need to study its five-year trend. Is the trend upwards or downwards? Is the company getting financially stronger or weaker? The below graph shows the historical current ratio of Dabur India Ltd, Marico Ltd and Godrej Consumer Products Ltd.

Current Ratio Vs Industry Current Ratio

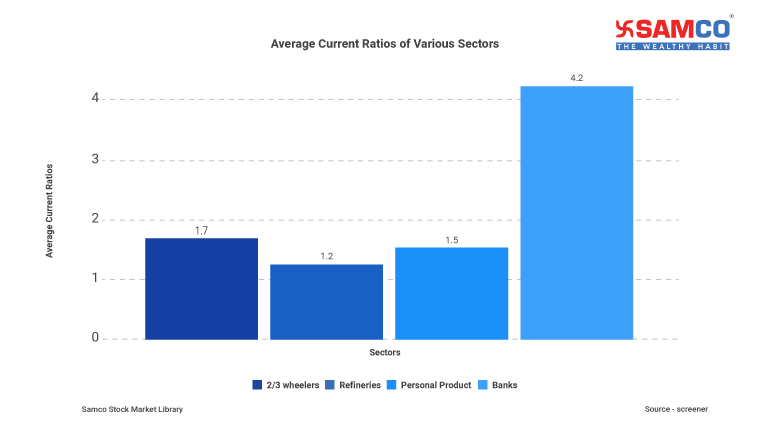

Current ratio varies across sectors. The below graph shows the average current ratios of 2/3 wheelers, banks, refineries and the personal products sector.

- The average current ratio for the 2/3 wheeler sector is 1.70.

- Whereas its 1.26 for the refineries sector.

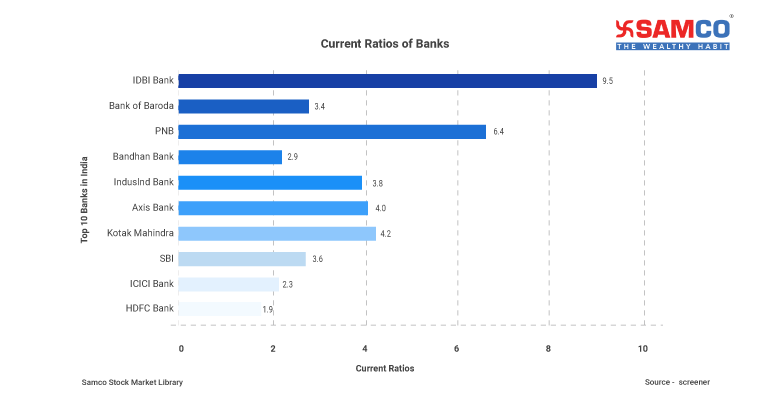

- The average current ratio of top 10 banks in India is 4.25.

3 Major Limitations of Current Ratios

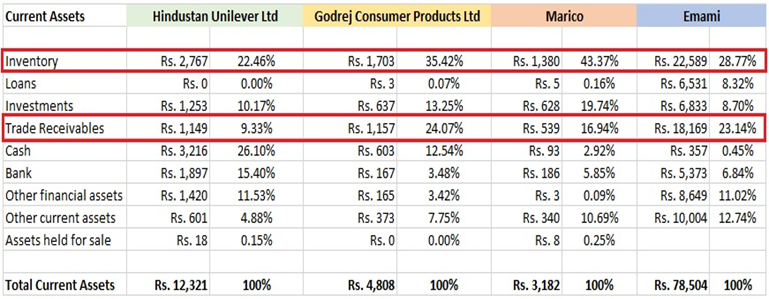

1. Current Ratio Includes Inventory: To calculate current ratio, inventory is added to current assets. It can be in the form of raw materials, work in progress and finished goods. But converting inventory into cash is not easy. It can take more than a year. The process is longer for goods in the raw material or work in progress stage. There can also be a big gap between sales and actual receipt of cash. This happens in the textile sector. Hence, the current ratio does not work in companies with huge inventory. Current assets include prepaid expenses, advance received etc. which is not real cash. The below table shows the current ratio of top four personal products companies in India.| Personal Products Companies | Current Ratio |

| Hindustan Unilever Ltd | 1.04 |

| Godrej Consumer Products Ltd | 1.08 |

| Marico Ltd | 1.66 |

| Emami Ltd | 1.61 |

| Company Name | Market Capitalisation | Current Ratio | Sector |

| Reliance Industries Ltd | 14,34,067 | 1.16 | Integrated Oil & Gas |

| Tata Consultancy Services Ltd | 12,19,577 | 2.13 | IT Consulting & Software |

| HDFC Bank Ltd | 8,16,588 | 1.96 | Banks |

| Hindustan Unilever Ltd | 5,82,874 | 1.04 | Personal Products |

| HDFC Ltd | 4,49,177 | 1.02 | Housing Finance |

| Bharti Airtel Ltd | 2,95,965 | 0.49 | Telecom Services |

| Asian Paints Ltd | 2,92,522 | 1.62 | Furniture-Furnishing-Paints |

| Avenue Supermarts Ltd | 2,14,899 | 3.67 | Department Stores |

| Maruti Suzuki India Ltd | 2,10,208 | 1.15 | Cars & Utility Vehicles |

Easy & quick

Easy & quick

Leave A Comment?