Defence stocks in India are in the limelight since Russia attacked Ukraine. The stock markets are in a bearish phase but there are a few defence stocks which continued their bullish rally. You might be wondering, what might be the reason behind the rally in defence stocks. Well, the reason is…after Russia’s invasion of Ukraine, many countries are forced to hike their defence budget.

- Germany allocated US$ 113 billion towards their military spending.

- China increased its defence spending by 7.1% and revised its target to US$ 229 billion.

Many other countries have also increased their defense budget and hence defense stocks have outperformed in the process. Not just that, as of 2025 India is among the four biggest defense spenders in the world. According to a report by Stockholm International Peace Research Institute (SIPRI), the global military expenditure was increased by 2.6% in a year since 2019. So, we can conclude that all the countries in the world are making defense their priority. The world is in an arms race once again after the end of Cold War. I know by now you might be wondering how you can make the most out of this growth story. Simple. Invest in defense stocks listed on the Indian Stock Exchanges. Don’t worry… you don’t have to sit and scan all 4,000 shares in the Indian stocks markets. In this article, we will cover a list of all defense stocks listed on the stock exchanges.

Let’s begin. In this article on defence stocks, we will cover -

- Overview of the Indian defence sector

- List of defence stocks listed on the Indian Stock Exchanges

- Top Defence Companies Listed in India

Overview of the Indian defence sector

Even though the pandemic has impacted the Indian economy, but still, the government has increased its defense spending from Rs. 5.94 lakh crore to Rs.6.22 lakh crore in the recent Budget 2024-25. This is a strategic move as all the other countries keep updating their military system with new technology and India needs to keep up with the pace. Why so? Simply because of our neighbouring countries

The geopolitical conflicts between India and its neighbouring countries have been increasing in the last few years. In the middle of the pandemic on 5th May 2020, the Indian troops engaged in an aggressive scuffle with China. This happened because India claimed Aksai Chin to be a part of Ladakh while China claimed that it belonged to Xinjiang.

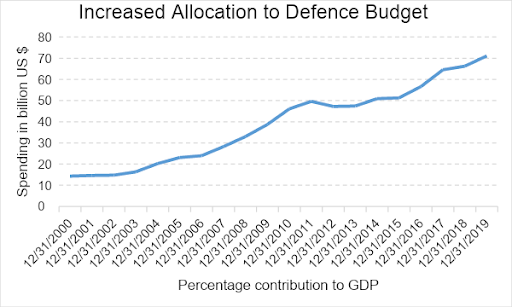

There has also been a considerable increase in exports of equipment across the globe from India. India’s Defense Minister Rajnath Singh announced that he has an ambition to increase India defense export to worth Rs 50000 crores per annum . In the year 2014-2015, India had exported defense equipment worth Rs. 1,940.64 crores. Whereas in 2020-2021, the total exports of defense equipment amounted to a whopping Rs. 21083 crores. Since the year 2000, India has constantly increased its allocation to the defence budget too.

*Source: Statista

The defense sector is vast. It includes the army, navy and the air force. As of 2021, majority of the defense budget was utilised by the air force segment. In the air force segment, the government focused on modernising aircrafts and other equipments. Moreover, many defense companies have started their own startups to manufacture Unmanned Ariel Vehicles (UAVs). So, defense companies like Hindustan Aeronautics Limited (HAL) is working on manufacturing lightweight combat aircraft and helicopters. Apart from this, there are many other unlisted companies that are focused on manufacturing drones for defense purposes such as Sagar Defense, ideaForge, etc. By encouraging these companies to manufacture drones, India will someday become self-reliant in the field of defense.

Which are the drone stocks listed on the Indian Stock Exchanges.

From all the factors listed above, it is safe to say that during normal times or during such difficult times every country will definitely spend a considerable amount of money towards strengthening and updating its military. Hence, it wouldn’t be wrong to say that investing in defence stock is always going to be in trend.

Recommended watch: Best defence stocks in India

List of defence stocks listed on the Indian Stock Exchanges 2025

Name | Industry | Current Price | Market Capitalization (Rs. in Cr) |

Electronic – Components | 333.00 | Rs. 2,43,635 | |

Engineering | 5561.00 | Rs. 3,71,886 | |

Chemicals | 12205.00 | Rs. 1,10,441 | |

Engineering | 1675.00 | Rs. 61,401 | |

Engineering | 4956.00 | Rs. 20,635 | |

Engineering | 1966.00 | Rs. 6,048 | |

Miscellaneous | 2813.00 | Rs. 73,998 | |

Electronic – Components | 3262.00 | Rs. 18,260 | |

Miscellaneous | 2611.00 | Rs. 29,908 | |

Engineering | 1472.00 | Rs. 5,739 | |

Telecommunications – Equipment | 935.00 | Rs. 8,879 | |

Telecommunications – Equipment | 909.00 | Rs. 2,073 | |

Chemicals | 749.00 | Rs. 4,027 | |

Engineering | 330.00 | Rs. 1,829 |

*Data as on 10th July 2024

Top Defence Companies Listed in India

1. Bharat Electronics Ltd.

Bharat Electronics Limited (BEL) was established in 1954 in association with France. It was set up to meet the need for electronic equipment of the Indian Defense Services. It is a state-owned aerospace and defense company. It focuses on manufacturing advanced electronics products for ground and aerospace applications. BEL spends 7.5% of its entire turnover on research and development (R&D). This makes the company the highest spending company on R&D in the Defense Public Sector Undertaking (PSU) space. As on 1st April 2024, the company has an order book of Rs 75934 crores out of which Rs 35000 crores was received in the last year. The export orders outstanding of the company amounts to $400 million. If we take a look at the fundamentals of the company, then the market capitalization of BEL is the highest among all the defense stocks in India. It has a market capitalization of Rs. 243635 (as of July 9 ,2024). Moreover, it is a debt-free company with a Return on Equity (ROE) of 26.4%.

Let’s take a look at the key financial ratios of Bharat Electronics Ltd.

Market Cap (Cr): Rs. 2,43,635 Cr. | Face Value: Rs. 1 | EPS: Rs. 5.45 |

Book Value: Rs. 22.3 | ROCE (%): 34.8 | Debt to Equity: 0.00 |

Stock PE: 61.1 | ROE (%): 26.4 | Dividend Yield (%): 0.55 |

Total Debt (Cr): 62.5 | Promoter’s Holdings (%): 51.1 |

|

*Data as on 10th July 2024

2. Hindustan Aeronautics Ltd.

Hindustan Aeronautics Ltd. is the backbone of the Indian air force system. It manufactures advanced technology equipment such as lightweight fighter aircraft and helicopters. Apart from manufacturing, it also has the ability to repair these equipments. This makes it the only Indian company which not only has specialization in aircraft manufacturing but can also repair the equipment. The company was ranked 41th amongst the top 100 defense companies across the world. Just like BEL, Hindustan Aeronautics is also a debt-free company.

Let’s take a look at the key financial ratios of Hindustan Aeronautics Ltd.

Market Cap (Cr): Rs. 37,1886 Cr. | Face Value: Rs. 5 | EPS: Rs. 114 |

Book Value: Rs. 434 | ROCE (%): 38.90 | Debt to Equity: 0.00 |

Stock PE: 49.0 | ROE (%): 28.90 | Dividend Yield (%): 0.61 |

Total Debt (Cr): Rs. 0.35 | Promoter’s Holdings (%): 71.60 |

|

*Data as on 10th July 2024

3. Solar Industries Ltd.

Solar Industries is one of the world’s leading manufacturer of bulk explosives and packaged explosives. In 2010 the company entered into the defense segment and diversified its business in two major segments -

- Industrial explosives

- Defence equipment

The company has also entered into a partnership with the Indian Space Research Organization (ISRO) which will help the ammunition business of the company grow. It has also invested Rs. 14.7 Cr in Skyroot Aerospace. This company will focus on manufacturing space launch vehicles.

Let’s take a look at the key financial ratios of Solar Industries Ltd.

Market Cap (Cr): Rs. 110,441 Cr. | Face Value: Rs. 2 | EPS: Rs. 92.4 |

Book Value: Rs. 365 | ROCE (%): 32.5 | Debt to Equity: 0.34 |

Stock PE: 120 | ROE (%): 30.9 | Dividend Yield (%): 0.07 |

Total Debt (Cr): Rs. 1138 | Promoter’s Holdings (%): 73.1 |

|

*Data as on 10th July 2024

4. Bharat Dynamics

Bharat Dynamics was incorporated in 1970 as a public sector undertaking (PSU) under the ministry of finance. It manufactures missile systems and allied equipment for the Indian Armed Forces. As on 1st April 2024, the company had a total order book of Rs. 19,434 crores. It is also the only company which manufactures medium-range surface-to-air missile system named Akash and Konkur.

Let’s look at the key financial ratios of Bharat Dynamics Ltd.

Market Cap: Rs. 61,401 Cr. | Face Value: Rs. 5 | EPS: Rs. 16.7 |

Book Value: Rs. 99.2 | ROCE (%):24.2 | Debt to Equity: 0 |

Stock PE: 100 | ROE (%):17.9 | Dividend Yield (%): 0.27 |

Total Debt: Rs. 3.75 Cr | Promoter’s Holdings (%): 74.9 |

|

*Data as on 10th July 2024

5. Bharat Earth Movers Limited (BEML)

The primary business of BEML is manufacturing a wide range of heavy earthmoving types of equipment. It is also involved in manufacturing railway and metro coaches. The company is also a leading defense equipment manufacturer and supplies the Indian Army and other defense forces. The company spent 2% of its revenue on research and development (R&D) for FY23.

Let’s look at the key financial ratios of Bharat Earth Movers Limited

Market Cap (Cr): Rs. 20,635 Cr. | Face Value: Rs. 10 | EPS: Rs. 67.7 |

Book Value: Rs. 641 | ROCE (%): 15.2 | Debt to Equity: 0.03 |

Stock PE: 73.3 | ROE (%): 11.1 | Dividend Yield (%): 0.19 |

Total Debt (Cr): Rs. 70.9 | Promoter’s Holdings (%): 54.0 |

|

*Data as on 10th July 2024

6. MTAR Technologies

MTAR is a recent listing in the Indian stock market. The company was established in 1970. It manufactures various machine equipment, assemblies, sub-assemblies, and spare parts for energy, nuclear, space, aerospace, defense and other engineering industries. The company generates 9% of revenues from its nuclear segment, 9% from the space and defense segment and 62% from the clean energy business while other products contribute 20% of the revenue for 9MFY24.

Let’s take a look at the key financial ratios of MTAR Technologies.

Market Cap (Cr): Rs. 6,048 Cr. | Face Value: Rs. 10 | EPS: Rs. 18.3 |

Book Value: Rs. 220 | ROCE (%): 11.7 | Debt to Equity: 0.28 |

Stock PE: 108 | ROE (%): 8.67 | Dividend Yield (%): 0 |

Total Debt (Cr): Rs. 190 | Promoter’s Holdings (%): 37.3 |

|

*Data as on 10th July 2024

7. Mazagon Dock

Mazagon Dock is engaged in building & repairing ships, submarines and various types of vessels and related engineering products for various domestic and international clients. It is a leading shipyard in India and it has built 795 vessels including 25 warships ranging from advanced destroyers to missile boats and 3 submarines. The company generates 98% of its revenues from ship construction, and 2% from the ship repair segment. Let’s look at the key financial ratios of Mazagon Dock.

Market Cap (Cr): Rs. 1,11,248 Cr. | Face Value: Rs. 10 | EPS: Rs. 96 |

Book Value: Rs. 310 | ROCE (%): 44.1 % | Debt to Equity: 0.0 |

Stock PE: 57.4 | ROE (%): 35.2 % | Dividend Yield (%): 0.29 % |

Total Debt (Cr): Rs. 0.93 | Promoter’s Holdings (%): 84.8 |

|

*Data as on 10th July 2024

Bottom line

With this we come to an end of our discussion on which are the best defence stocks listed on the Indian Stock Exchanges. With the increased allocation towards the defence sector, it is safe to say that defence stocks are forever going to be in limelight. Comment below and let us know which are the defence stocks in your portfolio. To know which defence stocks to buy, simply visit Samco’s Star Ratings Page and check the star ratings of each stock you wish to invest in. Open a FREE Demat account with Samco Securities now and enjoy trading and investment ideas at your fingertips.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?