In this article, we will discuss:

- How Your Risk Appetite Affects Your Choice of Option Trading Strategies

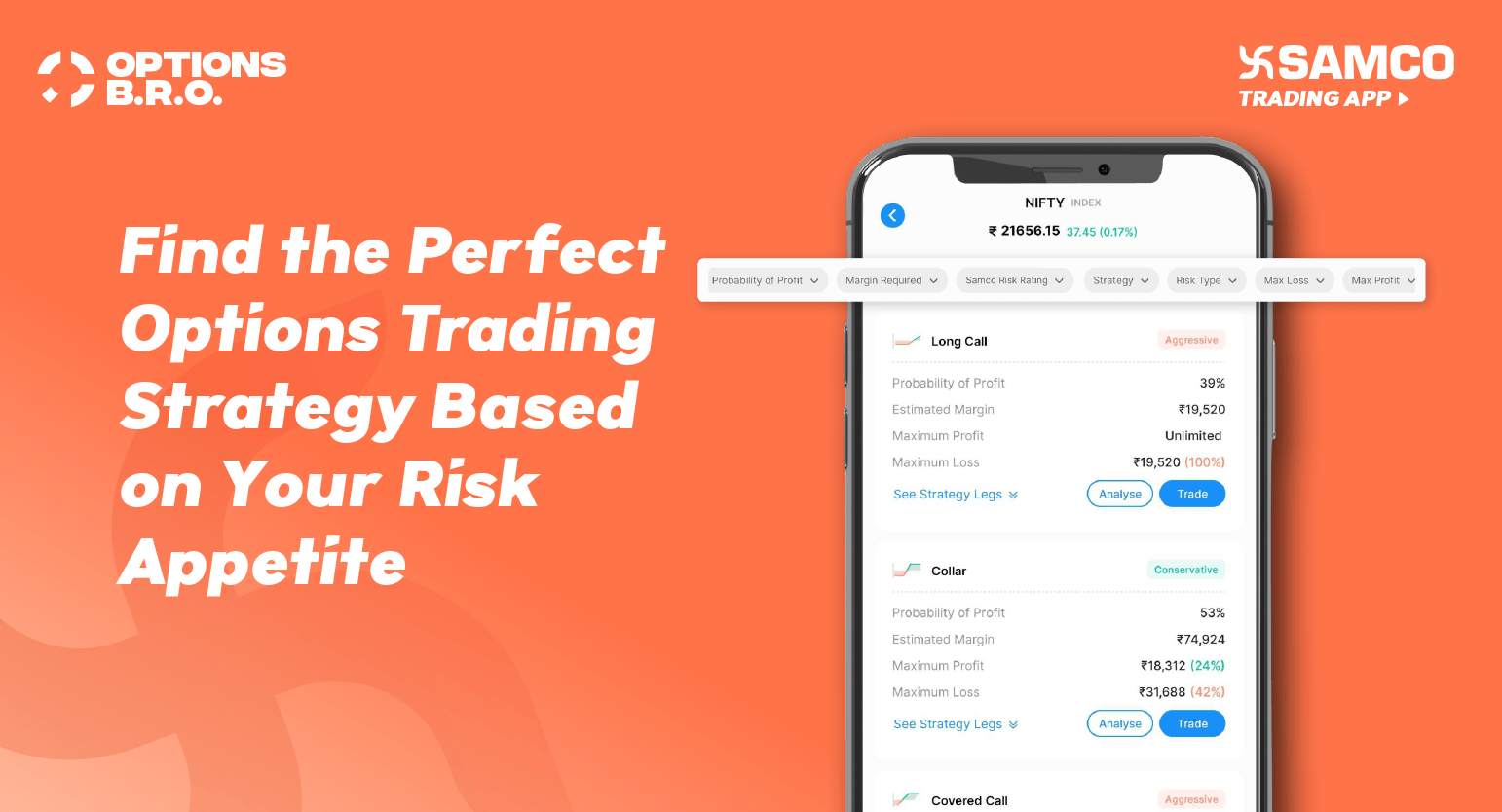

- Use Options BRO to Find the Perfect Options Trading Strategy Based on Your Risk Appetite

- Beyond the Top 3 Strategies: A Wealth of Alternatives for Every Kind of Options Trader

Options trading may be a risky business, but it can also be rewarding if you have the right tools and use the right strategy. The issue, however, is that there are thousands of options trading strategies that you can choose from. And each of these strategies comes with its own risk profile.

Some strategies, like selling naked calls or puts, can be particularly risky. If you do not have the underlying assets to back up your position, your loss can be potentially unlimited should the market move in an unfavourable manner. However, other strategies, particularly the multi-legged trades that incorporate hedged positions, can bring down the risk drastically.

While it’s comforting to know that there is an options strategy for every risk profile, the truly important question is this — how do you find the strategy that aligns with your risk appetite?

Options B.R.O. — the new flagship feature in the Samco trading app — has the answer to this question.

How Your Risk Appetite Affects Your Choice of Option Trading Strategies

No two traders have the same risk-reward preferences. Even for the same trader, the risk tolerance may vary over the years. For instance, if you currently have a well-paying job with a steady stream of income, you can afford to take on more risks when you trade. However, if you are between jobs or if you have recently had a major financial outlay, your risk-taking capacity can drop steeply.

To account for different risk preferences, we’ve handpicked three risk categories in the Samco trading platform, as outlined below.

Conservative Trader

If you're a conservative options trader, your priority may be to preserve your capital while earning decent returns on your trades. You may not be looking to hit a home run on every trade; instead, you may aim for consistent singles. So, your strategies need to be designed to minimise risk and protect your positions against major downturns. This approach often involves using options to hedge your existing positions or generate steady income.

Some strategies that check these boxes include writing covered calls on stocks you own or buying protective puts to insure your holdings. You could also explore credit spreads, where your risk and potential reward are both limited and defined.

Aggressive Trader

As an aggressive trader, you’re most likely on the lookout for opportunities to earn substantial returns, even if the traders with high potential rewards come with high risks. You may be comfortable with the possibility of incurring significant losses while chasing lucrative returns. So, your strategies may be more bold and could often involve a high degree of speculation.

One of the key strategies that exemplifies this risk tolerance is writing naked calls and puts, where you sell options without a position in the underlying asset. You might also find yourself drawn to ratio spreads and backspreads, which can help leverage market movements to your advantage.

Moderate Risk-Taker

If you're a moderate risk-taker, you prefer to find the sweet spot and establish a balance between risk and reward. To achieve this, you need to select strategies that offer a blend of stability and opportunity. While risk is inherent to chasing returns in the market, your choice of option trading strategies must typically aim to fit within a comfort zone that neither avoids risk entirely nor embraces it recklessly.

Strategies that fit this risk profile include butterfly spreads and calendar spreads, which allow you to chase profits within defined risk parameters and in a controlled manner. You might also consider iron condors, which aim to benefit from market stability or minimal movement.

Use Options B.R.O. to Find the Perfect Options Trading Strategy Based on Your Risk Appetite

On paper, identifying a strategy that aligns with your risk profile may be easy. But in practice, it can be incredibly challenging to manually analyse millions of data points and choose the optimal trading strategy. This issue is further compounded by the volatile and dynamic nature of the options market.

With last traded prices changing every few seconds and investor sentiment being so flexible, how do you find the perfect strategy for your risk appetite? The answer lies in two words — Options B.R.O.

This flagship feature in the Samco trading app performs superhuman analysis within a matter of mere seconds. All you need to do is submit three simple details:

- The option that you want to buy or sell

- The expiry of that contract

- The manner in which you expect the market to behave over the life of the option (this could be bullish, bearish, neutral or even volatile)

After you’ve submitted these data points, Options B.R.O in the Samco trading platform carries out over 1.5 lakh mathematical computations, evaluates over 1,000 strategies and analyses over 2,000 option contracts — all to pick out the top 3 option trading strategies that fit your market view.

These strategies each cater to a different risk profile, as follows:

- The aggressive strategy: This is for traders who are comfortable taking risky positions if they come with the potential for higher rewards.

- The conservative strategy: This is for those traders who want to play it very safe and minimise the risk as much as possible, even if it means potentially reduced returns.

- The moderate strategy: This is for those traders who want to find the sweet spot between risks and rewards.

Beyond the Top 3 Strategies: A Wealth of Alternatives for Every Kind of Options Trader

If you are looking for alternatives beyond the top 3 options trading strategies suggested in the Samco trading app, Options BRO has you covered. You can explore hundreds of other strategies that all align with the market outlook you selected. What’s more, you can even filter these strategies according to the risk profile they cater to — and choose from aggressive, moderate or conservative strategies as you see fit.

The strategy builder the Samco trading app also goes the extra mile and lets you analyse any strategy, so you can get a clear idea of how the expected profit or loss from a trade varies on the different dates till expiry. Options B.R.O in the Samco trading platform also reveals the payoff details for each strategy — including crucial information like the probability of profit, risk-reward ratio, maximum profit and loss, break-even points and more. This way, you can thoroughly assess if you are comfortable taking on a given level of risk.

The best part is that all of these insights are available free of cost. Samco charges no extra fee from traders for using this flagship feature (or any of the several other pioneering tools and insights accessible in the Samco trading app). To enjoy these benefits for free, all you need to do is complete the Samco account opening process, download the Samco trading app and explore Options B.R.O. today!

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?