In this article, we will discuss:

- What Are Strategy Legs?

- What Will Be The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Understanding Strategy Greeks

- Things To Keep In Mind

What Are Strategy Legs?

A front spread call is a multi-leg option strategy that involves buying one call option (usually at the money) and selling two call options (usually out of the money) with the same expiration date but different strike prices. The strike price of the call option sold is higher than the strike price of the call option bought. This strategy is also known as a call ratio vertical spread¹ or a call front spread.

The main idea behind this strategy is to reduce the cost of buying the call option at the money by selling two call options out of the money. The strategy can be established for a net credit or a net debit, depending on the difference between the strike prices and the premiums of the options. The net credit or debit is the maximum risk of the strategy if the stock price goes down.

What Will Be The Payoff?

The payoff of this strategy depends on the movement of the underlying stock price and whether the strategy is established for a net credit or a net debit. The maximum loss of this strategy is unlimited if the stock price goes significantly higher than the strike price of the call option sold. This is because one of the call options sold is uncovered, meaning that there is no offsetting position to limit the loss. The maximum profit of this strategy is limited and occurs when the stock price is exactly at the strike price of the call option sold at expiration. This is because the call option bought is in the money and the two call options sold expire worthless.

The breakeven point(s) of this strategy depend on whether the strategy is established for a net credit or a net debit. If the strategy is established for a net credit, there is only one breakeven point, which is calculated as:

Breakeven=Strike price of call option sold+(Difference between strike prices of call options)+Net premium received

In this case, the strategy will start making a loss if the stock price moves above the breakeven point.

If the strategy is established for a net debit, there are two breakeven points, which are calculated as:

Upper breakeven=Strike price of call option sold+(Difference between strike prices of call options)−Net premium paid

Lower breakeven=Strike price of call option bought - Net premium paid

In this case, the strategy will make a profit only if the stock price closes between the two breakeven points at expiration. The losses below the lower breakeven point will be very small and limited to the net debit paid. The losses above the upper breakeven point can be unlimited.

Who Can Deploy This Strategy?

This strategy can be deployed by veterans who have a moderate risk approach and a slightly bullish view on the underlying stock. Since this strategy involves unlimited risk on the upside, it requires careful management and a stop-loss plan in case the stock price moves against the view. This strategy is not suitable for beginners or those who are extremely bullish on the stock.

When Should This Strategy Be Deployed?

This strategy should be deployed when the investor expects a slight rise in the stock price to the strike price of the call option sold and then stop. This is because the maximum profit of this strategy is achieved when the stock price is exactly at the strike price of the call option sold at expiration. If the investor is extremely bullish on the stock, then this strategy should be avoided or modified by buying the call option at a deeper out of the money strike price.

Understanding Strategy Greeks

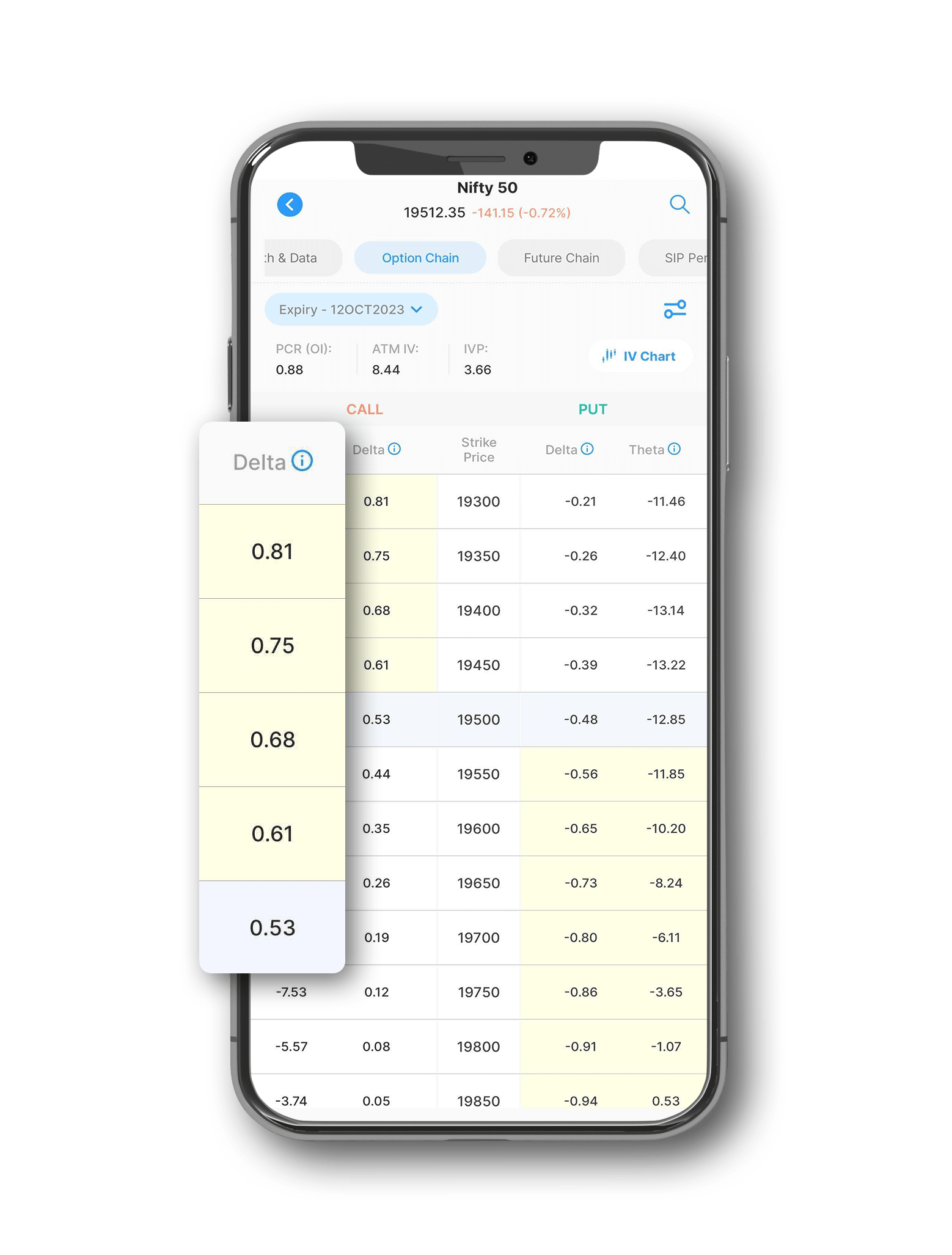

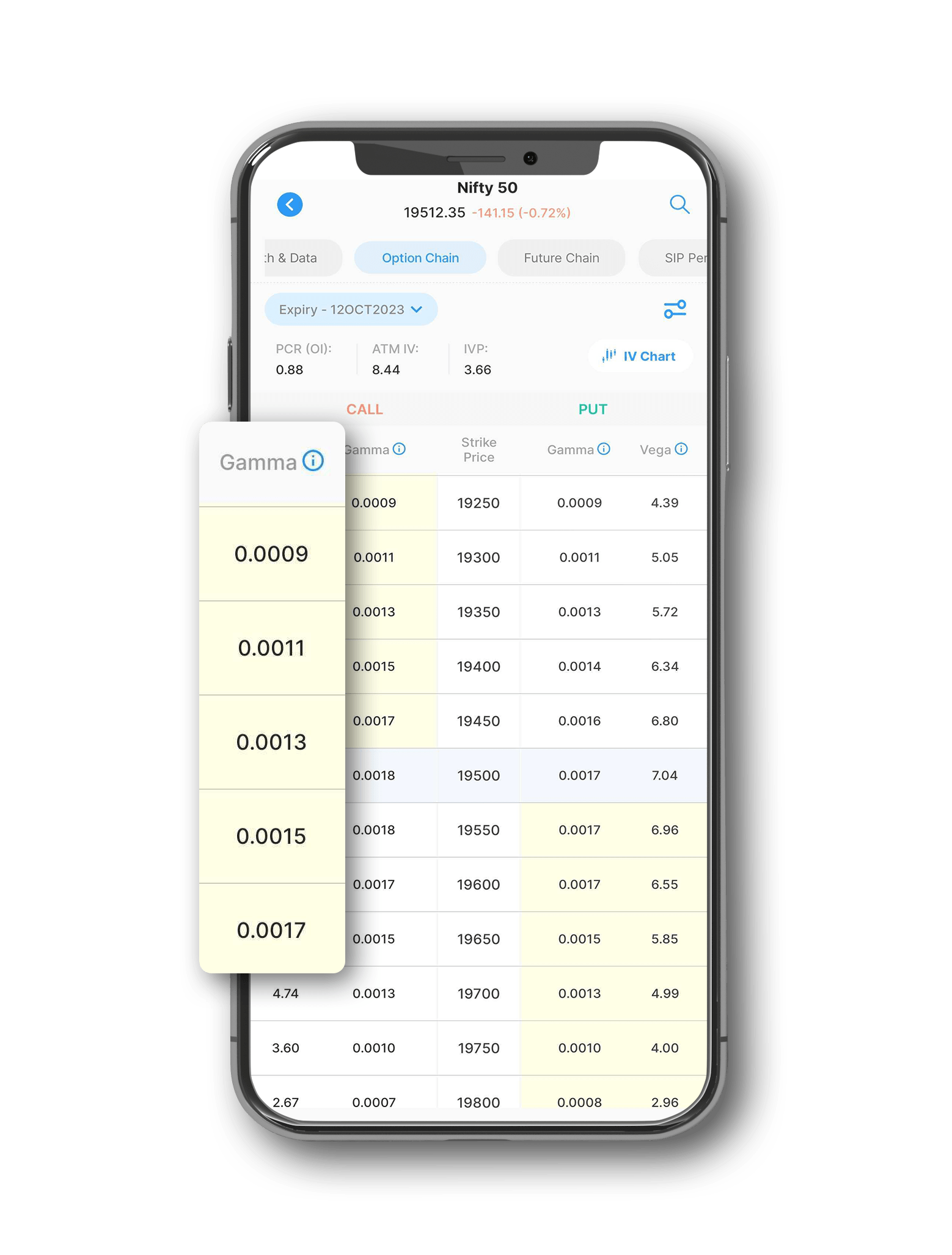

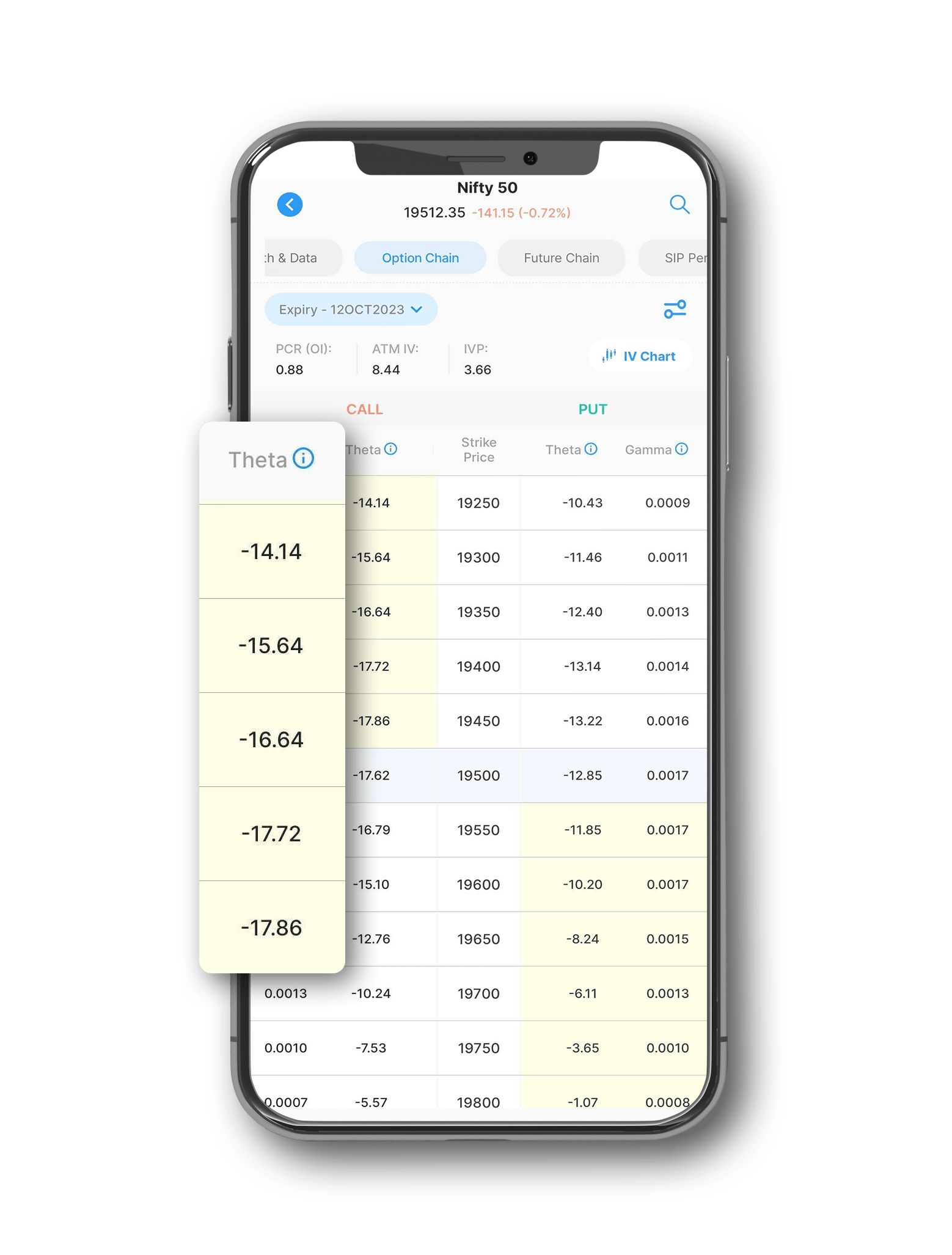

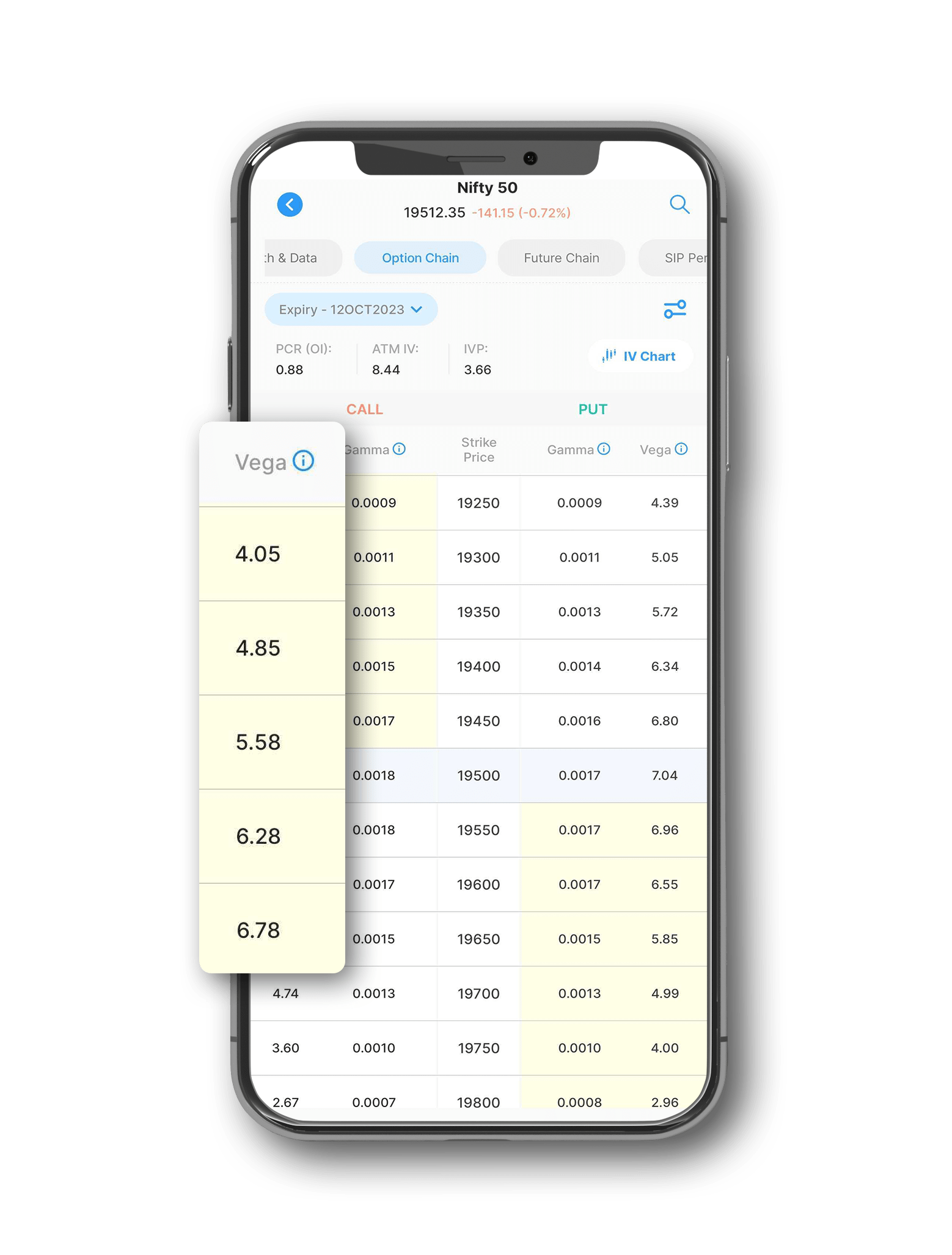

The Options Greeks are the sensitivity measures of the option strategy to various factors, such as the stock price, volatility, time decay, and interest rate. The main Greeks that affect this strategy are delta, gamma, theta, and vega.

Delta measures the change in the option price with respect to the change in the stock price. The delta of this strategy is positive, meaning that the strategy will benefit from a rise in the stock price. However, the delta is not constant and will change as the stock price moves. The delta will increase as the stock price approaches the strike price of the call option sold and then decrease as the stock price goes beyond that point. This is because the call option bought will become more in the money and the two call options sold will also become more in the money.

Gamma measures the change in the delta with respect to the change in the stock price. The gamma of this strategy is negative. The strategy will become more sensitive to the stock price movement as the stock price goes higher or lower.

Theta measures the change in the option price with respect to the passage of time. The theta of this strategy is negative, meaning that the strategy will lose value as time passes. However, the theta is not constant and will depend on the strike prices selected and the net credit or debit of the strategy. In a normal scenario, where the net credit or debit is close to zero, the theta will be positive, meaning that the strategy will benefit from time decay. This is because the theta of the out of the money options will be higher than the theta of the at the money option, and the strategy is selling twice the quantity of the out of the money options.

Vega measures the change in the option price with respect to the change in the volatility of the stock. The vega of this strategy is negative, meaning that the strategy will lose value as the volatility increases. This is because the strategy is net short on options, and higher volatility implies higher option premiums.

Things To Keep In Mind

Even though this strategy can offer a low-cost way to profit from a moderate bullish view on the stock, it also involves unlimited risk on the upside. Therefore, it is very important to have a stop-loss plan in case the stock price moves sharply higher than expected. One way to manage the risk is to buy another call option with a strike price above the upper breakeven point. This will create a butterfly spread and limit the maximum loss of the strategy.

Another thing to keep in mind is the impact of dividends on the option prices. If the stock pays a dividend before the expiration date, the call option prices will decrease, and the strategy will lose value. Therefore, it is advisable to avoid this strategy on dividend-paying stocks or close the position before the ex-dividend date.

Finally, it is also important to consider the liquidity and bid-ask spread of the options. Since this strategy involves two different strike prices, it may be difficult to find a good price to enter or exit the position. Therefore, it is advisable to use limit orders and avoid market orders when trading this strategy. Try out Samco Options B.R.O. a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?