Introduction:

This company is a part of the Somaiya Group, which has a long history in the sugar industry and bio-based chemical industries in India. It is one among the few manufacturers of ethanol-based chemicals in India with an installed capacity of 570 Kilo Liters Per Day (KLPD) for manufacturing of ethanol as of June 30, 2024.

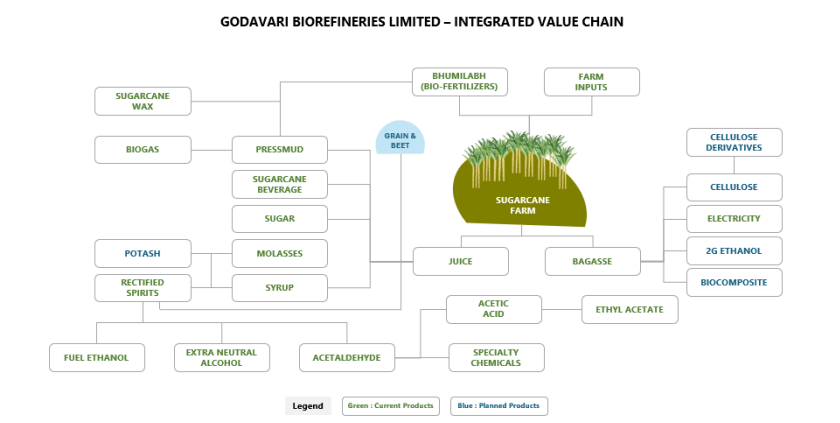

It produces a diversified product portfolio of bio-based chemicals, sugar, ethanol and power which are used in different industries, such as the food, beverage, pharmaceutical, flavor and fragrance, power, fuel, personal care, and cosmetics industries.

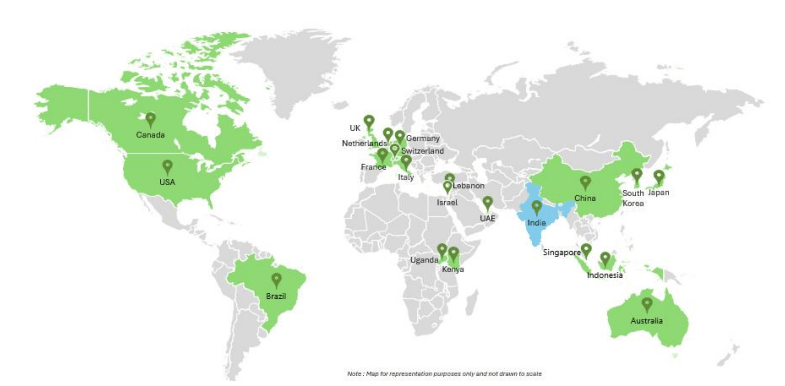

With 2 manufacturing facilities in India (1 in Karnataka, and 1 in Maharashtra) it is considered as one of India’s largest producers of ethanol in terms of volume as of March 31, 2024 (as per F&S Report).

The company has a global presence, serving customers in over 20 countries.

IPO Details:

IPO Date | 23rd Oct-24 to 25th Oct-24 |

Face Value | ₹ 10/- per share |

Price Band | ₹ 334 to ₹ 352 per share |

Lot Size | 42 shares and in multiples thereof |

Issue Size | ₹ 554 crores |

Fresh Issue | ₹ 325 crores |

OFS | ₹ 229 crores |

Expected Post Issue Market Cap (At upper price band) | ~ ₹ 1,800 crores |

Objects of the Issue:

From the net proceeds

- Repayment/pre-payment outstanding borrowings

- Balance General Corporate Purposes

Key Strengths:

- Unique flexibility in ethanol production: The operational flexibility of one of its plants allows it to easily switch between sugar and ethanol production, giving it a competitive edge similar to Brazilian mills. Allowing them to respond to market changes effectively & maximizing profits.

- Diversified product portfolio catering to a variety of industries: This range enables them to serve multiple industries—food, beverages, pharmaceuticals, and cosmetics—reducing reliance on any single sector and minimizing risks linked to industry-specific downturns.

- Integrated biorefinery with a focus on sugarcane valorisation: It operates an integrated biorefinery that maximizes sugarcane use. As sugarcane juice and syrup are used for ethanol production, but additionally the downstream products are also used for developing value added products. Due to this their operations, margins and supply chain are strengthened.

- Well-established relationships with a wide customer base: It has built a strong relationship with a diverse clientele, which includes prominent multinational and domestic companies.

Example: Hershey India Pvt Ltd, Hindustan Coca-Cola Beverages Private Limited, LANXESS India Private Limited, IFF Inc., Privi Speciality Chemicals Limited, and etc.

Key Risks:

- Reliance on a few suppliers for key raw materials: This dependence could disrupt manufacturing operations if these suppliers fail to deliver, increase prices, or experience financial difficulties.

- Customer concentration: A significant portion of the company's revenue comes from a small group of customers. Top-5 customers constitute approx. 33% of the total revenues, if these key customers reduce their orders, experience financial difficulties, or choose alternative suppliers then it would impact the company.

- Contingent Liabilities and Capital Commitments: The company’s contingent liabilities stand at Rs. 163.2 crores (excluding Letter of Credits used for procurement of raw materials to the tune of Rs. 43.3 crores) which is 10% of the Revenues from operations (FY24) amount.

- Suppressed Margins: The company's margins are already quite low, so any rise in costs or drop in sales revenue will have an immediate impact on its financials, similar to what happened in Q1FY25.

Financial Snapshot:

Particulars | FY24 | FY23 | FY22 |

Revenue from operations (Rs. In Crores) | 1,687 | 2,015 | 1,702 |

YoY Growth | -16% | 18% | |

EBITDA (Rs. In Crores) | 148 | 155 | 140 |

YoY Growth | -4% | 11% | |

EBITDA Margin | 8.8% | 7.7% | 8.2% |

PAT (Rs. In Crores) | 12 | 20 | 19 |

PAT Margin | 0.7% | 0.9% | 1.1% |

RoCE | 9.5% | 10.6% | 10.6% |

RoE | 4.7% | 7.9% | 8.2% |

Conclusion:

The listed peers namely Alkyl Amines, Dwarikesh Sugar, & Dhampur Sugar Mills with similar levels of revenue from operations recorded a decline in sales growth in the FY24 for FY23.

But, the RoCE of Godavari stood at 9.53% being the least amongst its peers with Alkyl amines – 16.32%, Dwarikesh Sugar – 12.9%, Dhampur Sugar Mills – 11.37%.

Additionally, the asset turns of the company stood at 1.98x whereas its peers such Alkyl amines, Dwarikesh Sugar, & Dhampur Sugar Mills are at 1.32x, 2.93x, and 2.3x respectively.

Although the company reported positive EPS in FY24, it turned negative in Q1FY25. Therefore, comparing the company based on earnings valuation may not be appropriate.

However, considering other factors such as growth potential and financials, the IPO appears overvalued, and it is recommended to avoid investing in it.

Easy & quick

Easy & quick

Leave A Comment?