What is the full form of HDFC? – HDFC Full Form

HDFC stands for Housing Development Finance Corporation. It is a development finance institution which was incorporated by Mr. H. T. Parekh in 1977. The company’s main business is to provide home loans to individuals and corporates. To strengthen their core business, they diversified in the fields of:

- Banking

- Insurance (life and general)

- Asset management

- Real Estate

- Venture capital and a lot more.

Genesis and Profile of HDFC Ltd.

HDFC Ltd. is an Indian financial corporation headquartered in Mumbai, India. It has a distribution network of 651 interconnected offices (including 206 offices of HDFC Sales) as on March 31, 2022. Apart from this, they have three representative offices in Dubai, London and Singapore offering loan facilities to Non Resident Indians (NRI) and people of Indian origin.

Key Personnel at HDFC Ltd.

Chairman: Mr Deepak S. Parekh Vice-Chairman & Chief Executive Officer: Mr Keki M. Mistry Managing Director: Ms Renu Sud Karnad Executive Director: Mr V. Srinivasa Rangan Independent Directors: Mr Nasser Munjee, Ms Ireena Vittal, Dr Bhaskar Ghosh, Mr Jalaj Ashwin Dani, Mr U. K. Sinha, Dr J. J. Irani

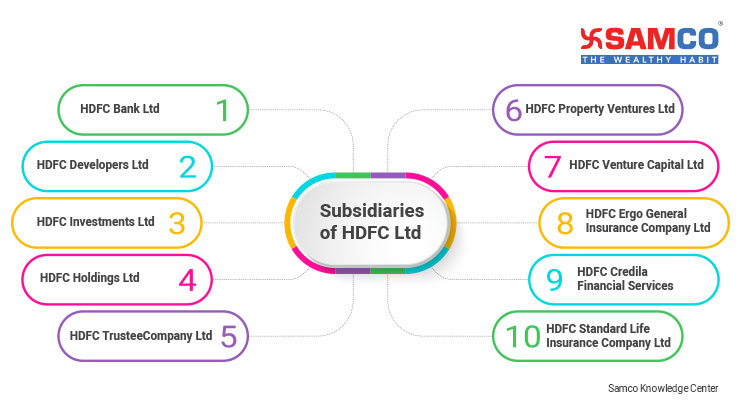

Subsidiaries of HDFC Ltd

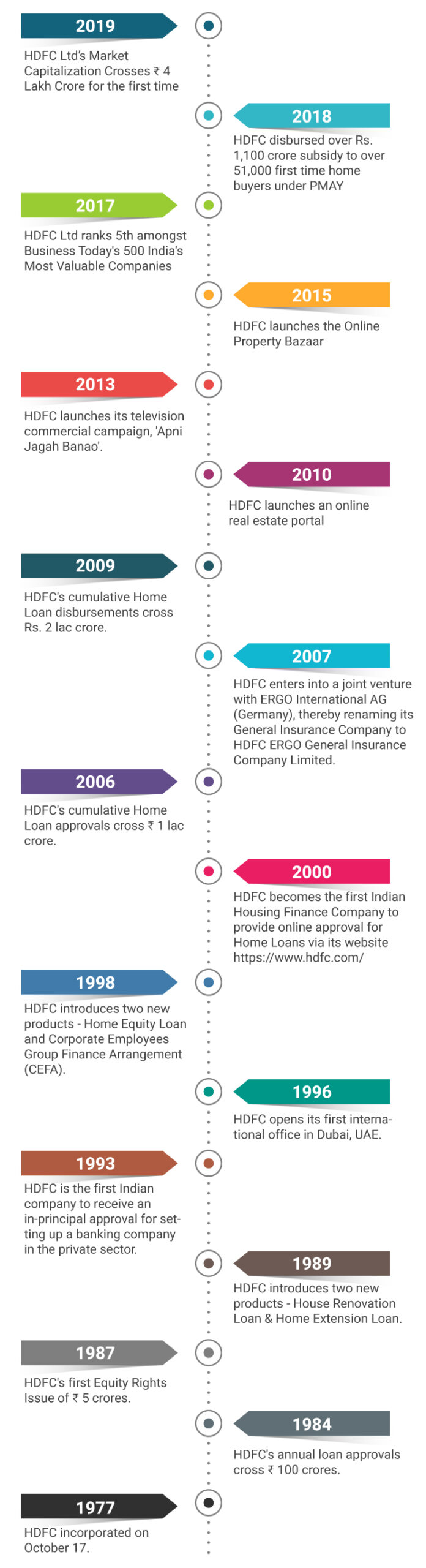

History of HDFC Ltd in India

Listing and Shareholding of HDFC Ltd.

Shareholding Pattern of HDFC Ltd.

| MAR 2021 | JUN 2021 | SEP 2021 | DEC 2021 | MAR 2022 | |

| Promoters | 0 | 0 | 0 | 0 | 0 |

| FIIs | 72.78 | 72.22 | 71.95 | 72.14 | 69.19 |

| DIIs | 16.13 | 16.47 | 16.85 | 16.59 | 18.99 |

| Government | 0.22 | 0.14 | 0.14 | 0.14 | 0.14 |

| Public | 10.88 | 11.18 | 11.06 | 11.13 | 11.69 |

*Data as on 4th May 2022

Quarterly results of HDFC Ltd.

(Rs in Cr.)

| Jun 2021 | Sep 2021 | Dec 2021 | Mar 2022 | |

| Revenue | 30,991 | 38,591 | 31,298 | 35,047 |

| Expenses | 19,875 | 27,228 | 19,562 | 22,373 |

| Financing Profit | 4,492 | 4,679 | 4,740 | 5,748 |

| Financing Margin | 14 | 12 | 15 | 16 |

| Other Income | 1,891 | 2,189 | 2,470 | 2,461 |

| Interest | 6,624 | 6,684 | 6,995 | 6,925 |

| Depreciation | 87 | 88 | 90 | 153 |

| Profit before tax | 6,295 | 6,779 | 7,121 | 8,056 |

| Tax | 16 | 16 | 13 | 14 |

| Net Profit | 5,041 | 5,258 | 5,837 | 6,459 |

*Data as on 4th May 2022

Mutual Fund Holdings and Trends of HDFC Ltd.

| Schemes | Quantity | Holdings as on |

| AXIS LONG TERM EQUITY FUND REGULAR GROWTH | 1,50,968 | 31-03-2021 |

| AXIS BLUECHIP FUND - REGULAR GROWTH | 1,30,152 | 31-03-2021 |

| ADITYA BIRLA SUN LIFE TAX RELIEF 96-IDCW PAYOUT | 1,20,776 | 31-03-2021 |

| ICICI PRUDENTIAL BLUECHIP FUND - GROWTH | 1,15,975 | 31-03-2021 |

| AXIS FOCUSED 25 FUND REGULAR GROWTH | 1,01,271 | 31-03-2021 |

| SBI BLUE CHIP FUND - GROWTH | 99,924 | 31-03-2021 |

| ICICI PRUDENTIAL BALANCED ADVANTAGE FUND - GROWTH | 85,619 | 31-03-2021 |

| HDFC TOP 100 FUND - REGULAR PLAN - GROWTH | 78,438 | 31-03-2021 |

| HDFC HYBRID EQUITY FUND - REGULAR PLAN - GROWTH | 77,442 | 31-03-2021 |

| MOTILAL OSWAL FLEXI CAP FUND - REGULAR GROWTH | 67,449 | 31-03-2021 |

Balance Sheet of HDFC Ltd.

(Rs in Cr.)

| Mar 2020 | Mar 2021 | Mar 2022 | |

| Share Capital | 346 | 361 | 363 |

| Reserves | 126,133 | 156,045 | 179,491 |

| Borrowings | 425,368 | 447,013 | 507,460 |

| Other Liabilities | 177,936 | 225,811 | 279,037 |

| Total Liabilities | 729,782 | 829,230 | 966,349 |

| Fixed Assets | 5,476 | 5,312 | 12,783 |

| Cwip | 59 | 47 | 1 |

| Investments | 243,248 | 302,481 | 119,457 |

| Other Assets | 481,000 | 521,390 | 834,109 |

| Total Assets | 729,782 | 829,230 | 966,349 |

| Inventories | 0 | 0 | 0 |

| Trade Receivables | 336 | 242 | 369 |

| Cash & Bank | 5,502 | 3,035 | 2,629 |

| Loans and Advances | 29,698 | 27,289 | 563,920 |

| Trade Payables | 2,165 | 3,080 | 3,811 |

*Data as on 4th May 2022

Important Ratios of HDFC Ltd:

| Market Cap (Cr): Rs 4,06,608 | Face Value: Rs 2 | EPS: Rs 125 |

| Book Value: Rs 992 | ROCE (%): 8.60 | Debt to Equity: 2.82 |

| Stock PE: 18 | ROE (%): 13.4 | Dividend Yield (%): 1.34 |

| Total Debt (Cr): Rs 5,07,460 |

*Data as of 4th May 2022

Samco’s Rating for HDFC Ltd

5 Star ✰✰✰✰✰

Samco’s stock rating helps you understand how well the company has managed its ratios and other finances. This rating is evaluated with the help of two million stock rating parameters.

Valuation Analysis of HDFC Ltd

Valuation analysis helps you analyse how overvalued or undervalued a stock is. This can be evaluated with the help of the margin of safety index. It is the difference between the intrinsic value and the current value of a share. Intrinsic value is the true valuation of a share.

- A high margin of safety indicates that the stock is currently expensive.

- A low margin of safety indicates that the stock is undervalued.

You can check the latest data on Samco’s stock page. Samco is awarded as the best equity stock broker by CNBC Awaaz. So, open a demat account today and experience world class trading at your fingertips.

Easy & quick

Easy & quick

Leave A Comment?