In this article, we will provide you a list of stocks with the highest share price in India. These stocks are the costliest stocks to invest in India today. (Updated – August 2021) Let’s begin! Ever wondered which might be the costliest stock in India? Which stocks are trading at the highest share price in India? This is a valid question by a curious trader and investor. As a new investor, you might think that HDFC Bank or Infosys Ltd. which are trading at around Rs. 1,500 today are costly shares. That is not the case. In fact, it is far from the truth. There are more than 7,000 companies listed on the Indian stock exchange. More than 300 companies are trading above Rs. 1,000 today. Over 3,700 shares of a company trade below Rs 1,000 per share. Out of these, over 3,400 companies trade below Rs. 500 per share. The most expensive stock, that is the highest share in India is trading above Rs. 75,000 per share as of August 2021. Shocked? Intrigued? Which company is this? Let’s find that out!

Here is a list of 15 companies with the highest share price in India as on August 2021.

Note: Please analyse the companies carefully before you invest in them. A high stock price does not guarantee a good investment. Or vice versa. Now, let’s get started on our list of costliest shares in India.

List of Companies with the Highest Share Price in India (Updated: August 2021)

| S.No. | Name | CMP (in Rs.) | Mar Cap (in Rs.Cr.) | PE Ratio | Samco Star Ratings |

| 1 | MRF Ltd. | 78,076.95 | 33,104.63 | 23.16 | 1 out of 5 stars |

| 2 | Honeywell Auto | 39,097.10 | 34,561.84 | 76.21 | 2 out of 5 stars |

| 3 | Page Industries | 31,116.55 | 34,694.95 | 88.72 | 3 out of 5 stars |

| 4 | Shree Cement | 26,291.15 | 94,860.44 | 36.68 | 2 out of 5 stars |

| 5 | 3M India | 22,839.65 | 25,740.29 | 118.52 | 2 out of 5 stars |

| 6 | Nestle India | 19,571.25 | 188,697.61 | 85.34 | 5 out of 5 stars |

| 7 | Abbott India | 19,074.40 | 40,533.10 | 57.40 | 2 out of 5 stars |

| 8 | Yamuna Syndicate | 18,500.00 | 568.63 | 5.49 | 0.5 out of 5 stars |

| 9 | Tasty Bite Eat. | 18,130.60 | 4,652.31 | 103.16 | 0.5 out of 5 stars |

| 10 | Bajaj Finserv | 14,978.55 | 238,364.82 | 58.31 | 3 out of 5 stars |

| 11 | Bosch | 13,676.35 | 40,336.53 | 30.65 | 2 out of 5 stars |

| 12 | P & G Hygiene | 12,806.90 | 41,572.14 | 61.86 | 4 out of 5 stars |

| 13 | Bombay Oxygen | 12,782.50 | 191.74 | 3.15 | 0.5 out of 5 stars |

| 14 | Bharat Rasayan | 12,438.65 | 5,286.43 | 32.94 | 0.5 out of 5 stars |

| 15 | Polson | 11,164.85 | 133.98 | 12.44 | 0.5 out of 5 stars |

(Note: The above list is for information purposes only. Avoid trading and investing based on the information given above. Conduct due diligence before investing in stocks.)

Highest Share Price in India –

Market Cap: Rs. 34,561 crore Industry: Auto Tyres & Rubber Products Samco Stock Rating: 1 out of 5 stars MRF Ltd. has the highest share price in India. It is a tyre manufacturer that produces a wide range of tyres. It falls under tyre and rubber product industry. It specializes in car & bike tyres, trucks/bus tyres, etc. They are one of the best tyre companies in India. It was founded in 1946. MRF Ltd. crossed the Rs. 10,000 mark in March 2012. The all-time high stock price of MRF Ltd. is Rs. 98,599. The reason for such high stock price is that management of MRF Ltd. never split the stock or issued. Visit MRF Ltd. share page to check its current market price and valuation.

- Honeywell Automation India Limited (HAIL)

Market Cap: Rs. 34,561 crore Industry: Consumer Durables – Electronics Samco Stock Rating: 2 out of 5 stars Honeywell is a Fortune 100 company. It ranked 92nd in 2019. HAIL is a leader in providing integrated automation and software solutions. It has an extensive product portfolio in environmental and combustion controls. They also provide engineering services in the field of automation. HAIL trades on the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). From August 2020 to August 2021, HAIL generated a return of over 15%. It is currently trading at a PE of 76.21 (August 2021). Visit Honeywell Automation India Limited (HAIL) share page to check its current market price and valuation.

- Page Industries

Market Value: Rs. 34,694 crore Industry: Textile Samco Stock Rating: 3 out of 5 stars Page Industries is an Indian manufacturer and retailer operating in Textile Industry. One of its most popular brands is Jockey. It is the exclusive licensee of Jockey International in India, Sri Lanka, Nepal, Bangladesh, the United Arab Emirates, Oman and Qatar. Page Industry stock has turned out to be a multi-bagger stock in the last couple of years. It generated a return of over 1,100% in the last ten years. From August 2020 to August 2021, Page Industries generated a return of over 51%. It is currently trading at a PE of 88.72 (August 2021). Visit Page Industries share page to check its current market price and valuation.

- Shree Cement

Market Cap: Rs. 94,860 crore Industry: Cement & Construction Materials Samco Stock Rating: 2 out of 5 stars Shree Cement is an Indian cement manufacturer. They are the biggest cement maker in northern India. They also produce and sell power under the name Shree Power and Shree Mega Power. From August 2020 to August 2021, Shree Cements generated a return of over 23%. It is currently trading at a PE of 36.68% (August 2021). Visit Shree Cements share page to check its current market price and valuation.

- 3M India Ltd

Market Cap: Rs. 25,740 crore Industry: Diversified Samco Stock Rating: 2 out of 5 stars 3M India Ltd is the subsidiary listed company of 3M Company USA in India. 3M Company USA holds a 75% equity stake in the company. It has a diversified portfolio of products in dental cement, health care, cleaning, etc. From August 2020 to August 2021, Shree Cements generated a return of over 8%. It is currently trading at a PE of 118.52% (August 2021). Visit 3M share page here to check its current market price and valuation.

- Nestle India

Market Cap: Rs. 1,88,697.61 crore Industry: Consumer Food Samco Stock Rating: 5 out of 5 stars Nestle India is in the food processing industry. They have a wide variety of products like Maggi, Kit-Kat, Nescafe, etc. Nestle India has the highest capitalization in the list of costliest shares in India. It is the Indian subsidiary of Nestlé – Swiss multinational food and drinks processing conglomerate. From August 2020 to August 2021, Nestle India generated a return of over 4.8%. It is currently trading at a PE of 85.34%. (August 2021). Visit Nestle India’s share page to check its current market price and valuation.

- Abbott India Ltd

Market Cap: Rs. 40,533.10 crore Industry: Pharmaceuticals & Drugs Samco Stock Rating: 2 out of 5 stars Abbott India Limited is a Pharmaceutical and Drugs company. They have their headquartered in Mumbai. It is a subsidiary of Abbott Laboratories. They offer a wide range of medicines in multiple therapeutic categories. For example, in women’s health, gastroenterology, cardiology, metabolic disorders, and primary care. From August 2020 to August 2021, Nestle India generated a return of over 11.18%. It is currently trading at a PE of 57.40%. (August 2021). Visit Abbott India’s share price to check its current market price and valuation.

- The Yamuna Syndicate

Market Cap: Rs. 568.63 crore Industry: Trading Samco Stock Rating: 0.5 out of 5 stars The Yamuna Syndicate Limited trades and markets a wide variety of products. They offer petrol, diesel, sugar, lubricants, grease, batteries, etc. The company was incorporated in 1954 and is based in Yamuna Nagar, India. From August 2020 to August 2021, Yamuna Syndicate generated a return of over 106%. It is currently trading at a PE of 5.49%. (August 2021). Visit Yamuna Syndicate’s share price page to check its current market price and valuation.

- Tasty Bite Eatables

Market Cap: Rs. 4,652.31 crore Industry: Consumer Food Samco Rating: 0.5 out of 5 stars Tasty Bite Eatables operates in the food processing industry. They offer a range of ready-to-serve ethnic food products. It includes Indian and Asian cuisines, ready-to-cook sauces, organic rice, whole-grain preparations. Their products are available in the US, Canada, Australia, New Zealand, Japan, Germany, and the UK. From August 2020 to August 2021, Tasty Bite Eatables generated a return of over 40.7%. It is currently trading at a PE of 103%. (August 2021). Visit Tasty Bite Eatables share price page to check its current market price and valuation.

- Bajaj Finserv

Market Cap: Rs. 2,38,364.82 crore Industry: Finance – Investment Samco Stock Rating: 3 out of 5 stars Bajaj Finserv is India’s most diversified NBFC. It is a part of Bajaj Holdings & Investments Limited. It is an Indian financial services company. They focus on lending, asset management, wealth management, and insurance. From August 2020 to August 2021, Bajaj Finserv generated a return of over 143%. It is currently trading at a PE of 58.31% (August 2021). Visit Bajaj Finserv share price page to check its current market price and valuation.

- Bosch

Market Cap: Rs. 40,336.53 crore Industry: Auto Ancillary Samco Stock Rating: 2 out of 5 stars Bosch is a part of the German multinational company Robert Bosch. They have their headquartered in Germany and operate in Auto Ancillary industry. Bosch Group is a leading global supplier of technology and services. They have the largest development centre outside Germany. From August 2020 to August 2021, Bosch generated a return of over 10.49%. It is currently trading at a PE of 30.6%. (August 2021). Visit Bosh’s share price page to check its current market price and valuation.

- Procter & Gamble Hygiene

Market Cap: Rs. 41,572.14 crore Industry: Personal Products Samco Stock Rating: 4 out of 5 stars Procter & Gamble Hygiene and Health Care Limited is an India-based company. They engage in the manufacturing and selling of branded packaged fast-moving consumer goods. They offer ayurvedic products and sanitary napkins. Their brands include Ariel, Duracell, Gillette, Head & Shoulders, Olay, Oral-B, Pampers, Pantene, Tide, Vicks. From August 2020 to August 2021, P & G Hygiene generated a return of over 33%. It is currently trading at a PE of 61.86%. (August 2021). Visit P & G Hygiene share price page to check its current market price and valuation.

- Bombay Oxygen

Market Cap: Rs. 191.74 crore Industry: Finance Samco Stock Rating: 0.5 out of 5 stars Bombay Oxygen Corporation (BOCL) was incorporated in 1960. They manufacture and market industrial gases like oxygen, argon, nitrogen and carbon dioxide. However, the company gets more than 50% of its revenue from the substantial investments it owns in the form of stocks, mutual funds, and other financial securities. From August 2020 to August 2021, Bombay Oxygen generated a return of over 25%. It is currently trading at a PE of 3.15% (August 2021). Visit Bombay Oxygen share price page to check its current market price and valuation.

- Bharat Rasayan

Market Cap: Rs. 5,286.43 crore Industry: Pesticides & Agrochemicals Samco Stock Rating: 0.5 out of 5 stars Bharat Rasayan operates in the Pesticides and Agrochemical industry. It is a part of the Bharat Group of companies. They engage in manufacturing technical grade pesticides, pesticides formulations and intermediates. The company has a niche in the international market through exports of Agro Chemicals and many other segments. From August 2020 to August 2021, Bharat Rasayan generated a return of over 24.56%. It is currently trading at a PE of 32.92% (August 2021). Visit Bharat Rasayan share price page to check its current market price and valuation.

- Polson

Market Cap: Rs. 133.98 crore Industry: Chemicals Samco Stock Rating: 0.5 out of 5 stars Polson operates in the chemical industry. They have diversified business activities including diary, agriculture, pharmaceuticals, leather chemicals, and Real Estate. Polson is Asia’s largest manufacturer and exporter of natural-based vegetable tannin extracts and eco-friendly leather chemicals. From August 2020 to August 2021, Polson generated a return of over 22%. It is currently trading at a PE of 12.4% (August 2021). Visit Polson’s share price page to check its current market price and valuation. Before we discuss why are these stocks trading at such high price, let’s have a look at the competitors of India’s highest share price company, MRF Ltd. –

Here is a comparative overview of MRF tyres –

| S.No. | Name | CMP Rs.(Aug 2021) | Mar Cap(in Rs. Cr.) | PE Ratio | Ind PE | BV Ratio | Ind PBV | EPS |

| 1 | MRF Ltd. | 78,076.95 | 33,104.63 | 23.16 | 13.83 | 2.47 | 1.39 | 3,369.86 |

| 2 | Balkrishna Inds | 2,236.20 | 43,229.59 | 31.40 | 13.83 | 7.21 | 1.39 | 71.21 |

| 3 | Apollo Tyres | 211.55 | 13,435.56 | 11.42 | 13.83 | 1.17 | 1.39 | 9.22 |

| 4 | CEAT | 1,298.65 | 5,253.05 | 10.53 | 13.83 | 1.58 | 1.39 | 121.33 |

| 5 | JK Tyre & Indust | 148.70 | 3,661.45 | 7.06 | 13.83 | 1.37 | 1.39 | 22.93 |

| 6 | Goodyear India | 1,030.60 | 2,377.59 | 14.18 | 13.83 | 2.83 | 1.39 | 72.68 |

| 7 | TVS Srichakra | 2,091.00 | 1,601.71 | 14.27 | 13.83 | 1.94 | 1.39 | 146.61 |

While MRF Ltd.’s competitor trade way below MRF Ltd.’s share price, it is very important to analyse other fundamental factors of the companies in the industry. For example, Price to earnings Ratio (PE Ratio). PE Ratio compares company’s share price to the its earnings per share (EPS). It is used to understand if a company’s stock is fairly valued or not. Recommended Watch: What is PE Ratio and how to use it for analysing a company

Why are these shares so expensive?

Share price of a company depends on the number of shares that are outstanding. One reason why stocks are generally trading at such record high prices is because the company might have never done a stock spilt or bonus. This is the case with MRF Ltd. – India’s most expensive stock as well as with Berkshire Hathaway – world’s most expensive stock. Berkshire Hathaway trades at over US $ 4,30,007 per share as of August 2021. That is approximately more than Rs. 3 crores. It is world’s costliest stock. Berkshire Hathaway trades on The New York Stock Exchange. It operates under the leadership of Warren Buffett and Charlie Munger. Expensive stocks do not mean that the company is a good investment option. It is very important to focus on the fundamentals of the company to make a valuable investment. Investors must always look at the quantitative as well as qualitative aspects before investing in a company.

End Note:

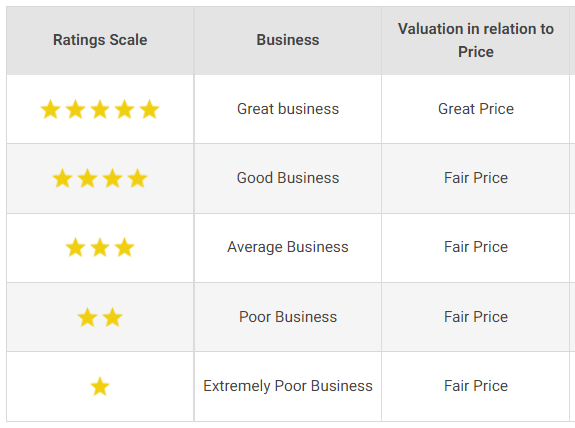

Start your investing journey today! Use Samco’s Stock Rating – India’s only stock rating tool which will help you improve your investment decisions to invest in the right stock. It analyses 20 million data points every day to assign rating on the scale of 1 to 5 starts on 50+ rating parameters. All the ratings are backed by detailed observations with pros and cons. This will help you get better insight on which stocks to buy and which to stay away from.

Easy & quick

Easy & quick

Leave A Comment?