In this article, we will discuss:

- What Are The Strategy Legs?

- What Will Be The Payoff?

- Who Can Deploy This Strategy?

- When Should This Strategy Be Deployed?

- Greeks Corner

- Things To Keep In Mind

The bear put spread is a popular option strategy that allows you to profit from a moderate decline in the price of an underlying asset, such as a stock or an index. It involves buying a put option at a higher strike price and selling another put option at a lower strike price, both with the same expiration d-ate. The strategy is also known as a debit put spread, because you have to pay a net premium to initiate the trade.

What Are The Strategy Legs?

Let's say you are bearish on the Nifty 50 index, which is currently trading at 19,400. You expect the index to fall by around 5% in the next month, but you are not sure how much it will drop. You decide to use the bear put spread strategy to benefit from the potential downside, while limiting your risk.

To execute the strategy, you buy one put option on the Nifty 50 with a strike price of 19,350 and a premium of ₹95, and sell one put option on the Nifty 50 with a strike price of 19,250 and a premium of ₹50. Both options have the same expiration date, which is one month from now.

The strike price of the put option you buy is close to the current market price, so it is called an at-the-money (ATM) option. The strike price of the put option you sell is below the current market price, so it is called an out-of-the-money (OTM) option.

The net premium you pay for the trade is ₹45 (95 - 50), which is also your maximum loss. This is the amount you will lose if the Nifty 50 stays above 19,350 at expiration.

What Will Be The Payoff?

The payoff of the bear put spread strategy depends on the price of the underlying asset at expiration. There are three possible scenarios:

- If the Nifty 50 is above 19,350 at expiration, both options will expire worthless and you will lose the net premium of ₹45. This is your maximum loss and it occurs when the index does not move down as expected.

- If the Nifty 50 is between 19,350 and 19,250 at expiration, the put option you bought will be in-the-money and the put option you sold will be out-of-the-money. You will exercise the put option you bought and sell the index at 19,350, and let the put option you sold expire worthless. Your profit will be the difference between the strike price of the put option you bought and the index price, minus the net premium. For example, if the Nifty 50 is at 19,300 at expiration, your profit will be ₹5 (19,350 - 19,300 - 45).

- If the Nifty 50 is below 19,250 at expiration, both options will be in-the-money and you will exercise both of them. You will sell the index at 19,350 and buy it back at 19,250, making a profit of ₹100. However, you will also have to pay the net premium of ₹45, so your net profit will be ₹55 (100 - 45). This is your maximum profit and it occurs when the index falls below the strike price of the put option you sold.

The breakeven point of the strategy is the strike price of the put option you bought minus the net premium. In this case, it is 19,305 (19,350 - 45). This means that you will break even if the Nifty 50 is at 19,305 at expiration. Below this level, you will make a profit and above this level, you will make a loss.

Who Can Deploy This Strategy?

The bear put spread strategy is suitable for traders who have a moderately bearish outlook on the underlying asset and want to limit their downside risk. It is also a good strategy for beginners who want to learn about options trading, as it is easy to implement and has a defined risk-reward profile.

When Should This Strategy Be Deployed?

The bear put spread strategy is ideal for expecting a moderate decline in asset prices, considering volatility's impact on option premiums. It works best in low volatility, lowering trade costs, but increased volatility post-entry can amplify profits. Choose option strike prices carefully to balance risk and reward: closer strikes offer higher probability of profit but lower maximum profit, while farther strikes offer higher potential profit but lower probability of profit.

Greeks Corner

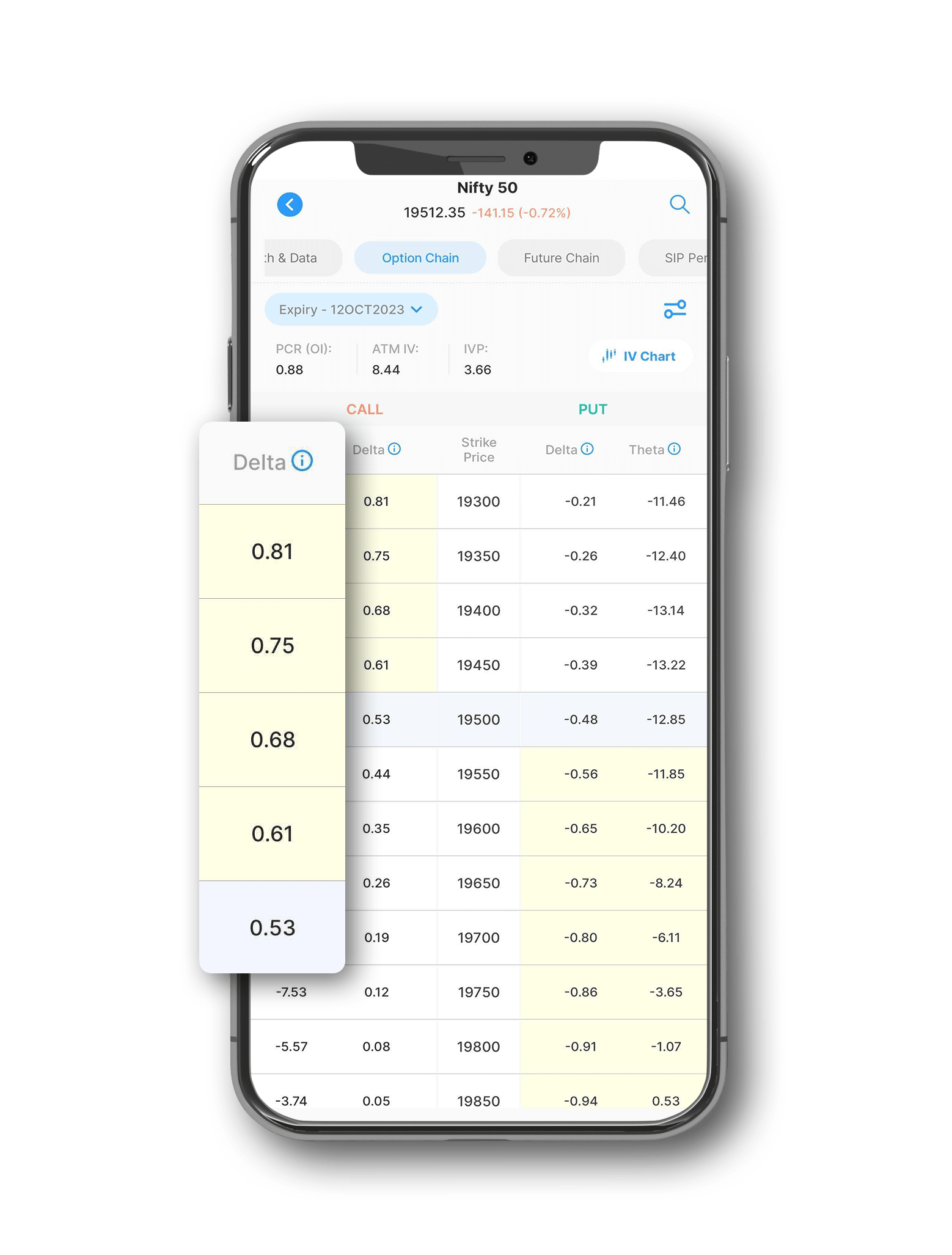

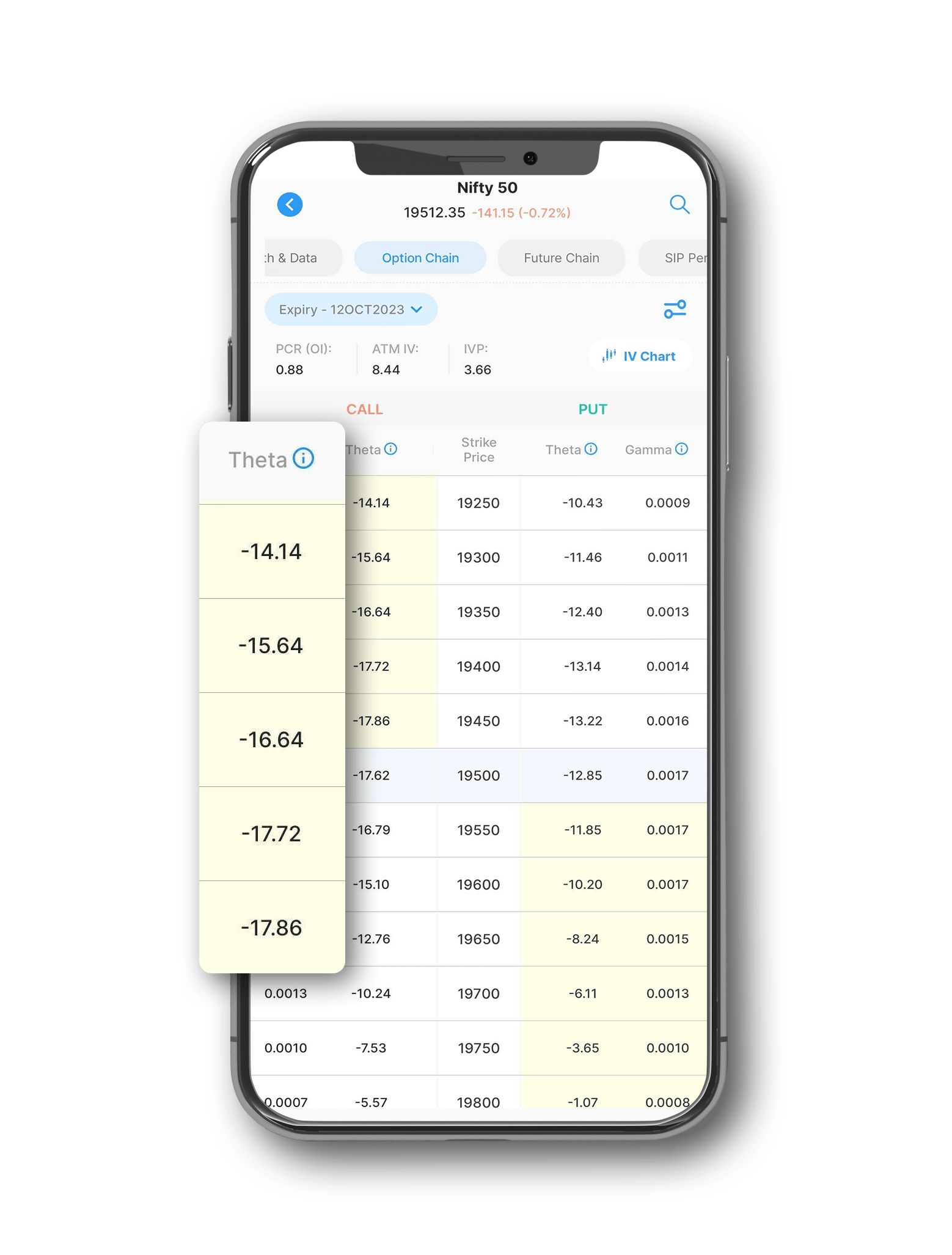

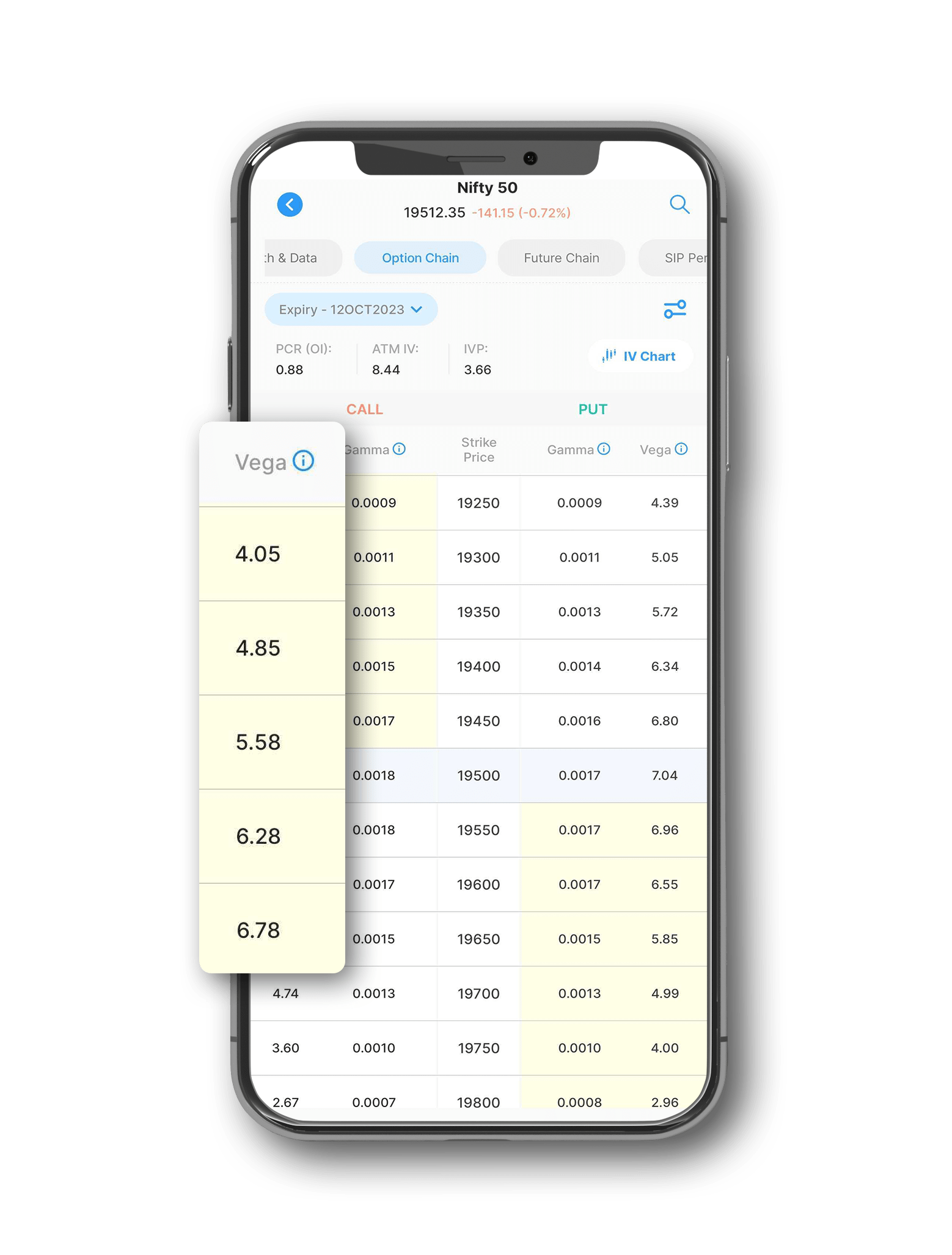

The Greeks are the parameters that measure the sensitivity of the options price to various factors, such as the price of the underlying asset, the time to expiration, the volatility, and the interest rate. The main Greeks that affect the bear put spread strategy are delta, theta, and vega.

Delta measures the change in the options price for a unit change in the price of the underlying asset. The bear put spread strategy has a negative delta, which means that the value of the trade decreases as the price of the underlying asset increases, and vice versa. The delta of the strategy depends on the distance between the strike prices of the options. The farther apart the strike prices are, the higher the absolute value of the delta is, and vice versa.

Theta measures the change in the options price for a unit change in the time to expiration. The bear put spread strategy has a negative theta, which means that the value of the trade decreases as the time to expiration decreases, and vice versa. The theta of the strategy depends on the moneyness of the options. The closer the options are to being at-the-money, the higher the absolute value of the theta is, and vice versa.

Vega measures the change in the options price for a unit change in the volatility of the underlying asset. The bear put spread strategy has a positive vega, which means that the value of the trade increases as the volatility of the underlying asset increases, and vice versa. The vega of the strategy depends on the distance between the strike prices of the options. The farther apart the strike prices are, the higher the value of the vega is, and vice versa.

Things To Keep In Mind

The bear put spread strategy is a simple and effective way to profit from a moderate decline in the price of an underlying asset, while limiting the downside risk. However, there are some things to keep in mind before using this strategy, such as:

- The strategy involves paying a net premium upfront, which reduces the return on investment and increases the breakeven point.

- The strategy has a limited profit potential, which is capped by the strike price of the put option sold. If the underlying asset falls significantly, you will not be able to capture the full benefit of the decline.

- The strategy is exposed to time decay, which erodes the value of the options as the expiration date approaches. This reduces the profitability of the trade, especially if the underlying asset stays near the strike price of the put option bought.

- The strategy is affected by the volatility of the underlying asset, which can increase or decrease the value of the options and the trade. You should monitor the volatility and adjust your position accordingly.

- The strategy requires margin maintenance, as it involves selling an option. You should ensure that you have enough funds in your account to meet the margin requirements.

The bear put spread strategy is a useful tool for traders who want to take advantage of a bearish market scenario, while managing their risk. However, it is not a foolproof strategy and requires careful analysis and execution. You should always do your own research and consult a financial advisor before investing in any option strategy. Similarly, Options B.R.O. is a feature in the Samco trading app that helps you select the best options trading strategy based on your market view, risk appetite, and return expectations. It also provides you with the optimal strike prices, expiry dates, and quantities for your chosen strategy.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847.

Easy & quick

Easy & quick

Leave A Comment?