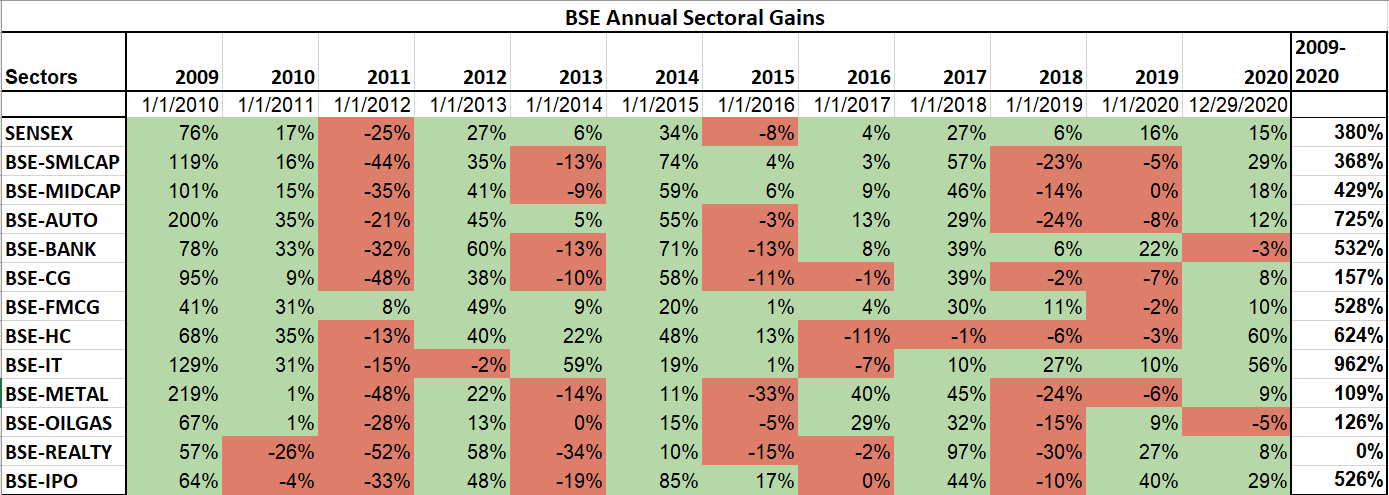

Here’s how major sectors have performed each year over the last 12 years.

Source: Google Finance

Source: Google Finance

10 things that stand out

- 2009 and 2014 were the only years when all the sectoral indices ended in the green despite being Lok Sabha election years.

- 2011 was the worst year for markets as all except FMCG sector ended in the red.

- 2020 is the fifth consecutive year of gains for Sensex.

- Smallcap and Midcap's index has bounced back in 2020 after 2 years of negative performance.

- Healthcare bounced back in style in 2020 with the best performance of 60% in a decade.

- FMCG is the most consistent performer with only one losing year in the last 12 years.

- IT is the only sector to clock gains for four years in a row in 2020. It’s also the best performing sector over the last 12 years.

- Capital Goods, Metal, Oil&Gas and Realty which were the star performers in 2008 rally have underperformed over the last 12 years.

- Realty is the worst-performing sector in 12 years with no returns.

- IPO’s were in full swing in 2019 and 2020 as new investors minted money on most new listings.

What might happen over the next 12 years?

- Will the defensive sectors like FMCG, Pharma and IT continue their outperformance?

- How long before the star performers of 2008 start outperforming once again?

- Will Realty see light at the end of the tunnel?

- Banks and Autos have benefitted from falling interest rates. Will it sustain?

- Markets always revert to the mean in the long run. Up moves will be followed by down moves and vice versa.

- Markets are dynamic. There isn’t a constant. So be prepared for change.

- Never put all your eggs in one basket. But don’t over diversify either. Keep a well-balanced yet concentrated portfolio.

- Unfortunately, there isn’t a one size fits all rule for diversification or concentration. Find your own sweet spot.

- Don’t be overjoyed when markets are good. Don’t be sad when markets are not going your way. Remember: This too shall pass.

- Buy right and sit tight works only if you have bought right. Realty is yet to perform even after 12 years while FMCG lost in just one out of 12 years.

- Patience is a superpower. Healthcare underperformed for four years in a row before its massive outperformance in 2020.

Easy & quick

Easy & quick

Leave A Comment?