Have you ever travelled in a train that was not run by the Indian Railways? My guess is No. You see, the Indian Railways enjoys a monopoly in the railway sector. How about stock exchanges? Well, the Bombay Stock Exchange is in a direct competition with the National Stock Exchange. So, there isn’t a monopoly there. But what about the commodity exchanges? There is The Multi Commodity Exchange of India (MCX) that deals in base metals or energy has monopoly in trading of energy and metals. Both the Indian Railways, and MCX are classic examples of monopoly businesses in India. Now we sure are big fans of monopoly stocks. But do you know who else loves monopoly stocks? Its non-other than Investing legend, Mr. Warren Buffett. Yes, he has made most of his wealth by investing in monopoly stocks. He refers to these stocks as companies with economic moats. What is a moat? Let’s find out with this example.

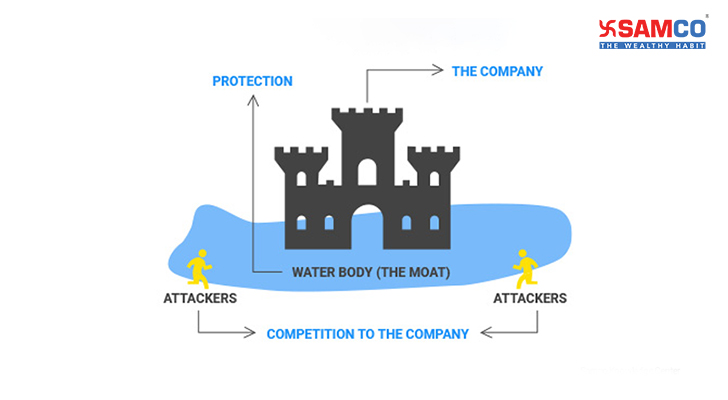

Historically, a moat is a big valley dug all around a medieval castle which is filled with water. It is dug deep to prevent the attackers from entering the castle. So, the wider the moat, the more protected the castle is. Let’s consider the castle to be a company and the attackers to be its competitors. If a company has a deeper market share or a moat in their industry, then it will be difficult for its competitors to survive and compete with the company having the moat. But the question is…how will the company achieve this competitive edge over its peers? Well, by fulfilling this checklist.

- The industry has high entry barriers

- The company has a distinct cost advantage

- New players will not be able to achieve the company’s scale and pricing

- The company has a proven track record of generating huge revenues compared to its peers.

One example of a company with moat is the Indian Railway Catering and Tourism Corporation Ltd. IRCTC is the only company which is allowed to sell railway tickets, water bottles and provide food services in the railway premises. As IRCTC has no competitors, it is a monopoly company in the railway ticketing space.

Now, investing in a monopoly stock has major benefits. These companies have prolonged existence and have a history of generating revenues even in adverse economic conditions. In addition, generally monopoly stocks also provide dividends to its investors. IRCTC was just one example of a monopoly stock listed on the Indian stock exchange. But, today in this article we will list down all the monopoly stocks listed on the Indian stock exchanges. In this article:

- How does a company achieve a strong monopoly in the market?

- List of Monopoly stocks listed on the Indian stock exchanges

- Monopoly Stocks in detail - Indian Railway Catering and Tourism Corporation Ltd - Hindustan Aeronautics Ltd. - Indian Energy Exchange (IEX) - Multi commodity exchange(MCX) - Coal India

How does a company achieve a strong monopoly in the markets?

Firstly, monopoly stocks have pricing power in their hands. What does this mean? Well, it simply means that even if the monopoly company decides to increase the prices of its goods or services, you will still buy their products. For example, imagine you want to buy a BMW car. BMW is a reputed car company. Owing a BMW is a status symbol. Now, even if BMW increases the price of its car, you will still buy it. Now the question is…what made you buy the product even at a high price? Well, it is simply the impact of a high switching cost. What is switching cost? It is the cost that the customer would incur to switch from one product to another. Companies with high pricing power and a wider moat make it tough for their customers to use a competitor's product by offering a unique features in their product. The unique feature is a competitive advantage and hence such monopoly stocks have a bright future. The second reason that makes monopoly stocks unique is the goodwill of the company. Let me ask you a question. Whenever you think about toothpaste, what is the first brand that comes to your mind…It’s Colgate, isn’t it? Similarly, while thinking about noodles, Maggi is the first product that comes to your mind. Monopoly companies have extraordinary brand recognition. That’s because they have invested a lot of time in adding a unique quality to their product. Not just that… the company has also invested a huge amount in marketing and building a huge distribution network. Because of these reasons, monopoly stocks have the ability to turn into multi-baggers in the future.

Firstly, monopoly stocks have pricing power in their hands. What does this mean? Well, it simply means that even if the monopoly company decides to increase the prices of its goods or services, you will still buy their products. For example, imagine you want to buy a BMW car. BMW is a reputed car company. Owing a BMW is a status symbol. Now, even if BMW increases the price of its car, you will still buy it. Now the question is…what made you buy the product even at a high price? Well, it is simply the impact of a high switching cost. What is switching cost? It is the cost that the customer would incur to switch from one product to another. Companies with high pricing power and a wider moat make it tough for their customers to use a competitor's product by offering a unique features in their product. The unique feature is a competitive advantage and hence such monopoly stocks have a bright future. The second reason that makes monopoly stocks unique is the goodwill of the company. Let me ask you a question. Whenever you think about toothpaste, what is the first brand that comes to your mind…It’s Colgate, isn’t it? Similarly, while thinking about noodles, Maggi is the first product that comes to your mind. Monopoly companies have extraordinary brand recognition. That’s because they have invested a lot of time in adding a unique quality to their product. Not just that… the company has also invested a huge amount in marketing and building a huge distribution network. Because of these reasons, monopoly stocks have the ability to turn into multi-baggers in the future.

List of Monopoly Stocks Listed on the Indian Stock Exchanges 2025

Monopoly stock | Percentage of market share in a segment | Latest Price (Rs.) | Market Capitalization (Rs. in Crores) |

100% in ticketing business | 926.95 | 74156.00 | |

100% in defence manufacturing | 4723.90 | 315922.62 | |

92% in India’s commodities exchange sector | 4377.95 | 22326.83 | |

Coal India | 82% in coal production | 529.80 | 326501.35 |

78% in zinc industry | 594.00 | 250983.95 | |

77% in cigarettes | 495.90 | 620109.60 | |

73% in oil products | 653.00 | 84539.64 | |

70% within the mutual fund industry | 4370.75 | 21513.09 | |

70% share in adhesive | 3133.15 | 159354.94 | |

68.52% in cargo carrier | 980.80 | 59759.59 | |

60% in ethanol plant installation industry | 672.05 | 12353.16 | |

67% in the power equipment sector | 302.20 | 105227.95 | |

59% in depository business | 2565.25 | 26806.86 | |

50% share in pre-galvanised and structural tube industry | 1425.10 | 39550.03 |

*Data as on 9th August 2024

Let’s look at the each of these monopoly stocks in detail.

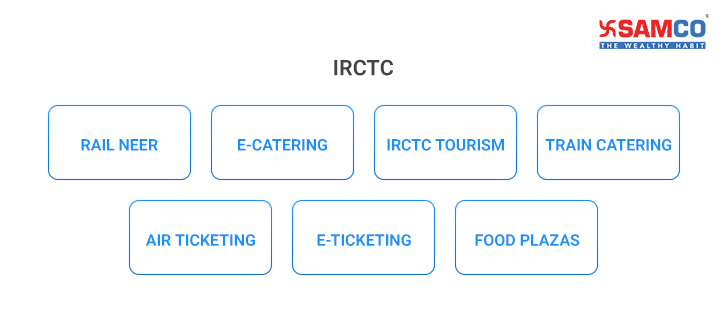

Indian Railway Catering and Tourism Corporation Ltd. is a Mini Ratna of India. It offers services like ticketing, selling of packaged water bottles and catering to the Indian Railways. IRCTC is the only company in this segment and hence it is a true monopoly in the railway sector. Here is the revenue breakup of IRCTC –

- 57% revenue was generated from the internet ticketing segment.

- 19% from the catering business

- 10% from tourism

- 9.25% from the Rail Neer (packaged water bottle segment)

- 5% from other businesses

The stock is currently trading at a PE ratio of 65.49. It has also offered an absolute return of 40% in the last year (as on August 9, 2024). Promotors have a solid stake of 67.40% and the general public holds a 20.96% stake.

Hindustan Aeronautics Ltd. is another leading monopoly stock in India from the Indian defence sector. The company was set up in Mysore in 1940 by Mr. Walchand Hirachand. Currently, it is a state owned business. It designs and manufactures fighter jets, helicopters, jet engines, marine gas turbine engines, and a lot more for the Indian military. HAL is almost debt-free and it is maintaining a healthy dividend pay-out of 31%. The promoters hold a stake of 75.15% and the public hold a stake of 3.45%.

Indian Energy Exchange (IEX)

The Indian Energy Exchange (IEX) is the country's first and largest electricity exchange. It's an online marketplace where traders can trade in energy. Not just this, but you can also trade in the electricity market, green energy and renewable energy certificates. IEX is a monopoly stock because it has the maximum number of transactions for trading electricity. Moreover, the company is continuously innovating according to the latest digital trends. It is also trying to automate the entire market operation by using Robotic Process Automation to improve forecasting models and reduce the time taken to execute each transaction. The company has almost 95% monopoly in the energy exchange space. That is because 95% of energy exchange happens on IEX. And because there are multiple buyers and sellers quoting different prices, it increases liquidity and you can buy energy at a competitive rate. IEX has over 4,800 registered participants to trade electricity contracts and 4,400 registered participants to trade in renewable energy contracts. In the last year, the stock offered a CAGR return of 104%. The promoter holdings of the company is zero but, the Foreign Institutional Investors (FIIs) hold a 31.01% stake. DIIs hold a 17.66% stake and the public holding is 51.02%.

Multi Commodity Exchange (MCX)

Multi commodity exchange or MCX is India's first commodities derivatives exchange. In this exchange, you can trade in a wide variety of commodity derivatives. MCX has a market share of around 92% in India’s commodity exchange sector. It has a 100% monopoly in the trading of precious metals, energy & base metals. The distant competitor of the company is National Commodity and Derivatives Exchange Limited (NCDEX) with a market share of around 7%. Let’s take a look at the revenue breakup of the company.

- 3% revenue is generated from trading of silver contracts

- 27.3% revenue is generated from trading of gold contracts

- 13.2% revenue is generated from trading of natural gas

- 8.5% revenue is generated from crude oil

- 7.2% revenue is generated from trading of nickel contracts.

- 7% from trading copper contracts

- 3.2% from trading zinc contracts

Coal India

Coal India is a leading coal mining and refining company in India. It was incorporated in 1973 as Coal Mines Authority Ltd. Today it is owned by the Union Government and is managed by the ministry of coal. It also has the title of the world’s largest coal-producing company. The company has a market share of 82% in the coal production industry. The major consumers of the company are power and steel sector companies. Now, India is the second largest producer of coal in the world. In 2020, it produced about 729 million tonnes of coal. Moreover, the power and steel manufacturing companies use around 57% coal for commercial energy consumption. Coal India is a government-managed company. Most of the coal requirements of the government are fulfilled by Coal India. This makes it a leading monopoly company in the coal production segment. The company fulfils around 83% of the coal requirements of the company. The company is also diversifying its business by setting up solar power projects and fertilizers plants but still Coal India remains a monopoly company in the coal production segment. If we look at the financials of Coal India, then the company is almost debt-free and it maintains a healthy dividend pay-out of 56.04%. Promoters have a stake of 66.13% and the general public hold a stake of 5.93%.

Bottom line

With this, we come to the end of the discussion on the best monopoly stocks listed on the Indian stock exchanges. In this article, we have discussed a few monopoly stocks and we have also provided a list of other monopoly stocks listed on the stock exchanges. Now if you are wondering which is the best monopoly stock which will mint money for you then you will have to research about each monopoly stock in detail and hold it for the long term. But when you are investing for the long term, you have to check a lot of things. This list includes analysing financial ratios, quality of the management, analysing future growth prospects of the company, and a lot more… And analysing each stock on these basis is time consuming. So, what is the solution to this? Simply invest through Stockbasket’s Largest Irreplacable Networks Basket which consists of nine monopoly stocks. This basket is specially curated with monopoly stocks which have a reliable network of distributors and are virtually irreplaceable. Here is a glimpse of the largest irreplaceable networks basket.

Company | Weightage |

United spirits Ltd. | 9.45% |

Multi commodity exchange (MCX) | 10.01% |

Indian energy exchange Ltd. | 23.12% |

*Data as on 21st March 2022

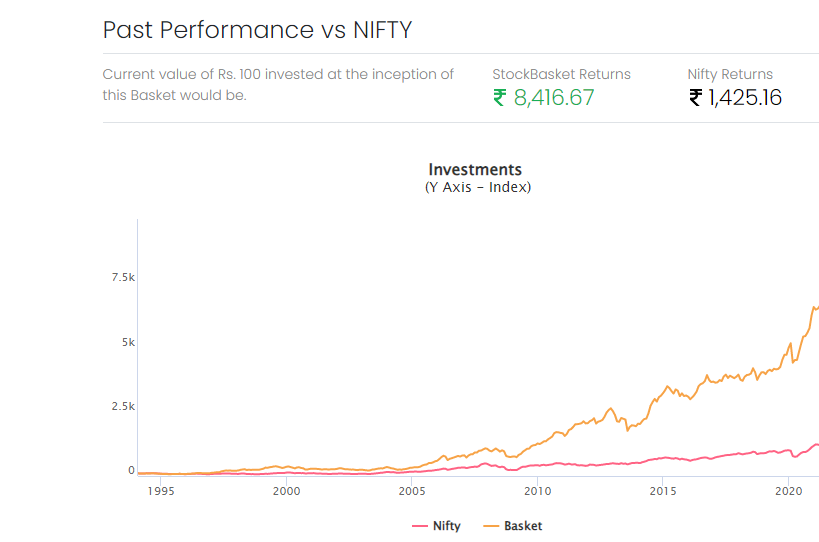

Here is how the basket has performed since inception as compared to the Nifty 50 index.

As you can see, Largest Irreplacable Networks Basket has outperformed the Nifty 50 Index since inception. Click here to explore the basket now. Here are the returns generated by the Largest Irreplacable Networks Basket in the last 5 years.

Duration | Returns |

1 year | 30.23% |

3 year | 110.03% |

5 year | 136.54% |

To invest in StockBasket all you need to do is Open a free demat account with Samco and invest in monopoly stocks listed in India.

Happy investing

Easy & quick

Easy & quick

Leave A Comment?