A mutual fund investor is like a child in a candy shop. Everything looks delicious and everything must be bought. It doesn’t matter if you like the flavour or taste of the candy, you MUST have it.

Similarly, investors are spoilt for choice. They are confused whether they should invest in –

A mutual fund investor is like a child in a candy shop. Everything looks delicious and everything must be bought. It doesn’t matter if you like the flavour or taste of the candy, you MUST have it.

Similarly, investors are spoilt for choice. They are confused whether they should invest in –

- Equities

- Debt

- Gold

- Commodities

- Currencies

- Overseas stocks

- Real estate etc.

Does this seem familiar …

Does this seem familiar …

- You invest in the stock market and it falls immediately!

- You invest in gilt funds and the bond prices crash!

- You invest in gold and gold hit 52-week lows!

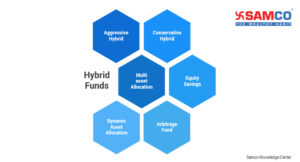

Multi asset allocation funds also invest in multiple asset classes. But they are different from balanced funds.

Balanced funds invest only in equity and debt. Whereas a multi asset allocation fund invests in any of the below assets:

Multi asset allocation funds also invest in multiple asset classes. But they are different from balanced funds.

Balanced funds invest only in equity and debt. Whereas a multi asset allocation fund invests in any of the below assets:

- Equity

- Debt

- Gold

- Commodities

- Overseas stocks etc.

What are Multi Asset Allocation Funds?

As per SEBI, ‘multi asset allocation funds must invest in at least three asset classes with a minimum of 10% each in equity, debt and gold’. The idea is to generate stable and superior returns using negative correlation of asset classes. Negative correlation is when one asset class falls while the other rises. Equity, Debt and Gold have negative correlation.- Equities outperform debt and gold in a growing economy.

- When stock markets are falling, investors shift to debt and gold for stable returns.

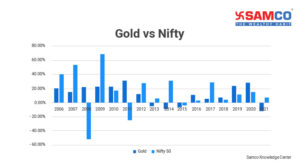

A clear negative correlation can be seen in 2008. In 2008, the stock markets fell by 51.84%. But Gold was up by 22.17%!

The same is happening in 2021 as well. As stock market rises, gold has begun its downward journey.

A clear negative correlation can be seen in 2008. In 2008, the stock markets fell by 51.84%. But Gold was up by 22.17%!

The same is happening in 2021 as well. As stock market rises, gold has begun its downward journey.

Who Should Invest in Multi asset allocation funds?

This fund is perfect for investors who are looking for a one-stop solution. So, instead of investing in three schemes, investors can get the same benefit by investing in just 1 scheme. This is perfect for investors who do not have the time or knowledge to rebalance their portfolios as per market conditions. But are these funds worth the hype?Should You Invest in Multi asset allocation funds?

This fund might look great on paper. But before investing in them, you need to know the following: 1. No Long Term Track Record: Multi asset allocation funds were launched in 2018-19. Before that, majority of these funds were monthly income plans or hybrid funds. For example:- SBI Multi Asset Allocation fund was SBI Monthly Income Plan.

- HDFC Multi asset fund was HDFC Multiple Yield Fund – Plan 2005.

- HDFC Multi asset fund holds 64.7% in cash, 10.8% in debt, 11.5% in equity and 13% in commodities.

- ICICI Prudential Multi asset allocation fund invests 87.8% in equities.

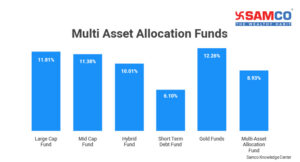

As seen above, multi asset allocation funds have underperformed other fund categories in the last 3 years.

So, there’s a high chance that your multi asset fund generated mediocre returns even though gold generated 28.32% returns in 2020.

As seen above, multi asset allocation funds have underperformed other fund categories in the last 3 years.

So, there’s a high chance that your multi asset fund generated mediocre returns even though gold generated 28.32% returns in 2020.

Final Thoughts:

Multi asset allocation funds might work for investors who do not have the time or knowledge to create a diversified portfolio. But for investors who do, it is much better to invest in individual asset classes. You will be able to generate substantially higher returns. Suppose you want to invest Rs 1 Lakhs. You have two options –- Invest in multi asset allocation fund (SBI Multi Asset Allocation Fund)

- Invest in individual asset-oriented funds.

| Fund | SBI Multi asset Allocation Fund |

| Investment Amount | 1,00,000 |

| NAV on 1st Jan 2019 | 26.02 |

| Units Acquired | 3842.55 |

| NAV as on 1st Jan 2021 | 32.99 |

| Current Value of Investment | 1,26,767 |

| Net Gains | 26,767 |

| Profit (%) | 12.59% |

| Fund | SBI Bluechip Fund | SBI Gold Fund | SBI Short Term Debt Fund |

| Investment Amount | 45,400 | 12,000 | 42,600 |

| NAV on 1st Jan 2019 | 37.31 | 9.96 | 20.87 |

| Units Acquired | 1216.72 | 1204.29 | 2041.33 |

| NAV as on 1st Jan 2021 | 48.57 | 15.56 | 25.11 |

| Current Value of Investment | 59,095 | 18,742 | 51,254 |

| Net Gains | 13,695 | 6,742 | 8,654 |

| Profit (%) | 14.09% | 24.97% | 9.69% |

Easy & quick

Easy & quick

Leave A Comment?