What is Currency Trading?

Just like stocks which have free market, currencies too have free market so that they can be traded to determine equilibrium price, which earlier was not possible due to non convertibility on current. Currencies are the largest traded assets on this planet. Daily volume alone in the US Dollar is 1.9 Trillion Dollars. There are speculators, arbitrageurs and hedgers which make the market dance up and down on a daily basis.

How are the USD INR and other pairs traded in the spot market?

Spot market is the retail market wherein the customer buys or sells currencies with the bank for immediate basis. The bank quotes a rate plus a spread on both sides for buying and selling the currency. The final quote may differ from bank to bank depending on loading policies of the banks.

How does currency trading work in India?

Currencies are traded on Recognized Stock Exchanges and in Inter Bank market on large scale. The rate determination mechanism has now shifted on the stock exchange floors. The contract size on the exchanges for USD INR contract is 1000 dollars which are traded from 9am to 5pm from Monday to Friday, which are settled on the last Wednesday of every month as per the RBI reference rate on that day. Approximate margins charged by the exchanges are 2.5% of the contract value, tick size being Rs 0.0025/-. You can check out the currency derivatives margin on the Samco website as well.

USD INR typically moves to maintain interest rate parity

The fundamental principle of currency market is interest rate parity which means that in a free market environment, holding any currency would fetch the same returns. But due to restrictions on capital account and interference by the Central Banks there arises trading or arbitrage opportunities for smart participants to profit there from on interest rate differentials.

Historical chart of USD INR and key observations

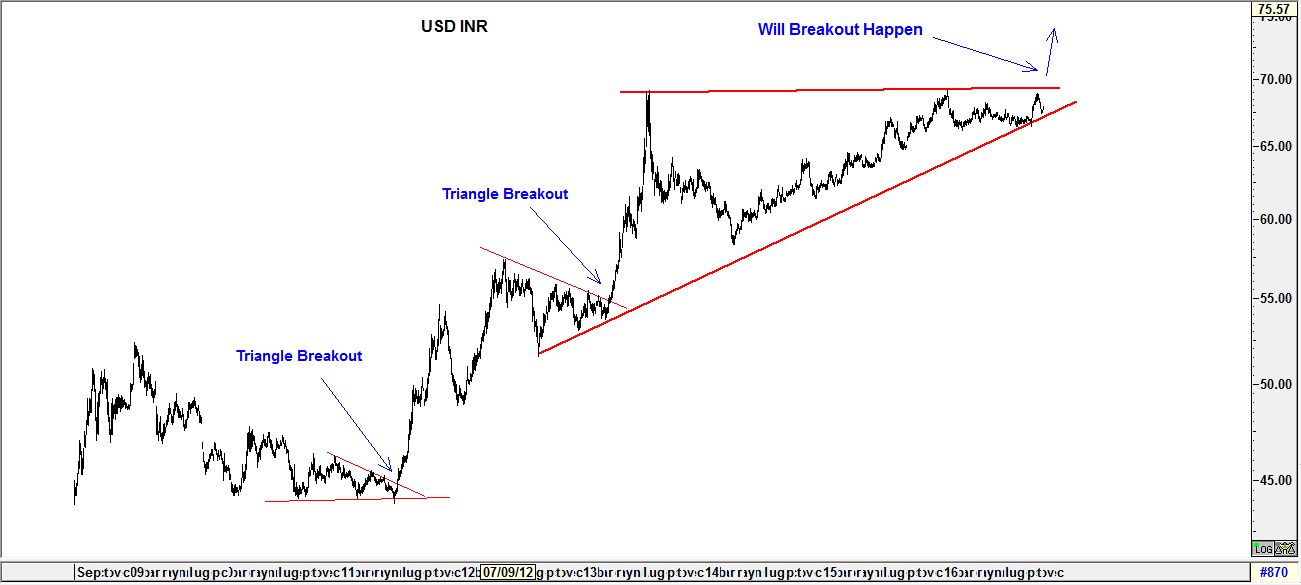

Pattern breakouts are very reliable in currencies for taking positional or intra day trades as there is minimum amount of manipulation unlike stocks where vested interest could be influencing the price movement.

[caption id="attachment_2356" align="aligncenter" width="967"] USD INR Chart[/caption]

USD INR Chart[/caption]Intraday Trading strategies for trading the USD INR

The principles of technical analysis are equally applicable to stocks as well as currencies. For capturing momentum the best way to play is through Breakouts. Breakouts after first hour of trade are generally very reliable and safe to trade. Stop loss can be conveniently placed at the low of the day for long positions when an hourly breakout is noticed. Risk management for Intraday Trading would be to

- Keeping a stop loss

- Trading with a minimum risk to reward ratio of 1:2 or above

- Risking not more than 0.5% of the trading capital and further dividing the same to generate multiple intraday trades will ensure sustainability of profits and will keep the necessary emotional calm to identify the opportunities as and when they come.

Positional trading strategies for trading the USD INR

Majority of market participants employ the use of technical analysis for understanding market direction of the currencies. All the techniques that are used for stock analysis can also be used to analyze currencies for example moving average cross over system, pattern breakout system which are considered most common for profitable trading strategies in currency market. The chart above show how breakouts are powerful signals for taking medium to long term trade.

Closing thoughts

Currencies as a financial instrument are as good as any other financial instrument for trading, in fact it has more merits as there is minimum manipulation and have a far more efficient price discovery mechanism. For a trader who has a valid trading strategy and has the discipline to follow the same day in and day out, huge money can be made. In stocks there are tens of factors like earnings, dividends, financial ratios, government policies etc to look upon, but in currencies, only if correct price analysis is done, it is more than sufficient for making extra ordinary trading gains.

Easy & quick

Easy & quick

Leave A Comment?