In this article, we wil disucss:

- Why are F&O Traders Losing Money?

- The Role of Options Greeks in Derivatives Trading

- Can the Gamma Help You Select the Right Strike Price in Options Trading?

- Factors Influencing the Gamma

- Use the Samco Trading App to Factor in the Gamma in Your Options Trading Strategy

- Improve Your F&O Strategies with Options Greeks on the Samco Trading App

The issue of financial losses among futures & options (F&O) traders has emerged as a significant concern in the financial markets. A recent study conducted by SEBI indicates that 9 out of 10 individual F&O traders faced losses, with the average loss crossing the ₹1.1 lakh mark. This troubling statistic raises questions about the causes of these losses and the role of analytical tools — or the lack thereof — in options trading software.

At Samco Securities, we’ve identified the key factors contributing to poor success among F&O traders and remain committed to bridging this gap, so more traders can improve their success rate in the futures and options segment.

Why are F&O Traders Losing Money?

Several factors contribute to the high rate of losses among F&O traders. Experts in the field attribute these losses to various factors, including lack of knowledge, poor trading discipline, and inadequate risk management. If you too have been unsuccessful in this market segment, let’s explore the factors that could be contributing to your losses.

Lack of Knowledge and Experience

F&O trading is complex and requires a solid grasp of market dynamics, the specific characteristics of derivatives, and an understanding of financial instruments. Unfortunately, many traders enter the F&O market without a clear understanding of how it operates.

Poor Risk Management

Effective risk management is also crucial in F&O trading. Many traders who incur losses often ignore the importance of risk management. Without factoring in potential risks, you are more vulnerable to market volatility and may make poor trading decisions.

Poor Trading Discipline

Disciplined F&O trading involves setting and adhering to specific rules and strategies. Many traders fail to maintain this kind of focus, especially in a dynamic and volatile market that is rife with fluctuations. This naturally leads to hasty decisions and losses.

Lack of Advanced Analytical Tools

In addition to the above reasons, the lack of advanced options trading software and tools has also emerged as a pressing issue. Modern options trading software and platforms should ideally provide tools like options Greeks, which are crucial for successful trading.

However, most platforms do not offer them. Even among the ones that do, the accompanying price tag makes such options trading software inaccessible to a vast majority of retail traders.

The Role of Options Greeks in Derivatives Trading

Options Greeks like delta, gamma, theta and vega are vital tools that measure various risk factors associated with options trading. They give you insights into how the price of options changes in response to different market variables. These variables include changes in the price of the underlying asset, price volatility, time decay and interest rates.

When you do not have access to these Greeks — whether it’s because your chosen options trading software does not offer them or because it comes at an additional cost — it can adversely affect the outcomes of your options trading strategies.

Let’s understand what options Greeks are and why they are essential.

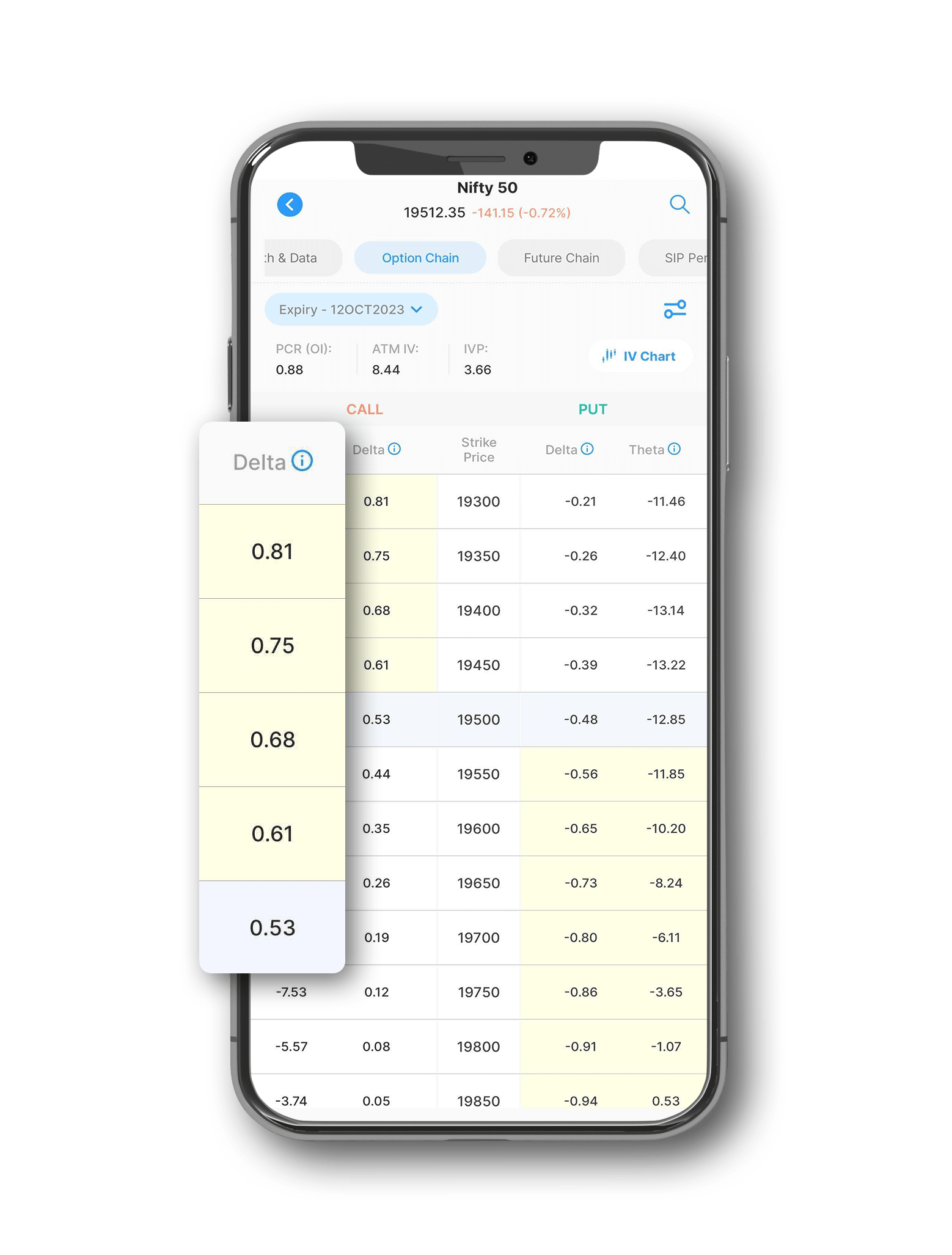

The delta measures how sensitive the price of an option is to every unit of change in the underlying asset’s price. It tells you how an option's price may reach when the price of the underlying asset moves.

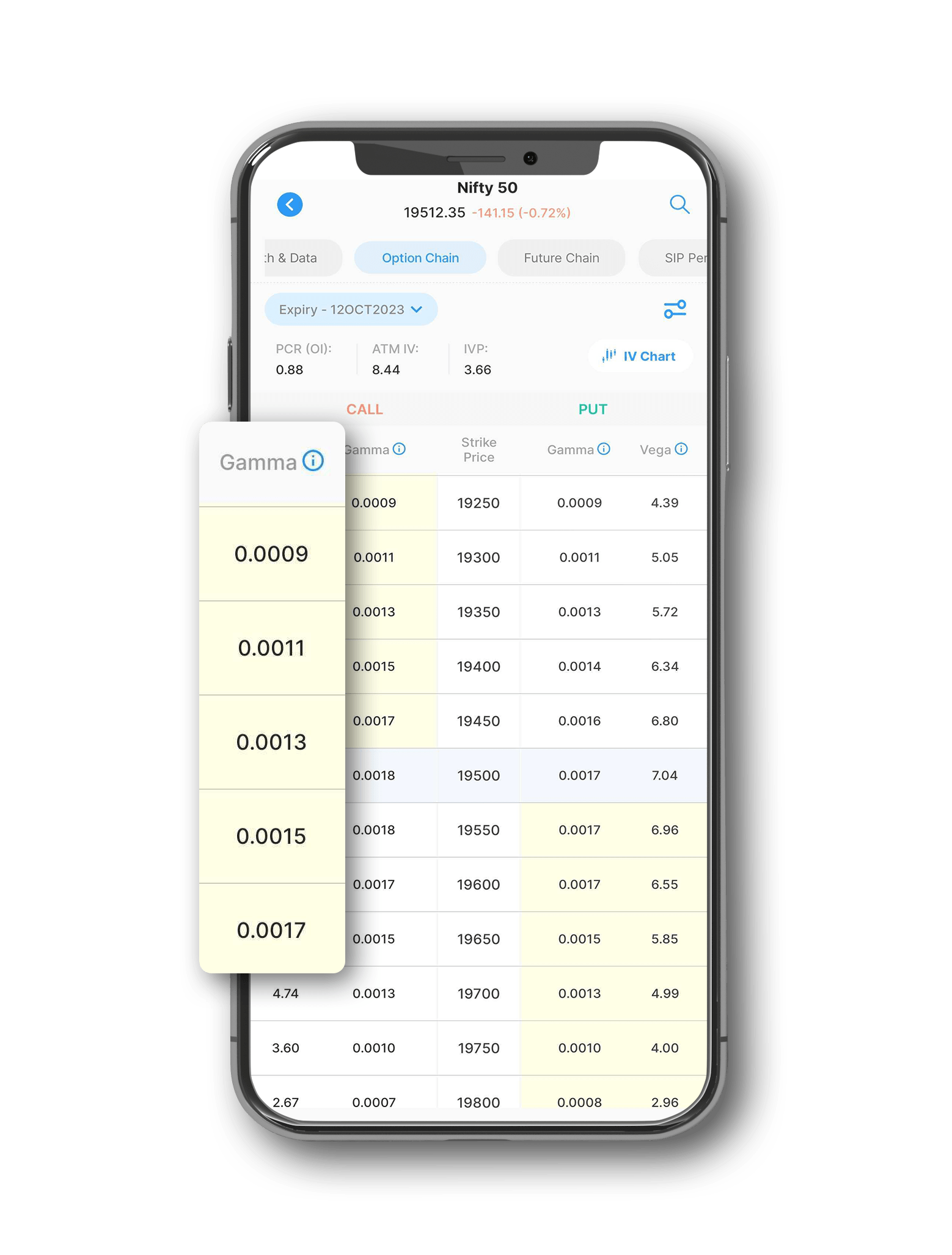

The gamma is a second-order Greek that quantifies the rate of change of delta. When the underlying asset's price moves, the option's price changes (as indicated by delta), but so does the rate at which this change occurs. This is what the gamma indicates.

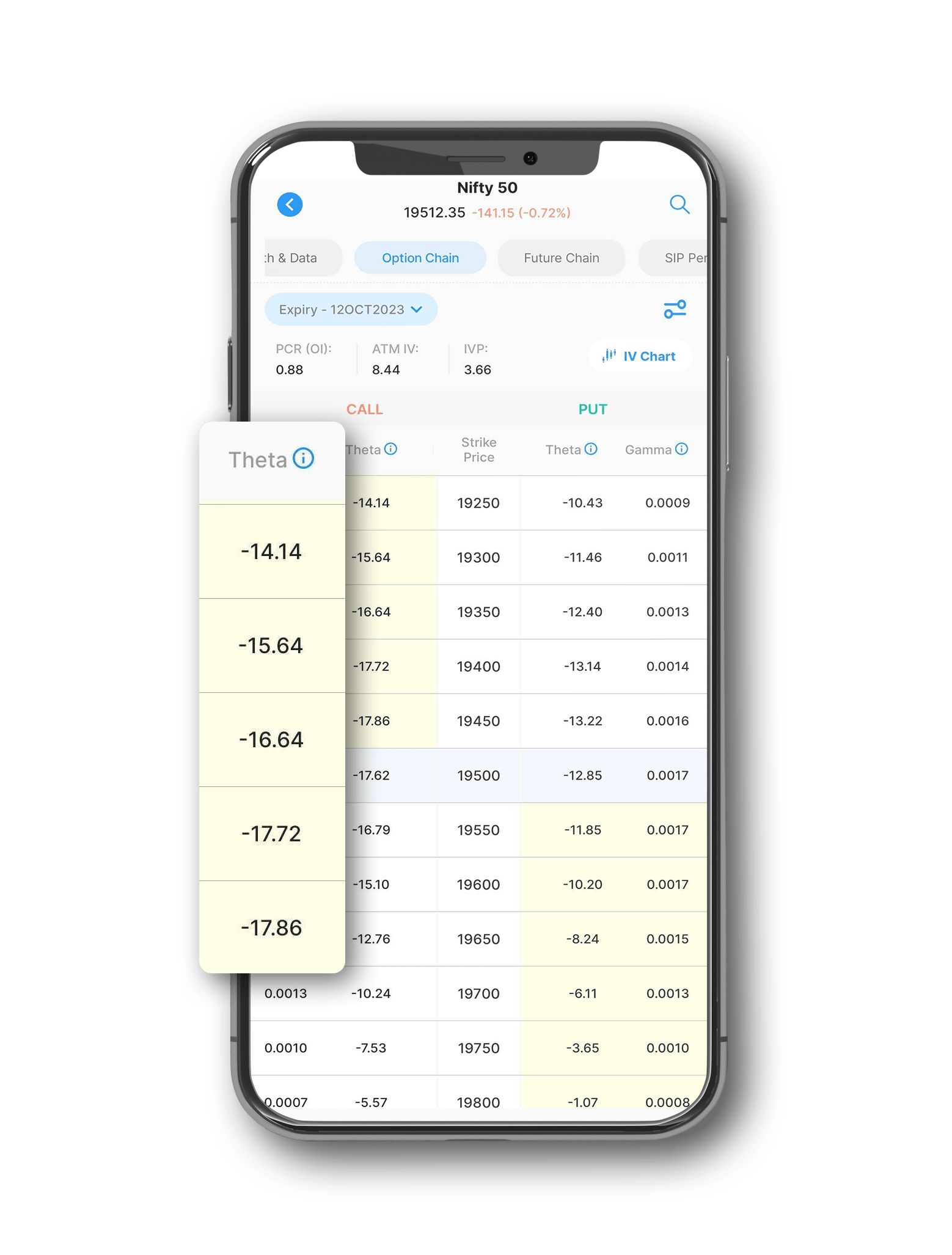

The theta tells you about the rate at which the value of an option decreases as the expiration date approaches. Without this information, you may find it tough to accurately assess the time decay and may hold onto options that are rapidly diminishing in value.

The vega indicates how sensitive an option’s price is to changes in the volatility of the underlying asset. In a highly volatile market, you need to factor in the vega to make accurate judgements about the pricing of options and the risks associated with them.

Let’s take a closer look at how the gamma of an options contract can help you select the right strike price when you are entering or exiting a position.

Can the Gamma Help You Select the Right Strike Price in Options Trading?

The short answer is yes. However, to select the optimal options strike price using the gamma, you need to understand the nuances of options trading and the role Greeks play in evaluating the risk and potential rewards from an options contract. This analysis is particularly critical if you need to balance their risk with their expected return.

The gamma is most relevant for at-the-money options, where its value is the highest. High gamma values indicate that the option is extremely sensitive to movements in the underlying asset’s price. This sensitivity decreases as options move further in-the-money or out-of-the-money. So, when you factor in the gamma, you can predict how the delta of an option will change as the market moves in either direction.

Factors Influencing the Gamma

The gamma of an option is influenced by various factors, some of which are intrinsic to the options and others that are external. Here’s a preview of what affects the gamma of options.

Time to Expiry

The values of gamma values are higher for options that are closer to their expiration date. This increased sensitivity is because of their diminishing time value. For such options, near-term predictions become more critical.

Strike Price Positioning

At-the-money options have the highest gamma because their value is most sensitive to movements in the price of the underlying asset. On the other hand, when an options contract is deep in-the-money or out-of-the-money, it typically has lower gamma values.

Volatility of the Underlying Asset

If the price of the underlying asset is extremely volatile, it can result in higher gamma values. This is because as the volatility increases, the likelihood of the asset price reaching the strike price also becomes higher.

Use the Samco Trading App to Factor in the Gamma in Your Options Trading Strategy

If you do not have access to Options Greeks like the gamma, you are undoubtedly at a disadvantage because you cannot fully understand and manage the risks associated with your positions. This, in turn, results in poor trading decisions where you may enter or exit a position at the wrong time or choose the wrong strike price.

It’s also possible that you may underestimate the impact of market volatility or fail to adjust your strategies appropriately in a volatile market. Moreover, when access to options Greeks is available only at a premium, it creates an uneven playing field among traders.

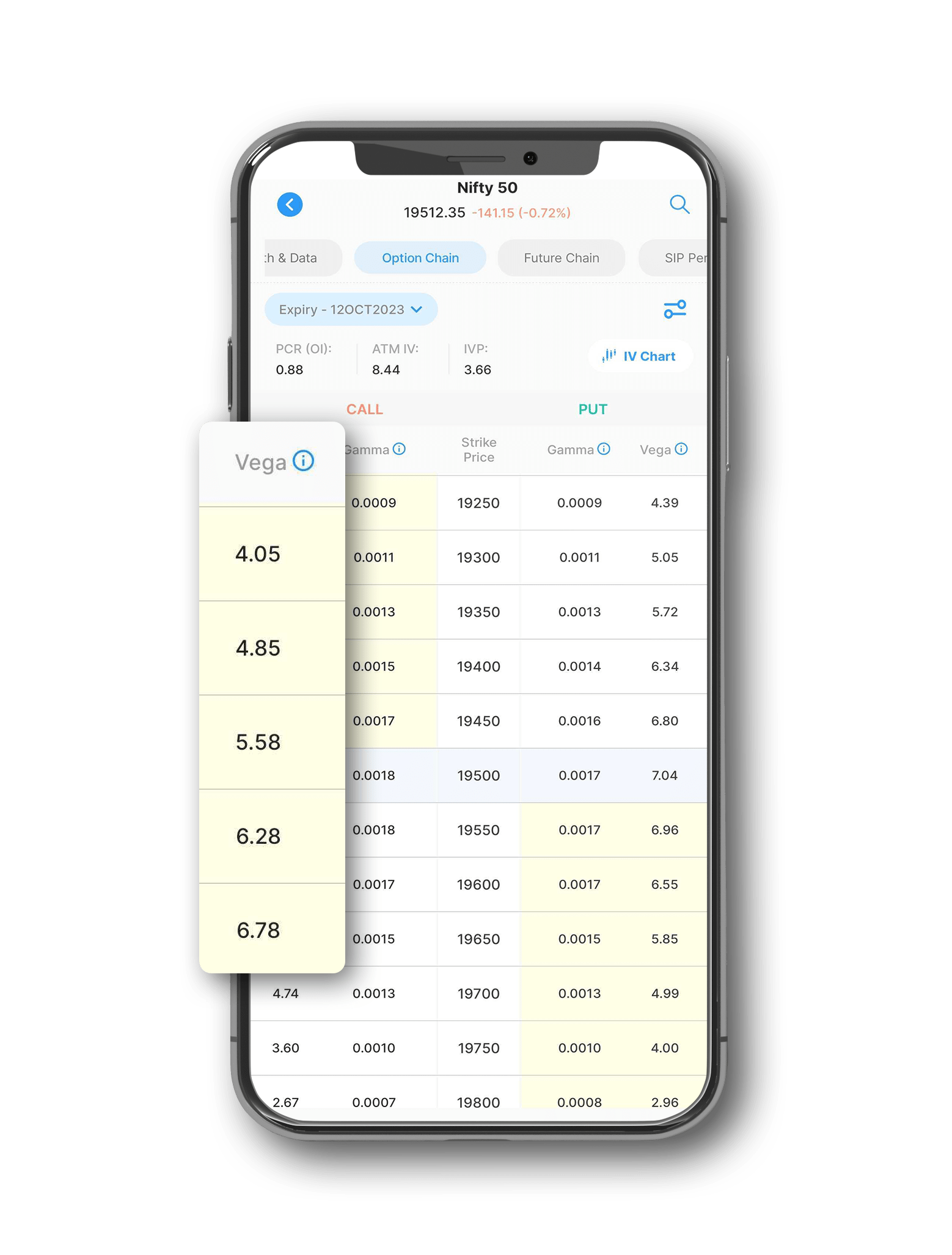

We at Samco Securities are focused on bridging this gap by making options Greeks more accessible to traders in our online community. What’s more, Greeks like delta, gamma, theta and vega are all available to our traders at their fingertips free of cost. To level the trading field, we've integrated these tools directly into the Samco trading app. This means that with our app, you can enjoy immediate and unrestricted access to these powerful analytics.

Here’s how you can factor in the gamma to select the ideal strike price and execute options trades using the new-gen trading app from Samco.

Assess Your Risk Tolerance

Your risk tolerance greatly influences the optimal strike price for a new position. High gamma options have the potential to provide higher returns, but they are also more volatile and come with greater risks. If you have a low tolerance for risk, you might prefer options with lower gamma values.

Evaluate the Time to Expiry

The gamma is higher for options that are close to their expiration date. This is particularly true for at-the-money options. So, when you are selecting a strike price, you must consider how the gamma of an option will change as the expiration date approaches. This will influence the net returns from your trade.

Balance the Delta and the Gamma

While the gamma shows you the rate of change of the delta, it's essential to consider both these Greeks together. A high gamma might not always be beneficial if the delta is low. This is because while it indicates that the delta changes dynamically, the overall sensitivity to the underlying asset's price might still be minimal.

Market Volatility Considerations

In highly volatile markets, the gamma can change rapidly. This can be a double-edged sword because the move may be favourable or detrimental to your open positions. So, it's best if you monitor the market conditions and adjust how you select the strike price according to the prevailing trends.

Using the Gamma to Hedge Your Positions

The gamma of an option can also be used as a hedging tool. By selecting options at different strike prices, which also have different gamma values, you can create a balanced trading position that mitigates your risk and simultaneously offers the potential for decent profits.

Analyse Historical Gamma Values

Historical data can tell you how the gamma values for the options you’re interested in have behaved in the past under different market conditions. You can use this information to make more informed decisions about the ideal strike price for an options strategy that you intend to execute.

Improve Your F&O Strategies with Options Greeks on the Samco Trading App

While it’s important to focus on the gamma when you are selecting the strike price, it’s also essential to consider the Greeks as a cohesive whole. The interplay between the gamma, delta, theta and vega of an options contract provides a more comprehensive picture, so you can make an informed decision about selecting the strike price.

Samco Securities makes this possible by giving you access to all the Options Greeks and other essential insights like the implied volatility right at your fingertips. The best part? You don’t need to pay any charges to access these critical insights. If you already have a trading account or use a different options trading software that offers none of these tools, you can switch to the Samco trading app today to improve your F&O trading strategies and become a better options trader.

Disclaimer: INVESTMENT IN SECURITIES MARKET ARE SUBJECT TO MARKET RISKS, READ ALL THE RELATED DOCUMENTS CAREFULLY BEFORE INVESTING. The asset classes and securities quoted in the film are exemplary and are not recommendatory. SAMCO Securities Limited (Formerly known as Samruddhi Stock Brokers Limited): BSE: 935 | NSE: 12135 | MSEI- 31600 | SEBI Reg. No.: INZ000002535 | AMFI Reg. No. 120121 | Depository Participant: CDSL: IN-DP-CDSL-443-2008 CIN No.: U67120MH2004PLC146183 | SAMCO Commodities Limited (Formerly known as Samruddhi Tradecom India Limited) | MCX- 55190 | SEBI Reg. No.: INZ000013932 Registered Address: Samco Securities Limited, 1004 - A, 10th Floor, Naman Midtown - A Wing, Senapati Bapat Marg, Prabhadevi, Mumbai - 400 013, Maharashtra, India. For any complaints Email - grievances@samco.in Research Analysts -SEBI Reg.No.-INHO0O0005847

Easy & quick

Easy & quick

Leave A Comment?